Maximizing Kailua Kona LLC Write-Offs for 2026: A Complete Guide

Running an LLC in Kailua Kona, Hawaii, comes with unique opportunities and challenges—especially when it comes to maximizing your write-offs for the 2026 tax year. Smart tax planning can save your business thousands of dollars, but it’s critical to understand both federal and Hawaii-specific rules. This in-depth guide arms business owners, real estate investors, and the self-employed with actionable strategies to reduce their taxable income and stay IRS-compliant.

What Are LLC Write-Offs?

Write-offs, or tax deductions, are allowable expenses that LLCs can claim to lower their taxable income. Some are universal across all states, while others depend on Hawaii’s tax laws. Typical deductible expenses include operating costs, rent, employee wages, and certain travel and meal expenses.

Eligible Business Expenses for 2026

- Rent for business property

- Utilities and maintenance

- Office supplies and software

- Insurance premiums (general liability, workers’ comp, etc.)

- Business travel (within IRS guidelines)

- Professional services (CPAs, attorneys, consultants)

- Marketing and advertising

- Bank fees and interest on business loans

- Employee benefits and salaries

Table 1: Common Deductible Expenses for Kailua Kona LLCs in 2026

| Expense Category | Deductible? | Hawaii Notes |

|---|---|---|

| Office Rent | Yes | Applies to in-state and out-of-state properties |

| Hawaii GE Tax | Partially | Portion may be deductible if not already credited |

| Vehicle Mileage | Yes | Must keep detailed logs per IRS rules |

| Travel to Mainland | Yes, with documentation | Trips must be business-necessary |

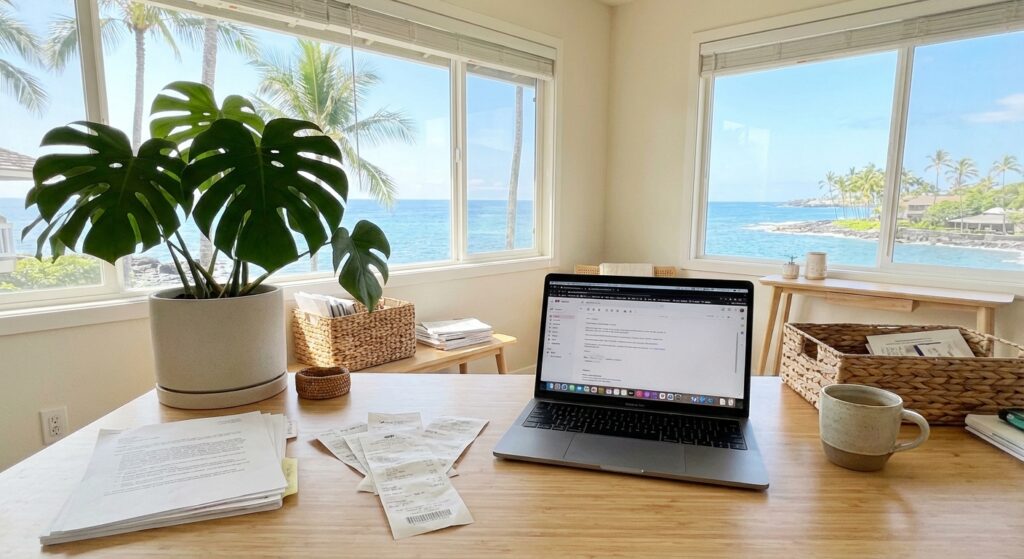

Home Office Deduction: Maximizing Your Space

If you use part of your home in Kailua Kona exclusively for business, you may be eligible for the home office deduction—even in Hawaii. For 2026, the simplified deduction is $5 per square foot up to 300 square feet, but itemized deductions may yield greater savings if you have higher expenses.

- Exclusive & regular use: The space must be used solely for business activities.

- Principal place of business: Your home must be the main location used for business.

Document all home office expenses (utilities, internet, maintenance, etc.) for audit protection. See detailed IRS rules here.

Vehicle and Equipment Depreciation in 2026

If your LLC uses vehicles or equipment, depreciation can be a powerful write-off. In 2026, bonus depreciation remains available for most new and used property placed in service, but will phase down to 60% unless Congress extends the provision. Section 179 expensing also lets you immediately deduct the cost of qualifying property, subject to Hawaii limits.

Vehicle Deduction Strategies

- Standard mileage rate: 67 cents per mile (2026 projected rate); detailed logs required.

- Actual expense method: Deduct proportion of total auto expenses (fuel, repairs, insurance) directly related to business.

Leased vs. owned vehicles have different rules—consult with a Hawaii-based CPA for optimal strategy.

IRS Documentation Requirements

For every deduction you claim, the IRS—and the Hawaii Department of Taxation—require adequate documentation. Save copies of receipts, digital logs, bank statements, and signed contracts. The IRS recommends keeping records for at least 3 years, but Hawaii may require longer for state audits. Consider using digital bookkeeping apps like QuickBooks for streamlined organization.

Common Mistakes to Avoid

- Mixing personal and business expenses

- Poor documentation for meals and entertainment

- Claiming non-deductible travel

- Ignoring Hawaii’s General Excise Tax implications

- Overlooking depreciation on new purchases

Engaging a licensed tax professional familiar with Hawaii business tax codes can help you remain compliant and maximize deductions.

Hawaii-Specific Write-Off Considerations

- General Excise Tax (GET): Not an income tax, but often deductible as an ordinary business expense.

- State conformity: Hawaii does NOT always conform to federal bonus depreciation rules.

- County Surcharge: Some counties, including Hawaii County, may impose surcharges; verify with your preparer.

Table 2: Key Differences—Federal vs. Hawaii LLC Write-Offs

| Deduction | Federal | Hawaii |

|---|---|---|

| Bonus Depreciation | Available, phased down to 60% in 2026 | Hawaii does not conform as of 2026 |

| Section 179 Limits | $1,220,000 (projected) | $25,000 (Hawaii limit) |

| GET Payments | Not applicable | Deductible if not credited elsewhere |

Strategic Planning for 2026: Maximize Your Write-Offs

- Review your LLC’s organizational structure: SMLLCs, multi-member LLCs, and partnerships have different deduction paths.

- Plan capital equipment purchases for maximum deduction timing.

- Consider making estimated payments to Hawaii to avoid penalties.

- Update your accounting systems for new 2026 rules and rates.

Not sure if you’re claiming everything you could? Contact our team for a personalized assessment.

FAQs About Kailua Kona LLC Write-Offs

- What if I operate in both Hawaii and on the mainland? — You must apportion deductions to each jurisdiction appropriately.

- Can I deduct my home renovation? — Only the portion exclusively used for business is deductible.

- Is vehicle leasing better than owning for write-off purposes? — Leasing offers different deduction schedules; evaluate with your CPA.

Get Expert Help for 2026

Tax laws change yearly. For up-to-date guidance and to ensure you’re maximizing every eligible deduction, work with a local accountant who specializes in Hawaii LLCs.

Learn more about our LLC tax planning services for Kailua Kona businesses →