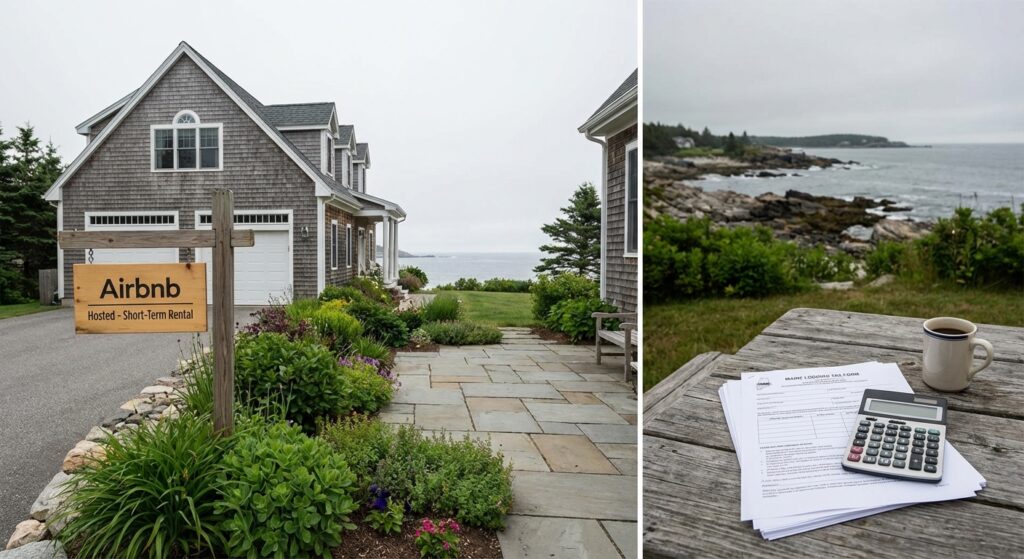

For the 2026 tax year, maine short term rental taxes require careful attention to both state and local requirements. Whether you’re renting a coastal cabin, historic farmhouse, or urban apartment on Airbnb, VRBO, or other platforms, understanding your 2026 tax obligations is essential. This comprehensive guide covers Maine’s occupancy tax rates, deductible expenses, estimated quarterly payments, and smart strategies to minimize your tax burden while staying compliant.

Table of Contents

- Key Takeaways

- What Is Maine’s Occupancy Tax and How Does It Apply?

- How Does Federal Income Tax Apply to Maine Short-Term Rentals?

- What Expenses Can You Deduct from Rental Income?

- Will You Owe Self-Employment Tax on Rental Income?

- What Business Structure Works Best for Maine STR Operations?

- When Must You Make Estimated Quarterly Tax Payments?

- What Are the Reporting and Filing Requirements?

- Uncle Kam in Action

- Next Steps

- Frequently Asked Questions

- Related Resources

Key Takeaways

- Maine’s state occupancy tax is 7%, plus additional local taxes ranging from 2-6% depending on municipality location.

- Short-term rental income is taxable federal income. For 2026, single filers have a standard deduction of $15,000 and married couples $30,000.

- Deductible expenses include mortgage interest, property taxes, utilities, repairs, insurance, and management fees—not capital improvements.

- If you actively manage your rental, you may qualify for the 20% QBI deduction on 2026 returns if eligible as a real estate professional.

- Make quarterly estimated tax payments by April 15, June 15, September 15, and January 15 to avoid penalties and interest.

What Is Maine’s Occupancy Tax and How Does It Apply?

Quick Answer: Maine charges a 7% state occupancy tax on all short-term rental accommodations. Most municipalities add 2-6% local tax. Check your specific town’s rate and collection responsibilities.

Understanding maine short term rental taxes begins with the occupancy tax—a fundamental requirement for all hosts. Maine’s state occupancy tax rate for short-term accommodations is 7% of the nightly room rate. This applies to any rental lasting fewer than 30 consecutive days, including Airbnb, VRBO, and direct bookings.

Many people focus solely on the state rate and miss critical local obligations. Your municipality likely adds its own occupancy tax, ranging from 2% to 6% depending on location. For example, Portland may have different rates than rural areas, and popular tourist destinations often have higher local taxes.

Who Collects the Tax?

Collection responsibility varies significantly across Maine. Platforms like Airbnb and VRBO may automatically collect state occupancy tax in some municipalities and remit it to Maine Revenue Services. However, you remain responsible for:

- Verifying that the platform actually collected the tax in your jurisdiction.

- Collecting and remitting any local occupancy tax yourself if not handled by the platform.

- Remitting any shortfall if platform collection amounts differ from actual tax owed.

Pro Tip: Contact Maine Revenue Services to confirm whether your municipality has established a collection agreement with major platforms. Don’t assume collection is automatic—verify directly with your town’s tax assessor office.

Local Occupancy Tax Rates by Region

Maine’s occupancy tax system requires understanding both state and local layers. The combined rate determines your total collection obligation:

| Region/Municipality Type | State Tax | Local Tax Range | Combined Rate |

|---|---|---|---|

| Tourist Destinations (Portland, Bar Harbor) | 7% | 4-6% | 11-13% |

| Suburban Areas | 7% | 2-4% | 9-11% |

| Rural Communities | 7% | 0-2% | 7-9% |

How Does Federal Income Tax Apply to Maine Short-Term Rentals?

Quick Answer: All STR rental income is taxable federal income reported on your 2026 tax return. The filing threshold depends on your standard deduction ($15,000 single, $30,000 married filing jointly).

Federal income tax applies to all short-term rental income regardless of whether you actively manage the property. The IRS considers maine short term rental taxes part of your overall income tax picture. For the 2026 tax year, your filing requirement depends on your total income against the standard deduction: $15,000 for single filers and $30,000 for married couples filing jointly.

Which Form Should You Use?

The correct tax form determines how your rental income flows through your return. This choice affects deductions, self-employment tax, and professional credibility with the IRS:

- Schedule E (Form 1040): Use if you’re a passive investor with minimal involvement in day-to-day operations. This approach typically offers simpler reporting but limits tax strategy options.

- Schedule C (Form 1040): Use if you actively manage the property, handle bookings, or treat the rental as a business. This form allows more deductions but triggers self-employment tax obligations.

Pro Tip: If you manage multiple properties or have significant rental income exceeding $50,000 annually, consult a tax advisor about whether you qualify as a real estate professional for passive activity rule exceptions.

What Expenses Can You Deduct from Rental Income?

Quick Answer: Deduct ordinary and necessary expenses: mortgage interest, property taxes, insurance, utilities, repairs, cleaning, maintenance, and management fees. Exclude capital improvements like roof replacements or additions.

Identifying deductible expenses properly is crucial for minimizing your 2026 tax liability on maine short term rental taxes. The IRS allows deductions for expenses that are ordinary (common in STR operations) and necessary (helpful to generate income).

Fully Deductible Expenses (2026 Tax Year)

| Expense Category | Examples | Deductible? |

|---|---|---|

| Mortgage Interest | Interest paid to lender (not principal) | ✓ Yes |

| Property Taxes | Maine county and municipal property tax | ✓ Yes |

| Insurance | Landlord/STR liability and property insurance | ✓ Yes |

| Utilities | Electricity, water, gas, internet, phone | ✓ Yes |

| Repairs & Maintenance | Fixing leaks, painting walls, replacing fixtures | ✓ Yes |

| Occupancy Tax Paid | State and local occupancy taxes collected | ✓ Yes |

| Cleaning & Supplies | Professional cleaning, linens, toiletries | ✓ Yes |

| Management Fees | Property manager or booking platform fees | ✓ Yes |

| Depreciation | Buildings and improvements (using IRS tables) | ✓ Yes |

Non-Deductible Expenses (Critical to Understand)

- Capital improvements (new roof, deck addition, kitchen remodel) must be depreciated over time, not deducted immediately.

- Personal use days—if you stay in the property, allocate expenses proportionally to rental use.

- Down payment or principal loan payments—only interest is deductible.

- Personal expenses (your meals, travel, entertainment) unless directly connected to property.

Will You Owe Self-Employment Tax on Rental Income?

Quick Answer: Generally, passive rental income on Schedule E doesn’t trigger self-employment tax. However, active management or Schedule C reporting may impose 15.3% self-employment tax on net income for 2026.

Self-employment tax applies the 15.3% rate (12.4% Social Security plus 2.9% Medicare) to your net profit if you file Schedule C for your maine short term rental taxes. This determination hinges on whether the IRS views your rental activity as a passive investment or an active business.

Passive vs. Active Income Classification

The IRS uses several tests to classify income. Understanding this classification affects both self-employment tax and deduction limitations:

- Passive Rental (Schedule E): You own the property but don’t actively manage. Renters handle bookings. No self-employment tax. Limited to $25,000 deduction cap if you file as single with income under $100,000.

- Active Business (Schedule C): You manage bookings, coordinate cleanings, handle guest communications. Subject to 15.3% self-employment tax on profits but potentially qualifying for higher deductions and entity structuring benefits.

Pro Tip: If you’re actively managing your Maine STR, carefully document your efforts. The IRS scrutinizes classification decisions, so keep records of management decisions, guest communications, and maintenance coordination to support Schedule C classification if needed.

What Business Structure Works Best for Maine STR Operations?

Quick Answer: Sole proprietorship, LLC, or S Corp each offer different tax benefits. Your choice depends on income level, liability concerns, and whether you operate multiple properties.

Choosing the right structure for your maine short term rental taxes can significantly impact your 2026 tax burden. Maine permits several legal structures, each with distinct tax implications and liability protections.

Comparing Structures for 2026

- Sole Proprietorship (Schedule C): Simplest structure, all income flows to your personal return, subject to 15.3% self-employment tax. Use our LLC vs S-Corp Tax Calculator for Everett to compare your potential tax savings with other structures.

- Limited Liability Company (LLC): Provides liability protection, taxed as sole proprietor unless you elect S Corp status, still subject to self-employment tax unless S Corp election is made.

- S Corporation Election: If your net income exceeds $60,000, consider electing S Corp status. You pay yourself a reasonable salary (subject to payroll taxes) and take remaining profit as distributions (avoiding 15.3% self-employment tax).

Pro Tip: If you operate multiple Maine STR properties generating combined income above $100,000, an S Corp election could save 10-15% in self-employment taxes. Work with a tax strategist to model whether filing fees justify the savings.

When Must You Make Estimated Quarterly Tax Payments?

Quick Answer: If you expect to owe more than $1,000 in federal income and self-employment tax for 2026, file Form 1040-ES quarterly by April 15, June 15, September 15, and January 15.

Estimated quarterly taxes are crucial for maine short term rental taxes because the IRS expects payment throughout the year, not in one lump sum at tax time. Missing these deadlines triggers penalties and interest even if you eventually owe the same total amount.

2026 Estimated Tax Deadlines and Payment Process

- Q1 Payment (January-March income): Due April 15, 2026. Calculate based on January-March rental income minus deductions.

- Q2 Payment (April-May income): Due June 15, 2026. Update your estimate based on actual spring rental season performance.

- Q3 Payment (July-August income): Due September 15, 2026. Typically highest payment if summer is busy season.

- Q4 Payment (October-December income): Due January 15, 2027. Can be adjusted based on year-to-date actual income.

You can pay estimated taxes online through IRS.gov, by phone, or via mail. Set calendar reminders now to avoid missing deadlines that could trigger failure-to-pay penalties.

What Are the Reporting and Filing Requirements?

Quick Answer: Report STR income on Form 1040 Schedule C or E, file annually by April 15, and maintain records of all income and deductions for six years.

Proper reporting of maine short term rental taxes ensures compliance and protects you from IRS audits. Understanding what documents to keep and when to file is essential.

Essential Documents for 2026 Filing

- Airbnb/VRBO annual host statements showing total bookings and revenue.

- Mortgage and property tax statements documenting deductible interest and taxes.

- Insurance policy documentation and premium payments.

- Receipts and invoices for all repairs, maintenance, and cleaning expenses.

- Depreciation schedules for the building and improvements.

- Bank and credit card statements showing rental income deposits and expense payments.

Did You Know? The IRS can audit returns for six years back. Maintaining organized digital records in cloud storage ensures you can quickly respond to audit requests and prove the legitimacy of your maine short term rental taxes deductions.

Uncle Kam in Action: Portland STR Host Saves $8,400 Through Strategic Tax Planning

Client Profile: Sarah operates two coastal Maine properties on Airbnb in Portland and Bar Harbor. She generates $125,000 annually from short-term rentals and previously filed as a sole proprietor on Schedule C. Sarah had never considered structural optimization or quarterly tax planning.

The Challenge: Sarah owed $18,600 in federal income and self-employment taxes for her previous tax year. She was frustrated by the size of the bill and worried about penalties due to underpayment throughout the year. Additionally, her accountant mentioned she might qualify for the 20% qualified business income (QBI) deduction but wasn’t sure how to structure it.

The Uncle Kam Solution: We conducted a 2026 tax strategy review and recommended three key changes. First, we established an S Corporation election for Sarah’s Maine STR business, allowing her to pay herself a $60,000 reasonable salary and take $65,000 as tax-free distributions. Second, we implemented quarterly estimated tax payments aligned with her seasonal income patterns. Third, we documented her active property management activities to qualify her for the QBI deduction.

The Results:

- Tax Savings: $8,400 reduction in federal taxes for 2026 through S Corp election and self-employment tax savings.

- QBI Deduction: Qualified for $21,600 additional deduction (20% of $108,000 qualified business income).

- Quarterly Payments: Implemented structured quarterly payments eliminating underpayment penalties.

- Return on Investment: S Corp election cost $350 in filing fees, generating 2,400% ROI in first year through tax savings.

Sarah now has a sustainable maine short term rental taxes strategy that reduces her annual tax burden while maintaining compliance and documentation standards. Her quarterly payments are on schedule, and she’s positioned for continued growth with optimized tax efficiency.

Next Steps

Take action now to optimize your maine short term rental taxes strategy for 2026. These steps will ensure compliance and maximize tax efficiency:

- Verify Your Local Tax Rate: Contact your municipality’s tax assessor to confirm the exact occupancy tax rates for your property location.

- Review Your Current Structure: Evaluate whether your business structure (sole proprietor, LLC, S Corp) still makes sense for your 2026 income level.

- Schedule Quarterly Payments: Set up calendar reminders for April 15, June 15, September 15, and January 15 estimated tax deadlines.

- Document Deductible Expenses: Organize records of mortgage statements, property tax bills, insurance policies, and repair receipts for 2026 filings.

- Consult a Tax Professional: Schedule a consultation with a tax advisor to review your specific situation and explore potential S Corp election benefits.

Frequently Asked Questions

Does Airbnb automatically collect Maine occupancy tax?

Airbnb collects and remits state occupancy tax in many Maine municipalities, but not all. Local agreements vary significantly. Contact your municipality directly to verify whether the platform has an established collection agreement. If not, you’re responsible for collection and remittance. The platform will not handle this obligation automatically, and the IRS holds you liable.

Can I deduct a vacation home as a short-term rental?

Yes, but with strict limitations. If you use the home personally for more than 14 days per year or rent it at fair market rate for fewer than 30 days, the IRS classifies it as a personal residence. Deductions are severely limited. Maintain excellent records documenting your rental use versus personal use days to maximize valid deductions.

What’s the difference between repairing and improving a rental property?

Repairs maintain the property’s current condition and are immediately deductible. Improvements enhance value, extend the property’s life, or adapt it to new uses—these must be capitalized and depreciated over time. Painting interior walls is a repair (deductible). Adding a new deck is an improvement (capitalized). When in doubt, consult your tax advisor about the specific expense.

How do I calculate depreciation for a Maine rental property?

Depreciation allows you to deduct a portion of the building’s cost over 27.5 years for residential rental property. You’ll need the original purchase price, allocation between land and building, and improvement costs. The IRS provides depreciation tables in Publication 946. However, depreciation creates “recapture” upon sale. Work with a tax professional to calculate depreciation correctly and understand long-term implications on capital gains.

What happens if I don’t collect occupancy tax and remit it?

Failing to collect and remit required occupancy tax creates serious consequences. Maine Revenue Services can assess penalties, interest, and pursue collection actions against you personally. You could face criminal charges for willful tax evasion. Additionally, your business license can be suspended. Verify your obligations immediately and establish a system for collection and remittance to avoid these outcomes.

Is maine short term rental income subject to Maine state income tax?

Yes. In addition to occupancy tax, Maine also taxes net rental income as regular state income at rates from 5.8% to 7.15% depending on your overall income. You’ll file Maine Form 1040 reporting your net rental income calculated on federal Schedule C or E. Don’t overlook Maine state tax—it compounds the burden of maine short term rental taxes significantly.

Related Resources

- Real Estate Investor Tax Strategies and Planning Resources

- Tax Preparation and Filing Services for Short-Term Rental Hosts

- Business Solutions Including Bookkeeping and Expense Tracking

- MERNA Tax Strategy Method for Maximizing Deductions

- Case Studies: Real STR Host Tax Savings Results

Last updated: February, 2026

Compliance Checkpoint: This information is current as of 2/16/2026. Maine tax laws and occupancy tax rates may change. Verify updates with Maine Revenue Services or a qualified tax professional before filing your 2026 return.