The Ultimate Guide to Quarterly Estimated Taxes for LLCs: A Simple System for a Complicated Tax

What Are Estimated Taxes and Why Do I Have to Pay Them?

That’s all estimated taxes are: you paying your taxes as you go.

Who Needs to Pay?

The rule is simple: if you expect to owe more than $1,000 in tax for the year when you file your return, you need to pay estimated taxes. For most successful LLC owners, this is a given.

A Masterclass on the Estimated Tax Worksheet (Form 1040-ES)

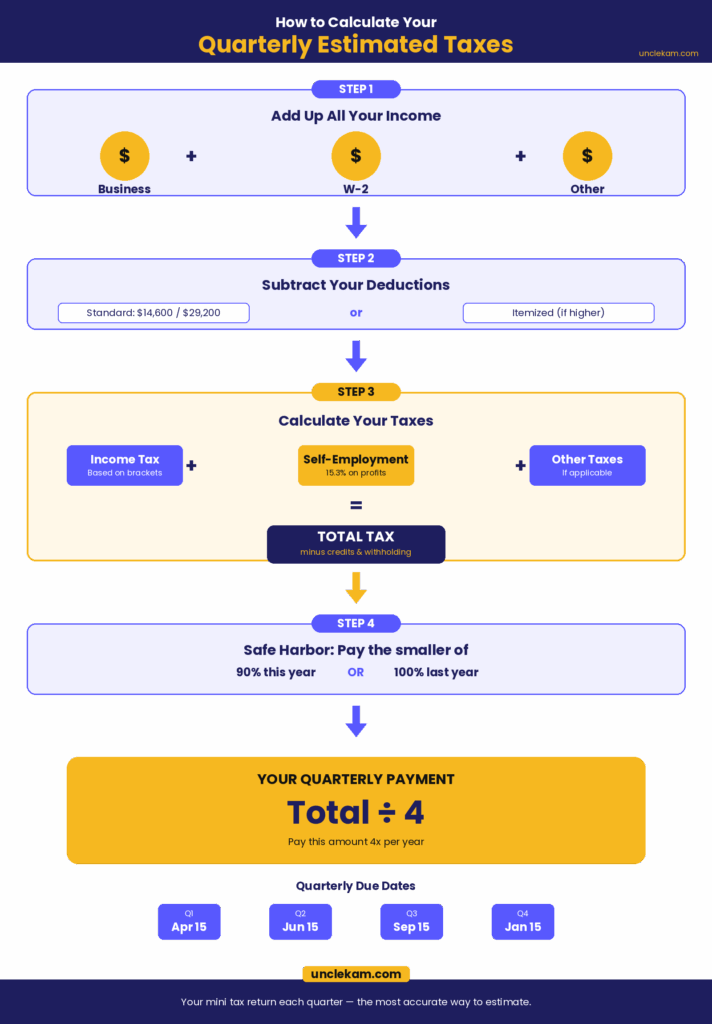

- Adjusted Gross Income (AGI): This is your total income minus certain “above-the-line” deductions. You will need to project your business profit for the year, as well as any other income you have (W-2, investments, etc.).

- Deductions: You will either take the standard deduction or itemize your deductions. You will need to project which one will be higher for you.

- Taxable Income: Line 1 minus Line 2.

- Tax: You will use the tax brackets for your filing status to calculate the tax on your taxable income.

- Alternative Minimum Tax (AMT): For most small business owners, this will be zero.

- Credits: You will subtract any tax credits you expect to receive.

- Self-Employment Tax: This is a big one. You will need to calculate your self-employment tax (15.3% on the first $168,600 of profit in 2024).

- Other Taxes: This could include things like the net investment income tax.

- Total Tax: This is your total estimated tax for the year.

- The Safe Harbor Calculation: This is where you multiply your total tax by 90% (or 100% of your prior year tax, if that is smaller).

- Withholding: You will subtract any taxes you expect to have withheld from a W-2 job.

- The Bottom Line: This is the total amount of estimated tax you need to pay for the year.

- Your Quarterly Payment: Divide Line 12 by four.

This process forces you to create a mini-tax return for yourself each quarter. It is the most accurate way to determine your estimated tax payments.

The Quarterly Estimated Tax Calculator

How to Pay Your Estimated Taxes: A Step-by-Step Guide

- April 15

- June 15

- September 15

- January 15 of the following year

- IRS Direct Pay: This is the easiest method. You can pay directly from your bank account for free on the IRS website.

- EFTPS (Electronic Federal Tax Payment System): This is a more robust system that is good for businesses that make frequent tax payments. You have to enroll in the system, but it gives you more flexibility.

- Mail a Check: You can still print out a Form 1040-ES payment voucher and mail a check to the IRS.

A Deep Dive on the Underpayment Penalty (Form 2210)

Form 2210, “Underpayment of Estimated Tax by Individuals, Estates, and Trusts,” is the form the IRS uses to calculate the penalty. It is a complex form, but the concept is simple. It compares the amount you should have paid each quarter to the amount you actually paid. If there is a shortfall, it calculates the interest on that shortfall from the due date of the payment to the date you paid it.

- Casualty or Disaster: If you were unable to pay due to a casualty, disaster, or other unusual circumstance, the IRS may waive the penalty.

- Retirement or Disability: If you retired (after reaching age 62) or became disabled during the tax year, and your underpayment was due to reasonable cause and not willful neglect, the IRS may waive the penalty.

An Expanded Guide for First-Year Businesses

Your first year in business is the hardest when it comes to estimated taxes because you have no prior year tax liability to use as a safe harbor. You are flying blind. Here is a simple framework to get you through it.

- Be Conservative: It is always better to overpay than to underpay in your first year. You will get the money back as a refund.

- Project High: When you are projecting your income for the year, err on the side of being optimistic. This will help you avoid an underpayment penalty.

- The “25% of Profit” Rule of Thumb: A good, conservative rule of thumb for your first year is to set aside 25-30% of your net profit for taxes. This will generally be enough to cover your federal and state obligations.

- Create Your Safe Harbor: The goal in your first year is to create a tax liability that you can use as your safe harbor for year two. Even if you have to overpay a bit to do it, it will make your life so much simpler in your second year.

The Ultimate 50-State Guide to Estimated Tax Payments

| State | Income Tax? | Payment Portal |

|---|---|---|

| Alabama | Yes | AL DOR |

| Alaska | No | N/A |

| Arizona | Yes | AZ DOR |

| Arkansas | Yes | AR DFA |

| California | Yes | CA FTB |

| Colorado | Yes | CO DOR |

| Connecticut | Yes | CT DRS |

| Delaware | Yes | DE DOR |

| Florida | No | N/A |

| Georgia | Yes | GA DOR |

| Hawaii | Yes | HI DOT |

| Idaho | Yes | ID STC |

| Illinois | Yes | IL DOR |

| Indiana | Yes | IN DOR |

| Iowa | Yes | IA DOR |

| Kansas | Yes | KS DOR |

| Kentucky | Yes | KY DOR |

| Louisiana | Yes | LA DOR |

| Maine | Yes | ME MRS |

| Maryland | Yes | MD Comptroller |

| Massachusetts | Yes | MA DOR |

| Michigan | Yes | MI Treasury |

| Minnesota | Yes | MN DOR |

| Mississippi | Yes | MS DOR |

| Missouri | Yes | MO DOR |

| Montana | Yes | MT DOR |

| Nebraska | Yes | NE DOR |

| Nevada | No | N/A |

| New Hampshire | No (earned income) | N/A |

| New Jersey | Yes | NJ Treasury |

| New Mexico | Yes | NM TRD |

| New York | Yes | NY DTF |

| North Carolina | Yes | NC DOR |

| North Dakota | Yes | ND OTR |

| Ohio | Yes | OH DT |

| Oklahoma | Yes | OK TC |

| Oregon | Yes | OR DOR |

| Pennsylvania | Yes | PA DOR |

| Rhode Island | Yes | RI DOT |

| South Carolina | Yes | SC DOR |

| South Dakota | No | N/A |

| Tennessee | No (earned income) | N/A |

| Texas | No | N/A |

| Utah | Yes | UT STC |

| Vermont | Yes | VT DOT |

| Virginia | Yes | VA TAX |

| Washington | No | N/A |

| West Virginia | Yes | WV STD |

| Wisconsin | Yes | WI DOR |

| Wyoming | No | N/A |