Maryland Passive Activity Loss Rules: Complete 2026 Guide for Real Estate Investors

Quick Answer:

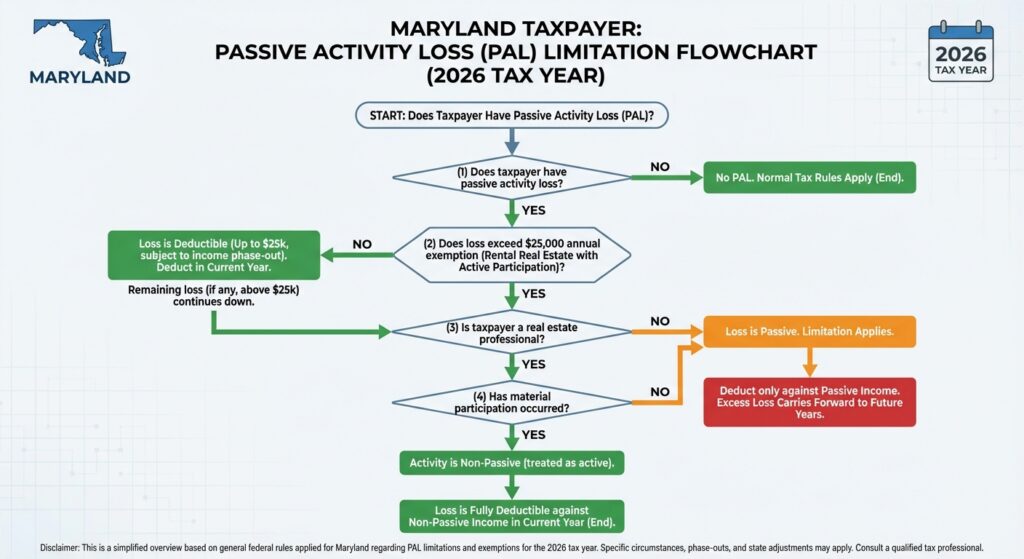

Maryland follows federal passive activity loss (PAL) rules under IRC Section 469. Most Maryland taxpayers can deduct up to $25,000 in passive losses annually if they actively participate in real estate activities. Losses exceeding this limit carry forward indefinitely to future tax years. Maryland real estate professionals may deduct all passive losses without limitation. All PAL rules apply to Maryland state tax returns.

Key Takeaways:

- Maryland adopts federal IRC Section 469 passive activity loss rules without modification

- Annual deduction limit: $25,000 for active participants in real estate activities

- Income thresholds trigger phase-out: $100,000-$150,000 MAGI eliminates the $25K allowance

- Material participation exempts activity from PAL rules; real estate professionals avoid limitations

- Unused losses carry forward indefinitely and may offset passive gains in future years

- Qualifying disposition of passive activity releases suspended losses immediately

Table of Contents

- What Is Passive Activity Loss (PAL)?

- How Maryland Treats Passive Activity Losses

- The $25,000 Passive Loss Exception Explained

- Material Participation Test

- Real Estate Professional Exception

- Passive Loss Carryforward and Suspended Losses

- How to Calculate and Claim Passive Losses

- Qualifying Disposition Rules

- Common Mistakes to Avoid

- Frequently Asked Questions

- Next Steps

What Is Passive Activity Loss (PAL)?

Passive Activity Loss (PAL) is a loss generated from trade or business activities in which the taxpayer does not materially participate during the tax year. Common sources include rental real estate, limited partnerships, S corporations where you’re a passive investor, and other business interests where you’re not actively involved in daily operations.

Why Passive Activity Loss Rules Exist

Congress enacted IRC Section 469 in 1986 to prevent high-income taxpayers from using losses from passive investments to offset active business income or W-2 wages. Without these restrictions, wealthy individuals could shelter substantial income through strategic real estate and partnership losses, reducing federal (and therefore Maryland state) tax liability significantly.

The PAL rules create a firewall: passive losses generally can only offset passive income, not active income or portfolio income (interest, dividends, capital gains).

What Activities Are Considered “Passive”?

An activity is passive if:

- The taxpayer does NOT materially participate in the activity during the tax year

- The activity is a trade or business (or rental activity)

- The taxpayer is not a “real estate professional” (defined below)

Common passive activities:

- Rental properties where you don’t actively manage or make decisions

- Limited partnership interests in real estate or business ventures

- S corporation ownership where you’re not active in operations

- Business interests where you contribute capital but not labor

- Equipment leasing arrangements

How Maryland Treats Passive Activity Losses

Maryland’s Tax Conformity

Maryland adopts federal passive activity loss rules with minimal modifications. This means:

Federal PAL treatment = Maryland PAL treatment (with rare exceptions)

When you file Form 8582 (Passive Activity Loss Limitations) for your federal return, those same loss limitations apply to your Maryland state return. Maryland does not provide additional deductions or alternative calculations for passive losses.

The Maryland Department of Revenue (DOR) explicitly acknowledges Section 469 limitations in its tax guidance, requiring taxpayers to follow federal rules precisely.

What This Means for Maryland Taxpayers

If you’re a Maryland resident or have Maryland-source passive income/losses:

- You must file Form 8582 with your federal return if you have net passive losses

- The limitations shown on Form 8582 transfer directly to your Maryland state return

- Suspended (disallowed) losses carried forward on federal returns also carry forward on Maryland returns

- Any release of suspended losses on your federal return (via qualifying disposition) applies to Maryland as well

Note: Maryland has no state-specific forms for passive activity loss. Use federal Form 8582 as your documentation, and reference the suspended loss amounts on your Maryland return.

The $25,000 Passive Loss Exception Explained

What Is the $25,000 Exception?

IRC Section 469(i) allows taxpayers to deduct up to $25,000 of passive losses annually, even though they exceed passive income. This exception is critical for real estate investors because it allows a meaningful deduction without the need to earn passive income to offset losses.

For 2026: The $25,000 allowance applies to Maryland state returns. This figure is not indexed for inflation and remains $25,000 for all tax years (as originally set in 1986).

Who Qualifies for the $25,000 Exception?

To claim the full $25,000 deduction, you must meet ALL of these criteria:

- Active Participation: You must actively participate in the rental real estate activity. Active participation is a lower standard than material participation (see section below).

- Real Estate Activity: The passive activity must be a real estate rental activity (not equipment leasing, S corp interests, or other passive activities).

- MAGI Limitation: Your modified adjusted gross income (MAGI) must not exceed certain thresholds (see phase-out below).

- Ownership Requirement: You must own at least 10% of the activity during the tax year.

MAGI Phase-Out for the $25,000 Exception

The $25,000 allowance is NOT available to high-income taxpayers. The deduction phases out as MAGI increases:

| MAGI Range | $25,000 Deduction Status | Filing Status Impact |

|---|---|---|

| Under $100,000 | FULL $25,000 deduction allowed | Single, MFJ, HOH all same |

| $100,000 – $150,000 | PARTIAL deduction (50% of excess over $100K) | Reduced by $0.50 for every $1 over $100K |

| Over $150,000 | NO $25,000 exception available | Exception eliminated entirely |

Calculation Example: Phase-Out in Action

Scenario: John (filing single) has MAGI of $125,000 and rental property losses of $35,000 from Maryland real estate where he actively participates.

Calculation:

- MAGI = $125,000

- Excess over $100,000 = $25,000

- Phase-out reduction = $25,000 × 50% = $12,500

- Allowable deduction = $25,000 – $12,500 = $12,500

- Suspended loss (carried forward) = $35,000 – $12,500 = $22,500

Maryland Impact: John’s Maryland state return reflects the same $12,500 allowable loss and $22,500 suspended loss (since Maryland follows federal rules).

Material Participation Test

What Is Material Participation?

Material Participation (MP) means you are involved in the operation of an activity on a regular, continuous, and substantial basis. If you materially participate, the activity is NOT passive, and you can deduct ALL losses without limitation.

Pro Tip: Material participation is the easiest way to avoid passive activity loss limitations entirely. If you can establish MP, you bypass the $25K cap and income phase-outs.

Seven Material Participation Tests (IRS Safe Harbors)

You satisfy the material participation requirement if you meet ANY ONE of these seven tests:

| Test # | Standard | Practical Application |

|---|---|---|

| Test 1 | 500+ hours of work in the activity during the year | Working nearly full-time (10 hours/week average) |

| Test 2 | You perform substantially all the work in the activity | You do almost all the work; minimal outsourcing |

| Test 3 | 100+ hours and no other individual works more hours | You work 100+ hours; no spouse/partner works more |

| Test 4 | Prior participation & no change in facts/circumstances | Established pattern from prior years continues |

| Test 5 | Rental activity exception (if meets specific criteria) | Limited to specific high-involvement rental scenarios |

| Test 6 | Participation in prior 3 of 5 tax years (businesses) | Active in 3+ years out of 5-year lookback period |

| Test 7 | Significant participation activity (SPAs) | 100+ hours with others; aggregate participation meets test |

Documenting Material Participation

Critical for Maryland returns: Keep contemporaneous records of hours worked. This documentation is essential if the IRS (or Maryland DOR) challenges your material participation claim.

What to document:

- Daily log of hours spent on activity (rental property: maintenance, tenant calls, repairs, accounting)

- Calendar or spreadsheet with weekly/monthly summaries

- Receipts and invoices showing the nature of work performed

- Communications (emails, notes) showing decision-making and management

- Photos or records of property inspections and work completed

Real Estate Professional Exception

Who Is a “Real Estate Professional”?

If you qualify as a real estate professional (REP), ALL passive losses from rental real estate activities can be deducted without limitation. This is the most valuable PAL exception.

Important: Real estate professional status is complex and frequently challenged by the IRS. Qualification requires meeting TWO strict tests simultaneously.

Real Estate Professional Qualification Tests

You are a real estate professional IF you meet BOTH requirements:

Test 1: Real Property Trade or Business

- More than 50% of your personal service hours in the tax year are spent in real property development, redevelopment, construction, reconstruction, acquisition, conversion, rental, operation, management, leasing, or brokerage activities

Test 2: Substantial Participation

- You spend more than 100 hours in the real property business in the tax year

Real Estate Professional Example: Maryland Landlord

Scenario: Sarah is a Maryland real estate agent (60% of her 1,500 work hours annually) and owns 3 rental properties (40% of her work hours). She spends approximately 600 hours on property management, tenant relations, and maintenance.

Qualification Analysis:

- Personal service hours in real property business: 50% (real estate agent) + 40% (property management) = 90% of total hours ✓ (Exceeds 50% test)

- Hours in real property activities: 1,500 × 40% = 600 hours ✓ (Exceeds 100-hour test)

- Result: Sarah qualifies as a real estate professional

- Tax benefit: All losses from her 3 rental properties bypass PAL limitations

Maryland Impact: Sarah’s Maryland state return reflects her full deduction (no $25K limitation, no phase-out). This treatment aligns with her federal return since Maryland adopts federal rules.

Passive Loss Carryforward and Suspended Losses

What Happens to Excess Passive Losses?

If your passive losses exceed the allowable deduction, the excess doesn’t disappear. It carries forward indefinitely to future tax years where it may be deductible against:

- Passive income generated in future years

- Gains from a qualifying disposition of the activity

- Complete phase-out of the activity (if income rises above phase-out limits, suspended losses await future relief)

Passive Loss Carryforward Mechanics

Form 8582 tracks suspended losses year-by-year. Here’s the flow:

| Year | Passive Loss | Deductible Amount | Suspended Loss |

|---|---|---|---|

| 2024 | ($30,000) | $25,000 | ($5,000) |

| 2025 | ($28,000) | $25,000 | ($8,000) [= $5K + $3K prior surplus] |

| 2026 | $12,000 (passive income) | $12,000 (offset suspended loss) | ($4,000) [remaining suspended] |

Key Point on Carryforward for Maryland Taxpayers

Your federal Form 8582 provides the carryforward amounts that transfer directly to your Maryland state return. Maryland does not independently track suspended losses; it adopts the federal calculation.

How to Calculate and Claim Passive Losses

Step-by-Step Guide to Calculate Your Passive Loss Deduction

Step 1: Identify All Passive Activities

- List all rental properties, partnerships, S corp interests, and other passive business interests

- For each activity, determine: (a) passive income generated, (b) passive losses incurred

- Document whether you materially participate in each activity (see Material Participation test above)

You’ve completed this step when: You have a complete list of activities, classified as passive or non-passive, with income/loss figures for 2026.

Step 2: Calculate Net Passive Loss for the Year

- Sum all passive losses from all activities

- Sum all passive income from all activities

- Net result = Total Passive Loss (if losses exceed income)

Example:

- Rental Property A (passive): Loss of ($15,000)

- Rental Property B (passive): Income of $8,000

- Partnership Interest (passive): Loss of ($12,000)

- Net Passive Loss = ($15,000) + $8,000 + ($12,000) = ($19,000)

You’ve completed this step when: You have a net passive loss figure for the tax year.

Step 3: Determine Your MAGI and Active Participation Status

- Calculate your Modified Adjusted Gross Income (MAGI) per IRC Section 469(i)

- Determine if you actively participate in any real estate rental activity (lower standard than material participation)

- Note your filing status (single, married filing jointly, married filing separately)

Active Participation Definition: You actively participate if you: – Make or approve management decisions (tenant approvals, repairs, rent amounts) – Regularly and actively manage the property – At least 10% ownership interest – NOT treated as a passive investor with minimal involvement

You’ve completed this step when: You know your MAGI and have documented active participation in any real estate activities.

Step 4: Apply the $25,000 Exception (If Eligible)

- If MAGI ≤ $100,000 AND you actively participate in real estate activities: Deduct up to $25,000 of passive loss

- If MAGI $100,001 – $150,000: Calculate phase-out reduction (50% of excess over $100K) and reduce $25,000 allowance

- If MAGI > $150,000: No $25,000 exception available

Calculate your deductible amount:

Deductible Passive Loss = Lesser of:

(a) Net Passive Loss for the year, OR

(b) $25,000 (reduced by phase-out if MAGI > $100K)

You’ve completed this step when: You’ve calculated the allowable deduction and suspended loss amounts.

Step 5: Complete Form 8582 (Federal)

- File IRS Form 8582 (Passive Activity Loss Limitations) with your federal return

- Report each passive activity, income/loss amounts, and suspended loss carryforwards

- Form 8582 automatically flows to Schedule D or other applicable schedules

- Keep a copy for your Maryland records

You’ve completed this step when: Form 8582 is completed, reviewed, and filed with your federal return.

Step 6: Report on Maryland Return

- On your Maryland return, report the same passive loss figures shown on Form 8582

- Maryland does not require a separate state form; use federal Form 8582 as documentation

- Reference suspended loss carryforwards in your notes for future year calculations

You’ve completed this step when: Your Maryland return reflects the same passive loss treatment as your federal return.

Qualifying Disposition Rules

What Is a Qualifying Disposition?

A qualifying disposition is a taxable event that allows you to immediately deduct all previously suspended passive losses from that activity. Common scenarios include:

- Sale of the passive activity (rental property, partnership interest) to an unrelated third party

- Complete disposition of the activity for taxable gain

- Death of the taxpayer (heirs may deduct suspended losses against stepped-up basis)

Qualifying Disposition Example: Maryland Real Estate Sale

Scenario: You own a Maryland rental property with accumulated suspended losses of $45,000 from prior years. In 2026, you sell the property for $350,000 (realizing a capital gain of $80,000).

Tax treatment:

- Capital gain on sale: $80,000

- Released suspended losses: $45,000 (full amount deductible in 2026)

- Net taxable gain: $80,000 – $45,000 = $35,000

- Maryland Impact: The same treatment applies to your Maryland return (no additional suspended losses retained)

Common Mistakes to Avoid

Mistake 1: Incorrectly Claiming Material Participation Without Documentation

The Trap: Claiming material participation (Test 1: 500+ hours) without maintaining contemporaneous time logs or records.

Why It’s Costly: If audited, the IRS will demand proof of hours worked. Without written documentation, the IRS presumes you didn’t materially participate, disallowing your deductions and imposing penalties.

How to Avoid It: – Maintain daily logs of hours worked on the activity (even simple spreadsheets count) – Track the nature of work (e.g., “Tenant meeting – 2 hours,” “Property maintenance – 3 hours”) – File copies with your tax return or keep in a safe location for audit defense

Mistake 2: Confusing Material Participation with Active Participation

The Trap: Thinking that active participation (lower standard) is the same as material participation (higher standard).

Why It’s Costly: You might claim a deduction under the $25,000 exception (which requires active participation) when you don’t actually meet the test. Or you might fail to claim material participation benefits because you misunderstood the requirements.

How to Avoid It: – Material Participation: Needed to escape PAL limitations entirely (no $25K cap) – Active Participation: Needed to claim the $25,000 exception (for rental real estate only) – Review the definitions in the Material Participation section above and clearly document which applies to your situation

Mistake 3: Forgetting About Passive Loss Carryforwards in Future Years

The Trap: Not tracking suspended losses across multiple tax years, so you miss opportunities to deduct them when you have passive income.

Why It’s Costly: You may overpay taxes in a year when you have passive income because you forgot you had suspended losses to offset it.

How to Avoid It: – Maintain a “suspended loss tracker” spreadsheet updating each year – Include suspended loss amounts in your tax return notes or preparers’ notes – Review carryforward amounts each year when you have passive income generation

Mistake 4: Ignoring Maryland-Specific Conformity Issues

The Trap: Assuming that federal PAL treatment automatically applies to Maryland without verification.

Why It’s Costly: While Maryland generally conforms to federal rules, there may be limited exceptions or different treatment for certain activities. Filing incorrect amounts on your state return can trigger an audit.

How to Avoid It: – After calculating federal Form 8582, verify that your Maryland return reflects the same amounts – If you’re involved in Maryland-specific passive activities (e.g., Maryland real estate professional status), consult a Maryland tax professional – Review Maryland Department of Revenue guidance on passive activity loss annually for any updates

Mistake 5: Mixing Passive and Non-Passive Income Incorrectly

The Trap: Using passive losses to offset W-2 wages, business income, or portfolio income (which is not allowed).

Why It’s Costly: The entire deduction could be disallowed, with penalties and interest assessed.

How to Avoid It: – Remember: Passive losses offset ONLY passive income (or are carried forward) – W-2 wages, self-employment income, and investment income are NOT passive and cannot be offset – Keep passive income/loss calculations separate from active income calculations

Frequently Asked Questions

Q1: Can I Deduct Passive Losses on My Maryland Return if I Can’t on My Federal Return?

A: No. Maryland adopts federal IRC Section 469 rules without modification. If the IRS disallows a passive loss deduction, Maryland will also disallow it. Conversely, if you deduct a passive loss on your federal return, you can deduct the same amount on Maryland.

Q2: What If I’m a Real Estate Professional in Maryland—Do I Still Need to Track Material Participation?

A: No. If you meet the real estate professional tests (>50% hours in real property business + 100+ hours), you can deduct ALL rental real estate losses without limitation and without proving material participation for individual properties. Material participation is only required if you’re NOT a real estate professional.

Q3: Can I Deduct Passive Losses in the Year I Buy a Rental Property?

A: Yes, if the property generates a loss for that year. However, you must meet material participation or active participation tests for that year. Simply owning the property doesn’t guarantee a deduction.

Q4: If I Materially Participate in a Rental Property, Am I Considered a “Real Estate Professional”?

A: Not necessarily. Material participation applies to individual activities. Real estate professional status is a taxpayer-level determination based on >50% of your personal service hours in real estate and 100+ hours in the business. You can have material participation in one rental property without being a real estate professional overall.

Q5: What Happens to My Suspended Passive Losses if I Die?

A: Your heirs receive the passive activity at fair market value (stepped-up basis). Suspended losses are generally deductible against this stepped-up basis in the year of death or shortly after. Consult an estate attorney and tax advisor for specifics, as rules vary.

Q6: Can My Spouse and I Each Claim the $25,000 Exception on a Joint Return?

A: No. The $25,000 exception applies to the return filing unit (married couple on joint return = one $25K limit). You cannot split it as $12,500 each. Filing separately (Married Filing Separately) limits each spouse to $12,500 (and raises MAGI phase-out to $50K-$75K), so joint filing is typically better.

Q7: Does Maryland Have State-Specific Passive Activity Loss Modifications or Credits?

A: Maryland follows federal rules without significant state-level modifications. Unlike some states that offer passive loss credits or different limitations, Maryland requires strict adherence to IRC Section 469. Consult Maryland Department of Revenue for the latest guidance.

Q8: If I Have Passive Losses and No Passive Income, Can I Ever Deduct Them?

A: Yes, through two mechanisms: (1) If you become a real estate professional or meet material participation in subsequent years, suspended losses become deductible; (2) If you have a qualifying disposition of the passive activity, all suspended losses release immediately.

Q9: How Does the Passive Activity Loss Rule Apply to S Corporations and Partnerships?

A: If you own a passive interest in an S corp or partnership (without material participation), the pro-rata share of losses is passive and subject to the $25K limitation. If you materially participate, losses are not passive and deductible without limitation.

Q10: Are Suspended Passive Losses Adjusted for Inflation?

A: No. Suspended losses retain their original dollar amount and carry forward without inflation adjustment. The $25,000 annual allowance is also NOT indexed and remains $25,000 forever.

Q11: If I Convert a Passive Activity to Active/Material Participation, When Do Suspended Losses Become Deductible?

A: Upon the conversion year, suspended losses from prior years become deductible as the activity is reclassified as non-passive. Complete Form 8582 to show the reclassification and release of suspended losses.

Q12: What Records Should I Keep to Support Passive Activity Loss Deductions for Maryland Tax Purposes?

A: Maintain: (1) Time logs and activity records for material participation claims; (2) Form 8582 copies for all years; (3) Rental property documentation (income/expense records, tenant agreements, repairs); (4) Suspended loss tracking across years; (5) Correspondence with the IRS or Maryland DOR if audited. Keep records for at least 7 years.

Next Steps

Immediate Actions

- Organize Your Activity List: Identify all passive activities (rental properties, partnerships, S corp interests) and gather 2026 income/loss statements.

- Calculate Net Passive Loss: Sum all passive income and losses to determine your total passive activity loss for 2026.

- Verify MAGI: Calculate your modified adjusted gross income to confirm $25,000 exception eligibility and phase-out status.

- Document Material/Active Participation: Compile time logs, photos, emails, and records proving your involvement in passive activities.

- Review Prior Suspended Losses: Pull your 2024-2025 tax returns to identify any carryforward amounts that might offset 2026 passive income.

Professional Guidance Needed If:

- Your passive losses exceed $25,000 and you’re in the MAGI phase-out range ($100K-$150K)

- You’re claiming real estate professional status (high IRS audit risk)

- You have material participation disputes (inadequate documentation)

- You’re disposing of passive activities (qualifying disposition rules are complex)

- You have Maryland-source rental income and also out-of-state passive activities

- You’re an S corp or partnership investor with passive interest questions

Where to File in Maryland

For 2026 Maryland state tax returns and passive activity loss guidance, contact:

Maryland Department of Revenue

110 Carroll Street

Annapolis, MD 21411

Phone: 1-800-638-2937

Website: Maryland Department of Revenue

For federal passive activity loss forms and IRS guidance: IRS Form 8582 Instructions

Additional Resources for Maryland Taxpayers

- Tax Preparation Services: Consult a Maryland-based CPA or Enrolled Agent experienced in real estate and passive activity loss rules. Our Maryland tax preparation services can help navigate these complex rules.

- IRS Publication 925: Passive Activity and At-Risk Rules (comprehensive federal guidance)

- Maryland Tax Guide: Updated annually on the Maryland Department of Revenue website