Understanding the Durham Series LLC: Structure, Benefits, and Tax Considerations

Published: February 12, 2026

Durham Series LLC formations are gaining popularity among entrepreneurs and real estate investors in North Carolina. But what makes this business structure unique, and how does it impact your taxes, liability, and growth potential? If you’re managing multiple properties or businesses in the Research Triangle region, understanding the Durham Series LLC could save you thousands in administrative costs while protecting your assets. Learn more about our comprehensive tax strategy services designed for North Carolina business owners.

Table of Contents

- Key Takeaways

- What is a Series LLC?

- Key Benefits of a Durham Series LLC

- How Does the Durham Series LLC Work?

- Tax Implications for Series LLCs in North Carolina

- Common Questions about Durham Series LLCs

- Best Practices for Maintaining Series Protections

- Uncle Kam in Action: Durham Real Estate Success Story

- When is a Series LLC Right for You?

- Next Steps

- Frequently Asked Questions

- Related Resources

Key Takeaways

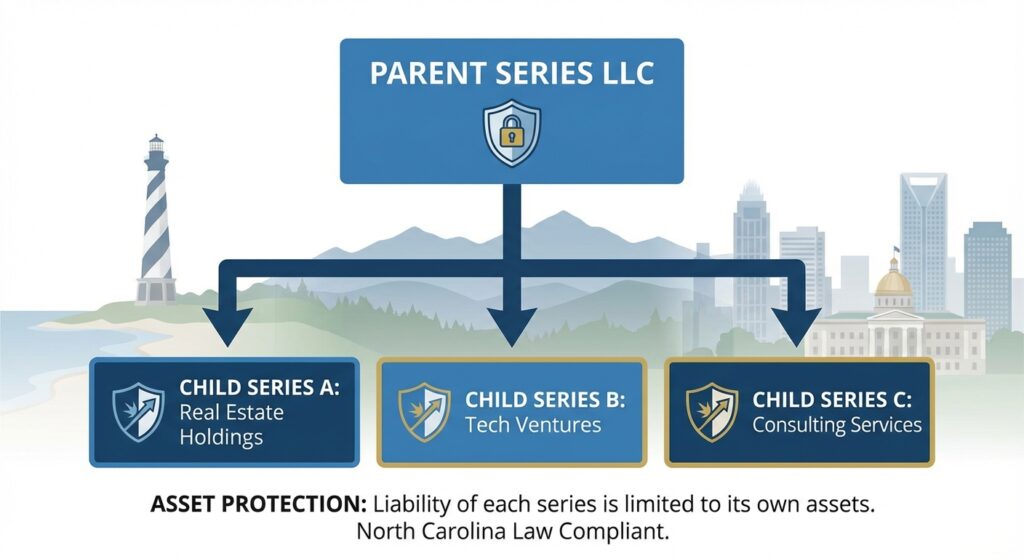

- One Parent, Multiple Series: A Durham Series LLC lets you create unlimited subsidiary series under one parent entity, each with separate assets, liabilities, and members—often without additional North Carolina state filing fees per series.

- Asset Protection: Creditors pursuing one series typically cannot reach assets held in another series, making this ideal for real estate investors holding multiple Durham-area properties or entrepreneurs running separate business lines.

- Federal vs. State Tax Treatment: The IRS allows each series to elect its own tax classification (disregarded entity, partnership, or corporation), but North Carolina currently treats the parent and all series as one entity for state franchise tax and annual report purposes.

- Cost Savings: Instead of paying formation and annual fees for five separate LLCs (approximately $625 in North Carolina filing fees alone), you pay one parent fee and maintain streamlined recordkeeping.

- Strict Recordkeeping Required: To preserve liability protection, you must maintain separate bank accounts, contracts, and books for each series—commingling funds can pierce the corporate veil and expose all assets to creditors.

What is a Series LLC?

Quick Answer: A Series LLC is a specialized limited liability company structure authorized under North Carolina law that allows you to create multiple “series” or cells within one parent LLC. Each series can own distinct assets, have separate members, and maintain independent liability protection—all under a single state registration.

A Series LLC is a form of limited liability company that allows you to create multiple ‘series’ or cells under one parent LLC. Each series can have separate assets, members, and liabilities. North Carolina has enabled this flexible business structure—sometimes called the Durham Series LLC after the high-tech business ecosystem in Durham County.

Origins and Legal Framework

North Carolina adopted Series LLC legislation to help business owners manage multiple ventures without the administrative burden of forming separate legal entities for each project. The structure originated in Delaware for mutual fund management but has since expanded to real estate holding companies, tech startups managing multiple product lines, and franchise operations.

How Series Function Independently

Think of a Series LLC as an apartment building: the parent LLC is the building itself, and each series is an individual apartment unit. Just as fire damage in Unit 3A doesn’t make residents of Unit 5B liable, a lawsuit targeting assets in Series A cannot attach assets held in Series B. Each series can enter contracts, sue or be sued, and hold property in its own name.

Key Benefits of a Durham Series LLC

Quick Answer: Durham Series LLCs provide asset protection, cost savings, operational efficiency, and flexible tax planning. You can segregate real estate holdings, separate business ventures, and protect assets across multiple series while managing everything under one administrative umbrella.

- Asset Protection: Creditors of one series generally cannot reach the assets of another series.

- Administrative Efficiency: Set up one parent LLC and add as many series as needed, typically without extra state filing fees for each series.

- Cost-Effective: Manage multiple investments or ventures under a single umbrella, reducing management and formation costs.

- Operational Segregation: Maintain clear recordkeeping and operational policies for each series to maximize limited liability protections.

Real-World Cost Comparison

Consider a Durham real estate investor with five rental properties. Creating five separate LLCs in North Carolina would cost approximately $125 per filing (totaling $625), plus annual report fees of $200 per entity ($1,000 annually). With a Series LLC, you pay the $125 parent formation fee and $200 annual report for the parent only—saving $825 in the first year and $800 every year thereafter.

Pro Tip: Banking relationships matter. Before forming your Series LLC, confirm that your preferred Durham-area bank or credit union can open separate accounts for each series. Some regional institutions aren’t yet equipped to handle Series LLC banking, which could undermine your liability protection if you’re forced to commingle funds.

How Does the Durham Series LLC Work?

Quick Answer: Each series within your Durham Series LLC operates like a mini-LLC with its own assets, contracts, and liability shield. You create series through your operating agreement (not state filings), making it fast and inexpensive to add new series as your business grows.

Each series operates similarly to a separate LLC regarding asset ownership, contracts, and liability shielding. This makes the structure ideal for real estate investors with multiple properties or entrepreneurs running several independent businesses.

| Feature | Traditional LLC | Series LLC |

|---|---|---|

| Liability Segregation | One entity, all assets share liability risk | Separate liability per series |

| Formation Cost | Filing fee per LLC | One parent fee + low/no fee for series |

| Tax Filing | One return per LLC | Typically one at parent level (state dependent) |

| Use Case | Single business/investment per LLC | Multiple businesses/investments per entity |

Creating New Series

Unlike forming a traditional LLC, you typically don’t file paperwork with the North Carolina Secretary of State to create a new series. Instead, you add the series to your parent LLC’s operating agreement. This means you can establish Series A to hold your Durham rental property on Monday, then create Series B for your consulting business on Tuesday—without waiting for state approval or paying additional filing fees.

Naming Conventions

Most Durham Series LLCs use clear naming to maintain separation: “Durham Holdings LLC, Series A,” “Durham Holdings LLC, Series B,” and so forth. Your operating agreement should specify the exact legal name for each series and define which assets belong to which series.

Tax Implications for Series LLCs in North Carolina

Quick Answer: Each series can elect its own federal tax classification (disregarded entity, partnership, or S-corp), but North Carolina treats the parent and all series as one entity for state franchise tax. You’ll need separate EINs for each series and meticulous bookkeeping to support federal elections.

Each series can be treated as a separate entity for federal tax purposes if it has distinct members and assets. The IRS issued guidance (see IRS Series LLC Guidance) allowing certain series to elect their own tax status (e.g., disregarded entity, partnership, or corporation). However, North Carolina currently treats the parent and its series as a single entity for state tax purposes, with nuances for franchise taxes and annual reports.

- Each series may apply for its own EIN for tax administration.

- Make sure to keep separate bank accounts and bookkeeping for each series.

- Consult a tax strategist to determine optimal structures for property holding, rental income, or operating businesses.

Federal Tax Elections

The IRS allows substantial flexibility. You might elect Series A (your rental property) as a disregarded entity for simplicity, Series B (your e-commerce business) as an S-corporation to reduce self-employment tax, and Series C (your consulting practice) as a partnership if you bring on a co-owner. Each series files its own federal return based on its election, giving you targeted tax optimization.

North Carolina State Tax Considerations

North Carolina’s franchise tax applies to the parent LLC’s total capital, which includes all series assets. This means you can’t reduce your state tax burden by splitting assets across series. However, the administrative savings and federal tax planning opportunities often far outweigh this limitation for Durham business owners with diverse holdings.

Pro Tip: Apply for separate EINs for each series immediately after formation. The IRS processes EIN applications within minutes online, and having distinct taxpayer identification numbers from day one prevents headaches when opening bank accounts, filing tax returns, and establishing vendor relationships.

Common Questions about Durham Series LLCs

Quick Answer: Series LLCs work for multiple businesses, real estate portfolios, and asset segregation strategies. The main drawbacks involve banking challenges, interstate recognition issues, and the need for rigorous recordkeeping to maintain legal protections.

- Can I use a Series LLC for multiple businesses? Yes, each series can operate a unique venture with distinct assets and liabilities.

- Are there drawbacks? Some banks and title companies are unfamiliar with Series LLCs. Not all states recognize this structure, which could complicate interstate business.

- How do I form a Durham Series LLC? File articles of organization with the NC Secretary of State and draft an operating agreement outlining series governance.

- What if I own real estate in different states? Some states do not recognize series entities, so check local laws where each property is located.

- Does each series need its own tax filing? For federal purposes, possibly; for state, North Carolina typically treats all as one.

- Is the Series LLC structure recognized in court? Series protection is still relatively new—use strong recordkeeping and legal agreements.

- Are there specific reporting requirements? North Carolina requires annual reports for the parent; best practice includes internal ledgers for each series.

- Can I convert an existing LLC to a Series LLC? Often, yes, with amendments to your operating agreement and possible state filings.

Best Practices for Maintaining Series Protections

Quick Answer: Treat each series as a completely separate business. Separate bank accounts, independent contracts, dedicated bookkeeping, and clear operating agreement language are non-negotiable if you want to preserve the liability shield between series.

- Keep finances and contracts for each series separate.

- Draft a comprehensive operating agreement.

- Document all transfers between series.

- Work with attorneys and tax professionals familiar with North Carolina Series LLC law and IRS guidance.

The Commingling Danger

Courts have shown willingness to pierce the series veil when owners fail to maintain separation. If you pay Series A’s property tax bill from Series B’s bank account, or sign a contract on behalf of “Durham Holdings LLC” without specifying which series, you risk exposing all series assets to creditors. One sloppy transaction can undo years of careful planning.

Documentation Standards

Every contract, lease, purchase agreement, and vendor invoice should explicitly identify the series involved: “Durham Holdings LLC, Series A” rather than just “Durham Holdings LLC.” Similarly, all bank accounts, insurance policies, and tax filings must use the full series designation.

Uncle Kam in Action: Durham Real Estate Success Story

Quick Answer: See how a Durham investor used a Series LLC to protect five rental properties, save $800 annually in state fees, and implement customized tax strategies for each property—while simplifying administration and estate planning.

Meet David, a Durham-based software engineer who built a rental property portfolio over seven years. By 2025, he owned five single-family homes across Durham County, each held in its own standalone LLC. David was paying $1,000 annually just for North Carolina annual reports, plus separate accounting fees to track five different entities.

The Challenge

David’s accountant flagged inefficiencies: he was overpaying for entity maintenance, struggling to track which property belonged to which LLC, and missing opportunities for tax optimization. When a tenant threatened a lawsuit over a slip-and-fall incident at one property, David realized his entire portfolio could be at risk if he lost the case—each LLC owned just one property, but nothing prevented a determined creditor from piercing the corporate veil if recordkeeping wasn’t perfect.

The Uncle Kam Solution

We helped David restructure using a Durham Series LLC. We formed “Durham Property Holdings LLC” as the parent entity, then created five series—one for each property. Each series elected disregarded entity status for federal tax purposes, maintaining David’s existing tax treatment while consolidating administration.

- Year 1 savings: $800 in eliminated annual report fees, plus $1,200 in reduced accounting costs

- Asset protection: Each property isolated within its own series, with lawsuit risk limited to the affected property

- Estate planning: Simplified transfer of ownership interests to David’s children through the parent LLC structure

- Growth flexibility: When David acquired a sixth property in 2026, we created Series F in 15 minutes—no state filing required

The Outcome

The slip-and-fall lawsuit settled for $15,000 paid by Series C’s insurance policy. David’s other four properties remained completely protected. Over three years, the Series LLC structure has saved him $4,800 in state fees and over $3,600 in accounting costs—a total savings of $8,400 while improving asset protection and operational efficiency.

Pro Tip: If you’re converting existing LLCs to a Series LLC structure like David did, pay attention to title transfer requirements. You’ll need to deed each property from the old LLC to the appropriate series, which involves recording fees and potential title insurance considerations. Budget $200-$400 per property for these one-time costs.

When is a Series LLC Right for You?

Quick Answer: Series LLCs work best for investors or entrepreneurs with three or more separate assets or business lines who want liability segregation without the cost and complexity of multiple standalone entities. If you have just one or two ventures, traditional LLCs may be simpler.

If you are a real estate investor with multiple properties, a business owner exploring multiple projects, or a professional seeking robust asset protection and tax efficiency, a Durham Series LLC could streamline your operations. Always consult with legal and tax advisors before making any business entity decision.

Ideal Candidates

- Real estate investors: Holding three or more rental properties, fix-and-flip projects, or commercial buildings

- Multi-business entrepreneurs: Running separate e-commerce stores, consulting practices, or product lines

- Franchise owners: Operating multiple franchise locations under one parent structure

- Tech startups: Managing different product development projects with distinct investor groups

- Professional practices: Separating real estate holdings from operating businesses to protect assets

When to Consider Alternatives

If you’re managing assets in multiple states that don’t recognize Series LLCs, you may need traditional LLCs qualified to do business in each jurisdiction. Similarly, if your industry involves complex licensing requirements (healthcare, financial services), check whether licensing boards accept Series LLC structures before formation.

Next Steps

Ready to explore whether a Durham Series LLC makes sense for your situation? Follow these five steps to move forward strategically.

- Inventory your assets and ventures. List all properties, businesses, or projects you currently operate or plan to launch. Identify which assets carry the most liability risk and which could benefit from isolation.

- Consult with a North Carolina business attorney. Confirm that a Series LLC structure works for your specific assets, especially if you hold property outside North Carolina or operate in regulated industries. Your attorney should draft or review the operating agreement to ensure proper series separation.

- Meet with a tax strategist. Schedule a consultation with Uncle Kam to model the federal and state tax implications. We’ll help you determine the optimal tax election for each series and estimate your potential savings compared to separate LLCs.

- Establish banking relationships early. Contact Durham-area banks to confirm they can open separate accounts for each series. You’ll need dedicated checking accounts for each series before transferring any assets to maintain liability protection.

- Implement robust bookkeeping systems. Set up accounting software with separate ledgers for each series, or hire a bookkeeper experienced with Series LLC structures. From day one, treat each series as a completely independent business for recordkeeping purposes.

Schedule a free consultation with our team of North Carolina Series LLC tax specialists. Check out our guide to real estate investor tax strategies and explore our comprehensive tax advisory services for entrepreneurs and investors.

Frequently Asked Questions

Do I need a separate operating agreement for each series?

No, you typically maintain one comprehensive operating agreement for the parent LLC that includes provisions governing each series. The operating agreement should clearly define which assets belong to each series, how series are created and dissolved, and how liability is segregated. However, you may want supplemental agreements if different series have different member ownership structures.

Can I transfer assets between series without tax consequences?

Generally, yes, but you must document the transfer properly. The IRS treats inter-series transfers similarly to contributions and distributions between related entities. If you transfer a rental property from Series A to Series B, document the transaction with written agreements, update title records, and consult your tax advisor to ensure you’re not triggering unexpected gain recognition or violating debt allocation rules.

What happens to my Series LLC if I move to another state?

Your North Carolina Series LLC continues to exist even if you relocate personally. However, if you move your business operations to a state that doesn’t recognize Series LLCs, you may face complications. Some states may treat each series as a separate foreign LLC requiring qualification. Consult with attorneys in both North Carolina and your destination state before relocating.

How do I obtain insurance for a Series LLC?

Each series should carry its own liability insurance policy naming that specific series as the insured party. For example, “Durham Holdings LLC, Series A” would have a separate policy from “Durham Holdings LLC, Series B.” Some insurance carriers are unfamiliar with Series LLCs, so work with an agent experienced in commercial coverage for multiple-entity structures. Budget approximately the same premium you’d pay for standalone LLC coverage.

Can I add new members to just one series without affecting others?

Yes, this is one of the Series LLC’s most powerful features. You can bring a partner into Series B to co-own a specific business venture while maintaining 100% ownership of Series A, C, and D. The operating agreement should specify member ownership at both the parent and series level, and you’ll need to allocate profits and losses accordingly on tax returns.

What records should I keep for each series?

Maintain the same records you would for a standalone LLC: separate bank statements, QuickBooks files or accounting ledgers, contracts and leases, receipts and invoices, annual financial statements, and meeting minutes if the series has its own members or managers. Store these records in clearly labeled folders—physical or digital—organized by series designation.

How does a Series LLC affect my estate planning?

Series LLCs can simplify estate planning by allowing you to transfer specific series interests to heirs rather than dividing up individual properties or businesses. For example, you might leave Series A (your primary rental property) to your daughter, Series B (your e-commerce business) to your son, and Series C (your consulting practice) to a key employee—all without dissolving the parent LLC or creating complex trust structures. Work with an estate planning attorney to structure ownership transfers tax-efficiently.

Related Resources

Expand your knowledge of Series LLCs, North Carolina business structures, and tax optimization strategies with these trusted resources.

Government and Official Sources

- IRS: Series LLCs and Other Series Entities — Official IRS guidance on federal tax treatment of series

- North Carolina Bar: Series LLC Overview — Legal framework and requirements in North Carolina

- NC Courts: Business Structure Case Law — Court decisions interpreting series liability protection

Uncle Kam Resources

- Tax Strategies for Real Estate Investors — Comprehensive guide to entity selection, depreciation, and 1031 exchanges

- Tax Advisory Services — Ongoing strategic tax planning for businesses and investors

- Client Success Stories — Real-world results from Uncle Kam’s tax optimization strategies

- Schedule Your Consultation — Connect with our Durham-area tax specialists

Disclaimer: The above is for informational purposes only and does not constitute legal or tax advice. Always consult with qualified legal and tax professionals familiar with your specific circumstances.

Last updated: February 12, 2026