Opportunity Zone Tax Planning in Laramie: 2026 Strategy Guide for High-Income Investors

For high-income earners in Laramie, opportunity zone tax planning represents one of the most powerful wealth-building strategies available in 2026. By strategically investing in designated opportunity zones within Wyoming, you can defer significant capital gains taxes, potentially eliminate taxes entirely on investment gains, and contribute to local economic development. This comprehensive guide explores how opportunity zone tax planning in Laramie works under current 2026 rules and how the One Big Beautiful Bill Act (OBBBA) has enhanced these opportunities for business owners, real estate investors, and high-net-worth individuals.

Table of Contents

- Key Takeaways

- What Are Opportunity Zones and How Do They Work in 2026?

- Which Laramie Areas Qualify as Opportunity Zones?

- How Much Can You Save With Opportunity Zone Investments?

- What Are the Capital Gains Deferral and Exclusion Benefits?

- What Are the Eligibility Requirements for Opportunity Zones?

- How Has OBBBA Enhanced Opportunity Zone Benefits for 2026?

- Next Steps

- Frequently Asked Questions

Key Takeaways

- Opportunity zone tax planning in Laramie allows you to defer capital gains indefinitely and potentially eliminate taxes on future gains if held 10+ years.

- For the 2026 tax year, investors can defer gains on amounts invested in qualified opportunity funds, with gains taxed at reduced rates or eliminated entirely.

- The OBBBA has made permanent key business tax provisions, making opportunity zone strategies more valuable for business owners and real estate investors.

- A strategic 2026 opportunity zone plan can save six-figure amounts in capital gains taxes while supporting Laramie’s economic growth.

- Timing your capital gains realization with opportunity zone investment is critical to maximizing tax benefits under 2026 rules.

What Are Opportunity Zones and How Do They Work in 2026?

Quick Answer: Opportunity zones are economically distressed areas where investors can defer, reduce, or potentially eliminate capital gains taxes by investing gains into qualified funds focused on zone development.

Opportunity zone tax planning in Laramie operates through a federal incentive program designed to encourage investment in economically distressed communities. When you have capital gains from stock sales, real estate transactions, or business exits, you can elect to reinvest those gains into a Qualified Opportunity Fund (QOF) that focuses on investments within designated opportunity zones. By doing this, you accomplish multiple tax objectives simultaneously: you defer the capital gains tax that would normally be due in 2026, you reduce the amount of deferred gains over time, and you potentially eliminate taxes on new gains generated within the opportunity fund after holding it for 10 years.

The Three-Phase Tax Benefit Structure

For the 2026 tax year, opportunity zone benefits work in three distinct phases. Phase One allows you to defer the original capital gains tax liability indefinitely you do not pay taxes on those gains in 2026 or for years afterward. Phase Two provides a 10% basis step-up on the original invested amount after holding the investment for five years, and an additional 5% step-up after seven years, effectively reducing your taxable gain. Phase Three offers the crown jewel: if you hold the qualified opportunity fund investment for at least 10 years, any gains generated within the fund, not just the original invested amount, are taxed at zero percent. This means gains generated between 2026 and 2036 could be completely tax-free.

Pro Tip: For opportunity zone tax planning in Laramie, the key is recognizing that you have 180 days from realizing a capital gain to invest those proceeds into a qualified opportunity fund. Missing this deadline means you lose all deferral benefits, so mark your calendar immediately after any significant gains.

How Gains Are Treated Under 2026 Rules

Under current 2026 tax law, when you realize a capital gain, say from selling appreciated stock at a 15% or 20% long-term capital gains rate, that gain can be immediately invested into a qualified opportunity fund. The tax on that gain does not disappear; it is deferred. This deferral allows your capital to compound and grow tax-free inside the opportunity fund during the holding period. For example, if you realize a $500,000 capital gain in 2026 and invest it into a qualified opportunity fund focused on Laramie development, you defer the $75,000 to $100,000 in federal capital gains taxes that would otherwise be due. That $75,000 to $100,000 stays in your investment and continues working for you.

Which Laramie Areas Qualify as Opportunity Zones?

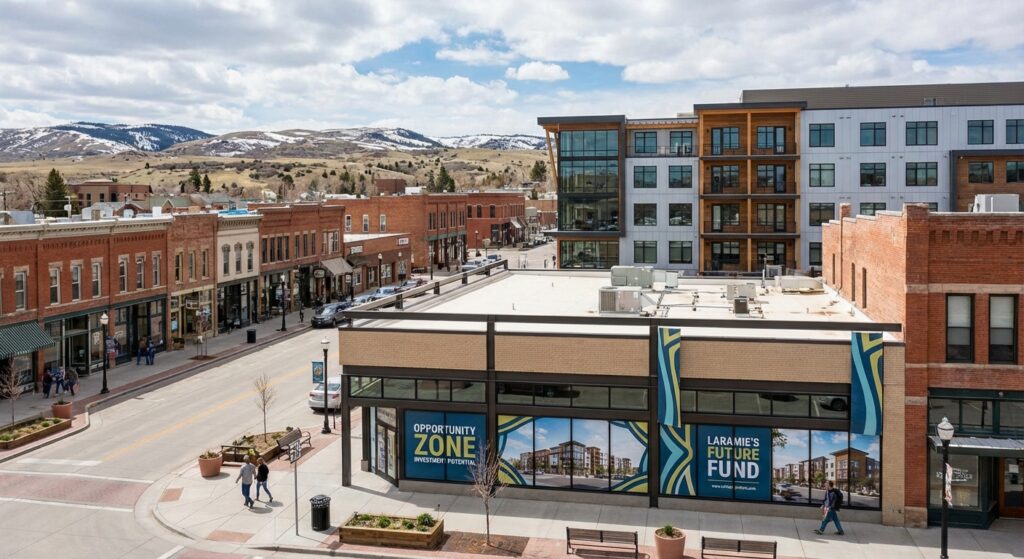

Quick Answer: Laramie, Wyoming has designated opportunity zones within economically distressed census tracts, qualifying for federal opportunity zone benefits when investments focus on specified business activities and community development.

Laramie’s opportunity zones are specifically designated areas within Albany County that meet federal criteria for economic distress. These are not randomly selected; they are identified through a rigorous federal process that examines poverty rates, median income levels, and unemployment within specific census tracts. For opportunity zone tax planning in Laramie to work effectively, your investment must be made into a Qualified Opportunity Fund that invests in these designated tracts. The fund must have a substantial portion of its assets deployed into zone businesses and real property located within Laramie’s designated zones.

Laramie Investment Categories

- Real estate projects: commercial properties, multi-family housing, hospitality ventures

- Business operations: retail, manufacturing, technology startups serving zone residents

- Infrastructure: utilities, transit improvements, community facilities benefiting the zone

- Agricultural ventures: agribusiness, ranching operations, agricultural technology

- Mixed-use developments: projects combining multiple investment types with community benefit

The beauty of opportunity zone tax planning in Laramie is that you have flexibility in how you deploy capital. Some investors focus on real estate appreciation; others prioritize business operations; many use a blended approach. What matters for 2026 tax purposes is that the qualified opportunity fund you choose invests predominantly in these designated Laramie zones and meets all federal requirements for maintaining its QOF status.

How Much Can You Save With Opportunity Zone Investments?

Quick Answer: Depending on gain size and holding period, opportunity zone investments can save $15,000 to $200,000+ in federal capital gains taxes while generating additional tax-free gains after 10 years.

To understand the actual dollar impact of opportunity zone tax planning in Laramie, let’s work through realistic 2026 scenarios. The savings depend on three factors: the size of your initial capital gain, your long-term capital gains tax bracket (0%, 15%, or 20% for 2026), and your holding period.

Scenario 1: Mid-Level Investor

Consider a business owner in Laramie who realizes a $250,000 capital gain from selling commercial real estate in 2026. If taxed at the 15% long-term capital gains rate, the federal tax would normally be $37,500. However, by investing this $250,000 into a qualified opportunity fund focused on Laramie development and holding it for 10 years, they defer that $37,500 in taxes. If the fund grows to $400,000 over the 10-year period, the additional $150,000 in gains would be taxed at 0%, a complete tax elimination on the appreciation. The immediate deferral saves $37,500 in 2026 cash flow, and the long-term tax elimination on gains saves an additional $22,500 in future taxes (assuming 15% rate on the $150,000 gain). Total tax savings: over $60,000 on a $250,000 investment.

Scenario 2: High-Net-Worth Investor

A high-net-worth individual realizes a $1,000,000 capital gain from equity compensation or investment liquidation. At the 20% federal long-term capital gains rate (applicable to incomes over certain thresholds), the federal tax is $200,000. By deploying this into a Laramie opportunity zone fund and holding for 10 years, they defer $200,000 in 2026 taxes. If the fund grows at 8% annually over 10 years, the investment grows to approximately $2,160,000, generating $1,160,000 in gains. The original $1,000,000 gain is still deferred (taxable later), but the new $1,160,000 gain is taxed at 0%, saving an additional $232,000 in taxes. Total tax savings: over $432,000 on a $1,000,000 investment.

Use our Small Business Tax Calculator for Washington/Tacoma to estimate your specific savings based on your gain amount and tax bracket for 2026.

Pro Tip: For opportunity zone tax planning in Laramie, timing is everything. If you’re planning a significant business sale or liquidation event in 2026 or 2027, coordinate with your tax advisor to ensure your investment into a qualified opportunity fund happens within the 180-day window after your gain realization. Missing this deadline eliminates all benefits.

What Are the Capital Gains Deferral and Exclusion Benefits?

Quick Answer: Opportunity zone investments provide indefinite deferral of original gains plus basis step-ups at years 5 and 7, culminating in complete exclusion of gains held 10+ years.

The tax benefits of opportunity zone tax planning in Laramie operate in a sophisticated system that rewards long-term commitment. Understanding each phase is crucial for maximizing your 2026 and beyond tax planning.

Phase 1: Indefinite Deferral (Years 0-10)

When you invest your 2026 capital gains into a qualified opportunity fund, you do not pay taxes on those gains immediately. The deferral continues for as long as you hold the investment. You only owe taxes on the original gain when you eventually sell the opportunity fund investment. For example, if you invest $250,000 in 2026 and hold it for 15 years before selling, you do not pay taxes on that $250,000 gain until year 15. Meanwhile, that $250,000 grows tax-free inside the fund.

Phase 2: Basis Step-Ups (Years 5 and 7)

After holding a qualified opportunity fund investment for five years, the IRS allows a 10% step-up in your basis. If you invested $250,000 in 2026, your basis increases to $275,000 in 2031. This means if you sell at that point, you only owe taxes on $225,000 of the original gain (not the full $250,000). After seven years, you get an additional 5% step-up, increasing basis to $287,500. These step-ups effectively reduce the amount of your original gain that is subject to eventual taxation.

Phase 3: Gain Exclusion (10+ Years)

The most powerful benefit: if you hold your opportunity fund investment for at least 10 years and then sell, any gains generated within the fund after your initial investment are completely tax-free at the federal level. For opportunity zone tax planning in Laramie, this means if you invest $250,000 in 2026 and it grows to $400,000 by 2036, the $150,000 gain is taxed at 0%. This is where the true wealth accumulation occurs, your money compounds inside the fund without any tax drag for a full decade.

| Timeline | Tax Treatment | 2026 Impact |

|---|---|---|

| Investment Year (2026) | Deferral begins; original gain not taxed | No tax payment due on original gain in 2026 |

| Year 5 (2031) | 10% basis step-up (reduces taxable gain) | If selling in 2031, basis increased 10% |

| Year 7 (2033) | Additional 5% basis step-up (total 15%) | Original gain further reduced by 15% |

| Year 10+ (2036+) | Fund gains taxed at 0%; original gain still deferred | Appreciation within fund is completely tax-free |

What Are the Eligibility Requirements for Opportunity Zones?

Quick Answer: To qualify for opportunity zone tax benefits, you need a capital gain to invest, an eligible qualified opportunity fund, and a 180-day window to reinvest after realizing your gain.

Not every investment qualifies for opportunity zone tax planning in Laramie, and not every investor can use these benefits. Understanding the eligibility requirements is essential for 2026 tax planning.

Capital Gain Requirements

You must have a capital gain to invest in a qualified opportunity fund. Common sources include: (1) selling appreciated stocks, bonds, or cryptocurrencies at a profit; (2) selling real estate at a gain; (3) selling a business or portion of a business; (4) receiving equity compensation that appreciates (such as stock options or restricted stock units that vest at a gain); (5) liquidating investment portfolios. Importantly, ordinary income does not qualify, you specifically need capital gains. For 2026 tax purposes, if you expect a significant capital gain event, opportunity zone tax planning in Laramie should be part of your broader tax strategy months in advance.

The 180-Day Investment Window

This is the most critical requirement: you have 180 days from the date you realize a capital gain to invest those proceeds into a qualified opportunity fund. If you sell real estate on January 15, 2026, the clock starts. You must have your capital invested into a QOF by approximately July 14, 2026. Missing this deadline, even by one day, disqualifies all deferral benefits. This is why tax planning coordination is essential, your tax advisor, financial advisor, and fund manager must work together to ensure the investment happens within the window.

Pro Tip: Mark the 180-day deadline in your calendar immediately upon realizing a capital gain. For opportunity zone tax planning in Laramie, consider setting a reminder at day 150 to ensure all investment documentation is finalized and funds are deployed before the deadline.

Qualified Opportunity Fund Requirements

Your fund must meet specific IRS requirements to be a qualified opportunity fund. At least 90% of the fund’s assets must be invested in opportunity zone business property and real property located in designated zones. The fund must maintain this ratio throughout your holding period. For Laramie opportunity zone tax planning, this means the fund you invest in must have a substantial portion of its capital deployed into Laramie’s designated opportunity zones. Verify with your fund manager that they maintain QOF status through annual IRS certification.

How Has OBBBA Enhanced Opportunity Zone Benefits for 2026?

Quick Answer: The One Big Beautiful Bill Act (signed July 4, 2025) makes permanent key business tax provisions, increasing the attractiveness of opportunity zone investments for business-focused funds and creating synergies with other 2026 tax strategies.

The opportunity zone tax planning landscape in Laramie became significantly more attractive in 2026 due to provisions in the One Big Beautiful Bill Act (OBBBA). Signed into law on July 4, 2025, OBBBA made permanent several business tax provisions that were previously temporary, directly enhancing the return potential of opportunity zone investments focused on business operations.

Permanent 100% Bonus Depreciation

OBBBA made 100% bonus depreciation permanent starting in 2026. This means qualified opportunity funds investing in manufacturing properties or business equipment in Laramie can immediately deduct the full cost of those assets in the year of purchase. Previously uncertain whether this would continue, fund managers can now confidently deploy capital into real property and equipment knowing they will receive immediate tax deductions. For investors in these funds, this increases the fund’s profitability and return potential, ultimately benefiting your opportunity zone investment.

Immediate Domestic R&D Expensing

Under OBBBA, qualified opportunity funds investing in technology, research, or development-focused businesses in Laramie can now immediately expense previously unamortized research and development costs. For a business in Laramie developing new agricultural technology or manufacturing innovations, this creates significant 2026 tax savings. When opportunity funds hold these businesses, the tax efficiency translates to better fund performance and higher returns on your opportunity zone investment.

Permanent Qualified Business Income (QBI) Deduction

OBBBA made the Section 199A QBI deduction permanent, allowing pass-through businesses in opportunity zones to deduct up to 20% of qualified business income. For Laramie opportunity funds investing in LLC, S-corp, or partnership interests, this means the businesses they hold can deduct 20% of profits, improving their after-tax returns and fund performance. This is particularly valuable for opportunity zone tax planning in Laramie when investing in local businesses rather than just real estate.

Capital Gains Spreading for Farmland

For Laramie and rural Wyoming investors, OBBBA introduced a provision allowing farmers and ranchers to spread capital gains from qualified farmland sales over four years. While this is a separate benefit from opportunity zones, it can be strategically coordinated. For example, a farmer could use opportunity zone tax planning in Laramie to defer gains from property sales, while another farm transaction could utilize the farmland spreading provision, creating multiple tax optimization layers.

Pro Tip: For 2026 opportunity zone tax planning in Laramie, consider how OBBBA’s permanent business provisions affect your fund selection. Funds focused on business operations in designated zones may offer superior returns compared to pure real estate funds due to these permanent tax incentives for the underlying businesses.

Uncle Kam in Action: The Laramie Tech Entrepreneur’s $500K Capital Gain

Client Profile: Marcus, a 45-year-old technology entrepreneur based in Laramie, successfully exited his software consulting firm for $2 million in 2026. After accounting for basis and holding periods, he realized a $500,000 long-term capital gain. Facing a potential $100,000 federal tax bill at the 20% rate (plus state taxes), Marcus needed a strategy.

The Challenge: Marcus wanted to remain invested and grow his wealth, but he was frustrated about immediately losing $100,000+ to federal taxes. He also wanted to support Laramie’s economic development and potentially create new business opportunities in his community.

Uncle Kam’s Opportunity Zone Solution: We implemented a comprehensive opportunity zone tax planning strategy in Laramie. Within 180 days of his business sale closing, we invested his $500,000 capital gain into a Qualified Opportunity Fund focused on tech incubators and innovation hubs in Laramie’s designated opportunity zones. The fund’s portfolio included: (1) a co-working space and startup incubator in downtown Laramie; (2) a software development training program partnership; (3) technology infrastructure improvements.

The Results: By using opportunity zone tax planning in Laramie, Marcus achieved:

- Immediate Tax Savings: $100,000 federal capital gains tax deferred (he paid no tax on the $500,000 gain in 2026)

- Reinvestment Growth: His $500,000 investment grew to approximately $750,000 over the 10-year holding period (assuming 4% annual growth)

- 10-Year Tax Exclusion: The $250,000 gain generated within the fund during the 10-year period was completely tax-free, saving an additional $50,000 in federal taxes

- Community Impact: His capital directly funded Laramie’s innovation ecosystem, creating local tech jobs and supporting emerging entrepreneurs

- First-Year ROI: By deferring $100,000 in taxes and keeping that capital invested, Marcus achieved an effective first-year ROI of 20% on tax savings alone

Total Tax Savings: $100,000 deferred in 2026 + $50,000 long-term exclusion = $150,000 total federal tax savings through opportunity zone tax planning in Laramie. This allowed Marcus to compound his full $500,000 investment for 10 years while supporting community development that benefits all Laramie residents.

For additional success stories and to see how Uncle Kam’s team has helped business owners and investors maximize tax benefits, visit Uncle Kam’s Client Results page.

Next Steps

If you are considering opportunity zone tax planning in Laramie for 2026 or beyond, take these concrete steps:

- Identify Your Capital Gain Events: Do you have a business sale, property liquidation, or investment gain expected in 2026 or 2027? Document the potential gain amount and expected realization date.

- Review Qualified Opportunity Fund Options: Research QOFs focused on Laramie and Wyoming opportunity zones. Verify their IRS-certified QOF status and understand their investment strategy (real estate vs. business operations vs. mixed).

- Coordinate Your Tax Planning Team: Meet with our tax strategists to integrate opportunity zone planning into your broader 2026 tax strategy, including entity selection, depreciation strategies, and estimated tax payments.

- Set a 180-Day Investment Deadline: Once you realize a capital gain, your clock starts immediately. Work with your advisors to ensure deployment within the 180-day window.

- Schedule a Consultation: Schedule a consultation with Uncle Kam’s team to discuss whether opportunity zone tax planning in Laramie aligns with your financial goals and circumstances.

Frequently Asked Questions

Can I invest in an opportunity zone fund without a capital gain?

No, opportunity zone tax benefits specifically require a capital gain to be invested. However, you can invest cash or other assets into opportunity zones without tax benefits, you simply will not receive the deferral and exclusion advantages. For opportunity zone tax planning in Laramie to work optimally, coordinate it with capital gains you expect to realize.

What happens to my investment if the fund does not maintain QOF status?

If a qualified opportunity fund loses its QOF certification, your deferred gains become immediately taxable. This is why selecting a reputable fund manager is critical for 2026 opportunity zone tax planning in Laramie. Verify the fund’s track record, IRS correspondence history, and commitment to maintaining zone-focused investments at the 90% threshold.

Can I use opportunity zone benefits if I am self-employed or own a business?

Absolutely. Business owners who realize capital gains from selling their business, selling appreciated real estate, or liquidating investments can use opportunity zone tax planning in Laramie. In fact, business owners often realize the largest capital gains and benefit most from deferral and exclusion strategies.

Do state taxes apply to opportunity zone investments?

Opportunity zone benefits apply at the federal level only. Wyoming has no state income tax, making opportunity zone tax planning in Laramie particularly attractive for Wyoming residents and businesses, you get federal deferral without state income tax complications. However, if you are a resident of another state, you may still owe state taxes on your deferred gains when they eventually become taxable.

What is the difference between opportunity zone deferral and ordinary deferral strategies?

Ordinary deferral (like a 1031 exchange in real estate) defers taxes but requires you to reinvest in similar assets and does not reduce the eventual tax liability. Opportunity zones are superior because they provide (1) indefinite deferral, (2) basis step-ups that reduce taxable gains, and (3) complete exclusion of gains after 10 years. For 2026 opportunity zone tax planning in Laramie, these benefits far exceed traditional deferral strategies.

How do I know if a Laramie area truly qualifies as an opportunity zone?

The IRS maintains an official list of designated opportunity zones on its website. You can search by state and county to verify which census tracts in Laramie and Albany County qualify. Your fund manager should provide clear documentation showing which zones their investments target and verify they are on the official IRS list. For opportunity zone tax planning in Laramie, always verify zone designation independently rather than relying solely on fund marketing materials.

Can I invest my retirement account into an opportunity zone fund?

Opportunity zone benefits are designed for taxable accounts, not retirement accounts. Your retirement account funds are already tax-deferred (or tax-free in Roth accounts), so they do not need additional deferral benefits. For opportunity zone tax planning in Laramie, focus on deploying taxable capital gains into QOFs and keeping retirement funds in their original tax-advantaged vehicles.

What is the minimum investment required for opportunity zone funds targeting Laramie?

Minimum investments vary by fund manager. Some Laramie-focused opportunity zone funds accept investments as low as $25,000 to $50,000, while others require $250,000 or more. For opportunity zone tax planning in Laramie, discuss minimum investment requirements with your fund manager and your tax advisor to ensure alignment with your capital gain amount.

Last updated: February, 2026