Maryland DOD Employee Taxes: Complete 2026 Guide to Federal Employee Tax Benefits & State Filing Requirements

Quick Answer:

Maryland DOD employees enjoy federal tax benefits including TSP deferrals, FERS/CSRS contributions, and military-specific deductions, but must file Maryland state income taxes on all earned income. Federal employees can deduct health insurance premiums, life insurance, and TSP contributions, reducing taxable income before Maryland state taxes apply. Filing deadline: April 15, 2026.

Key Takeaways:

- 2026 TSP deferral limit: $24,500 (increased from $23,500)

- FERS employee contribution rate: 0.8% of salary (unchanged 2026)

- Maryland state income tax rate: 5.75% (standard) to 8.75% (highest)

- Thrift Savings Plan investments are federal-tax deferred, not Maryland-tax exempt

- Military Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS) are tax-free

What Is a Maryland DOD Employee? (Definition & Scope)

Maryland is home to several major DOD installations, including Fort Meade (home to NSA and Cyber Command) and Aberdeen Proving Ground. Both civilian and active-duty military personnel stationed here or working remotely for DOD must navigate unique tax situations that blend federal employee benefits with state-level filing requirements.

Who This Guide Covers:

- DOD Civilian Employees: Career civil service employees in GS pay grades, earning federal benefits packages

- Active-Duty Military: Service members stationed in or working for DOD in Maryland

- Military Spouses: Federal employee spouses with their own DOD employment

- Contractors/Remote Workers: DOD contractors physically located in Maryland

- Retired Military with Second Careers: Veterans working for DOD as civilians post-military service

Why This Matters for Maryland Residents:

Maryland’s state income tax applies to all residents working within the state, including federal employees. Unlike some states that exempt certain federal income, Maryland does not provide preferential treatment for federal employee income. This means your total tax burden is federal tax + Maryland state tax, requiring strategic planning to maximize deductions and withholding accuracy.

Federal Employee Tax Deductions Available to Maryland DOD Employees (2026)

Quick Answer: DOD federal employees can deduct TSP contributions ($24,500 in 2026), health insurance premiums (FEHB), life insurance (FEGLI), FERS contributions (0.8%), professional licensing fees, and union dues from federal taxable income.

Above-the-Line Deductions for Federal Employees:

| Deduction Type | 2026 Limit/Amount | How to Claim | Impact on Taxes |

|---|---|---|---|

| Thrift Savings Plan (TSP) | $24,500 employee deferral | Pre-tax payroll deduction via TSP election | Reduces federal & state taxable income |

| FERS Contribution | 0.8% of salary (automatic) | Deducted from paycheck automatically | Reduces federal & state taxable income |

| FEHB Premiums | Varies by plan ($100-400+/month) | Pre-tax payroll deduction | Reduces federal & state taxable income |

| FEGLI Life Insurance | Varies by coverage level | Pre-tax payroll deduction | Reduces federal & state taxable income |

| Professional Licensing/Dues | Full cost if job-required | Itemize deductions or deduct if pre-tax | Reduces taxable income if deducted pre-tax |

| Union Dues | Full amount if applicable | Pre-tax payroll deduction if offered | Reduces taxable income if deducted pre-tax |

Military-Specific Tax-Free Benefits:

Active-duty military stationed in Maryland receives additional tax advantages unavailable to civilians:

- Basic Allowance for Housing (BAH): Entirely tax-free (not reported on W-2)

- Basic Allowance for Subsistence (BAS): Entirely tax-free (not reported on W-2)

- Combat Zone Tax Exclusion: Up to $12,900 (2026) excluded if serving in designated combat zones

- Military Dislocation Allowance: Tax-free when permanently changing duty stations

- Uniform Allowance: Deductible as unreimbursed employee expense (if not reimbursed)

How Maryland State Income Tax Applies to DOD Employees (2026)

Quick Answer: Maryland taxes all residents and non-residents working in Maryland at progressive rates from 5.75% to 8.75%, with no special exemptions for federal employees. Your Maryland tax is calculated on gross income minus federal deductions (TSP, health insurance, etc.).

Maryland Tax Rates & Brackets (2026):

| Taxable Income (Single) | Tax Rate | Taxable Income (Married Filing Jointly) | Tax Rate |

|---|---|---|---|

| $0 – $1,100 | 5.75% | $0 – $2,200 | 5.75% |

| $1,101 – $2,500 | 6.25% | $2,201 – $5,000 | 6.25% |

| $2,501 – $12,500 | 6.75% | $5,001 – $25,000 | 6.75% |

| $12,501+ | 8.75% | $25,001+ | 8.75% |

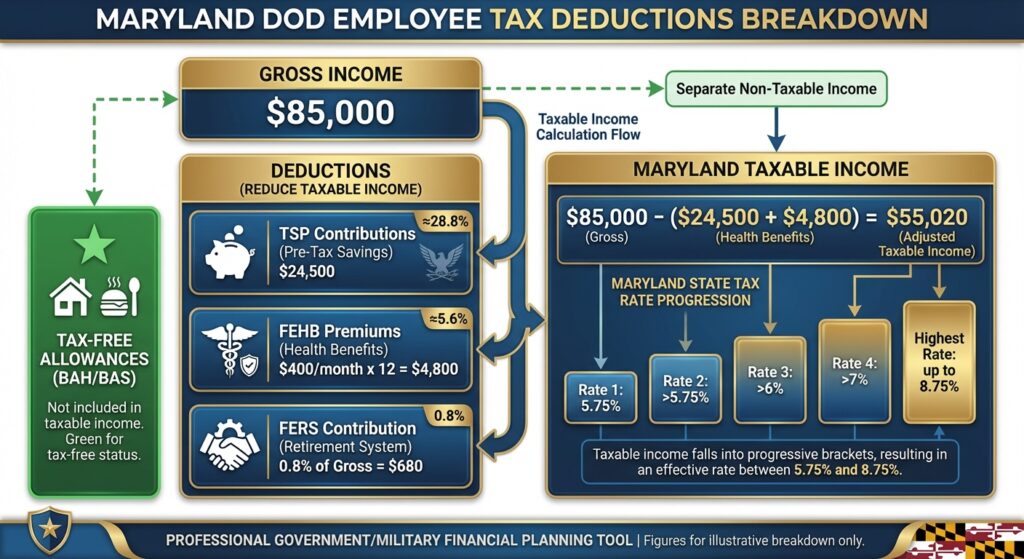

Example Calculation: A GS-13 federal employee in Maryland earning $85,000 salary:

- Gross salary: $85,000

- TSP deferral: -$24,500

- FEHB premium: -$400/month × 12 = -$4,800

- FERS contribution: -$680

- Maryland taxable income: $54,820

- Maryland state tax (at 8.75% on amount over $25,000): ~$4,078

Maryland Tax Credits & Deductions Available (2026):

- Senior Dependent Care Credit: Up to $360 (age 65+, new for 2026)

- Child and Dependent Care Credit: Up to $600 for dependent care expenses

- Education Credit: Lifetime Learning Credit up to $2,000

- Working Families Credit: Earned Income Tax Credit equivalent for low-income earners

- Property Tax Credit: If you own Maryland property (up to $1,200 for homeowners)

TSP (Thrift Savings Plan) & FERS Retirement Strategy for Maryland DOD Employees

Quick Answer: TSP contributions reduce both federal and Maryland taxes immediately. Maximize TSP ($24,500 for 2026) to reduce Maryland state tax burden by up to $1,400 annually. FERS contributions (0.8%) are mandatory and offer modest tax savings.

Step 1: Maximize TSP Contributions

How to Adjust TSP Elections:

- Log into your TSP account at tsp.gov (federal employees only)

- Navigate to “Contributions” > “Employee Contributions”

- Select contribution type: Traditional (pre-tax, reduces Maryland taxes) or Roth (post-tax, no Maryland tax reduction)

- Enter annual contribution amount (2026 maximum: $24,500)

- Allocate contributions across funds: C Fund, S Fund, I Fund, F Fund, G Fund

- Confirm changes effective next pay period

- Verify on next pay stub that TSP deduction appears

You’ll know this step is complete when: Your pay stub shows TSP deductions, and your gross pay is reduced by the TSP amount before Maryland state tax is calculated.

Step 2: Understand FERS Contributions & Benefits

Federal employees under the Federal Employees Retirement System (FERS) are required to contribute 0.8% of gross salary to FERS. This is a mandatory deduction and reduces your taxable income for both federal and Maryland state tax purposes.

| FERS Component | Employee Contribution Rate | Tax Treatment | Benefit at Retirement |

|---|---|---|---|

| Basic FERS | 0.8% of salary | Pre-tax (reduces federal & MD state taxes) | Pension based on High-3 salary & years of service |

| Social Security | 6.2% of salary | Pre-tax (reduces federal & MD taxes) | Social Security benefits at 62-67 depending on birth year |

| Medicare | 1.45% of salary | Pre-tax (reduces federal & MD taxes) | Medicare eligibility at 65 |

Step 3: CSRS Employees (If Applicable)

Employees hired before 1984 may be under the Civil Service Retirement System (CSRS). CSRS contributions are higher (7.5% to 8.5%) but provide more generous pension benefits.

Maryland Tax Filing Requirements for DOD Employees (2026)

Quick Answer: All Maryland residents and non-residents earning Maryland income must file Maryland Form 502 (Individual Income Tax Return) if gross income exceeds $12,500 (single) or $25,000 (married filing jointly). Filing deadline: April 15, 2026.

Maryland Filing Requirement Checklist:

Must file Maryland taxes if:

- ☐ You’re a Maryland resident earning any income

- ☐ You’re a non-resident working in Maryland with $12,500+ in Maryland-source income

- ☐ You have Maryland tax withheld on your pay stub

- ☐ You have Maryland tax liability even if no tax was withheld

- ☐ You’re claiming the Earned Income Tax Credit (even if income is below threshold)

Step-by-Step Maryland Tax Filing Guide:

- Gather Documents (by March 31, 2026):

- W-2 form from your DOD employer (federal box shows gross salary with TSP deducted)

- 1098-T (if you paid education expenses)

- Records of Maryland estimated tax payments (if any)

- Proof of dependent care expenses (if claiming child/dependent care credit)

- Maryland property tax statement (if claiming property tax credit)

- Complete Federal Return First:

- File federal Form 1040 (deadline: April 15, 2026)

- This establishes your federal AGI used on Maryland Form 502

- Complete Maryland Form 502:

- Transfer your federal AGI to line 1 of Form 502

- Add back certain deductions (TSP, FERS) if not already included

- Claim Maryland credits (dependent care, property tax, education, etc.)

- Calculate Maryland state tax using tax tables or software

- Report Withholding & Calculate Refund/Payment:

- Enter total Maryland tax withheld from pay stubs (Box 17 on W-2)

- Calculate refund or payment due

- File via Online or Mail:

- Online (Recommended): MD TaxFile (free for most residents)

- Mail: Send Form 502 to Maryland Department of Revenue, Annapolis, MD

- Postmark Deadline: April 15, 2026

- Keep Documentation:

- Retain W-2, receipts, and filed return for 7 years (IRS statute of limitations)

You’ve completed this step when: You’ve received confirmation of filing from Maryland Department of Revenue or software confirmation email.

Common Tax Mistakes Maryland DOD Employees Make (And How to Avoid Them)

Mistake 1: Failing to Account for TSP Deferrals on Maryland Taxes

The Problem: Many federal employees assume TSP contributions are hidden from Maryland tax calculation. They’re not. TSP is pre-tax federally and for Maryland purposes—but some employees fail to claim them, resulting in overpaying Maryland taxes.

How to Avoid It: Verify your W-2 Box 1 (federal wages) shows TSP already deducted. Maryland Form 502 should use this reduced amount. If your pay stub shows $85,000 gross but TSP of $24,500 was deducted, your W-2 Box 1 should show $60,500.

Mistake 2: Incorrect Withholding on Bonuses & Holiday Pay

The Problem: When bonuses or supplemental pay are paid, federal and Maryland withholding may be calculated incorrectly, leading to underwithholding or overwithholding.

How to Avoid It: Request adjusted W-4 forms (federal) and MD-W4 forms (Maryland) after receiving bonuses. Review your annual withholding by December 31 and adjust for 2027 if needed.

Mistake 3: Not Claiming Available Maryland Tax Credits

The Problem: DOD employees with dependents often miss Maryland-specific credits like dependent care credits (up to $600) or education credits ($2,000 Lifetime Learning Credit).

How to Avoid It: Review the full list of Maryland credits on your Form 502 instructions and determine eligibility. Many free tax prep services (Free File through IRS) include Maryland credit checking.

Mistake 4: Misunderstanding Combat Zone Exclusion (Military Only)

The Problem: Active-duty service members in designated combat zones can exclude up to $12,900 (2026) from gross income, but some fail to claim it or claim too much.

How to Avoid It: Verify your deployment location is on the IRS Combat Zone List. File Form 2555 or attach documentation to your return showing deployment dates and qualifying income.

Mistake 5: Forgetting to Report Non-W2 Income (Side Gigs, Rental Property)

The Problem: Federal employees with side income from consulting, freelancing, or rental property sometimes forget to report it on Maryland taxes.

How to Avoid It: Report all income sources. Self-employment income over $400 requires Form 1040 Schedule C and Schedule SE (federal), which automatically triggers Maryland Form 502 filing requirement.

Frequently Asked Questions About Maryland DOD Employee Taxes

Q1: Do I Have to File Maryland Taxes if I’m Military?

Yes. Active-duty military stationed in Maryland must file Maryland taxes on all income except BAH, BAS, and combat zone exclusions. Military service members are treated like other employees for state tax purposes.

Q2: What’s the Difference Between FERS and CSRS?

FERS (Federal Employees Retirement System): Hired 1984+; 0.8% employee contribution; eligible for TSP; social security benefits included.

CSRS (Civil Service Retirement System): Hired before 1984; 7.5-8.5% employee contribution; no TSP access; no social security but higher pension benefits.

Q3: Can I Deduct Union Dues on Maryland Taxes?

If deducted pre-tax from paycheck: Yes, automatically reduces Maryland taxable income.

If paid post-tax: Only if you itemize deductions (not standard deduction) and meet the 2% AGI threshold for unreimbursed employee expenses.

Q4: How Much Maryland State Tax Will I Pay on My $85,000 Federal Salary?

Example: GS-13 earning $85,000 with $24,500 TSP + $4,800 FEHB = $55,700 Maryland taxable income. Maryland tax = approximately $4,200 (varies by exact income brackets and credits).

Q5: Is Military BAH and BAS Taxable in Maryland?

No. BAH and BAS are entirely tax-free and don’t count toward Maryland income tax or federal income tax. These allowances don’t appear on your W-2.

Q6: What If I’m Stationed in Maryland But Not a Maryland Resident?

You must file Maryland taxes. Non-residents working in Maryland with over $12,500 in Maryland-source income must file Maryland Form 502 as a non-resident (Part B of the form).

Q7: When Is the Maryland Tax Deadline?

April 15, 2026 (same as federal). If filing an extension, automatic federal extension extends Maryland deadline to October 15, 2026.

Q8: Can I File Maryland Taxes Online?

Yes. Use Maryland’s free MD TaxFile at marylandtaxes.gov. If you’re low-income or near threshold, IRS Free File includes Maryland forms too.

Q9: How Do I Know If I’m Under-Withholding on Maryland Taxes?

Calculate estimated liability: Multiply Maryland taxable income × 8.75% (top rate). Compare to actual withholding shown on pay stubs (sum of all months’ Maryland tax withheld). If withholding is less than 90% of current year liability, you may owe penalties.

Q10: Are Federal Employees Exempt from Maryland Property Tax?

No. Federal employees don’t get property tax exemptions, but homeowners can claim a Maryland Property Tax Credit (up to $1,200) on state return if income is under certain thresholds.

Q11: What If I’m Retiring from DOD Mid-Year? Any Special Tax Rules?

Yes. You’ll receive Form 1099-R for pension/TSP distributions. These are taxable in both federal and Maryland. Consult a tax professional about withholding and estimated tax payments for retirement distributions.

Q12: How Much Should I Contribute to TSP to Minimize Maryland Taxes?

Maximum 2026 contribution: $24,500 saves ~$2,140 in Maryland state taxes (at 8.75% rate). This is the single most effective tax reduction strategy for Maryland DOD employees.

Next Steps: Take Action on Your Maryland DOD Employee Taxes

Immediate Actions (This Month):

- Review your pay stub – Verify TSP deduction, FERS contribution, FEHB premium, and Maryland tax withholding are correct

- Log into TSP account (tsp.gov) – Check if you’re maximizing contributions ($24,500 for 2026)

- Verify W-4 accuracy – Use IRS W-4 calculator to ensure correct federal withholding

- Download Maryland Form 502 – Review form early to prepare for April filing

Before April 15, 2026:

- File Federal 1040 return – Required before Maryland Form 502

- File Maryland Form 502 – Use online MD TaxFile or tax software

- Keep all documentation – W-2, receipts, records for 7 years

When to Get Professional Help:

- ☐ You have side income/self-employment

- ☐ You’re in a combat zone and claiming exclusions

- ☐ You’re retiring mid-year with TSP or pension distributions

- ☐ You have multiple states’ tax obligations

- ☐ Your tax situation changed (marriage, dependents, home purchase)

For expert guidance on Maryland DOD employee taxes, consult our Maryland tax preparation services. Our certified professionals specialize in federal employee tax planning and can help you optimize deductions, maximize retirement contributions, and ensure accurate Maryland filing.

Related Resources for Maryland DOD Employees

- TSP (Thrift Savings Plan) Official Site – Manage contributions and allocations

- OPM Retirement Services – FERS/CSRS information

- Maryland Department of Revenue – State tax forms and guidance

- IRS.gov – Federal tax forms and publications

- IRS Combat Zone Exclusion – Military deployment tax guidance

- Maryland Tax Preparation Services – Professional federal employee tax assistance