Columbia Series LLC: A Strategic Guide to Tax Preparation in 2026

Table of Contents:

- What Is a Series LLC?

- Tax Advantages of Columbia Series LLC

- Series LLC Benefits: A Deeper Look

- DC, Maryland & Virginia Compliance

- Real Estate Investor Use Cases

- Cost Comparison: Series LLC vs. Multiple LLCs

- 2026 Tax Preparation Checklist

- IRS Rules & Updates Impacting Series LLCs in 2026

- Compliance & Recordkeeping Tips

- Frequently Asked Questions

Quick Answer: A Columbia Series LLC allows business owners in the DC, Maryland, and Virginia area to operate multiple business lines or hold separate assets under one parent LLC. Each “series” enjoys its own liability protection, and the structure can streamline tax filing while reducing formation costs compared to creating multiple standalone LLCs. For 2026 tax preparation, each series must maintain separate books and may need its own EIN.

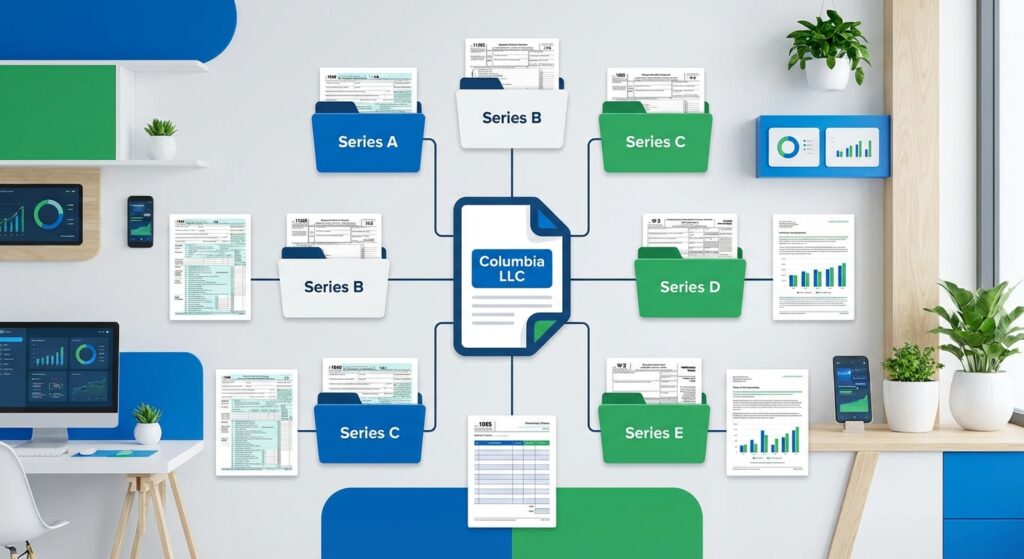

What Is a Series LLC?

A Series LLC is a unique type of limited liability company that allows for the establishment of multiple “series” under a single entity. Each series has separate assets, members, and operations, providing an advanced level of insulation and flexibility.

- Origins: Most commonly formed in states like Delaware, Nevada, and Illinois.

- Columbia Series LLC: Refers either to a Series LLC structured in the District of Columbia or a series branded with “Columbia” as part of its name for local business purposes.

As of 2026, the Series LLC structure is growing in popularity for real estate, investment funds, and small-to-mid businesses seeking asset segregation and streamlined operations.

For Columbia-area entrepreneurs, this structure is especially attractive because the DC metro region spans multiple jurisdictions. A Series LLC lets you compartmentalize operations in DC, Maryland, and Virginia without forming separate entities in each state. This can dramatically reduce administrative overhead while still providing the liability shields your business needs.

Key Tax Advantages

- Separate taxation: Each series can be treated as a unique entity for federal tax purposes [IRS Source].

- Pass-through taxation: Series LLCs can elect to be taxed as partnerships, avoiding double taxation.

- Deductions & Credits: Each series may qualify for specific deductions and tax credits.

Pro Tip: Columbia-area business owners with multiple rental properties or business ventures can potentially claim the Qualified Business Income (QBI) deduction under Section 199A for each qualifying series separately. This means each series could receive up to a 20% deduction on its qualified business income, compounding the overall tax savings across your entire portfolio. Talk to a qualified tax professional to determine eligibility.

Beyond these core advantages, the Series LLC structure also allows for flexible tax classification elections. One series might elect S-corp taxation to reduce self-employment taxes, while another remains a disregarded entity for simplicity. This level of customization is difficult or impossible to achieve with a single traditional LLC.

Series LLC Benefits: A Deeper Look

While the tax advantages alone make a Series LLC appealing, the structure offers several additional strategic benefits that Columbia-area business owners should consider.

Asset Protection and Liability Isolation

The primary advantage of a Series LLC is the liability firewall between each series. If one series is sued or incurs debts, the assets held in other series are generally protected. For Columbia business owners with diverse operations, this means a lawsuit involving one property or business line should not jeopardize your other holdings.

Consider this example: You own three rental properties in the Columbia, MD area and a consulting business. With a traditional single LLC, a slip-and-fall lawsuit at one property puts all of your assets at risk. With a Series LLC, only the series holding that specific property is exposed.

Operational Flexibility

Each series within a Columbia Series LLC can have different members, managers, and ownership percentages. This is particularly useful when you want to bring in a partner for one venture without giving them ownership stakes in your other businesses. You can also assign different profit-sharing arrangements to each series, giving you maximum flexibility in how you structure deals.

Simplified Administration

Instead of filing separate formation documents, paying multiple annual fees, and maintaining separate registered agents for each business entity, a Series LLC consolidates much of this under one umbrella. In states that fully recognize Series LLCs, you often only need one registered agent and one annual report for the parent LLC, even if you operate dozens of series beneath it.

Did You Know? Delaware was the first state to enact Series LLC legislation in 1996. Since then, over 20 states have adopted some form of Series LLC statute. While DC and Maryland have not yet enacted dedicated Series LLC statutes, Columbia-area business owners can still form a Series LLC in Delaware or another recognizing state and register it as a foreign entity locally.

Scalability for Growing Businesses

For Columbia entrepreneurs who plan to expand, the Series LLC structure scales efficiently. Adding a new business line or acquiring a new property simply means creating a new series under the existing umbrella, rather than going through the full LLC formation process again. This makes it ideal for investors and business owners who are actively building a portfolio.

DC, Maryland & Virginia Compliance for Series LLCs

Operating a Series LLC in the Columbia, DC metro area involves navigating the rules of up to three jurisdictions. Here is what you need to know about each.

District of Columbia

DC does not currently have a dedicated Series LLC statute. However, you can form your Series LLC in a state that does (such as Delaware) and then register the parent LLC as a foreign LLC in DC. Key considerations include:

- Register with the DC Department of Licensing and Consumer Protection (DLCP)

- File the DC Form D-30 (Unincorporated Business Franchise Tax Return) if doing business in the District

- Pay the DC annual report fee for the foreign LLC registration

- DC may not recognize the internal liability shields between series, so consult a local tax professional for risk assessment

Maryland

Maryland also lacks a dedicated Series LLC statute as of 2026. Columbia, MD business owners typically form the Series LLC in Delaware and register it as a foreign entity with the Maryland State Department of Assessments and Taxation (SDAT). Important Maryland considerations:

- File the Maryland Annual Report with SDAT and pay the associated $300 fee

- Maryland may require each series conducting business in the state to separately register, depending on the nature of its activities

- File Maryland Form 510 (Pass-Through Entity Tax Return) for each series generating Maryland-source income

- Columbia, MD businesses should also consider Howard County-specific business license requirements

Virginia

Virginia enacted Series LLC legislation effective July 1, 2019, making it one of the few states in the DMV area to formally recognize the structure. Key points for Virginia operations:

- You can form a Series LLC directly in Virginia through the State Corporation Commission (SCC)

- Virginia recognizes the liability shields between series under its Protected Series Act

- Each protected series must file a certificate of protected series designation with the SCC

- Virginia charges a registration fee for the parent LLC plus each protected series

Pro Tip: If your Columbia-area business operates across the DC, Maryland, and Virginia borders, Virginia may be the best formation state in the region since it formally recognizes Series LLCs. This can provide stronger legal protection for your series compared to registering a Delaware Series LLC as a foreign entity in DC or Maryland. Consult with a qualified advisor to determine the best formation strategy for your situation.

Real Estate Investor Use Cases in Columbia

The Series LLC is arguably most popular among real estate investors, and the Columbia area presents excellent opportunities for this strategy. Here are some common ways investors in the DC metro market use Series LLCs.

Rental Property Portfolios

A Columbia-based investor who owns five rental properties can place each property in its own series. This way, a tenant lawsuit related to one property cannot threaten the equity in the other four. Each series tracks its own rental income, expenses, depreciation, and capital improvements for tax purposes.

Fix-and-Flip Operations

Investors who buy, renovate, and sell properties in the Columbia and greater DC metro area can use a separate series for each flip project. This isolates the risk of construction defect claims and keeps the accounting clean for calculating profit on each individual project. Once a flip is complete and sold, the series can be dissolved or reused for the next project.

Mixed-Use Portfolios

Some Columbia investors hold a mix of residential rentals, commercial properties, and short-term vacation rentals. A Series LLC allows them to group these different property types into separate series, each with its own tax treatment and management structure. This is especially useful because short-term rentals (such as Airbnb properties) often have different tax reporting requirements than long-term residential leases.

| Use Case | Series Structure | Key Tax Benefit |

|---|---|---|

| Rental portfolio (5 properties) | 1 series per property | Separate depreciation schedules, isolated 1031 exchanges |

| Fix-and-flip projects | 1 series per flip | Clean capital gains tracking per project |

| Mixed-use portfolio | Series by property type | Different tax elections per series |

| Joint ventures | 1 series per partnership deal | Separate K-1 reporting, isolated profit splits |

Cost Comparison: Series LLC vs. Multiple LLCs

One of the most common questions Columbia-area business owners ask is whether the Series LLC is truly more cost-effective than simply forming multiple individual LLCs. The answer depends on how many entities you need and which jurisdictions you operate in.

| Cost Category | Series LLC (5 Series) | 5 Separate LLCs |

|---|---|---|

| Formation filing fees (Delaware) | $90 (one filing) | $450 (5 filings x $90) |

| Delaware annual franchise tax | $300 (one entity) | $1,500 (5 x $300) |

| Registered agent fees | $100-$300/year | $500-$1,500/year |

| Tax preparation (estimated) | $1,500-$3,000 | $3,000-$7,500 |

| Foreign registration (MD) | $300 (one entity) | $1,500 (5 x $300) |

| Estimated Annual Total | $2,290-$3,690 | $6,950-$11,250 |

As the table above illustrates, a Columbia-area business owner with five separate business lines or properties can save anywhere from $3,000 to $7,500 per year by using a Series LLC instead of forming five individual LLCs. The savings compound further as you add more series to your portfolio.

Did You Know? While the Series LLC saves on formation and maintenance costs, each series that files a separate tax return will still incur individual tax preparation fees. However, because all series share a common operating agreement framework and registered agent, the per-series preparation cost is typically lower than preparing returns for completely independent LLCs. Learn more about LLC tax preparation.

2026 Tax Preparation Checklist

| Step | Description |

|---|---|

| 1 | Identify each active series and activities |

| 2 | Maintain individual accounting for every series |

| 3 | Review IRS Form 1065 filing options for each series |

| 4 | Gather and categorize eligible deductions/credits |

| 5 | Double-check compliance with DC, Maryland, Virginia business tax rules |

Required Forms

- IRS Form 1065

- DC Form D-30 (if operating in DC)

- State-level forms for Maryland or Virginia, as applicable

Beyond the standard forms, Columbia Series LLC owners should also prepare Schedule K-1 forms for each member of each series, as well as any state-specific schedules. Keep in mind that the filing deadline for partnership returns (Form 1065) is March 15, 2026, and extensions push the deadline to September 15, 2026. Late filings can result in penalties of $220 per partner per month, so staying on top of deadlines is critical.

IRS Rules & Updates for Series LLCs in 2026

The IRS continues to clarify guidance for series LLCs:

- Each series may file as a separate taxpayer if it has its own members and economic independence.

- Consolidated reporting is only allowed if each series forms a disregarded entity under the main LLC umbrella.

- Recent IRS regulation update (2025) requires robust documentation to qualify for separate treatment.

Important: Always stay up-to-date with the IRS official resources or consult a tax professional familiar with series LLCs.

The 2025 IRS regulation update specifically addressed the documentation requirements for treating each series as a separate entity. Under these updated rules, Columbia Series LLC owners must maintain evidence of:

- Economic substance: Each series must demonstrate genuine business activity and purpose beyond mere liability isolation

- Financial independence: Separate bank accounts, accounting records, and financial statements for each series

- Operational separation: Distinct contracts, vendor relationships, and customer bases where applicable

- Governance documentation: Operating agreement provisions that clearly define each series, its assets, and its members

Quick Answer: Failing to meet the IRS documentation requirements can result in the IRS collapsing all series into a single entity for tax purposes. This would eliminate the separate filing advantage and could trigger back taxes, interest, and penalties. Columbia-area business owners should work with a tax professional to ensure compliance with these updated standards.

Compliance & Recordkeeping Best Practices

- Open separate bank accounts for each series.

- Maintain distinct records and financial statements.

- Update operating agreements to reflect series structure.

- Keep documentation of asset allocation and liability assignments.

| Requirement | Why It Matters |

|---|---|

| Separate EIN for each series | Ensures IRS and banks recognize series independence |

| Legally binding operating agreement | Prevent inter-series liability |

Columbia business owners should also implement these additional recordkeeping practices to strengthen their Series LLC compliance posture in 2026:

- Annual resolutions: Hold and document annual meetings or written consents for each series, covering major business decisions

- Insurance documentation: Maintain separate insurance policies or named insured endorsements for each series

- Inter-series transactions: If one series provides services or loans money to another, document these at arm’s-length terms

- Digital recordkeeping: Use cloud-based accounting software that supports multi-entity tracking, making it easy to generate per-series financial reports at tax time

Frequently Asked Questions

Can a Columbia Series LLC file separate tax returns for each series?

Yes—the IRS permits separate filings if each series meets criteria for economic independence and formal separation.

Are there extra compliance steps for series LLCs in DC or Maryland?

Yes. In addition to federal rules, review our DC LLC tax preparation guide and consult local statutes for series registration.

What are the audit risks in 2026?

IRS scrutiny on series LLC filings is increasing due to complexities. Maintain clear records and consult Columbia area tax advisors for audit defense strategies.

How do recent IRS changes affect real estate investors using series LLCs?

Track depreciation, rental income, and capital gains per series. Use qualified tax software, and read up on IRS real estate guidance.

Can I convert an existing Columbia LLC to a series LLC?

Usually, yes—file amendment documents and update your operating agreement. See our entity conversion checklist for step-by-step help.

How can tax professionals help?

Specialized CPAs and enrolled agents can optimize deductions, prepare complex returns, and ensure you pass IRS scrutiny in 2026 and beyond. Contact us for more information!

What happens if one series in my Columbia Series LLC goes bankrupt?

One of the core benefits of a Series LLC is liability isolation. If one series faces bankruptcy or insolvency, the assets held in other series should remain protected, provided you have maintained proper separation (separate bank accounts, records, and operating agreement provisions). However, bankruptcy courts are still developing case law around Series LLCs, so outcomes can vary. Columbia-area business owners should consult both a tax professional and an attorney experienced with Series LLC structures to understand the risks specific to their situation.

How much does it cost to add a new series to an existing Series LLC?

Adding a new series is generally much cheaper than forming an entirely new LLC. In most cases, you simply amend the operating agreement and, if required by your formation state, file a certificate of series designation. In Delaware, there is no additional state filing fee for creating a new series. In Virginia, you will need to file a certificate of protected series designation with the SCC, which carries a small fee. The primary costs are legal and accounting fees to draft the series addendum and set up separate books, typically ranging from $200 to $500 per series.

Conclusion

The Columbia Series LLC offers significant benefits for asset segregation and tax savings but comes with unique compliance and reporting requirements. For 2026, proactive preparation, attention to IRS updates, and professional support are keys to minimizing tax liabilities.

Whether you are a real estate investor managing multiple properties in the Columbia and DC metro area, a small business owner running several ventures, or an entrepreneur looking to scale efficiently, the Series LLC structure deserves serious consideration. The cost savings over maintaining multiple individual LLCs can be substantial, and the liability protection between series adds an important layer of security for your assets.

The key to success with a Columbia Series LLC in 2026 is meticulous recordkeeping, compliance with both federal and local jurisdiction requirements, and working with tax professionals who understand the nuances of this structure. Do not try to navigate the complexities of multi-series tax filing on your own, especially given the recent IRS documentation requirements.

Related Resources

- LLC Tax Preparation Services – 2026

- Business Tax Solutions in Columbia, MD

- DC Tax Preparation Guide

- Entity Conversion Checklist for Maryland

For personalized guidance, talk with our Columbia tax experts today!

Disclaimer: The information provided in this article is for general informational and educational purposes only and does not constitute legal, tax, or financial advice. Tax laws and regulations change frequently, and the application of Series LLC rules can vary by jurisdiction. The cost estimates, filing requirements, and tax strategies discussed here are approximations and may not reflect your specific situation. Always consult with a qualified tax professional, CPA, or attorney before making decisions about entity formation, tax elections, or compliance strategies. Uncle Kam and its affiliates are not responsible for any actions taken based on the information in this article. Past results do not guarantee future outcomes. For personalized advice tailored to your Columbia-area business, please contact our team directly.