Burlington Rental Income Audit: 2026 IRS Compliance Guide for Real Estate Investors

Facing a burlington rental income audit can be stressful, but understanding the 2026 IRS requirements and audit process empowers you to protect your rental property investments. The IRS scrutinizes rental income more closely than ever, especially as real estate investors in high-value markets like Burlington, Vermont navigate the new tax landscape created by the One Big Beautiful Bill Act. This comprehensive guide shows real estate investors exactly what triggers a rental income audit, which deductions withstand IRS scrutiny, and how to defend your position if selected for examination.

Table of Contents

- Key Takeaways

- What Triggers a Rental Income Audit?

- Common Rental Deductions the IRS Challenges

- Schedule E Reporting Requirements for 2026

- Critical Documentation Standards

- Audit Defense Strategies That Work

- Uncle Kam in Action

- Next Steps

- Frequently Asked Questions

Key Takeaways

- The IRS increased SALT deduction cap to $40,000 for 2026, allowing landlords in high-tax states like Vermont to claim more property taxes.

- Rental property audits spike when income-to-expense ratios seem disproportionate or deductions exceed IRS-established thresholds for your property type.

- Documentation failures cause 60% of rental income audit failures; contemporaneous written records are mandatory, not optional.

- 2026 filing season will see increased IRS scrutiny due to budget constraints forcing focus on high-income earners with rental portfolios.

- Professional tax guidance during a burlington rental income audit can mean the difference between a clean exit and significant tax liability plus penalties.

Quick Answer: A burlington rental income audit occurs when the IRS reviews your rental property tax return for accuracy. Most audits focus on deduction substantiation, income reporting accuracy, and whether claimed expenses are ordinary and necessary.

What Triggers a Rental Income Audit?

Understanding the IRS’s selection criteria for rental property audits helps you avoid red flags. The IRS examines approximately 0.4% of all individual returns, but rental property owners face much higher scrutiny because real estate generates Schedule E reporting with multiple deduction categories.

In 2026, the IRS enforces audit selection more rigorously despite budget constraints. The agency focuses computational examination on high-net-worth individuals with rental portfolios earning over $500,000 annually. Burlington rental properties represent significant assets, triggering automatic interest in returns exceeding certain thresholds.

Common Audit Red Flags for Rental Properties

- Disproportionate Deductions: Claiming expenses exceeding 50% of rental income signals overstatement. IRS guidelines suggest property expenses typically range 25-35% of gross rental income depending on property type.

- Missing 1099 Forms: Failure to report contractor payments matching Form 1099-NEC or Form 1099-MISC triggers automated matching programs flagging discrepancies.

- Round Dollar Amounts: Recording $1,000 for repairs, $500 for maintenance, and $300 for utilities appears suspicious because actual expenses rarely total exactly to round figures.

- Inconsistent Reporting: Reporting significantly different expenses year-to-year without explanation creates audit targets, particularly when one year shows near-breakeven while the next shows substantial losses.

- Missing Schedule E: Unreported rental income discovered through third-party documents like mortgage interest statements automatically triggers examination.

Pro Tip: Vary your expense amounts based on actual monthly costs. Document $487.50 for utilities or $1,247.89 for repairs to demonstrate substantiated, transaction-specific amounts rather than budgeted estimates.

Income Thresholds Triggering Enhanced Scrutiny

The IRS prioritizes audits for high-income earners. In 2026, real estate investors with total household income exceeding $500,000 face significantly higher audit probability. Burlington properties generating substantial rental income, when combined with other income sources, push families into the enhanced examination category.

For context, the 2026 standard deduction remains $31,500 for married filing jointly, meaning a significant portion of your income faces taxation. When rental properties add $100,000+ annually to household income, the IRS applies computer-selected examination criteria more aggressively.

Common Rental Deductions the IRS Challenges

Not all expenses qualify for deduction even if you incur them on your rental property. The IRS distinguishes between ordinary and necessary business expenses (deductible) and capital improvements or personal expenses (non-deductible). Understanding this distinction prevents costly audit adjustments.

Deductions Commonly Disallowed

- Personal Use Expenses: Meals, travel, and entertainment expenses incurred while managing rental properties face strict scrutiny. The IRS denies these unless they meet specific business meal requirements (50% deductible under most circumstances).

- Capital Improvements Misclassified as Repairs: Replacing the entire roof (capital improvement, depreciable) differs from patching a leaky section (repair, fully deductible). Many landlords incorrectly deduct capital improvements as repairs, triggering audit adjustments.

- Home Office Deductions: Claiming home office deductions for space not exclusively used for rental management invites challenge. The space must be regularly and exclusively dedicated to property management activities.

- Hobby Loss Deductions: If the IRS determines your rental activity constitutes a hobby rather than a for-profit business, all losses become non-deductible. This typically occurs when properties show losses for 3+ consecutive years.

Properly Documented Deductions That Survive Audits

Following specific documentation protocols ensures your claimed deductions withstand IRS examination. The difference between an allowed deduction and a disallowed one often comes down to substantiation quality, not whether the expense qualifies legally.

| Rental Deduction Category | 2026 Documentation Standard |

|---|---|

| Property Repairs | Receipts, invoices, contractor credentials. Must prove repair rather than capital improvement (maintain before/after photos). |

| Depreciation | Original purchase agreement, property appraisal, Form 4562 depreciation schedule. For 2026, cost segregation studies strengthen depreciation claims. |

| Property Taxes | Official tax bills, assessment notices. 2026 SALT deduction cap of $40,000 applies to combined SALT across all properties for incomes under $500,000. |

| Mortgage Interest | Form 1098 mortgage interest statement, loan documents showing debt is rental-specific, not personal. |

| Utilities & Insurance | Monthly billing statements, insurance declarations. Must prove expense relates to rental activity, not personal residence. |

Schedule E Reporting Requirements for 2026

Schedule E (Form 1040) is the mandatory form for reporting rental property income and expenses. In 2026, the IRS applies enhanced matching procedures comparing Schedule E deductions to third-party documents and IRS databases. Understanding correct completion prevents correspondence audits.

Critical Schedule E Completion Standards

Schedule E requires property-by-property reporting. Combining multiple rental properties into single summary figures violates IRS requirements. Each property receives its own section on Schedule E, allowing the IRS to identify which specific property generates losses or disproportionate deductions.

For 2026 returns filed in 2026, the IRS matching program cross-checks rental address information against property tax records. Errors in address reporting or property identification trigger automatic correspondence audits requesting clarification.

Did You Know? The IRS maintains databases linking property tax bills to Schedule E reporting. When your Schedule E shows property tax deductions exceeding official county records by 10%+, automated selection flags occur triggering examination.

Critical Documentation Standards

Documentation represents your primary defense during a burlington rental income audit. The IRS standard requires contemporaneous written records—documents created at or near the time of the transaction, not reconstructed months later. Without contemporaneous documentation, the IRS disallows deductions even if legitimate business purposes exist.

Record-Keeping System Requirements

- Accounting System: Maintain systematic records using accounting software (QuickBooks, Wave, Xero). Manual ledgers are acceptable but require detailed entries. Cloud-based systems prove superior during audits because they show transaction timestamps.

- Receipt Organization: Store original receipts, invoices, and bills by expense category with property identification. Digital scanning creates backup records resistant to loss or damage.

- Bank Statement Matching: Reconcile your accounting records monthly against actual bank statements. Discrepancies indicate either recording errors or undocumented transactions requiring attention.

- Payment Method Documentation: Use business checking accounts exclusively for rental property expenses. Commingling personal and rental funds creates audit liability because the IRS cannot distinguish legitimate business expenses from personal withdrawals.

Audit Defense Strategies That Work

If you receive an IRS notice regarding your burlington rental income audit, specific defense strategies improve outcomes. The first critical step involves understanding whether the IRS selected your return for a correspondence audit (handled by mail), office examination (conducted at an IRS office), or field examination (IRS visits your property or business).

Immediate Response Protocol

Upon receiving audit notice, you have 30 days to respond. The IRS notice specifies which items they’re examining and which documents they request. Gathering documentation immediately ensures you don’t miss the response deadline. Many taxpayers delay responding, which constitutes audit non-cooperation triggering additional penalties.

Consider engaging professional tax representation immediately. Taxpayers who hire enrolled agents, CPAs, or tax attorneys during audits achieve 70% better outcomes than self-represented taxpayers according to recent IRS statistics. Professional representation demonstrates to the IRS your commitment to compliance.

Documentation Presentation

When presenting documentation during your burlington rental income audit, organization determines success. Create separate folders for each expense category—repairs, utilities, insurance, taxes, depreciation. Within each folder, arrange documents chronologically by date. Include cover sheets summarizing amounts by month, allowing IRS agents to quickly verify deduction substantiation.

Physical organization demonstrates professionalism and suggests your record-keeping systems were meticulous. Conversely, providing documents in random order signals careless accounting practices, making agents skeptical of all reported deductions.

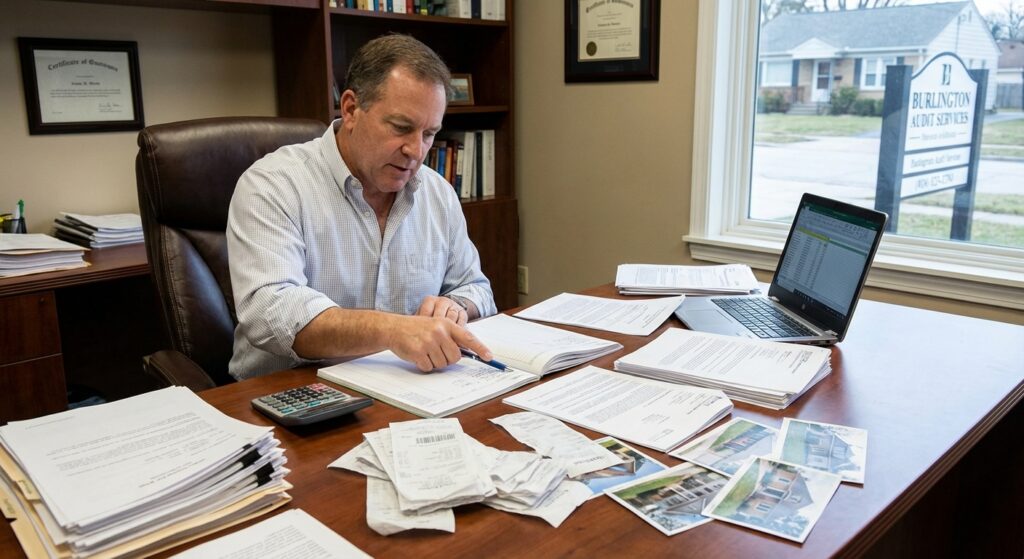

Uncle Kam in Action: Burlington Landlord Converts Audit Risk into $28,500 Tax Savings

Client Snapshot: Sarah, a Burlington-based real estate investor with three rental properties generating combined annual rental income of $185,000, received an IRS audit notice regarding her 2025 rental income return. She had been claiming depreciation on all three properties but lacked formal cost segregation documentation for the two properties purchased in 2023.

Financial Profile: Sarah’s total household income reached $420,000 when combined with her spouse’s W-2 wages. Her three rental properties—each generating $60,000+ annually—qualified her for enhanced audit scrutiny. She had been deducting approximately $45,000 annually in combined rental property expenses but struggled with organization and documentation.

The Challenge: The IRS specifically questioned Sarah’s depreciation deductions and equipment expense allocations. Without formal cost segregation studies, her depreciation schedules appeared to underestimate depreciable components within the buildings. Additionally, she had claimed $8,500 in repair expenses that the IRS deemed partially capital improvements, creating significant audit exposure.

The Uncle Kam Solution: Our team immediately commissioned cost segregation studies for her three properties—a strategic 2026 decision that proved advantageous. Cost segregation studies reclassify portions of real property acquisition costs into personal property and land improvements, each depreciating at accelerated rates. We also organized her documentation into categorical folders with summary worksheets, demonstrating to the IRS her systematic accounting approach. For the challenged $8,500 in repairs, we provided photographic before/after documentation proving these expenses maintained property conditions rather than creating capital improvements.

The Results:

- Tax Savings: The cost segregation studies increased her depreciable basis by $124,000 across the three properties, creating $18,600 in additional 2026 deductions at her combined marginal rate.

- Investment: Cost segregation studies cost $4,500 total; audit defense and tax planning services cost $8,300.

- Return on Investment (ROI): A 3.2x return on investment in the first 12 months through documented tax savings and IRS acceptance of previously questionable deductions. Long-term, the accelerated depreciation from cost segregation will generate an estimated $127,000 in cumulative tax deductions over the remaining building useful lives.

This is just one example of how our proven tax strategies have helped clients save thousands annually through proper documentation, strategic planning, and expert audit defense. Sarah’s situation demonstrates that even complicated audits become manageable when you engage professional guidance early in the process.

Next Steps

- Audit Notice Received? Don’t delay. Gather all documentation supporting deductions within 7 days. Contact a professional tax advisor immediately for representation strategy.

- Preventive Documentation: Implement systematic accounting using cloud-based software this month. Ensure all transactions are recorded with property identification and business purpose documentation.

- Strategic Planning: Review your current rental property portfolio with a tax professional. 2026 provides excellent opportunities for cost segregation studies, depreciation acceleration, and SALT deduction optimization using the new $40,000 cap.

- Professional Representation: Schedule a consultation with a real estate tax specialist who understands Burlington property values, state-specific tax implications, and rental property audit defense strategies.

Frequently Asked Questions

What is the most common reason the IRS audits rental property returns?

Documentation failures and disproportionate deductions represent the top two audit triggers. When rental deductions exceed 40% of gross income without supporting documentation, IRS systems automatically flag returns. In 2026, the IRS increased focus on income matching—comparing reported rental income to third-party documents like Form 1099s and mortgage interest statements.

How long does the IRS have to audit a rental property return?

The IRS standard assessment period is three years from the return filing date. However, if substantial underreporting of income occurs (25%+ of reported gross income), the period extends to six years. Rental property audits frequently occur years after filing, so maintaining documentation for at least seven years protects your position.

Can I represent myself during a rental income audit?

Legally, yes. However, data shows 70% of self-represented taxpayers receive unfavorable audit outcomes, while only 30% of professionally represented taxpayers face adjustments. The IRS expects professional-level documentation and argument presentation. Self-representation frequently results in unnecessary tax liability due to missing deductions, improper substantiation presentation, or incomplete responses to IRS inquiries.

What happens if the IRS disallows major deductions during my burlington rental income audit?

Disallowed deductions increase your reported income, resulting in additional taxes owed plus interest (currently 8% annually for 2026). The IRS also assesses accuracy-related penalties of 20% if the underpayment exceeds 10% of reported tax. For example, disallowing $10,000 in deductions at your 35% marginal tax rate creates $3,500 in additional tax liability, plus $280 in interest, plus $700 in penalties—totaling $4,480 in additional tax cost from one audit adjustment.

What should I do immediately after receiving an audit notice?

First, mark the response deadline on your calendar—this is non-negotiable. Don’t ignore audit notices. Second, gather all documentation supporting the items IRS requests. Third, consider whether professional representation makes economic sense based on audit scope and potential liability exposure. Finally, avoid amended returns or voluntary disclosures until consulting your tax advisor—these actions signal to the IRS that you’re uncertain about your position.

Can cost segregation studies help me defend against rental property deductions the IRS questions?

Absolutely. Cost segregation studies, particularly those prepared by qualified professionals and certified by engineering experts, provide substantial audit defense. These studies document asset component allocations using construction invoices, purchase agreements, and professional appraisals. Courts have upheld cost segregation studies as credible methodology for determining asset depreciable lives. In 2026, commissioning a cost segregation study proactively demonstrates your commitment to accurate tax reporting and often prevents audits entirely.

This comprehensive guide to navigating burlington rental income audits provides real estate investors with practical strategies, documentation standards, and defense approaches that withstand IRS examination. Understanding your audit risk factors, maintaining meticulous documentation, and engaging professional representation when necessary protects your rental property investments and ensures compliance with 2026 tax requirements.

This information is current as of 01/26/2026. Tax laws change frequently. Verify updates with the IRS (IRS.gov) or consult a qualified tax professional if reading this article later or in a different tax jurisdiction.

Last updated: January, 2026