What is a Minot Series LLC? Benefits, Structure, and How to Start in North Dakota

Published: February 12, 2026 | Tax & Business Planning for North Dakota Entrepreneurs

What is a Minot Series LLC?

A Minot Series LLC is a specific type of Limited Liability Company offered in North Dakota, designed to allow for the creation of multiple independent “series” or cells under a single parent LLC. Each series can hold its own assets, have separate members and managers, and limit liability between series. This structure is especially appealing to real estate investors, property managers, and entrepreneurs in Minot, ND, looking for flexibility and asset protection.

Whether you’re managing rental properties across Minot or operating multiple business ventures in North Dakota, understanding the Series LLC structure could save you thousands in filing fees while protecting your assets. Our tax strategy experts have helped dozens of North Dakota business owners leverage this powerful structure.

Table of Contents

- Key Takeaways

- How Does a Series LLC Work?

- Benefits of a Minot Series LLC

- Drawbacks and Considerations

- Who Should Use a Minot Series LLC?

- How to Form a Minot Series LLC

- Uncle Kam in Action: Real Minot Client Success

- Next Steps

- Frequently Asked Questions

- Related Resources

Key Takeaways

- Series LLCs create multiple protected divisions under one parent entity—ideal for North Dakota real estate investors with multiple properties

- Save on filing fees: One state filing covers unlimited series instead of separate LLCs for each property or venture

- Liability protection between series means a lawsuit against one property won’t affect your other holdings

- Operating agreement is critical—must clearly define how series are created, managed, and kept separate

- Best for Minot business owners with 2+ rental properties, multiple business lines, or complex investment portfolios in North Dakota

How Does a Series LLC Work?

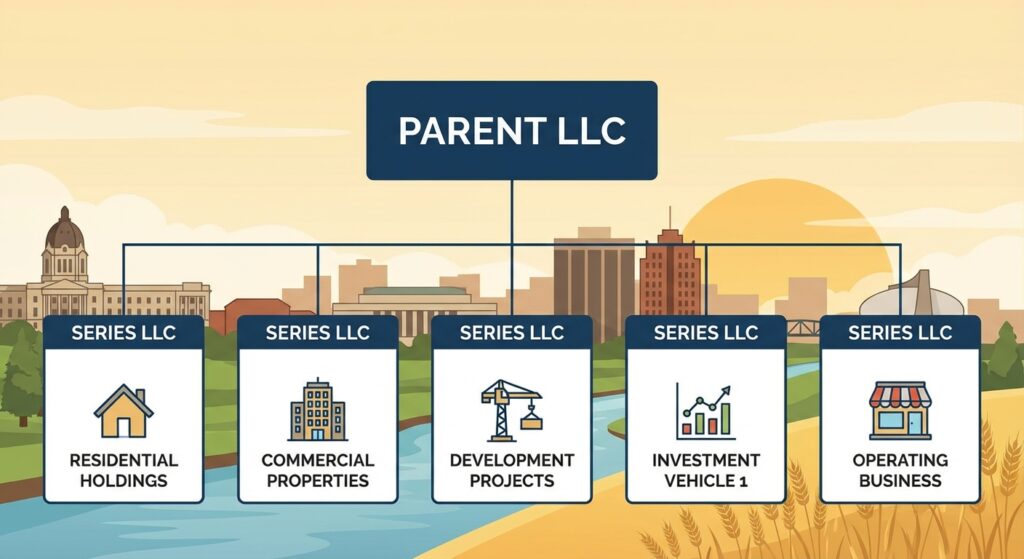

Quick Answer: A Series LLC functions like a parent company with multiple independent divisions. Each “series” operates like its own mini-LLC, holding separate assets and liabilities, but all under one state registration and one master operating agreement.

Unlike a traditional LLC, a Series LLC allows you to establish separate series (sometimes called cells), each functioning almost like a sub-LLC. The main or “parent” LLC files with the state, and its internal operating agreement then designates how the series within the LLC operate. These series can own assets, enter into contracts, and incur liabilities, all independently from one another and from the parent company. This means if one series faces a lawsuit or debt, the other series are insulated from risk.

The Parent LLC vs. Individual Series

The parent LLC is the entity you register with the North Dakota Secretary of State. It holds the authority to create series but typically doesn’t hold significant assets itself. Instead, assets are distributed to the individual series, which act as separate compartments. Think of it like an apartment building (the parent) with individual units (each series)—each unit has its own tenant, lease, and liability exposure.

How Series Are Created

Creating a new series doesn’t require additional state filings in North Dakota. Instead, you amend your internal operating agreement to formally establish the series, assign it specific assets or business activities, and define its management structure. This administrative simplicity is one of the primary advantages for Minot entrepreneurs managing multiple ventures.

Pro Tip: Maintain separate bank accounts and books for each series. Commingling funds can pierce the liability protection and expose all your series to risk. Your tax advisor should help you set up proper accounting systems.

Benefits of a Minot Series LLC

Quick Answer: Minot Series LLCs offer powerful asset protection, significant cost savings on filing fees, administrative simplicity for multiple ventures, and flexible tax treatment—all while maintaining the liability shield between different business activities or properties.

- Asset Protection: Each series shields its assets from the liabilities of other series and the parent.

- Cost Efficiency: Pay only one filing fee and maintain a single set of annual documents for many ventures.

- Administrative Flexibility: No need to register new LLCs for each property or business line.

- Ideal for Real Estate Investors: Easily separate multiple properties into individual series, simplifying tracking and risk management.

Cost Savings Breakdown

In North Dakota, forming a standard LLC costs $135 for the Articles of Organization. If you own five rental properties in Minot and form separate LLCs for each, you’ll pay $675 in initial filing fees alone, plus $50 annual reports per entity ($250/year ongoing). With a Series LLC, you pay one $135 filing fee and one $50 annual report, regardless of how many series you create. Over five years, that’s a savings of $1,790 just on state fees—not counting the reduced legal and accounting costs of managing one entity instead of five.

Liability Compartmentalization

The liability firewall between series is the structure’s most valuable feature. If a tenant in your Series A property (123 Main Street, Minot) slips and falls, resulting in a lawsuit, only the assets held by Series A are at risk. Your Series B, C, and D properties remain protected. This compartmentalization mirrors the protection you’d get from separate LLCs but without the administrative burden.

Scalability for Growing Portfolios

As your Minot real estate portfolio or business operations expand, simply create new series through your operating agreement. No need to file new paperwork with the state, obtain new EINs (in some cases), or juggle multiple registered agents. This scalability makes Series LLCs particularly attractive for entrepreneurs planning significant growth.

Drawbacks and Considerations

Quick Answer: While Series LLCs offer major advantages, they require sophisticated legal setup, may not be recognized in all states, and can complicate banking and financing. The complexity demands expert guidance to maintain proper liability protection.

- Complexity: A Series LLC requires careful setup—operating agreements must be detailed and accurate.

- Uncertain Legal Terrain: Not all states recognize Series LLC structures. If you operate or own assets outside North Dakota, there could be risk.

- Banking and Accounting: Some banks and accountants are less familiar with Series LLCs, which could complicate initial setup.

Interstate Recognition Issues

North Dakota recognizes Series LLCs, but not all states do. If you own property in Minnesota or Montana, for example, a court in those states might not honor the liability separation between your series. For cross-border investments, consult with an attorney licensed in each relevant state to understand your exposure.

Financing Challenges

Some Minot lenders and national banks are unfamiliar with Series LLC structures. They may require additional documentation, personal guarantees, or even refuse to lend to a series directly. Building relationships with North Dakota banks experienced in Series LLCs can smooth this process. Similarly, obtaining separate business credit cards or lines of credit for each series may prove more difficult than with traditional LLCs.

Operating Agreement Requirements

Your operating agreement must explicitly create each series, define how assets and liabilities are segregated, establish management protocols, and outline procedures for adding or dissolving series. Generic LLC operating agreement templates won’t suffice. Budget $1,500–$3,500 for a North Dakota attorney to draft a proper series-focused operating agreement that will stand up in court.

Who Should Use a Minot Series LLC?

Quick Answer: Series LLCs are ideal for North Dakota investors with multiple rental properties, entrepreneurs running several business lines, or anyone needing to segregate assets while minimizing administrative overhead. If you own 2+ properties or ventures in Minot, a Series LLC likely makes sense.

The Series LLC is best for North Dakota business owners with multiple lines of business or real estate investors with two or more properties. If you want to streamline management and protect each property or operation from the liabilities of others, the Minot Series LLC offers key advantages.

Real Estate Investors

If you own multiple rental properties in Minot—whether single-family homes, duplexes, or small apartment buildings—a Series LLC lets you isolate each property’s liability while managing everything under one umbrella. This is particularly valuable for investors building portfolios through the real estate tax strategies we recommend, including cost segregation and bonus depreciation.

Multi-Business Entrepreneurs

Operating a consulting firm, an e-commerce store, and a local service business? Rather than juggling three separate LLCs, create three series under one parent. Each business line stays legally separate, but you simplify tax filings, annual reports, and compliance tasks.

Who Should Avoid Series LLCs

If you own just one rental property or run a single business, the added complexity of a Series LLC outweighs the benefits. Stick with a standard LLC. Similarly, if you’re operating across multiple states that don’t recognize series structures, the legal uncertainty may expose you to unintended risk. Consult with a qualified attorney before proceeding.

How to Form a Minot Series LLC

Quick Answer: Form a Minot Series LLC by filing Articles of Organization with authorization for series, appointing a North Dakota registered agent, drafting a detailed operating agreement, obtaining an EIN, and documenting each series internally. No additional state filings are required when creating new series.

- Choose a Name. Your LLC name must comply with North Dakota naming rules and indicate it is a Series LLC.

- Select a Registered Agent in Minot. The registered agent must have a physical address in North Dakota.

- File Articles of Organization. Submit the proper paperwork to the North Dakota Secretary of State and specify that the LLC is authorized to form series.

- Create a Series-Focused Operating Agreement. This is critical for legal protection; specify how new series are created and how assets/liabilities are handled.

- Obtain Necessary Licenses and EIN. Apply for federal and state tax IDs and any business licenses local to Minot.

- Form Each Series Internally. No additional state filing is needed, but document each series precisely.

Naming Your Series LLC

North Dakota law requires your LLC name to include “Limited Liability Company,” “LLC,” or “L.L.C.” Additionally, to clearly signal the series structure, consider names like “Minot Property Holdings, LLC, a Series LLC” or “Dakota Ventures Series LLC.” Check name availability on the North Dakota Secretary of State website before filing.

Appointing a Registered Agent

Your registered agent receives legal documents on behalf of your LLC. You can serve as your own agent if you have a physical address in Minot, or hire a professional registered agent service (typically $100–$300/year). Ensure the agent is available during business hours at their registered address.

Filing the Articles of Organization

Submit your Articles of Organization to the North Dakota Secretary of State online or by mail. The filing fee is $135. In the articles, include language stating that the LLC has the authority to establish series. A sample provision: “This Limited Liability Company shall have the power to establish one or more designated series as provided by North Dakota Century Code § 10-32.1.”

Drafting the Operating Agreement

This document is your series LLC’s backbone. It must:

- Define how series are created, named, and dissolved

- Specify asset and liability allocation to each series

- Establish management rights and voting procedures

- Outline accounting and record-keeping requirements

- Address distributions, capital contributions, and membership transfers

Work with a North Dakota business attorney who understands series structures. This is not the place to cut corners with a $50 online template.

Obtaining Your EIN and Licenses

Apply for a federal Employer Identification Number (EIN) through the IRS website—it’s free and takes about 10 minutes. Depending on your business activities, you may also need a North Dakota Tax ID and local business licenses from Minot. Check with the City of Minot for specific requirements.

Documenting Each Series

When you create a new series, amend your operating agreement to formally establish it. Include the series name, its designated assets, its members or managers, and its specific business purpose. Maintain separate records, bank accounts, and accounting books for each series. This documentation is essential to preserve the liability shield.

Pro Tip: Set up a simple naming convention for your series—for example, “123 Main Street Series,” “456 Oak Avenue Series,” etc. This clarity helps with banking, insurance, and accounting. Our client success stories show that clear organization prevents costly mistakes down the road.

Table 1: Standard LLC vs. Series LLC (Comparison)

| Feature | Standard LLC | Series LLC |

|---|---|---|

| Number of entities needed | Separate LLC for each business/property | One parent, multiple internal series |

| Filing Fees | Paid for each LLC | Single fee for parent LLC |

| Asset Protection | Each LLC separate | Each series insulated from others |

| Administrative Overhead | Higher | Lower |

Taxation for Minot Series LLCs

Each series may be able to elect its own tax classification (such as disregarded entity for single-member series, or partnership for multiple members). It’s crucial to consult with a local CPA who understands North Dakota rules. For detailed local tax guidance, see our Minot, ND tax preparation page.

The IRS doesn’t have explicit guidance on Series LLCs, which creates some uncertainty. Most tax professionals treat each series as a separate entity for federal tax purposes, but state tax treatment varies. In North Dakota, you’ll likely file one annual report for the parent LLC. Work closely with your CPA to ensure compliance and optimize your tax position through strategies like cost segregation and qualified business income deductions.

Uncle Kam in Action: Real Minot Client Success

Client Background: Sarah M., a Minot real estate investor with four rental properties generating $120,000 in annual rental income. She was managing four separate LLCs and spending over $1,200/year on state filings and compliance alone.

The Challenge: Sarah’s administrative burden was consuming 6–8 hours per month just keeping up with separate bank accounts, annual reports, and accounting for each LLC. She also faced significant exposure—one property had foundation issues that could trigger litigation, and she worried the lawsuit might pierce through to her other holdings.

Our Solution: We helped Sarah form Dakota Property Holdings Series LLC with four distinct series—one for each Minot rental property. We drafted a comprehensive operating agreement, set up separate QuickBooks accounts for each series, and established dedicated bank accounts. We also implemented a cost segregation study across all four properties, accelerating $78,000 in depreciation deductions.

The Results:

- Saved $1,055/year in state filing fees and annual report costs

- Reduced administrative time from 8 hours/month to 3 hours/month

- Protected assets: When the foundation issue resulted in a $35,000 settlement, only Series B assets were affected—her other three properties remained completely shielded

- Tax savings of $18,200 in year one through accelerated depreciation and proper expense allocation

- Easier expansion: Sarah added her fifth Minot property six months later—creating Series E took just 30 minutes and $0 in state fees

“The Series LLC structure transformed my real estate business,” Sarah told us. “I’m spending less time on paperwork and more time finding my next property. And knowing that one problem property can’t sink my entire portfolio gives me incredible peace of mind.”

Explore more client success stories to see how North Dakota investors are leveraging smart structures and tax strategies to build wealth.

Next Steps: Setting Up Your Minot Series LLC

Ready to establish your Series LLC in North Dakota? Follow these action steps:

- Schedule a consultation with a tax professional. Discuss your specific business structure, number of properties or ventures, and long-term goals. Our tax strategy team offers free initial assessments for North Dakota business owners.

- Engage a North Dakota business attorney. Have them draft your Articles of Organization and series-focused operating agreement. Budget $2,000–$4,000 for proper legal setup—this investment protects assets worth far more.

- File with the North Dakota Secretary of State. Submit your Articles of Organization with series authorization language and pay the $135 filing fee. Processing typically takes 7–10 business days.

- Set up separate banking and accounting systems. Open a bank account for each series, establish QuickBooks or similar software with separate accounts, and implement strict procedures to avoid commingling funds.

- Document and maintain your series annually. Update your operating agreement when creating new series, file your annual report each year, and keep meticulous records to preserve liability protection. Consider quarterly check-ins with your CPA to ensure ongoing compliance.

Pro Tip: Don’t wait until you have 5+ properties to form a Series LLC. If you’re buying your second Minot rental property now, establishing the Series LLC from the start saves the hassle of dissolving separate LLCs and transferring assets later. Forward-thinking structure pays dividends.

Frequently Asked Questions about Series LLCs in North Dakota

Are series recognized outside North Dakota?

Recognition of series varies by state. While North Dakota fully recognizes Series LLCs, not all states do. If you’re investing or operating outside ND—particularly in states without series LLC statutes—there’s risk that a court might not honor the liability separation between series. Talk to a qualified attorney licensed in each state where you hold assets. For purely North Dakota operations, you’re on solid legal ground.

Can each series have its own name and bank account?

Yes, and it’s highly recommended. Each series should have a distinct name (e.g., “Dakota Holdings Series LLC – Main Street Series”) and its own dedicated bank account. This clarity is essential for maintaining the liability shield—commingled funds can destroy the separation you’ve worked to establish. Most Minot banks will allow you to open multiple accounts under the parent LLC umbrella once you provide documentation of each series.

Is the Series LLC more expensive to set up than a traditional LLC?

Upfront, yes—drafting a proper operating agreement for a Series LLC typically costs $1,500–$3,500 in legal fees, compared to $500–$1,500 for a standard LLC. However, ongoing costs are significantly lower. If you’d otherwise form 3–5 separate LLCs, you save hundreds of dollars per year in state filing fees, annual reports, and administrative overhead. Most Minot investors break even within the first year and save thousands over five years.

Do I need a separate EIN for each series?

It depends on the series’ tax classification. If each series is treated as a disregarded entity (single-member LLC), you can typically use the parent LLC’s EIN. If a series is taxed as a partnership or corporation, it needs its own EIN. This is a nuanced area—work with your CPA to determine the optimal tax structure for each series. Our tax advisory services include EIN guidance and filing assistance.

Do I need a business license for every series?

Depending on the activity, yes. If each series operates a distinct business requiring a Minot business license, you’ll need separate licenses. For real estate rental series, North Dakota generally doesn’t require separate licenses for each property, but you should verify with the City of Minot and your county. A quick call to Minot City Hall (701-857-4750) or check with your CPA is wise. Don’t assume—licensing violations can trigger fines and jeopardize your liability protection.

Can I convert my existing LLCs into a Series LLC?

Yes, but it requires careful planning. You’ll form a new Series LLC, then transfer the assets from your existing LLCs into designated series. This process may trigger transfer taxes, due-on-sale clauses in mortgages, and reassessment of property taxes depending on North Dakota county rules. Consult with both your attorney and CPA before proceeding. In many cases, the long-term savings justify the transition costs, but every situation is unique.

How do I dissolve a series without dissolving the entire LLC?

Your operating agreement should outline the dissolution process. Typically, you’ll distribute or transfer the series’ assets, settle its liabilities, and amend the operating agreement to formally dissolve the series. No state filing is required in North Dakota. Maintain documentation of the dissolution for your records. If you sell a property held by a series, you can simply wind down that series while keeping the rest of your LLC structure intact.

How do I get started with a Minot Series LLC?

Contact our Minot tax professionals for a personalized review. We’ll assess your current structure, project your long-term needs, and coordinate with qualified North Dakota attorneys to establish your Series LLC properly. Our clients typically see structure and tax strategy working together to save $5,000–$25,000+ annually. Book your free consultation today.

Related Resources

Expand your knowledge of North Dakota business structures and tax strategies:

- Tax Strategy Services – Comprehensive planning for North Dakota business owners

- Real Estate Investor Tax Services – Cost segregation, 1031 exchanges, and entity structuring

- Client Success Stories – See how Minot investors are building wealth with smart structures

- Tax Advisory Services – Year-round proactive tax planning and compliance

External Resources:

- North Dakota Secretary of State: Business Registration

- IRS: LLC Information

- Nolo Guide to Series LLCs

- IRS Publication 541: Partnerships – Tax guidance for multi-member series

Table 2: Steps to Form a Minot Series LLC

| Step | Action |

|---|---|

| 1 | Choose unique LLC name |

| 2 | Select registered agent in Minot |

| 3 | File Articles of Organization with authorization for series |

| 4 | Create series-informed operating agreement |

| 5 | Apply for EIN, business licenses |

| 6 | Document each new series within operating agreement |

Get Help Starting Your Minot Series LLC

Understanding and setting up a Minot Series LLC can be complex, but the benefits for local business owners and investors are substantial. For personalized help, contact Minot’s top tax experts or explore our free resources for North Dakota entrepreneurs.

Whether you’re managing multiple rental properties, running several business ventures, or planning for future expansion, the Series LLC structure offers powerful asset protection and cost savings. Don’t navigate this alone—work with professionals who understand North Dakota law and have helped hundreds of investors structure their holdings correctly.

Schedule your free consultation today and discover how much you could save with proper structuring and tax planning.

Last updated: February 12, 2026