Limited Time: Free Tax Analysis Ends February 12, 2026 2 days 22h 15m 30s remaining

See Your Tax Savings in 30 Minutes

See What You'll Owe — and What You Could Save

Book a call with a MERNA™ Certified Tax Strategist. No commitment required.

- 100% No-Obligation Guarantee

As Seen On

What You Get Free — Only 10 available at no cost

Tax Projection

See what you'll likely owe this year

Savings Opportunities

Identify deductions you're missing

Custom PDF Summary

Yours to keep — delivered after your call, even if you don't become a client

MERNA™ Certified Strategist

Work with a vetted tax professional

🕐 Offer Ends February 12, 2026 ( 2 days 22h 15m 30s remaining )

What Happens After You Book?

Step 1: Pick Your Time

Choose a slot that works for your schedule

Step 2: Get Confirmation

Instant email with calendar invite and Zoom link

Step 3: Join Your Call

Meet your strategist and discover your savings

- No credit card required • No prep needed • No pressure

Pick Your Time

Most calls take 30-45 minutes

Pick Your Time

Choose a date below

Get Confirmation

Email sent instantly

Join Your Call

Get your analysis

We Review:

Your income sources

Business, investment, or employment structure

How you're currently being taxed

Where inefficiencies or missed opportunities may exist

Select Date & Time

How it works

Book your assessment call

Choose a time that works for you. This initial call is designed to understand your tax situation, not to sell you a service.

Talk through your situation

An Uncle Kam advisor will ask a few targeted questions about your income, business, and financial goals to identify what type of tax expertise you need.

Get matched with the right professional

Based on your assessment, we'll connect you with a vetted Uncle Kam tax professional who specializes in your specific situation.

Move forward with confidence

If you choose to proceed, you'll work directly with your matched professional, knowing you're supported by the right expertise from the start.

Real People. Real Tax Savings.

These aren’t hypothetical numbers. These are real business owners who used the MERNA™ Method to restructure their entities, unlock hidden deductions, and legally lower their tax bills—fast.

You’ll see what’s possible when strategy—not guesswork—leads your plan.

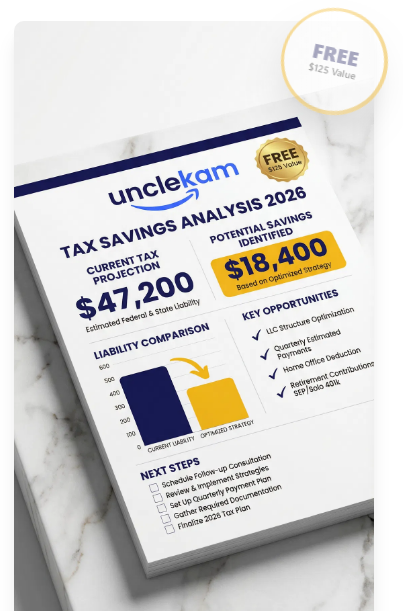

Saved $18,400

Melissa R., Salon Owner

“I always thought I was doing everything right. Turns out, I was missing out on write-offs I didn’t even know existed. Uncle Kam’s strategist showed me how to deduct my car, my home office—even part of my rent. I saved $18,400 in my first year using the MERNA Method. And it was all legal. Mind blown.”

Went from W-2 to LLC and Cut Tax Bill in Half

Jason W., Consultant

“I was getting crushed on taxes as a high-earning W-2. Uncle Kam helped me switch to an LLC and showed me exactly how to pay myself the right way. I ended up cutting my tax bill in half and finally feel in control. This is what every entrepreneur needs but no one teaches you.”

Saved $27,000 in Tax-Free Wealth

Karla B., Real Estate Investor

“I’ve had CPAs before, but no one ever explained strategy like this. Using the MERNA™ method, I restructured my LLC, layered in real estate deductions, and opened a solo 401(k). I saved over $27,000 and got a real plan—not just a return.”

Frequently Asked Questions

What happens during the call?

We’ll review your income sources, business structure, and current tax situation. Then we’ll identify potential savings opportunities and match you with the right tax strategist if you choose to move forward. No sales pressure—just clarity.

Do I need to prepare anything?

Not required, but helpful: your most recent tax return, estimated annual income, and any business structure details (LLC, S-Corp, sole proprietor, etc.). We can still have a productive conversation without these.

Is this really free?

Yes, 100% free. This is a consultation to understand your situation and see if we can help. There’s no obligation to work with us afterward.

How long does the call take?

Most calls are 30-45 minutes. We keep it focused and respect your time.

What if I can't make my scheduled time?

No problem! You can reschedule or cancel anytime through the confirmation email you’ll receive after booking.

Will I really get a PDF after the call?

Absolutely. After your call, you’ll receive a custom tax analysis PDF summarizing what we discussed, your potential savings opportunities, and next steps—even if you don’t move forward with us.

Ready to See What You Could Save?

No commitment. No pressure. Just clarity.

Sarah from Miami just booked

Just now

Wait! Don't Miss Your Free $125 Analysis

Get a reminder to book your free tax savings consultation before spots run out.

Reminder Sent!

Check your email for your booking reminder.