The Ultimate Guide to the LLC Home Office Deduction: How to Claim It Without Fear

There is a persistent myth in the world of small business taxes, a piece of well-meaning but misguided advice that has cost business owners billions of dollars in lost deductions. It’s the idea that claiming the home office deduction is an automatic red flag for an IRS audit. Let’s be clear: this is nonsense. The IRS is not targeting the home office deduction; they are targeting fraudulent claims. The truth is, the home office deduction is a powerful and legitimate tool for reducing your tax bill, and this guide will give you the confidence and the system to claim it correctly and without fear.

The Two Golden Rules: Exclusive and Regular Use

Before you can deduct a single penny, you must meet two strict, non-negotiable rules.

Exclusive Use:

This is the rule that trips up most people. The space you claim as your home office must be used *exclusively* for your business. A desk in the corner of your guest bedroom that is also used by guests does not count. A laptop on your dining room table does not count. The space must be a separately identifiable area that is used for nothing else but your business. This could be a spare bedroom, a converted garage, or even a corner of your basement, as long as it is clearly delineated and used for nothing else.

Regular Use:

This rule is simpler. You must use the space on a regular, ongoing basis for your business. You can’t just use it once a year and call it a home office. If you are meeting with clients in the space a few times a week, or if you are spending 10-15 hours a week doing administrative work in the space, you will meet the regular use test.

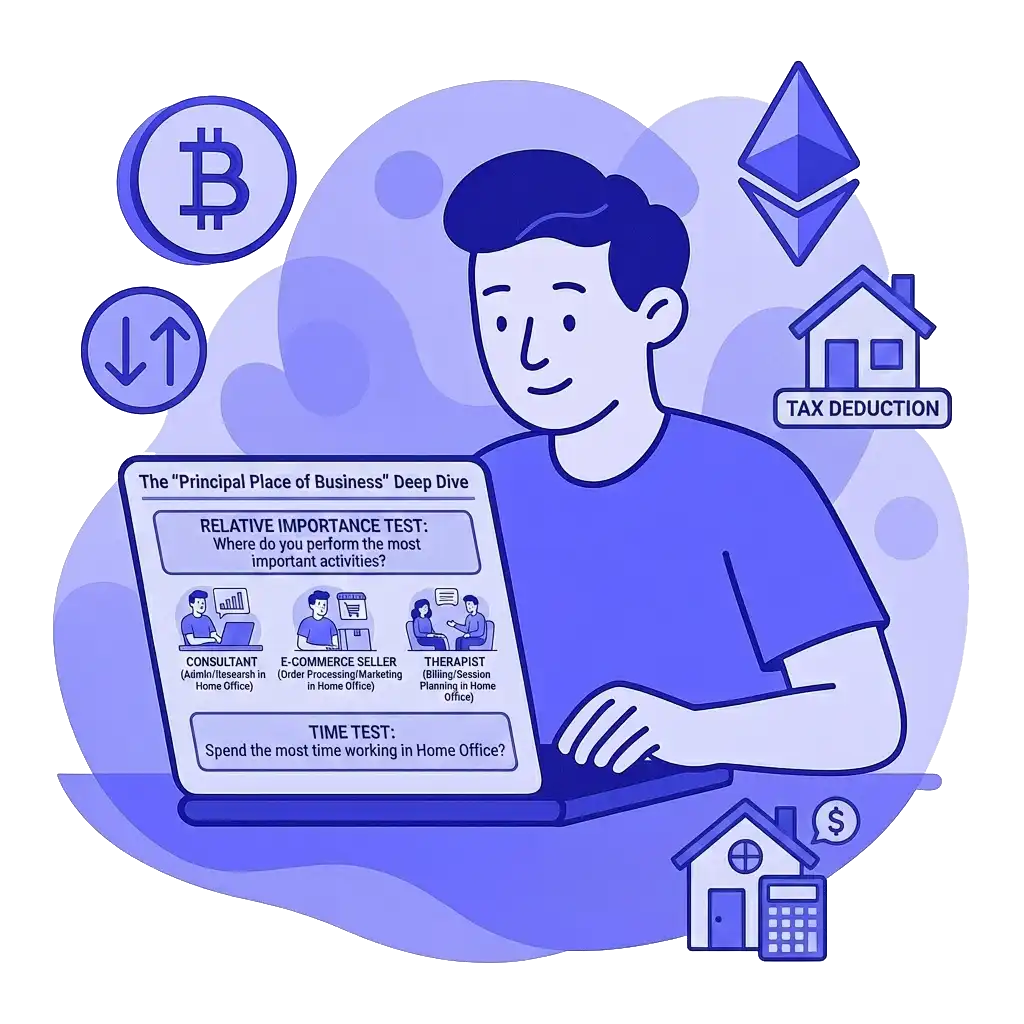

The “Principal Place of Business” Deep Dive

This is where the real nuance comes in. To qualify for the home office deduction, your home office must be your “principal place of business.” This doesn’t mean it has to be the *only* place you work. It just has to be the *most important* place. The IRS uses two tests to determine this.

The “Relative Importance” Test:

This test looks at the relative importance of the activities performed at each location where you conduct business. The key question is: where do you perform the most important activities of your business? For example:

- Consultant: If you are a consultant who meets with clients at their offices but you do all your administrative work, research, and client prep in your home office, your home office is likely your principal place of business.

- E-commerce Seller: If you store your inventory in a storage unit but you do all your order processing, marketing, and customer service from your home office, your home office is your principal place of business.

- Therapist: If you see patients in a rented office space but you do all your billing, record-keeping, and session planning in your home office, your home office is your principal place of business.

The “Time” Test:

- If you cannot determine your principal place of business based on the relative importance test, you can then use the time test. This test simply looks at where you spend the most time working. If you spend more time working in your home office than you do at any other single location, your home office will qualify as your principal place of business.

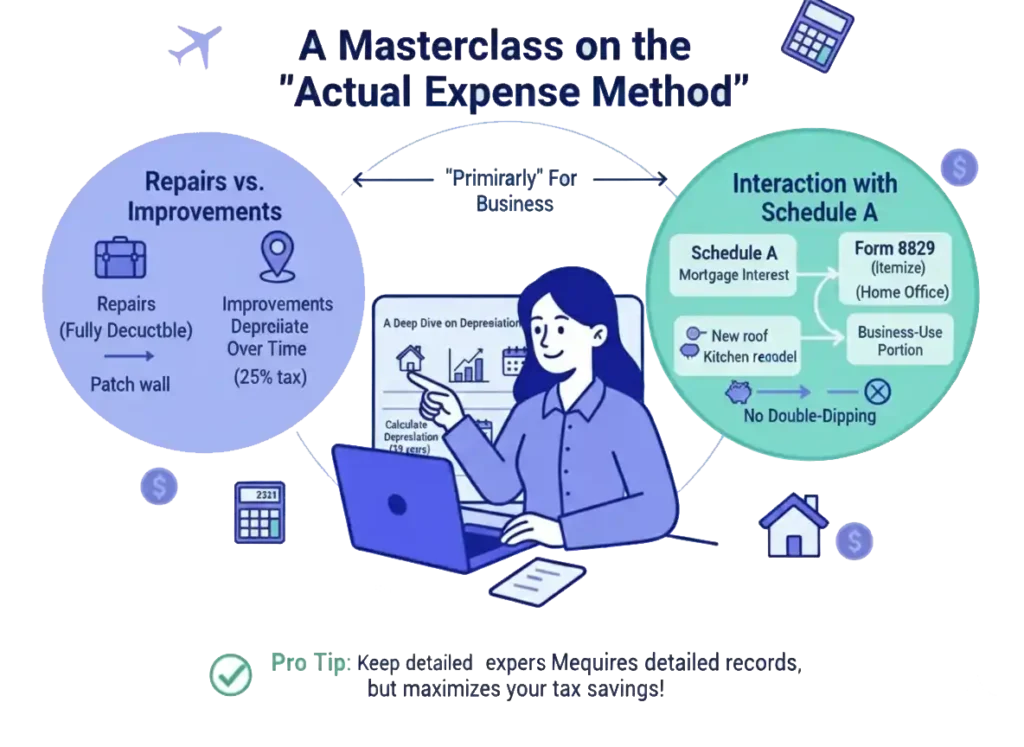

A Masterclass on the “Actual Expense Method

This is where the real money is. The actual expense method is more work, but the payoff is almost always worth it. Let’s go deep.

A Deep Dive on Depreciation

Depreciation is the most powerful and most misunderstood part of the home office deduction. It allows you to deduct a portion of the cost of your home itself. Here’s how it works:

- Determine the Basis of Your Home:This is generally what you paid for the home, plus the cost of any major improvements, minus the value of the land. You can only depreciate the structure, not the land.

- Calculate the Depreciation: You will depreciate the business-use portion of your home’s basis over 39 years for a commercial property. A good tax software will do this calculation for you, but it is critical to understand the concept.

Depreciation Recapture: The Payback

When you sell your home, you will have to “recapture” the depreciation you claimed. This means that the amount of depreciation you deducted will be taxed at a maximum rate of 25%. This is not a reason to avoid claiming depreciation; it is simply a factor to be aware of.

Repairs vs. Improvements: A Critical Distinction

- Repairs: A repair is something that keeps your home in good operating condition. A repair is a fully deductible expense in the year you pay for it. Examples include fixing a leaky faucet or patching a hole in the wall.

- Improvements:An improvement is something that adds value to your home or extends its life. An improvement must be depreciated over time; you cannot deduct the full cost in one year. Examples include a new roof, a new furnace, or a kitchen remodel.

Interaction with Schedule A

If you itemize your deductions on your personal tax return, you are already deducting your mortgage interest and property taxes on Schedule A. When you claim the home office deduction, you cannot double-dip. The portion of your mortgage interest and property taxes that is attributable to your home office must be deducted on your Form 8829, not on your Schedule A.

An Expanded Guide to the S-Corp Accountable Plan

For S-Corp owners, the accountable plan is the gold standard for claiming the home office deduction. It is cleaner, more defensible, and keeps the deduction off your personal return. Here’s how to do it right.

Adopt a Formal Plan:

Your S-Corp must formally adopt an accountable plan. This should be done via a board resolution that is kept in your corporate records. We have a downloadable template for this.

Submit an Expense Report:

Each month or each quarter, you will submit a formal expense report to your S-Corp for your home office expenses. This report should show the calculation of your deduction. We have a template for this as well.

Reimburse Yourself:

The S-Corp will then issue a check or a bank transfer to you for the exact amount of the expense report. This reimbursement is completely tax-free to you, and the S-Corp gets to deduct the expense.

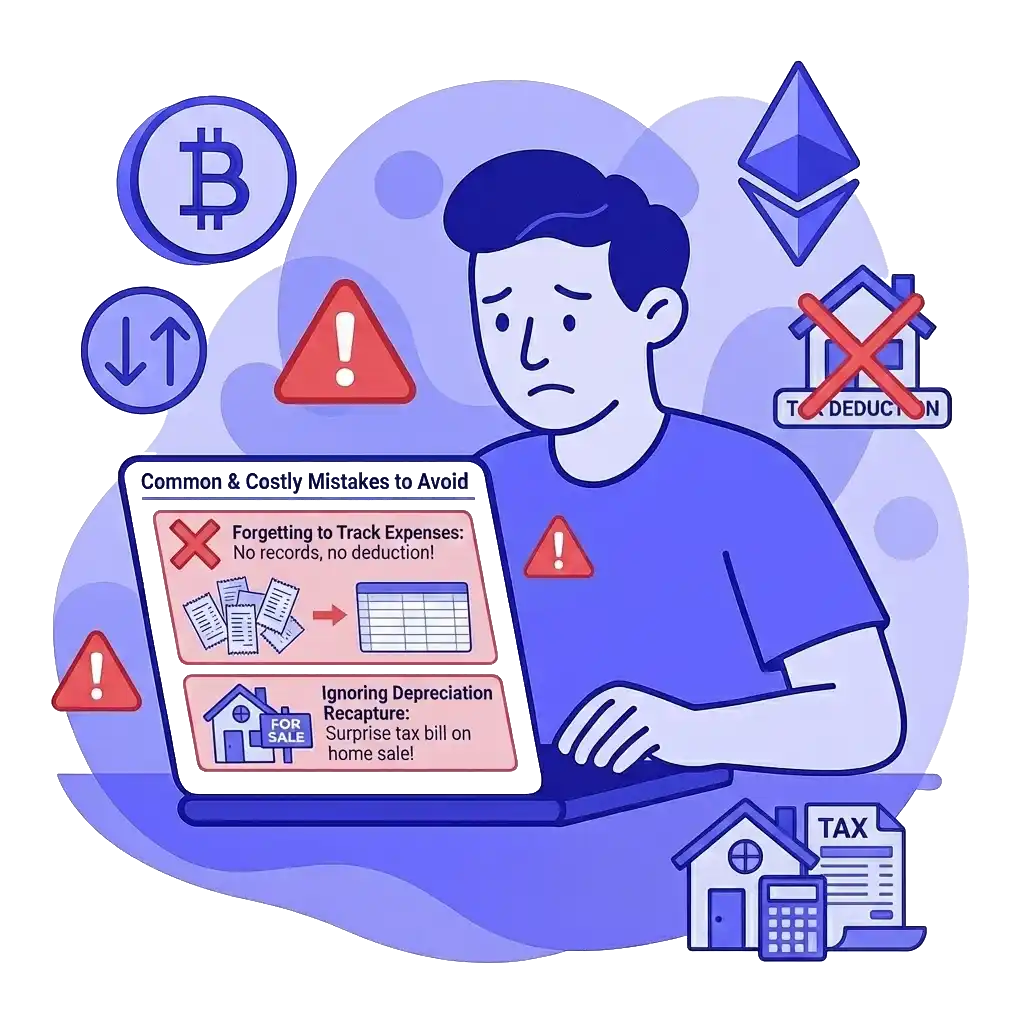

Common & Costly Mistakes to Avoid

The Guest Bedroom Office:

- Claiming a home office deduction for a room that is also used as a guest bedroom is the number one mistake. It violates the exclusive use test and will be disallowed in an audit.

The Dining Room Table Office:

- You cannot claim a deduction for a space that has another primary use.

Forgetting to Track Expenses:

- If you use the actual expense method, you must have a record of your expenses. A simple spreadsheet is all you need.

Ignoring Depreciation Recapture:

- When you sell your home, you must account for the depreciation you claimed. Forgetting to do so can lead to a nasty surprise from the IRS.

The Home Office Deduction Calculator

See the difference for yourself. Use this calculator to estimate your potential deduction under both methods.

The Final Word: Claim What Is Rightfully Yours

The home office deduction is not a loophole. It is a legitimate, powerful, and congressionally approved deduction for the millions of Americans who run their businesses from their homes. The fear surrounding this deduction is a relic of a bygone era. In the modern, post-COVID world, the home office is the new normal.

By understanding the rules, choosing the right method, and keeping good records, you can and should claim this deduction with confidence. It is your money. It’s time to claim it.