How to Pay Yourself From an LLC: The Definitive Guide to Maximizing Your Take-Home Pay

That feeling in your gut when you transfer money from your business? It’s anxiety. And it’s normal. Every business owner has been there. You look at the money in your business account, you know you’ve earned it, but a wave of uncertainty washes over you as you go to pay yourself.

- Am I doing this right?

- Will this get me in trouble with the IRS?

- Is this even legal?

- How much am I allowed to take?

This confusion is by design. The tax code is a labyrinth, and the stakes are high. Paying yourself the wrong way can lead to piercing the corporate veil (destroying your liability protection), overpaying by thousands in self-employment tax, and a constant, low-grade fear of an audit. It’s a feeling of financial paralysis that keeps you from confidently using the money you’ve rightfully earned.

It’s time to end the anxiety. This guide is the single most comprehensive, step-by-step playbook to eliminate that fear and create a confident, tax-efficient payment strategy. We will demystify the process and turn your anxiety into a powerful, repeatable financial system.

The Core Concept: Why Your Tax Status Dictates Your Paycheck

Before we dive into the “how,” we must understand the “why.” The single most important concept to grasp is this: an LLC is a legal entity created by state law, but for federal tax purposes, the IRS defaults to treating it as something else entirely. This disconnect is the source of almost all confusion around paying yourself.

Your power as an owner lies in your ability to choose how the IRS taxes your LLC. This choice directly dictates the methods you can use to pay yourself and the amount of tax you will owe. There are three paths.

| Payment Method | Who It’s For | How It Works | The Tax Impact |

|---|---|---|---|

| Owner’s Draw | Default Single-Member LLCs (taxed as Sole Proprietorships) & Multi-Member LLCs (taxed as Partnerships) | Simple transfer of funds from business to personal account. No tax withholding. | Extremely Inefficient. 100% of net profit is subject to 15.3% self-employment tax, regardless of the draw amount. |

| Guaranteed Payment | Multi-Member LLCs (taxed as Partnerships) | A fixed payment to a partner for services, similar to a salary. | No Tax Savings. Treated as self-employment income and fully subject to the 15.3% self-employment tax. |

| W-2 Salary & Distributions | LLCs electing to be taxed as S-Corporations | A formal W-2 salary is paid for the owner’s labor, and remaining profits are taken as distributions. | The Strategic Choice. Only the W-2 salary is subject to the 15.3% payroll tax. Distributions are NOT subject to this tax, leading to major savings. |

A Deep Dive into Each Payment Method

Method 1: The Owner’s Draw (The Default Trap)

What It Is: An owner’s draw is the simplest way to pay yourself. It is a direct transfer of funds from your business bank account to your personal bank account. You are simply “drawing” down the equity you have in your company. There is no tax withholding, no payroll to run, and no formal process required beyond the transfer itself.

Who It’s For: This is the default payment method for single-member LLCs (which the IRS taxes as sole proprietorships) and multi-member LLCs (which the IRS taxes as partnerships).

The Brutal Tax Trap: The simplicity of the owner’s draw is a siren song that leads many profitable business owners onto the rocks of excessive taxation. The IRS does not care how much you draw from your business. Your self-employment tax liability is based on the entire net profit of the business for the year.

Let’s make this painfully clear with an example:

- Your LLC makes $120,000 in net profit.

- You live modestly and only draw $60,000 to your personal account, leaving the other $60,000 in the business for future growth.

- The IRS says: “That’s nice. Your self-employment tax bill is $18,360 (15.3% of the full $120,000 profit).

That’s right. You pay taxes on money you never even touched. This is the fundamental flaw of the default LLC tax structure for a profitable business.

| Pros of the Owner’s Draw | Cons of the Owner’s Draw |

|---|---|

| Simplicity: Easy to execute and understand. | Massive Tax Inefficiency: You pay SE tax on all profits. |

| Flexibility: You can take draws whenever you need funds. | No Retirement Plan Integration: Harder to set up robust retirement plans like a Solo 401(k). |

| No Payroll Costs: No need for a payroll service. | Can Lead to Poor Financial Habits: Lack of discipline can blur the lines between business and personal finances. |

Method 2: Guaranteed Payments (A Tool for Partnerships, Not a Tax Saver)

What It Is: In a multi-member LLC taxed as a partnership, some partners may do more work than others. A guaranteed payment is a way to compensate a partner for their services or for the use of their capital, regardless of the partnership’s profit for the year. It’s a way to ensure a partner gets paid for their labor before profits are split.

The Tax Reality: This is a critical point of confusion. While a guaranteed payment feels like a salary, the IRS treats it as self-employment income to the receiving partner. It is reported on their Schedule K-1 and is fully subject to the 15.3% self-employment tax. It offers zero tax savings on that income.

Use Case Scenario: Consider a three-partner LLC that owns a rental property. Partner A manages the property, deals with tenants, and handles repairs. Partners B and C are passive investors. The partnership agreement could stipulate that Partner A receives a $30,000 guaranteed payment for their management services. After that $30,000 is paid, the remaining profits are split three ways. Partner A will pay self-employment tax on their $30,000 guaranteed payment AND on their one-third share of the remaining profits.

Method 3: The S-Corp Power Play (Salary + Distributions)

The Strategy Explained: This is the watershed moment when a business owner transitions from being a passive taxpayer to a strategic one. By electing to have your LLC taxed as an S-Corporation, you create a legal distinction between you, the employee, and you, the owner. You wear two hats, and you are compensated for each role differently.

- 1. Your Employee Hat (Your Labor): For the work you do—managing the business, providing services, etc.—you pay yourself a W-2 salary. This salary must be “reasonable” (more on that in a moment). This income is subject to payroll taxes (FICA), which is the same 15.3% as self-employment tax, but only on this specific salary amount.

- 2. Your Owner Hat (Your Investment): The remaining profit in the business is your return on investment for the risk you’ve taken as the owner. You can take this money as a distribution (an owner’s draw). These distributions are NOT subject to the 15.3% self-employment tax.

Detailed Case Study: Let’s revisit our consultant with $200,000 in profit.

- As a Default LLC: Her self-employment tax is $30,600 (15.3% of $200,000).

- As an S-Corp: We help her determine a reasonable salary of $90,000 for her work as a senior consultant.

- The payroll tax on this salary is $13,770 (15.3% of $90,000).

- The remaining $110,000 of profit can be taken as a distribution with $0 in self-employment tax.

- The Result: Her annual tax savings are $16,830. That’s a new car, a down payment on a rental property, or a fully funded family vacation, all created by filing one form with the IRS.

The S-Corp: A Brief History and Why It Exists

The S-Corporation was created in 1958 to give small businesses the liability protection of a corporation without the double taxation. It was a recognition by Congress that small business owners were different from passive shareholders in large public companies. The S-Corp allows the profits of the business to “pass through” to the owner’s personal tax return, avoiding the corporate income tax.

However, this created a new problem: if all the income passed through, how should the owner be compensated for their labor? This led to the development of the “reasonable compensation” doctrine. The IRS needed a way to ensure that owner-employees were paying their fair share of payroll taxes (Social Security and Medicare) on their labor, just like any other employee.

This is why the S-Corp structure is not a “loophole.” It is the intentional design of the tax code to separate the return on labor (your salary) from the return on investment (your distributions).

The “Reasonable Salary” Rule: A Deep Dive into Creating an Audit-Proof Number

The entire S-Corp strategy hinges on this single concept. The IRS is vigilant about S-Corp owners paying themselves an artificially low salary to maximize their tax-free distributions. Getting this wrong is the #1 audit risk for S-Corp owners, and the consequences can be severe, including reclassification of distributions as wages, back payroll taxes, penalties, and interest.

So, what is “reasonable”? The IRS itself says it’s “the amount that would ordinarily be paid for like services by like enterprises under like circumstances.” This vague definition has been shaped by decades of tax court cases. Understanding the legal precedent is key to building a defensible salary.

Lessons from the Tax Court: What the IRS Looks For

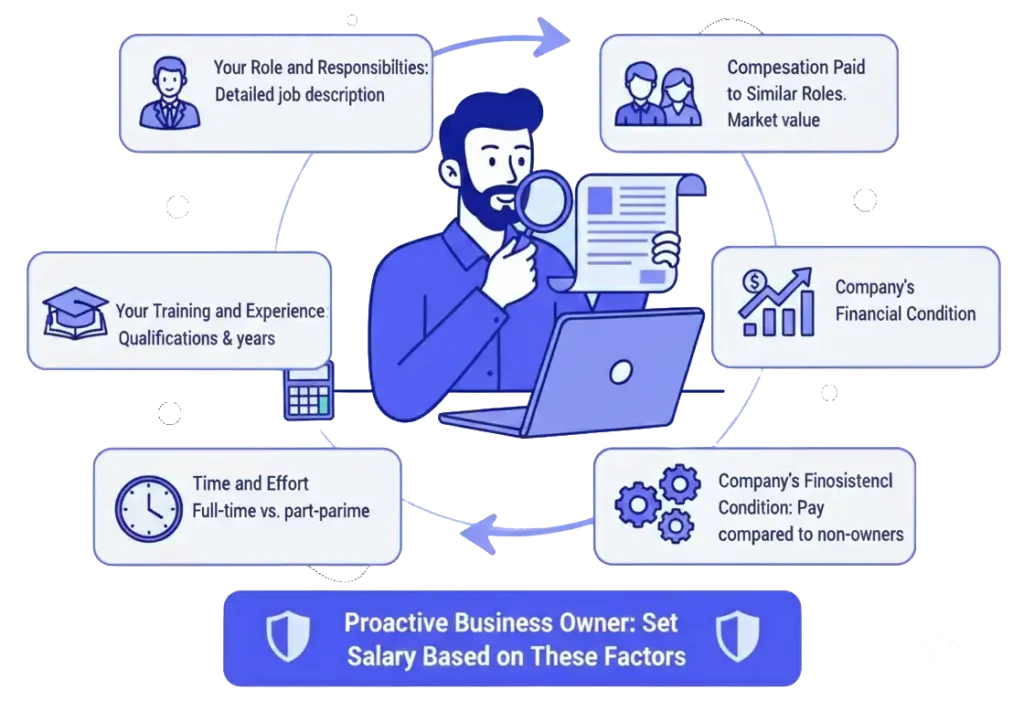

Several landmark court cases have given us a clearer picture of what the IRS considers when challenging a salary. In cases like Watson v. Commissioner and Glass Blocks Unlimited v. Commissioner, the courts have consistently looked at a combination of factors. A proactive business owner should consider these same factors when setting their salary.

- Your Role and Responsibilities: What do you actually do? Are you a CEO, a salesperson, a technician? A detailed job description is your first line of defense.

- Your Training and Experience: Your qualifications and years of experience have a direct impact on the value of your labor.

- Time and Effort Devoted to the Business: How many hours are you working? A full-time operator warrants a higher salary than a part-time or semi-absentee owner.

- Compensation Paid to Similar Roles: This is the most critical factor. What would you have to pay someone else to do what you do?

- The Company’s Financial Condition: A highly profitable company is expected to pay a higher salary than a business just scraping by.

- Internal Consistency: Is your salary consistent with what you pay other, non-owner employees with similar roles?

The Three Formal Methods for Determining a Defensible Salary

To create a truly audit-proof salary, you should formally document your process using one of these established valuation methods.

- 1. The Cost Approach (Market Data): This is the most common and straightforward method. It involves researching what the market pays for a similar role. Your goal is to create a file of evidence.

- Step 1: Define Your Role(s). Write a detailed job description for each hat you wear in the business.

- Step 2: Gather Data. Use multiple sources to find salary data for your role(s) in your geographic area. Excellent sources include the Bureau of Labor Statistics, Salary.com, Glassdoor, and live job postings on LinkedIn or Indeed. Print and save this data as PDFs.

- Step 3: Adjust for Your Circumstances. Adjust the market data based on your specific experience, hours worked, and the financial condition of your company. Document these adjustments.

- The Income Approach: This method is more complex and is often used for businesses where the owner’s personal skills and reputation are the primary source of revenue (e.g., a highly skilled consultant, surgeon, or attorney). It attempts to calculate the value the owner brings to the company based on the income they generate, often using a formula to attribute a portion of the profit to the owner's direct labor.

- The “Many Factors” Method (The Gold Standard): The strongest defense combines multiple approaches. A formal Reasonable Compensation Report, often prepared by a third-party expert, will analyze all the factors listed in the court cases, weigh different valuation methods, and produce a highly defensible salary figure. For businesses with significant profits (over $250,000), this is a worthwhile investment that provides near-total peace of mind.

The Three Formal Methods for Determining a Defensible Salary

To create a truly audit-proof salary, you should formally document your process using one of these established valuation methods.

- 1. The Cost Approach (Market Data): This is the most common and straightforward method. It involves researching what the market pays for a similar role. Your goal is to create a file of evidence.

Step 1: Define Your Role(s).

Write a detailed job description for each hat you wear in the business.

Step 2: Gather Data.

Use multiple sources to find salary data for your role(s) in your geographic area. Excellent sources include the Bureau of Labor Statistics, Salary.com, Glassdoor, and live job postings on LinkedIn or Indeed. Print and save this data as PDFs.

Step 3: Adjust for Your Circumstances.

Adjust the market data based on your specific experience, hours worked, and the financial condition of your company. Document these adjustments.

- 2. The Income Approach: This method is more complex and is often used for businesses where the owner’s personal skills and reputation are the primary source of revenue (e.g., a highly skilled consultant, surgeon, or attorney). It attempts to calculate the value the owner brings to the company based on the income they generate, often using a formula to attribute a portion of the profit to the owner's direct labor.

- 3. The “Many Factors” Method (The Gold Standard): The strongest defense combines multiple approaches. A formal Reasonable Compensation Report, often prepared by a third-party expert, will analyze all the factors listed in the court cases, weigh different valuation methods, and produce a highly defensible salary figure. For businesses with significant profits (over $250,000), this is a worthwhile investment that provides near-total peace of mind.

How to Create a “Reasonable Compensation Report” for Your Records

Even if you don’t hire an expert, you should create a formal document for your own records. This will be your Exhibit A in an audit.

The Reasonable Salary Calculator: Get Your Audit Proof Number

Before we dive into the manual methods, use our interactive calculator to get a data-driven estimate of your reasonable salary. This tool uses real-time salary data from multiple sources to give you a defensible number in minutes.

REASONABLE SALARY CALCULATOR

Input your role, experience, location, and business profit to get a defensible salary range based on real market data.

This calculator will give you a strong starting point. Now, let’s look at the formal methods you can use to document and support this number.

Case Study: Creating a Report for a Marketing Agency Owner

Step 1: The Job Description.

Sarah, owner of a boutique marketing agency in Denver with $250,000 in profit, documents her roles: CEO (20% of time – setting strategy, managing finances), Head of Client Services (50% – managing key accounts, leading client meetings), and Senior Copywriter (30% – writing for top clients).

- CEO (20% of time - setting strategy, managing finances)

- Head of Client Services (50% - managing key accounts, leading client meetings)

- Senior Copywriter (30% - writing for top clients)

Step 2: The Data

She researches salaries for these three roles in Denver:

- Marketing Director: $130,000

- Account Manager: $80,000

- Senior Copywriter: $90,000

Step 3: The Blended Role Calculation

Sarah creates a weighted average based on her time allocation:

- ($130,000 * 20%) + ($80,000 * 50%) + ($90,000 * 30%) = $26,000 + $40,000 + $27,000 = $93,000

Step 4: The Memo

Sarah writes a formal memo to her corporate file titled “Reasonable Compensation Determination for [Year].” She outlines her methodology, attaches the salary data she researched, and concludes that a salary of $95,000 is reasonable and defensible. This document is now her primary defense.

State-by-State Payroll & Withholding: A Deeper Look

Running payroll isn’t just a federal issue. Each state has its own complex web of rules for income tax withholding, unemployment insurance, and paid leave programs. This is another reason why using a professional payroll service is non-negotiable for an S-Corp. Here is a detailed look at the requirements in the top 10 most populous states.

| State | State Income Tax Withholding | State Unemployment Tax (SUTA) | Other Key Payroll Taxes & Nuances |

|---|---|---|---|

| California | Yes, progressive rates. | Yes, employer-paid. New employers have a set rate for the first 2–3 years. |

State Disability Insurance (SDI): Employee-paid. Paid Family Leave (PFL): Employee-paid. California is known for strict labor laws and aggressive enforcement. |

| Texas | No | Yes, employer-paid. | No state income tax simplifies payroll, but SUTA compliance is still required. |

| Florida | No | Yes, employer-paid. | Similar to Texas—no state income tax, but unemployment tax is mandatory. |

| New York | Yes, progressive rates. | Yes, employer-paid. |

NY Disability (DBL): Employer & employee. Paid Family Leave (PFL): Employee-paid. NYC and Yonkers also require local income tax withholding. |

| Pennsylvania | Yes, flat rate. | Yes, employer-paid. | Local Earned Income Tax (EIT) varies by municipality and must be withheld. |

| Illinois | Yes, flat rate. | Yes, employer-paid. | SUTA rates can be high for new employers. |

| Ohio | Yes, progressive rates. | Yes, employer-paid. | Local income taxes administered by RITA or individual cities. |

| Georgia | Yes, progressive rates. | Yes, employer-paid. | Payroll rules align closely with federal standards. |

| North Carolina | Yes, flat rate. | Yes, employer-paid. | Simplified tax structure with standard SUTA compliance. |

| Michigan | Yes, flat rate. | Yes, employer-paid. | Several cities also impose local income tax withholding. |

The Takeaway: State payroll compliance is a minefield. A single mistake in withholding or filing can lead to significant penalties. This is not a DIY project.

Supercharge Your Savings: A Guide to Retirement and Health Insurance for S-Corp Owners

A Deep Dive into Retirement Plans: Solo 401(k) vs. SEP IRA

As an S-Corp owner, you can establish a retirement plan for your business, which allows you to save aggressively for the future while significantly lowering your current taxable income. The two most popular options are the Solo 401(k) and the SEP IRA.

| Feature | Solo 401(k) | SEP IRA |

|---|---|---|

| Contribution Limits | Higher. You can contribute as both the “employee” and the “employer.” | Lower. Only the “employer” can contribute. |

| Loan Provision | Yes. You can take a loan of up to $50,000 from your 401(k). | No. Loans are not permitted. |

| Roth Contribution | Yes. You can make after-tax Roth contributions as the “employee.” | No. All contributions are pre-tax. |

| Best For | Owners who want to maximize their savings and have the flexibility of a loan. | Owners who want the simplest possible plan to set up and administer. |

The Solo 401(k) in Action:

Let’s say you are an S-Corp owner with a $100,000 reasonable salary.

Employee Contribution

You can contribute up to $23,000 (for 2024) of your salary to your Solo 401(k). This is a direct reduction of your taxable income.

Employer Contribution

Your S-Corp can contribute up to 25% of your salary, which is another $25,000.

Total Contribution

You can save a total of $48,000 in a single year. If you are over 50, you can add a catch-up contribution, bringing the total even higher.

This $48,000 contribution is a massive tax deduction that can save you an additional $10,000 – $15,000 in income taxes, on top of your self-employment tax savings.

The S-Corp Health Insurance Deduction: A Step-by-Step Guide

This is one of the most confusing but valuable deductions for S-Corp owners. If you are an S-Corp owner with more than 2% ownership, you cannot simply have the business pay for your health insurance premiums and take a deduction. This can result in the deduction being disallowed.

Here is the correct, IRS-approved method:

Payment

The health insurance premiums can be paid by either you personally or by the S-Corp.

Inclusion on W-2

The total amount of the premiums must be included in your W-2 as wages in Box 1. This amount is NOT subject to Social Security or Medicare (FICA) taxes.

Deduction

You then take a deduction for the health insurance premiums on your personal tax return (Form 1040) as an above-the-line deduction.

This process ensures that the business effectively gets the deduction for the health insurance, and you, the owner, are able to write off 100% of your premiums. It’s a bit of a workaround, but it is the only way to do it correctly.

The Accountable Plan: Your Guide to Tax-Free Reimbursements

An accountable plan is one of the most powerful—and underutilized—tools for S-Corp owners. It is a formal arrangement that allows your S-Corp to reimburse you, the owner-employee, for business expenses you incur personally. This is far superior to taking a deduction on your personal tax return for two reasons:

- 1) It provides a cleaner, more direct audit trail,

- 2) It ensures you get a 100% reimbursement, bypassing potential limitations on personal deductions.

What Qualifies for Reimbursement?

To be reimbursed under an accountable plan, an expense must have a clear business connection. Common examples include:

- Home Office Expenses: A portion of your mortgage interest or rent, utilities, insurance, and repairs, based on the percentage of your home used exclusively for business.

- Cell Phone & Internet: The business-use percentage of your personal cell phone and home internet bills.

- Vehicle Expenses: You can be reimbursed for the business use of your personal vehicle, either at the standard IRS mileage rate or for a percentage of your actual expenses (gas, oil, repairs, etc.).

- Business Travel: Flights, hotels, rental cars, and meals incurred while traveling for business.

- Office Supplies & Software: Any supplies or software you purchase with personal funds for your business.

The Three Requirements for an Accountable Plan

The IRS requires three things for your plan to be valid:

- Business Connection: The expenses must be legitimate business expenses.

- Substantiation: You must adequately account for the expenses to your employer (your S-Corp) within a reasonable time. This means receipts and records.

- Return of Excess Reimbursement: You must be required to return any reimbursement in excess of your substantiated expenses.

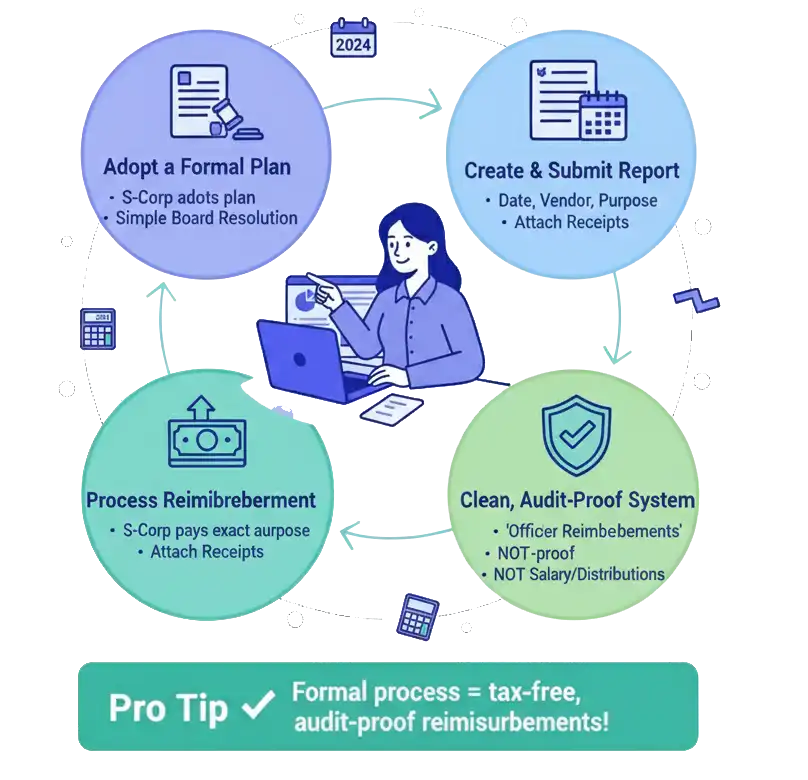

How to Implement Your Accountable Plan: A Step-by-Step Guide

- Adopt a Formal Plan: Your S-Corp should formally adopt an accountable plan. This can be done with a simple board resolution.

- Create an Expense Report Template: Create a standardized expense report form. It should include fields for the date, vendor, amount, business purpose, and a total.

- Submit Reports Monthly: At the end of each month, fill out your expense report, attach copies of all receipts, and submit it to your company (even if it’s just you).

- Process the Reimbursement: The S-Corp should issue a separate payment to you for the exact amount on the expense report. This payment should be categorized in your bookkeeping software as “Officer Reimbursements,” not as salary or distributions.

Advanced Scenarios & Strategic Planning

Scenario 1: The High-Earning W-2 Employee with a Side LLC

- The Situation: You have a $150,000/year day job, and your consulting side hustle LLC is now making $100,000 in profit. Your combined income puts you in a high tax bracket.

- The Strategy: The S-Corp election for your LLC is still incredibly valuable. Your W-2 job’s income does not affect the self-employment tax calculation for your business. By electing S-Corp status and paying yourself a $50,000 reasonable salary from your LLC, you save over $7,650 in self-employment tax on the remaining $50,000 of profit. This is pure tax savings, regardless of your income tax bracket.

- The Nuance: Your high income means you need to be precise with your tax payments. You can either increase the withholding at your W-2 job to cover the taxes from your LLC, or you can make separate quarterly estimated tax payments for your business income.

Scenario 2: Managing Highly Volatile or Seasonal Income

- The Situation: You run a wedding photography business. You make 80% of your income between May and October.

- The Strategy:You have two options for your S-Corp salary:

- The Steady Salary: Calculate your total annual reasonable salary and divide it by 12. Pay yourself a smaller, consistent salary each month, even in the slow season. This is simpler for budgeting.

- The Variable Salary: Pay yourself a much larger salary during your busy season and a minimal or zero salary during the off-season. This better aligns your cash flow.

- The Key: As long as the total salary paid by the end of the year is reasonable for the work performed, both methods are compliant.

Scenario 3: Transitioning from a Single-Member to a Multi-Member LLC

- The Situation: You are a single-member LLC taxed as an S-Corp. You decide to bring on a partner.

- The Strategy: When you add a partner, your S-Corp status is not automatically revoked. However, you must ensure that the new partner is an eligible S-Corp shareholder (a U.S. citizen or resident alien). You will need to amend your operating agreement and issue shares to the new partner. Both of you will now need to take a reasonable salary for the work you perform.

You’ve Built a Profitable Business. Now It’s Time to Pay Yourself Like It.

The anxiety you feel around paying yourself is a sign that you’re ready for a real strategy. It’s a sign that you’ve outgrown the default settings and are ready to step into the role of a financially savvy CEO.

You don’t have to figure this out alone. Our team of certified tax strategists helps business owners like you set up tax-efficient, audit-proof payment systems every single day. We can help you determine the optimal S-Corp salary, set up your payroll, and create a repeatable system that turns your financial anxiety into financial confidence.

Book Your Free Payroll & Savings Analysis

Let’s end the confusion. In a free, 15-minute call, we will:

- Analyze your current payment method.

- Determine if you are overpaying in self-employment taxes.

- Give you a clear, actionable plan for paying yourself the right way.