The Ultimate Guide to Charlotte Series LLCs: Structure, Tax Benefits, and Setup

The Charlotte Series LLC is an innovative option for entrepreneurs and real estate investors in North Carolina. In this in-depth guide, we break down everything you need to know about what a Series LLC is, why it may be the right choice for your Charlotte business, and how to start one — including the critical detail that North Carolina does not currently authorize Series LLCs in-state, and what that means for your setup strategy.

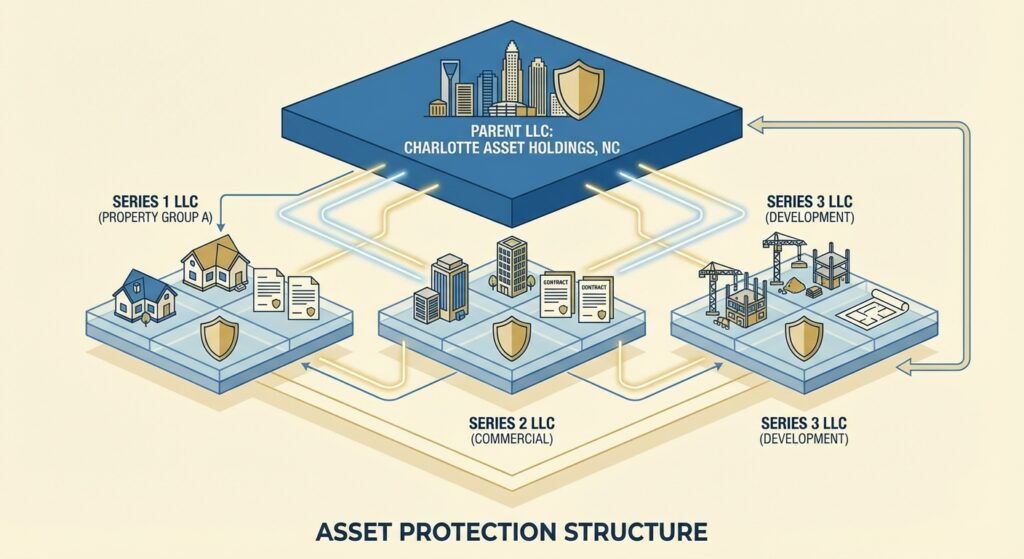

Quick Answer: A Series LLC allows you to create multiple segregated sub-LLCs under one parent entity, each with its own assets, liabilities, and members. North Carolina does not currently authorize Series LLCs, so Charlotte business owners typically form their Series LLC in a friendly state like Delaware, Texas, or Illinois and then register as a foreign LLC in NC to operate locally.

What is a Series LLC?

A Series LLC allows you to create a single parent LLC with multiple, segregated sub-LLCs (known as “series”) within it. Each series can have its own assets, members, and operations, and crucially, its own liability shield. This means that a lawsuit or debt against one series generally cannot reach the assets held in another series — providing a level of protection that would otherwise require forming and maintaining multiple separate LLCs.

While some states recognize Series LLCs directly, North Carolina law does not. However, many businesses in Charlotte use creative structuring: they form the Series LLC in a state that authorizes it (such as Delaware, Texas, or Illinois) and then register as a foreign entity in North Carolina to operate locally. This approach gives Charlotte business owners access to the Series LLC benefits while complying with NC law.

Why Form a Series LLC in Charlotte?

Charlotte’s booming real estate market and diverse business landscape make the Series LLC structure particularly attractive. Here are the primary reasons Charlotte entrepreneurs choose this structure:

- Asset protection: Segregates assets and liabilities by series. If one rental property faces a lawsuit, your other properties in separate series remain protected.

- Cost savings: One filing cost and one set of annual reports in the forming state, rather than paying separate formation and maintenance fees for each individual LLC.

- Simplified compliance: Manage multiple properties or business lines under one umbrella with a single registered agent, one master operating agreement, and streamlined record-keeping.

- Scalability: Adding a new series for a new Charlotte property or business venture is significantly faster and cheaper than forming an entirely new LLC.

Did You Know? Charlotte is one of the fastest-growing real estate markets in the Southeast. Investors managing multiple properties in neighborhoods like South End, NoDa, Plaza Midwood, and University City are increasingly using Series LLCs to compartmentalize risk across their portfolio without the overhead of forming five or ten separate LLCs.

Charlotte Series LLC Setup: Step by Step

- Choose your home state: Delaware, Texas, and Illinois are the most popular states for Series LLC formation. Delaware offers the most established legal framework, while Texas has no state income tax.

- Name your Series LLC: File Articles of Organization in the chosen state. The articles must explicitly authorize the creation of series within the LLC.

- Draft a master operating agreement: Delineate each series within the agreement, specifying assets, members, management rights, and profit-sharing for each series.

- Register as a Foreign LLC in North Carolina: File a Certificate of Authority with the NC Secretary of State to legally do business in Charlotte.

- Obtain EINs: Apply for a Federal Employer Identification Number for the parent LLC. Depending on your tax structure, each series may need its own EIN.

- Set up separate bank accounts: Each series should have its own dedicated bank account. Never commingle funds between series — this is critical to maintaining the liability shield.

- Maintain compliance: File annual reports in the forming state and in North Carolina. Keep separate financial records for each series.

Series LLC Compliance and Tax Filing

Each series is generally treated as a separate entity for liability purposes. For taxation, the IRS currently treats all series as part of the parent LLC unless explicitly elected otherwise. This means in most cases, the parent LLC files a single tax return (Form 1065 for partnerships, or Form 1120-S if an S Corp election is made) that includes the income and expenses of all series.

However, if each series has its own members and operates independently, you may elect to have each series treated as a separate taxpayer. This requires careful documentation and IRS compliance. Consult a North Carolina business accountant or attorney for specific structuring recommendations based on your Charlotte business.

Pro Tip: North Carolina has a flat individual income tax rate of 4.5% in 2026 and does not impose a franchise tax on LLCs. However, your Series LLC may owe annual report fees to both the forming state and NC. Factor these dual-state costs into your budget when comparing the Series LLC to forming multiple individual NC LLCs. A qualified tax advisor can run the numbers for your specific situation.

Pros and Cons of a Charlotte Series LLC

| Pros | Cons |

|---|---|

| Cost-effective for multi-asset operations | Not recognized by NC law (must form out-of-state) |

| Simplifies recordkeeping across properties | Complex setup and potential legal ambiguity in NC courts |

| Enhanced asset protection between series | May require professional legal and tax guidance |

| Easy to add new series as you grow | Some banks unfamiliar with Series LLC accounts |

| Single registered agent for all series | Dual-state filing requirements (forming state + NC) |

When Should You Use a Series LLC in Charlotte?

A Series LLC makes sense for Charlotte business owners in these situations:

- You own or plan to own multiple rental properties in the Charlotte metro area

- You operate diverse business lines from a single entity and want to ring-fence risk by project, investor, or asset group

- You want to add new properties or ventures quickly without forming and paying for entirely new LLCs

- You are comfortable with the dual-state registration requirement

Series LLC vs. Traditional LLC: Side-by-Side Comparison

| Feature | Traditional NC LLC | Series LLC (Foreign in NC) |

|---|---|---|

| Legal Structure | Single entity, all assets/liabilities commingled | Multiple segregated legal series |

| Operating Agreement | One operating agreement | Master + series-specific agreements |

| Formation | Filed directly in NC | Filed in Series-LLC-friendly state, then foreign registered in NC |

| Cost (5 properties) | 5 separate LLC fees + 5 annual reports | 1 formation + 1 NC foreign registration + 1 annual report each |

| Asset Protection | Strong per entity | Strong per series (if properly maintained) |

Resources and Professional Help

For Charlotte business owners considering a Series LLC, here are essential resources:

- North Carolina Secretary of State: Business Registration

- IRS: Limited Liability Company (LLC) Guide

- U.S. Small Business Administration

- LLC Holding Company Tax Strategy for 2026

- S Corp Salary vs. Distribution Guide

Conclusion

The Charlotte Series LLC is a cutting-edge approach for business owners and investors who want to protect assets and streamline operations across multiple ventures. Though North Carolina does not authorize Series LLCs in-state, savvy Charlotte entrepreneurs form them in other states and operate locally via foreign registration. The key to success is proper structuring, separate record-keeping for each series, and working with a tax professional who understands the nuances of cross-state entity planning.

Ready to explore whether a Series LLC is right for your Charlotte business? Contact Uncle Kam for a free consultation and personalized entity structuring advice.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Series LLC laws vary by state and are evolving. Consult with a qualified attorney and tax professional before forming any business entity.

Frequently Asked Questions

Can I form a Series LLC directly in North Carolina?

No, North Carolina law does not currently authorize Series LLCs. Charlotte business owners who want the Series LLC structure typically form in Delaware, Texas, or Illinois and then register as a foreign LLC in NC. This approach gives you access to the Series LLC framework while operating legally in Charlotte.

Is a Series LLC right for Charlotte real estate investors?

Yes, it is one of the most popular structures for Charlotte real estate investors managing multiple rental properties. By placing each property in its own series, you isolate the liability of each investment. If one property faces a lawsuit or claim, the assets in your other series remain protected.

How are Series LLCs taxed?

The IRS treats each series as part of the parent LLC unless individual election is made. In most cases, the parent files a single Form 1065 (partnership return) or Form 1120-S (if S Corp elected). However, if each series has distinct members and economic independence, separate filings may be required. State tax treatment can vary, so always consult a tax professional.

How much does it cost to set up a Charlotte Series LLC?

Formation costs depend on the state you choose. Delaware charges approximately $90 for Articles of Organization. North Carolina’s Certificate of Authority for a foreign LLC is $250. You will also need a registered agent in both states (typically $100-$300 per year each). Legal fees for drafting the operating agreement typically range from $500-$2,000. Overall, expect $1,000-$3,000 in first-year setup costs.

Will North Carolina courts recognize the liability protection of my Series LLC?

This is the key risk. Because NC does not have its own Series LLC statute, there is legal uncertainty about whether NC courts would honor the series-level liability protection. Most legal experts believe that properly structured and documented Series LLCs formed in recognized states would be respected under principles of comity, but there is no definitive NC case law on this point. Consult an attorney experienced in both NC business law and Series LLCs.

What is the difference between a Series LLC and a holding company?

A holding company structure involves one parent LLC that owns separate subsidiary LLCs. Each subsidiary is a fully independent entity with its own formation documents, EIN, and annual filings. A Series LLC achieves similar asset separation but within one legal entity, with one formation and typically one annual filing. The Series LLC is generally more cost-effective, while the holding company structure offers more established legal precedent in all 50 states.

Can I convert my existing Charlotte LLC to a Series LLC?

You cannot convert an NC LLC directly into a Series LLC because NC does not authorize the structure. However, you can form a new Series LLC in a friendly state, transfer assets from your existing NC LLC into the appropriate series, and then dissolve or maintain the original NC LLC. This process requires careful legal and tax planning to avoid triggering taxable events during the asset transfer. Work with both an attorney and a CPA to handle the conversion properly.