OBBBA STR Changes for 2026: What Property Owners and Investors Need to Know

The landscape of short-term rentals (STR) is changing rapidly, especially as the OBBBA (Online-Based Business and Booking Act) regulations are updated for 2026. Whether you operate a single vacation property or manage a portfolio of investment units, these regulatory shifts will directly affect how you register, report income, and maintain compliance. In this comprehensive guide, we break down what every OBBBA STR change means, how the new rules affect property owners and investors, and the concrete steps you can take to ensure compliance and continued profitability in the short-term rental market.

What Is the OBBBA and How Does It Affect STRs?

The OBBBA—Online-Based Business and Booking Act—sets nationwide standards for short-term rental operations. As demand for STRs on platforms like Airbnb, VRBO, and Booking.com has surged over the past several years, local governments have struggled to keep regulations consistent. The OBBBA addresses this gap by establishing a unified federal framework that covers taxation, health and safety compliance, and transparency requirements across all regions.

For real estate investors, this means a single set of rules to follow rather than navigating a patchwork of city and county ordinances. While the regulatory burden increases in some ways, the consistency can actually simplify multi-market operations for investors who own properties across state lines.

What Are the Major 2026 OBBBA STR Changes?

- Mandatory National Registration: All STR operators must register annually through a centralized federal portal, replacing the previous local and municipal registration systems.

- Unified Tax Reporting: A standardized tax reporting method for rental income and occupancy tax eliminates regional variations and reduces filing complexity.

- Minimum Safety Standards: Federal requirements now mandate smoke detectors, carbon monoxide alarms, fire extinguishers, and emergency contact disclosure in every STR unit.

- Limitations on Non-Resident Ownership: New restrictions cap the number of properties non-residents can operate as STRs in any given market area.

- Data Transparency Requirements: STR platforms must share booking data—including dates, income, and compliance status—with local and federal agencies.

Comparison Table: 2023 vs 2026 OBBBA STR Rules

| Feature | 2023 | 2026 |

|---|---|---|

| Registration | Local/Municipal | Nationalized portal |

| Tax Reporting | Varies by region | Standardized nationwide |

| Safety Standards | Local requirements | Federal minimums |

| Non-Resident Ownership | No limits | Strict property limits |

| Platform Data Sharing | Not required | Mandatory sharing |

How Will These Changes Impact Property Owners?

STR operators will need to prepare for a higher degree of oversight and some additional costs. However, these changes promise to level the playing field and improve the legitimacy of STR operations nationwide. Operators who have been running compliant businesses will benefit from reduced competition from unlicensed or non-compliant listings.

Most Significant Impacts

- Streamlined tax filing through automated platform reporting, reducing paperwork errors and missed deadlines

- Increased regulator access may reduce illegal STR competition, boosting occupancy rates for compliant operators

- Enhanced consumer trust due to improved safety standards, which can translate to higher nightly rates and better reviews

- Non-resident caps may create new opportunities for local owners and investors already established in their markets

Tax Implications of STR Income Under the New OBBBA Rules

One of the most significant 2026 changes involves how STR income is reported and taxed. Under the new unified reporting framework, platforms like Airbnb and VRBO will automatically generate standardized 1099-STR forms that consolidate gross rental income, occupancy taxes collected, and platform fees deducted. This replaces the inconsistent mix of 1099-K and 1099-MISC forms that previously created confusion for operators and tax professionals alike.

Property owners should be aware of several key tax considerations. First, the standardized reporting means the IRS will have clearer visibility into STR income, making accurate record-keeping more important than ever. Second, operators can still deduct ordinary and necessary expenses such as mortgage interest, property management fees, cleaning costs, maintenance, and depreciation. Third, the material participation rules under IRS guidelines continue to determine whether STR income is treated as passive or active income—a distinction that can significantly affect your overall tax liability.

For investors managing multiple STR properties, working with a tax professional who understands both the OBBBA framework and real estate taxation is essential. Our tax planning resources can help you develop a strategy that maximizes deductions while staying fully compliant with the new reporting requirements. You can also review the IRS guidance on short-term rentals for additional details.

Insurance and Liability Considerations for STR Operators

The 2026 OBBBA changes place a stronger emphasis on insurance and liability protections for STR operators. Under the new framework, proof of adequate insurance coverage is now a requirement for federal registration. This means standard homeowner’s insurance—which often excludes commercial rental activity—will no longer suffice for most operators.

STR operators should evaluate their insurance coverage across several categories. General liability insurance protects against guest injuries and property damage claims. Property insurance specifically endorsed for short-term rental use covers the structure and contents during rental periods. Business interruption coverage can offset lost income if a property becomes temporarily uninhabitable due to damage or required repairs. Additionally, umbrella policies provide an extra layer of protection for investors with larger portfolios.

The OBBBA also introduces clearer liability standards for platform-facilitated bookings, defining the responsibilities of the host, the platform, and the guest in dispute situations. Operators who document their safety compliance, maintain updated insurance certificates, and keep thorough records of property maintenance will be in the strongest position if a claim arises.

Technology Tools for OBBBA Compliance

Staying compliant with the new OBBBA regulations does not have to be an overwhelming manual process. A growing ecosystem of technology tools can help STR operators manage registration, tax reporting, safety documentation, and guest communications efficiently.

Property management software (PMS) platforms like Guesty, Hostaway, and Lodgify are updating their systems to integrate directly with the federal registration portal. These tools can auto-populate registration fields, track renewal deadlines, and maintain compliance checklists across multiple properties. Accounting and tax tools such as Stessa, Baselane, and specialized STR accounting platforms now support the new 1099-STR format, making year-end tax preparation significantly simpler.

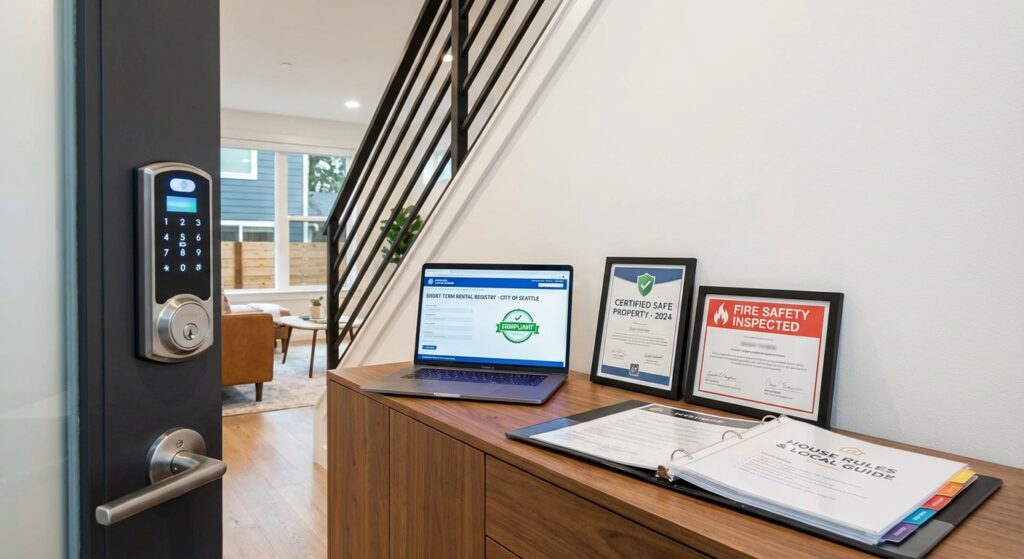

Smart home technology also plays a role in meeting the new safety standards. Connected smoke detectors and carbon monoxide monitors can provide real-time alerts and generate compliance logs that satisfy federal inspection requirements. Noise monitoring devices help prevent guest complaints and potential violations of local ordinances. Automated check-in systems with digital guest agreements can capture the required emergency contact disclosures mandated by the OBBBA.

For more strategies on using technology to manage your rental investments, explore our blog for ongoing guides and tutorials.

Action Steps for STR Operators

- Review your STR documentation for local and federal compliance; see our STR Compliance Checklist.

- Register all STR properties on the new federal portal as soon as it becomes available.

- Update your short-term rental listings to highlight new safety features and certifications.

- Consult a tax professional about how the new reporting system affects your 2026 returns (IRS Guidance).

- Verify your insurance coverage meets the new OBBBA requirements and upload documentation promptly.

- Invest in property management software that integrates with the federal registration system.

- For more STR tips, see our 2026 STR Regulation Guide.

Case Study: Successful Transition to 2026 OBBBA Rules

| Owner | Challenge | Solution | Result |

|---|---|---|---|

| Jane Doe (Austin, TX) | Conflicting local/federal rules | Consolidated compliance via federal portal | Maintained top-rated listing |

| ABC Mgmt (Orlando, FL) | Non-resident property limits | Shifted some rentals to long-term | Avoided registration penalties |

Frequently Asked Questions About OBBBA STR Changes

When do the 2026 OBBBA STR changes take effect?

The new OBBBA regulations officially take effect on January 1, 2026. However, the federal registration portal is expected to open several months in advance to allow operators time to submit their documentation and receive confirmation before the compliance deadline. Operators are strongly encouraged to begin preparing their materials now so they can register as soon as the portal launches.

What is required for national STR registration?

National STR registration requires operators to submit detailed property information, proof of valid insurance coverage, a documented emergency response plan, and a completed safety compliance form. Properties with multiple units may need to register each unit individually. The federal portal will also verify ownership records and cross-reference tax filings, so accuracy in your submission is essential to avoid processing delays.

What are the penalties for non-compliance with OBBBA STR rules?

Non-compliant operators face fines up to $10,000 per violation, and repeat offenders risk permanent suspension from major booking platforms. Additionally, unregistered properties discovered through the new platform data-sharing requirements may be subject to back taxes and interest on unreported income. The OBBBA enforcement division has indicated it will prioritize high-volume markets during the initial compliance period.

Do the OBBBA changes apply to long-term rentals?

No. The OBBBA framework specifically targets short-term rentals defined as stays of fewer than 30 consecutive days. Long-term rental properties remain subject to existing landlord-tenant laws at the state and local level. However, operators who convert STR properties to long-term rentals to avoid OBBBA requirements should be aware of the different regulatory and tax obligations that come with long-term leasing arrangements.

Are there exceptions for owner-occupied primary residences?

Yes, some provisions of the OBBBA include exemptions for owner-occupied primary residences that are rented on a short-term basis for limited periods each year. These exemptions typically apply to homeowners who rent out a room or their entire home for fewer than a specified number of nights annually. However, the safety compliance requirements still apply regardless of occupancy status, so even exempt operators must maintain proper smoke detectors, carbon monoxide alarms, and emergency contact disclosures.

How will the new safety standards be enforced?

Enforcement of the new safety standards operates on a dual system. Operators must complete an annual self-certification confirming that their properties meet all federal minimums. In addition, a percentage of registered properties will be selected for random federal inspections each year. Properties flagged through guest complaints or platform reports may also be prioritized for inspection. Failing an inspection triggers a correction period, and continued non-compliance results in listing suspension and potential fines.

Where can I find official OBBBA guidance and updates?

The most authoritative source for OBBBA updates is the official OBBBA website, which publishes regulatory updates, registration instructions, and compliance resources. For personalized guidance on how these changes affect your investment strategy, contact our team for a consultation.

Summary: Preparing for OBBBA STR Changes in 2026

The OBBBA STR changes coming in 2026 usher in a new era of professionalism and oversight for the short-term rental market. With proper preparation, STR owners and investors can not only comply with new regulations but also thrive in a fairer, more robust market. The key priorities for operators include early registration, insurance verification, safety upgrades, and adoption of technology tools that streamline compliance.

- Start gathering documentation early and complete registration as soon as the portal opens

- Invest in safety upgrades and obtain compliant insurance coverage

- Track platform communications for the latest requirements and deadlines

- Consult with tax and legal professionals to optimize your STR strategy under the new rules

Stay informed and proactive for success in 2026 and beyond. For ongoing updates, read our OBBBA STR News Hub, or visit our blog for the latest insights on real estate investing and rental property management.

Disclaimer: This article is provided for informational purposes only and does not constitute legal, tax, or financial advice. OBBBA regulations and enforcement details are subject to change. Property owners and investors should consult with qualified legal and tax professionals before making decisions based on the information presented here. Uncle Kam and RG Digital Marketing are not responsible for actions taken based on this content.