Arizona TPT Tax Guidance: The Ultimate 2024 Guide for Business Owners

Last updated: June 2024

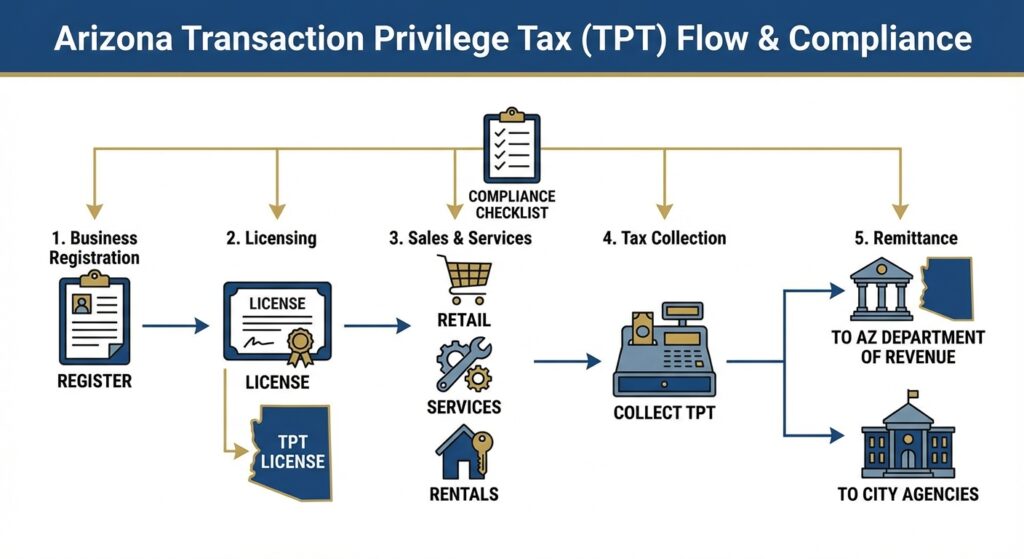

Arizona’s Transaction Privilege Tax (TPT) can be confusing for new—and even experienced—business owners. Unlike a traditional sales tax, Arizona TPT is a tax on the privilege of doing business, and it applies to a wide range of activities. This guide breaks down everything Arizona businesses need to know about TPT, covering registration, compliance, exemptions, and filing for 2024.

Table of Contents

- Key Takeaways

- What Is Arizona TPT?

- Who Needs to Pay Arizona TPT?

- Arizona TPT Rates for 2024

- Registration: How to Obtain a TPT License in Arizona

- Arizona TPT Filing & Payment Deadlines (2024)

- Arizona TPT Exemptions & Special Cases

- Common Mistakes Arizona Business Owners Make

- How Out-of-State Sellers Are Affected (Economic Nexus)

- Uncle Kam in Action: Real Arizona Business Case Study

- Next Steps: Your TPT Compliance Action Plan

- Frequently Asked Questions About Arizona TPT (2024)

- Arizona TPT Filing Example Table

- Related Resources

Key Takeaways

- TPT is not a sales tax. It’s a privilege tax on businesses for conducting transactions in Arizona, though it’s commonly passed on to customers.

- Multi-layered rates. Arizona TPT combines state (5.6%), county, and city taxes, with total rates ranging from 5.6% to 11.2% depending on your location.

- Economic nexus threshold is $100,000. Out-of-state sellers must register and collect TPT if they exceed this annual sales threshold in Arizona.

- Monthly filing due by the 20th. Most Arizona businesses must file and pay TPT by the 20th of each month for the previous month’s activity.

- Multiple licenses may be required. You may need separate TPT licenses for different business locations and each city or county where you operate.

What Is Arizona TPT?

Quick Answer: Arizona’s Transaction Privilege Tax (TPT) is a tax on businesses for the privilege of conducting certain business activities in the state. Unlike traditional sales taxes that are levied on the buyer, TPT is technically the seller’s responsibility, though most businesses pass it on to customers.

The Transaction Privilege Tax (TPT) is often referred to as Arizona’s “sales tax,” but it’s technically a tax on the vendor for the privilege of conducting business in the state. Businesses can—and usually do—pass the tax on to their customers. TPT covers activities including retail sales, renting/leasing real property, restaurant/bar sales, contracting, and service businesses.

Understanding this distinction is critical for Arizona business owners. Because the tax burden falls on you as the business owner, you’re responsible for calculating, collecting, and remitting TPT even if you choose not to separately itemize it on customer invoices. The Arizona Department of Revenue (ADOR) administers TPT at the state level, while individual counties and municipalities impose their own additional TPT rates.

How Does TPT Differ From Sales Tax?

- Charged to the vendor (business), not directly to the customer.

- Multiple layers: State, county, and city rates may apply separately.

- Applies to services, not just tangible goods in many cases.

What Business Activities Are Subject to TPT?

Arizona TPT applies to over 16 different business classifications. The most common include:

- Retail sales: Selling tangible personal property to end consumers

- Contracting: Prime contracting, speculative building, owner-builder sales

- Restaurant and bar: Food and beverage sales for immediate consumption

- Rental/leasing: Renting or leasing real or personal property

- Telecommunications: Phone, internet, and data services

- Transporting (for hire): Commercial transportation services

Who Needs to Pay Arizona TPT?

Quick Answer: You must collect and remit Arizona TPT if you sell products or taxable services to Arizona customers, operate a physical location in the state, or exceed $100,000 in annual Arizona sales (economic nexus). Both in-state and qualifying out-of-state businesses are required to register.

You must collect and remit TPT if you:

- Sell physical products to Arizona customers

- Provide taxable services within Arizona

- Rent or lease real property in Arizona

- Operate as a contractor or subcontractor

- Have economic nexus (e.g., $100,000+ in Arizona sales per year)

Both in-state and certain out-of-state sellers may have to register. For more help, see our Arizona Tax Preparation Guide.

Physical Presence vs. Economic Nexus

If you have a physical location in Arizona—whether it’s a storefront, warehouse, office, or even employees working from home in the state—you have nexus and must register for TPT. But Arizona also enforces economic nexus rules: if your business generates $100,000 or more in gross revenue from Arizona customers in a calendar year, you’re required to register and collect TPT, even if you have no physical presence in the state.

Pro Tip: Track your Arizona sales monthly. If you’re approaching the $100,000 threshold mid-year, register proactively rather than waiting until year-end to avoid penalties for late compliance.

Arizona TPT Rates for 2024

Quick Answer: Arizona’s base state TPT rate is 5.6%. When combined with county and city taxes, total rates typically range from 5.6% to 11.2%. Phoenix businesses, for example, pay 8.6% total (5.6% state + 0.7% county + 2.3% city).

| Agency | Typical Rate | Notes |

|---|---|---|

| State of Arizona | 5.6% | Base rate for most sales categories |

| Maricopa County | 0.7% | Varies by county |

| Phoenix (city) | 2.3% | Varies by city |

* Always check Arizona Department of Revenue TPT Rates to confirm your location’s current rates.

How Combined Rates Work in Practice

Let’s say you run a retail shop in Scottsdale, Arizona. Your customer purchases $1,000 in merchandise. Here’s how the TPT calculation breaks down:

- State TPT (5.6%): $56.00

- Maricopa County TPT (0.7%): $7.00

- Scottsdale City TPT (1.75%): $17.50

- Total TPT owed: $80.50

- Customer pays: $1,080.50 (if you pass the tax through)

Each jurisdiction’s tax must be calculated separately and reported on your monthly TPT return. The ADOR portal helps automate this for registered businesses.

Registration: How to Obtain a TPT License in Arizona

Quick Answer: Register for your Arizona TPT license through AZTaxes.gov before your first taxable sale. You’ll need your federal EIN, business structure details, and NAICS code. Separate licenses may be required for each business location and local jurisdiction.

- Register through the AZTaxes.gov portal (best for first-time applicants).

- Have your business EIN, legal structure, and NAICS code ready.

- You may need separate licenses for each business location and applicable city/county.

Step-by-Step Registration Process

The registration process through AZTaxes.gov typically takes 15-30 minutes. Here’s what to expect:

- Create an AZTaxes.gov account. You’ll need a valid email address and will set up security questions.

- Select “Register a new business.” Choose the TPT license application option.

- Provide business information. Enter your legal business name, DBA (if applicable), federal EIN, formation date, and business structure (LLC, corporation, sole proprietor, etc.).

- Identify your business classifications. Select all TPT categories that apply to your activities (retail, restaurant, contracting, etc.).

- Add location information. Enter each physical location where you’ll conduct business, including any warehouses or offices.

- Select local jurisdictions. The system will prompt you to register for city and county TPT based on your locations.

- Submit and receive your license number. You’ll receive a TPT license number immediately upon approval, which you’ll use for all future filings.

Pro Tip: Register before making your first taxable sale or providing a taxable service. Arizona imposes penalties for operating without a license, even if you haven’t yet collected any TPT from customers.

Arizona TPT Filing & Payment Deadlines (2024)

Quick Answer: Most Arizona businesses file monthly TPT returns due by the 20th of each month for the previous month’s activity. Small businesses may qualify for quarterly or annual filing. Late payments trigger automatic penalties of 4.5% plus 1% monthly interest.

- Most businesses file and pay monthly.

- Quarterly/annual filing available for small businesses with approval.

- Due date: 20th of each month for preceding month’s activity.

- File and pay online at AZTaxes.gov.

What Happens If You Miss the Deadline?

Arizona doesn’t offer grace periods for TPT filings. Missing the 20th of the month deadline results in:

- Late filing penalty: 4.5% of the tax due

- Late payment penalty: 0.5% per month (up to 10% total)

- Interest charges: 1% per month on unpaid balances

- Audit risk: Chronic late filers are flagged for ADOR audits

For a business owing $5,000 in monthly TPT that files 3 days late, the immediate penalty is $225 (4.5%), plus $50/month in late payment penalties and $50/month in interest until paid. These costs add up quickly.

Arizona TPT Exemptions & Special Cases

Quick Answer: Arizona offers TPT exemptions for wholesale sales to licensed resellers, certain agricultural products, sales to qualifying nonprofits and government entities, and out-of-state sales. Proper exemption certificates must be collected and maintained for audit protection.

Some transactions are exempt from TPT, such as:

- Wholesale sales to resellers (with proper exemption certificate)

- Certain agricultural products

- Sales to qualifying government or nonprofit organizations

- Out-of-state sales shipped directly to non-Arizona buyers

Always verify documentation to support exemptions. See the official Arizona TPT Exemptions Guide for details.

How to Properly Document Exemptions

If you sell to a reseller or exempt organization, you must obtain and retain a completed exemption certificate. Arizona accepts:

- Resale certificates: From buyers with valid Arizona TPT licenses purchasing inventory for resale

- Government exemption certificates: For direct purchases by federal, state, or local government agencies

- Nonprofit exemption forms: For qualifying 501(c)(3) organizations (not automatic—must verify eligibility)

During an audit, ADOR will request copies of all exemption certificates for exempt sales claimed on your returns. Missing or incomplete documentation can result in assessment of back taxes plus penalties on those transactions.

Common Mistakes Arizona Business Owners Make

Quick Answer: The most common Arizona TPT mistakes include failing to collect tax on taxable services, not registering with local jurisdictions, missing monthly filing deadlines, and assuming e-commerce businesses are exempt from TPT. All can trigger penalties and audits.

- Not collecting TPT on all taxable sales, including services where applicable.

- Forgetting to register for local city or county TPT licenses.

- Missing filing deadlines, leading to automatic penalties and interest.

- Incorrectly assuming online/e-commerce businesses are exempt.

The Service Business Blind Spot

Many Arizona service businesses—particularly those coming from states where services aren’t taxed—mistakenly believe they don’t need to collect TPT. But Arizona’s TPT system covers numerous service categories, including personal property rental, amusement activities, commercial lease income, and certain professional services. A landscaping company providing maintenance services, for instance, may owe TPT on their service revenue, not just on plants and materials sold.

Pro Tip: When in doubt about whether your service activity is taxable, consult ADOR’s business classification guide or work with an Arizona tax professional. The cost of expert advice is far less than the penalties for years of non-compliance discovered during an audit.

How Out-of-State Sellers Are Affected (Economic Nexus)

Quick Answer: Out-of-state businesses with $100,000+ in annual Arizona sales must register for TPT and collect tax from Arizona customers, even without a physical presence. This economic nexus rule applies to online retailers, marketplaces, and remote service providers.

If your business is not physically located in Arizona but you make $100,000+ in annual sales to Arizona customers, you may have what’s called economic nexus—requiring you to register and collect TPT. See the Remote Sellers Guidance for more info.

Marketplace Facilitator Rules

If you sell through platforms like Amazon, eBay, or Etsy, Arizona’s marketplace facilitator law may shift TPT collection responsibility to the platform. As of 2024, marketplace facilitators must collect and remit TPT on behalf of third-party sellers when the facilitator processes the payment. However, you remain responsible for TPT on any direct sales you make outside these platforms.

Track your Arizona sales by channel carefully. If you sell $80,000 through Amazon (facilitator collects) and $30,000 through your own website, you’ve exceeded the economic nexus threshold and must register for the direct sales, even though Amazon handles TPT for marketplace transactions.

Uncle Kam in Action: Real Arizona Business Case Study

Client: Desert Home Solutions LLC, a Tempe-based HVAC contractor

Challenge: The owner, Maria, was shocked to receive a notice from ADOR stating she owed $47,000 in back TPT, penalties, and interest for three years of contracting work. She had been collecting and remitting Arizona state TPT but didn’t realize she also needed separate registrations for Maricopa County and the City of Tempe. She assumed her state license covered all jurisdictions.

Uncle Kam’s Solution:

- Audit representation. We reviewed ADOR’s assessment and identified $8,200 in exempt government contract work that shouldn’t have been included.

- Penalty abatement request. We filed for first-time penalty abatement based on Maria’s otherwise clean compliance history and reasonable cause (genuine confusion about multi-jurisdictional requirements).

- Registered local licenses. We completed Maricopa County and City of Tempe TPT registrations and set up automated monthly filing reminders.

- Payment plan. Negotiated an 18-month payment plan for the remaining $28,400 balance after abatements.

Result: Maria saved $18,600 in penalties and exempt-transaction adjustments. She now maintains full TPT compliance across all three jurisdictions and hasn’t missed a filing deadline in two years. Her monthly TPT liability runs about $3,200, which she budgets as part of operating costs.

Pro Tip: If you receive a TPT audit notice or assessment from Arizona, don’t ignore it or attempt to handle it alone. ADOR auditors have wide authority, but there are legitimate strategies to reduce assessments, abate penalties, and negotiate payment terms. Professional representation often pays for itself many times over.

Next Steps: Your TPT Compliance Action Plan

Ready to ensure your Arizona business is fully TPT-compliant? Follow these five steps:

- Determine if you have nexus. Review your Arizona sales activity for the past 12 months. If you have a physical location or exceeded $100,000 in sales, you have nexus and must register.

- Register for all required licenses. Use AZTaxes.gov to register for state, county, and city TPT licenses based on each business location. Don’t assume your state license covers local jurisdictions.

- Set up your accounting system. Configure your point-of-sale or invoicing software to calculate and collect the correct combined TPT rate for each location. Track exempt sales separately and maintain exemption certificates.

- Create a filing calendar. Set monthly reminders for the 20th of each month. Consider filing a few days early to account for payment processing time. Many businesses file on the 15th to ensure they never miss the deadline.

- Consult with an Arizona tax professional. If you’re unsure about your business classification, exemptions, or multi-jurisdictional requirements, invest in expert guidance now rather than facing penalties later. Contact Uncle Kam’s Arizona tax team for a free TPT compliance assessment.

Frequently Asked Questions About Arizona TPT (2024)

Does every Arizona business need a TPT license?

No, only those engaged in taxable business activities. Always check your NAICS code and activity with AZDOR.

Can I pass TPT on to my customer?

Yes, most businesses include TPT in the price or as a separate line item. While you’re technically liable for the tax, Arizona law permits you to collect it from customers as reimbursement.

What happens if I file late?

Penalties and interest apply automatically. Late/non-filers are subject to audits and additional fees. Expect a 4.5% late filing penalty plus 0.5% monthly late payment penalties and 1% monthly interest on unpaid balances.

Do online businesses have to pay TPT?

Yes, if you have physical or economic nexus in Arizona. The $100,000 economic nexus threshold applies to all remote sellers, including e-commerce businesses, digital service providers, and marketplace sellers.

How do I know my local city/county tax rates?

Check the AZDOR TPT Rate Table for current details by area. Rates can change, so verify before each filing period if you operate in multiple locations.

Can I file TPT for all my locations on one return?

No. You’ll need to file separately for each location or jurisdiction where you’re registered. Each business location requires its own license and separate reporting, even if they’re in the same city.

What’s the difference between a sales tax license and a TPT license?

In Arizona, the TPT license covers both state, county, and city-level privilege taxes for most activities. Arizona doesn’t have a separate “sales tax”—TPT is the state’s equivalent taxation system.

Arizona TPT Filing Example Table

| Step | Action |

|---|---|

| 1 | Login to AZTaxes.gov |

| 2 | Select business TPT license |

| 3 | Input gross receipts for the month |

| 4 | Apply exemptions/deductions |

| 5 | Submit payment by the 20th |

Related Resources

Uncle Kam Services:

- Arizona Tax Preparation Services

- Tax Strategy & Planning

- Tax Advisory Services

- Small Business Tax Tips

Arizona Official Resources:

- Arizona Department of Revenue Official Site

- ADOR TPT Rates and Filing Information

- Arizona TPT Exemptions Guide

- Remote Sellers and Economic Nexus Guidance

Need personalized guidance? Arizona’s TPT system can be complex, especially for businesses with multiple locations or those operating in specialized industries. Contact our Arizona tax experts today for a comprehensive TPT compliance review and ongoing support. We’ll ensure you’re registered properly, filing on time, and taking advantage of all available exemptions.

Last updated: February 2026