LLC Self-Employment Tax: How to Legally Reduce the 15.3% Burden

When you started your LLC, you were probably excited about the freedom, the flexibility, and the potential for unlimited income. What nobody told you was that you would be hit with a tax that employees never see on their paychecks: the self-employment tax. This is a 15.3% tax on your net business income, and it applies to every dollar you earn, up to a certain limit. For many new business owners, this is a shocking and painful surprise when they file their first tax return.

The self-employment tax is not a small thing. If your LLC makes $100,000 in profit, you will owe $15,300 in self employment tax, in addition to your regular income tax. This can push your total tax bill well over $30,000, depending on your tax bracket. This is money that comes directly out of your pocket, and it’s money that many business owners don’t plan for. This is why understanding the self-employment tax and knowing how to legally reduce it is one of the most important things you can do as an LLC owner.

This guide will walk you through everything you need to know about the LLC self-employment tax, including how it’s calculated, why it hurts so much, and the primary legal strategy for reducing it: the S-Corp election. This is not a surface level overview; this is the definitive guide to reducing your self-employment tax and keeping more of your hard-earned money

The Hidden Tax That Nobody Warned You About

When you started your LLC, you were probably excited about the freedom, the flexibility, and the potential for unlimited income. What nobody told you was that you would be hit with a tax that employees never see on their paychecks: the self-employment tax. This is a 15.3% tax on your net business income, and it applies to every dollar you earn, up to a certain limit. For many new business owners, this is a shocking and painful surprise when they file their first tax return.

The self-employment tax is not a small thing. If your LLC makes $100,000 in profit, you will owe $15,300 in self employment tax, in addition to your regular income tax. This can push your total tax bill well over $30,000, depending on your tax bracket. This is money that comes directly out of your pocket, and it’s money that many business owners don’t plan for. This is why understanding the self-employment tax and knowing how to legally reduce it is one of the most important things you can do as an LLC owner.

What is the Self-Employment Tax?

The self-employment tax is the way the IRS collects Social Security and Medicare taxes from self-employed individuals. When you are an employee, your employer withholds 7.65% of your paycheck for Social Security and Medicare, and the employer pays a matching 7.65%. This means the total tax is 15.3%, but you only see 7.65% come out of your paycheck. The other 7.65% is paid by your employer, and you never see it.

When you are self-employed, you are both the employee and the employer. This means you have to pay both halves of the tax. This is why the self-employment tax is 15.3%. You are paying the employee’s share (7.65%) and the employer’s share (7.65%). This is the price you pay for being your own boss.

The Breakdown of the 15.3%:

Social Security Tax:

12.4% of your net self-employment income, up to a cap. For 2024, the cap is $168,600. This means you only pay Social Security tax on the first $168,600 of your net self-employment income. Any income above that

is not subject to Social Security tax. This cap is adjusted every year for inflation.

Medicare Tax:

2.9% of your net self-employment income, with no cap. This means you pay Medicare tax on every dollar you earn, no matter how much you make. There is also an additional 0.9% Medicare tax on high earners. If your income exceeds $200,000 (single) or $250,000 (married filing jointly), you will pay an additional 0.9% Medicare tax on the income above those thresholds. This brings the total Medicare tax to 3.8% for high earners.

How is the Self-Employment Tax Calculated?

The self-employment tax is calculated on your net self-employment income. This is your gross business income minus your business expenses. For example, if your LLC has $150,000 in revenue and $50,000 in expenses, your net self employment income is $100,000. This is the number you use to calculate your self-employment tax

However, there is a small adjustment that reduces the effective rate slightly. The IRS allows you to deduct half of your self-employment tax when calculating your adjusted gross income (AGI). This is an “above-the-line” deduction, which means it reduces your taxable income before you calculate your income tax. This is a small consolation, but it does reduce the sting of the self-employment tax slightly.

The Calculation:

- Step 1: Calculate your net self-employment income. This is your gross business income minus your business expenses.

- Step 2: Multiply your net self-employment income by 92.35%. This is the IRS's way of accounting for the fact that employees don't pay Social Security and Medicare taxes on the employer's share of the tax. The result is your "net earnings from self-employment."

- Step 3: Multiply your net earnings from self-employment by 15.3%. This is your self-employment tax.

- Step 4: Deduct half of your self-employment tax when calculating your AGI. This reduces your taxable income for income tax purposes.

Example:

- Step 1: Net self-employment income = $100,000

- Step 2: Net earnings from self-employment = $100,000 x 92.35% = $92,350

- Step 3: Self-employment tax = $92,350 x 15.3% = $14,130

- Step 4: Deductible portion of self-employment tax = $14,130 / 2 = $7,065

So, you would owe $14,130 in self-employment tax, and you would deduct $7,065 when calculating your AGI. This means your taxable income for income tax purposes would be $92,935 ($100,000 – $7,065).

Calculate your self-employment tax in 60 seconds

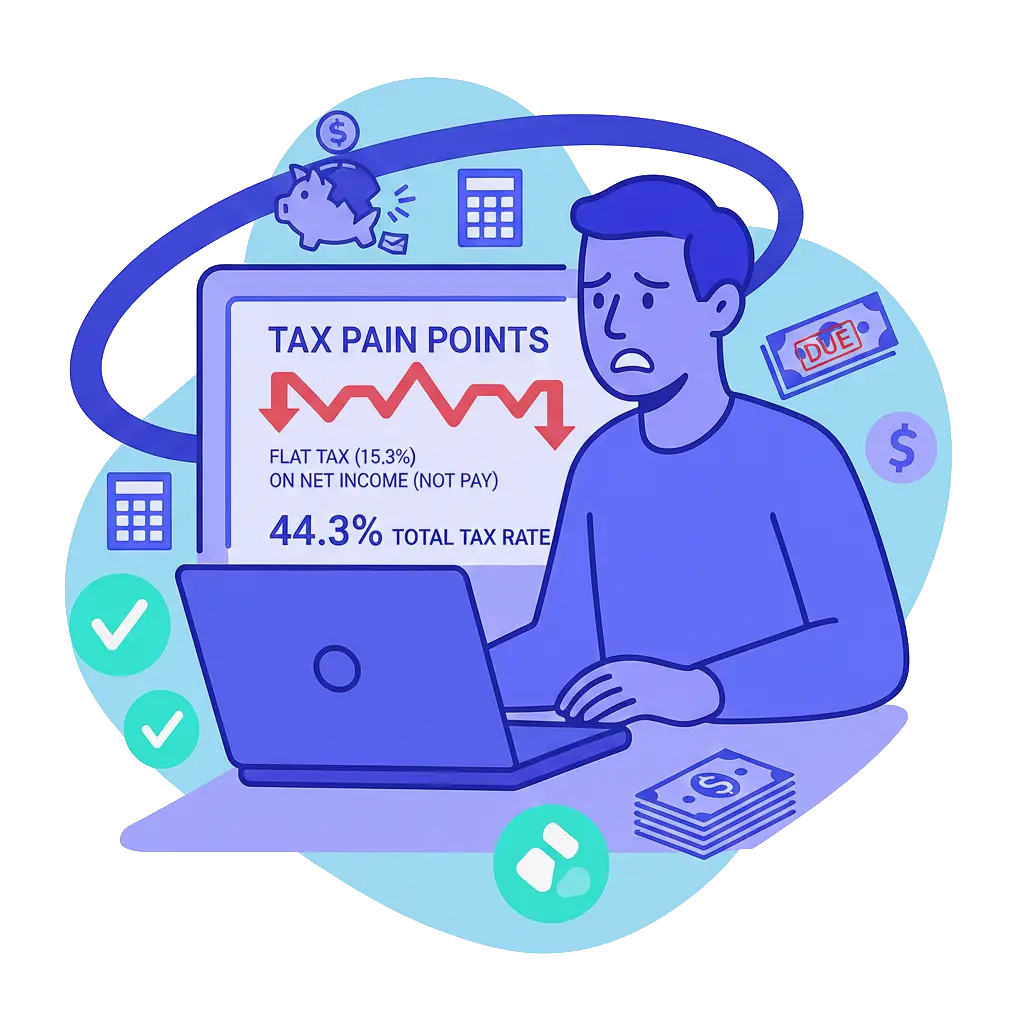

The Pain Point: Why This Tax Hurts So Much

The self-employment tax is painful for several reasons. First, it’s a flat tax. Unlike income tax, which is progressive (meaning higher earners pay a higher percentage), the self-employment tax is the same 15.3% for everyone, up to the Social Security cap. This means a business owner making $50,000 pays the same percentage as a business owner making $150,000.

Second, the self-employment tax is calculated on your net business income, not your take-home pay. This means you pay the tax on money that you may not have even taken out of the business yet. For example, if your LLC makes

$100,000 in profit, but you only take $60,000 as a draw, you still owe self-employment tax on the full $100,000. This can create a cash flow problem, especially for businesses that reinvest a lot of their profit back into the business.

Third, the self-employment tax is in addition to your regular income tax. This means your total tax bill can be quite high.

For example, if you are in the 24% federal income tax bracket and the 5% state income tax bracket, and you owe 15.3% in self-employment tax, your total tax rate is 44.3%. This means you are paying almost half of your income in taxes. This is a significant burden, and it’s one of the main reasons why many business owners look for ways to reduce their selfe mployment tax.

The Sole Proprietorship and Partnership Trap

If your LLC is taxed as a sole proprietorship (single-member LLC) or a partnership (multi-member LLC), you are subject to the full self-employment tax on all your net business income. There is no way to avoid it. You cannot pay yourself a salary and take the rest as a distribution. You cannot set up a retirement plan to reduce your self-employment tax. You are stuck paying 15.3% on every dollar you earn, up to the Social Security cap.

This is the default tax treatment for LLCs, and it’s the reason why many successful business owners eventually elect to have their LLC taxed as an S-Corp. The S-Corp election is the primary legal strategy for reducing self-employment tax, and it can save you thousands of dollars every year.

The S-Corp Election: The Game Changer

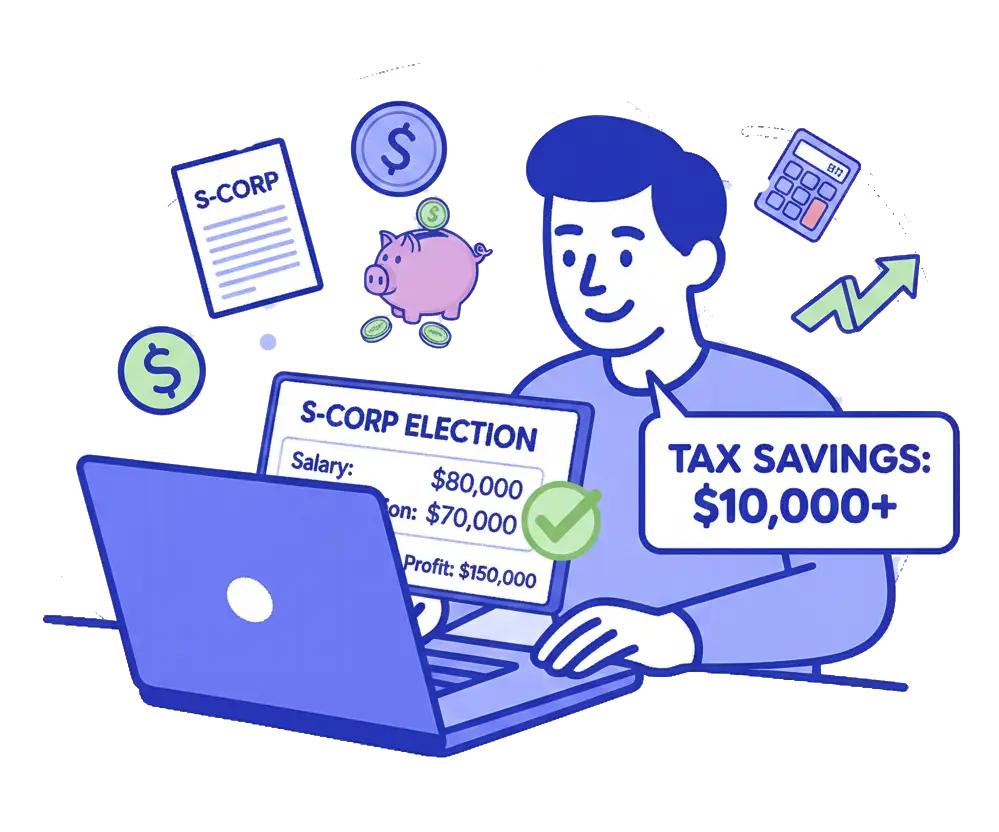

This is where everything changes. When you elect to have your LLC taxed as an S-Corp, you become an employee of your own company. This means you can pay yourself a reasonable salary, and the rest of the profit can be taken as a distribution. The salary is subject to payroll taxes (which are the same as self-employment taxes), but the distribution is not. This is the key to the tax savings

For example, if your LLC makes $150,000 in profit, and you elect S-Corp status, you might pay yourself a salary of $80,000 and take the remaining $70,000 as a distribution. You would pay payroll taxes on the $80,000 salary, but not on the $70,000 distribution. This can save you over $10,000 in taxes every year.

This is not a loophole. This is a legitimate tax strategy that is fully supported by the IRS. However, you must follow the rules. The IRS requires that you pay yourself a “reasonable” salary for the work you do. You cannot pay yourself $20,000 and take $130,000 as a distribution. The IRS will disallow the strategy and reclassify the distribution as salary, which means you will owe back taxes, penalties, and interest.

The S-Corp Savings Calculator: See Your Potential Savings

Before we dive into the mechanics of the S-Corp strategy, let’s see how much you could save. This calculator will show you the potential tax savings based on your business income and your reasonable salary.

How the S-Corp Reduces Your Self Employment Tax

The S-Corp strategy works because it allows you to split your income into two categories: salary and distributions. The salary is subject to payroll taxes (Social Security and Medicare), which are the same as self-employment taxes. However, the distributions are not subject to payroll taxes. This is the key to the tax savings.

- Step 1: You elect to have your LLC taxed as an S-Corp by filing Form 2553 with the IRS.

- Step 2: You become an employee of your own company. This means you must pay yourself a reasonable salary for the work you do.

- Step 3: You withhold payroll taxes from your salary and send them to the IRS. The S-Corp also pays the employer's share of the payroll taxes.

- Step 4: Any remaining profit can be taken as a distribution, which is not subject to payroll taxes.

Example:

Let’s say your LLC makes $150,000 in profit. If you are taxed as a sole proprietorship, you would owe $21,194 in self employment tax ($150,000 x 92.35% x 15.3%). However, if you elect S-Corp status and pay yourself a salary of $80,000, you would only owe $12,240 in payroll taxes ($80,000 x 15.3%). The remaining $70,000 would be taken as a distribution, which is not subject to payroll taxes. This saves you $8,954 in taxes every year.

The Critical Question: What is a "Reasonable" Salary?

This is the most important question in the S-Corp strategy, and it’s the one that causes the most anxiety. The IRS requires that you pay yourself a “reasonable” salary for the work you do. However, the IRS does not provide a specific formula or a safe harbor number. This means you have to use your judgment and document your decision.

The IRS has provided some guidance on what factors to consider when determining a reasonable salary. These factors include:

- Training and Experience: What is your level of education and experience in your field? A highly trained professional with years of experience should be paid more than a novice.

- Duties and Responsibilities: What are your specific duties and responsibilities in the business? The more responsibility you have, the higher your salary should be.

- Time and Effort: How much time do you spend working in the business? If you work full-time, your salary should reflect that.

- Comparable Salaries: What do other people in similar positions in similar businesses earn? This is often the most important factor. You can use salary surveys, job postings, and industry data to determine what a comparable salary would be.

- Payments to Non-Shareholder Employees: What do you pay your other employees? If you have employees who do similar work, your salary should be in line with theirs.

- The Size and Complexity of the Business: Larger, more complex businesses typically pay their owners more than smaller, simpler businesses.

The Three Methods for Determining a Reasonable Salary

There are three main methods for determining a reasonable salary for an S-Corp owner:

The Market-Based Method:

This is the most common and most defensible method. You research what other people in similar positions in similar businesses earn, and you use that data to set your salary. You can use salary surveys from organizations like the Bureau of Labor Statistics, industry associations, or private salary survey companies. You can also look at job postings on sites like Indeed, LinkedIn, or Glassdoor to see what employers are offering for similar positions.

For example, if you are a marketing consultant, you would research what other marketing consultants with similar experience and responsibilities earn in your geographic area. If the average salary is $75,000, you would use that as a starting point for your salary.

The Cost-Based Method:

This method is less common, but it can be useful in certain situations. You calculate the cost of hiring someone else to do your job, and you use that as your salary. This includes not just the base salary, but also the cost of benefits, payroll taxes, and other employment costs.

For example, if it would cost you $90,000 to hire someone to do your job (including salary, benefits, and payroll taxes), you would use $90,000 as your reasonable salary.

The Income-Based Method:

This method is the least defensible, but it can be used as a sanity check. You calculate a percentage of your business income and use that as your salary. The IRS has not provided a specific percentage, but many tax professionals recommend using 30-50% of your business income as a starting point.

For example, if your business makes $150,000 in profit, you might use 50% ($75,000) as your reasonable salary. However, this method should not be used in isolation. You should always cross-check it with the market-based method to ensure your salary is truly reasonable.

Documenting Your Reasonable Salary Decision

Once you have determined your reasonable salary, you must document your decision. This is critical for audit protection. If the IRS audits you and questions your salary, you need to be able to show them the research and analysis you did to arrive at your number.

- Salary Survey Data: Print out or save copies of the salary surveys, job postings, or industry data you used to determine your salary.

- Your Job Description: Write a detailed job description that outlines your duties and responsibilities in the business. This will help you justify your salary based on the work you do.

- Your Time Log: Keep a log of the time you spend working in the business. This will help you justify your salary based on the time and effort you put in.

- Board Resolution: Have your S-Corp's board of directors (which may just be you) pass a resolution setting your salary. This resolution should reference the research and analysis you did to determine the salary.

- Annual Review: Review your salary every year and adjust it as needed. Your salary should increase as your business grows and as your responsibilities increase

The Break-Even Point: When Does the S-Corp Make Sense?

The S-Corp election is not right for every business. There are additional costs and complexities associated with being an S-Corp, including payroll processing, additional tax filings, and potentially higher accounting fees. This means the tax savings must be large enough to justify the extra cost and hassle.

As a general rule of thumb, the S-Corp election starts to make sense when your business is making at least $60,000 to $80,000 in profit. At this level, the tax savings are typically large enough to offset the additional costs. However, the exact break-even point depends on your specific situation, including your state’s tax laws, your accounting fees, and your payroll processing costs.

- Below $60,000 in profit: The S-Corp election is probably not worth it. The tax savings are too small to justify the extra cost and complexity.

- $60,000 to $80,000 in profit: The S-Corp election may be worth it, depending on your specific situation. You should run the numbers and talk to a tax professional.

- Above $80,000 in profit: The S-Corp election is almost always worth it. The tax savings are significant, and they will more than offset the additional costs.

The Real-World Impact: Case Studies

Case Study 1: Sarah, the Freelance Graphic Designer

Sarah is a freelance graphic designer who makes $120,000 in profit. She is currently taxed as a sole proprietorship, which means she owes $16,977 in self-employment tax. She elects S-Corp status and pays herself a salary of $70,000. She takes the remaining $50,000 as a distribution. Her payroll taxes on the $70,000 salary are $10,710. This saves her $6,267 in taxes every year. After accounting for the additional cost of payroll processing ($1,200 per year) and higher accounting fees ($500 per year), her net savings are $4,567 per year.

Case Study 2: Mike, the IT Consultant

Mike is an IT consultant who makes $200,000 in profit. He is currently taxed as a sole proprietorship, which means he owes $28,278 in self-employment tax. He elects S-Corp status and pays himself a salary of $110,000. He takes the remaining $90,000 as a distribution. His payroll taxes on the $110,000 salary are $16,830. This saves him $11,448 in taxes every year. After accounting for the additional costs, his net savings are over $10,000 per year.

What If I Have a W-2 Job on the Side?

This is a common situation, and it adds a layer of complexity to the S-Corp strategy. If you have a W-2 job in addition to your LLC, you need to be aware of how the Social Security cap works. Remember, the Social Security tax is only applied to the first $168,600 of your income (for 2024). This cap applies to all your wages, including your W-2 wages and your S-Corp salary.

For example, if you make $100,000 at your W-2 job and $80,000 from your S-Corp salary, your total wages are $180,000. However, you only pay Social Security tax on the first $168,600. This means you would pay Social Security tax on your full $100,000 W-2 salary and only $68,600 of your S-Corp salary. The remaining $11,400 of your S-Corp salary would only be subject to Medicare tax (2.9%), not the full 15.3% payroll tax

This can create a significant additional savings. However, you need to coordinate with your payroll processor to ensure the taxes are calculated correctly. You may also need to file Form 843 to claim a refund of any excess Social Security tax that was withheld

What If My Income is Highly Variable?

If your business income is highly variable from year to year, the S-Corp strategy can still work, but you need to be more careful about setting your salary. You cannot change your salary every month based on your income. The IRS expects you to pay yourself a consistent salary throughout the year, just like any other employee.

However, you can adjust your salary at the beginning of each year based on your projected income for that year. If you have a good year, you can increase your salary for the following year. If you have a bad year, you can decrease your salary for the following year.

You can also use a bonus structure to manage variable income. You can pay yourself a base salary that is on the lower end of reasonable, and then pay yourself a bonus at the end of the year if the business has a good year. The bonus is subject to payroll taxes, just like your salary, but it gives you more flexibility to manage your cash flow throughout the year.

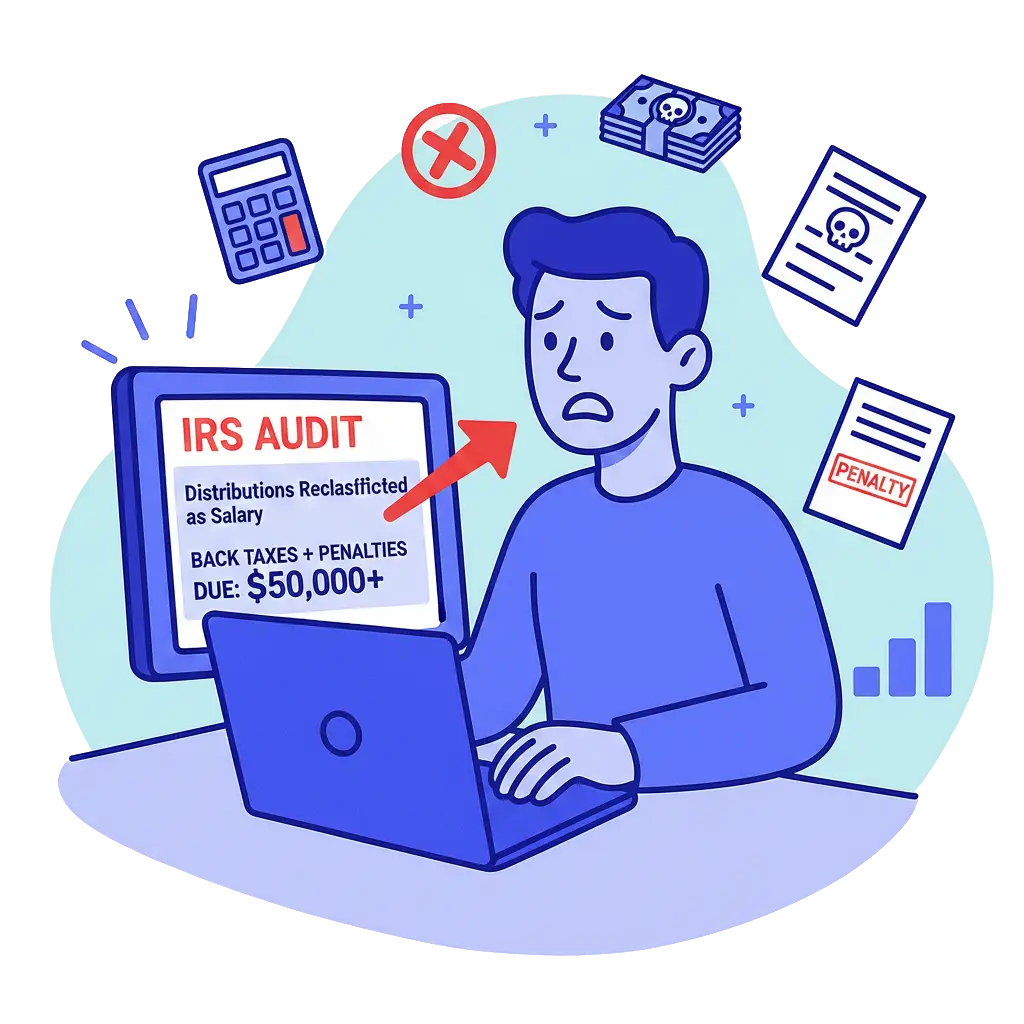

What If I Take Too Little Salary?

This is the biggest risk with the S-Corp strategy. If the IRS audits you and determines that your salary is unreasonably low, they will reclassify your distributions as salary. This means you will owe back taxes on the distributions, plus penalties and interest. The penalties can be significant, so it’s important to get this right.

The IRS has been cracking down on S-Corp owners who take unreasonably low salaries. In recent years, the IRS has won several high-profile cases where they reclassified distributions as salary. In one case, an accountant who made

$240,000 in profit paid himself a salary of only $24,000. The IRS reclassified $100,000 of his distributions as salary, and he owed over $50,000 in back taxes, penalties, and interest.

The key to avoiding this is to pay yourself a truly reasonable salary and to document your decision thoroughly. If you are ever audited, you need to be able to show the IRS the research and analysis you did to determine your salary.

How Does My S-Corp Salary Affect My Ability to Get a Mortgage?

This is a question that many S-Corp owners don’t think about until they try to buy a house. When you apply for a mortgage, the lender will look at your income to determine how much you can afford to borrow. If you are an S-Corp owner, the lender will typically look at your salary plus a portion of your distributions.

However, different lenders have different policies. Some lenders will only count your salary. Other lenders will count your salary plus 100% of your distributions. Still others will count your salary plus a percentage of your distributions (such as 50% or 75%).

This means that if you take a very low salary and large distributions, you may have trouble qualifying for a mortgage. For example, if you pay yourself a salary of $50,000 and take $100,000 in distributions, some lenders may only count $50,000 of your income, which could make it difficult to qualify for the mortgage you want.

If you are planning to buy a house in the near future, you should talk to a mortgage broker before you set your S-Corp salary. They can tell you what the lenders in your area will count as income, and you can adjust your salary accordingly.

Other Strategies to Reduce Self Employment Tax

The S-Corp election is the primary strategy for reducing self-employment tax, but there are a few other strategies that can help:

Maximize Your Business Deductions:

The more business deductions you can take, the lower your net self-employment income will be, and the lower your self employment tax will be. This means you should be aggressive about deducting all your ordinary and necessary business expenses. This includes home office expenses, vehicle expenses, travel expenses, meals and entertainment (subject to the 50% limit), and any other expenses that are related to your business.

Contribute to a Retirement Plan:

Contributions to a SEP IRA or Solo 401(k) reduce your net self-employment income, which reduces your self employment tax. For 2024, you can contribute up to 25% of your net self-employment income to a SEP IRA, or up to $69,000 to a Solo 401(k). This is a powerful way to save for retirement and reduce your taxes at the same time.

Hire Your Spouse or Children:

If you hire your spouse or children to work in your business, you can deduct their wages as a business expense. This reduces your net self-employment income, which reduces your self-employment tax. However, the wages must be reasonable for the work they do, and you must treat them like any other employee (withhold payroll taxes, file W-2s, etc.).

If you hire your child who is under 18, you do not have to pay Social Security or Medicare taxes on their wages. This can create a significant tax savings. However, the child must actually work in the business, and the wages must be reasonable for the work they do.

Consider a C-Corp Election:

In some rare cases, a C-Corp election can reduce your overall tax burden. A C-Corp pays corporate income tax on its profits, and then the owners pay personal income tax on any dividends they receive. This is called “double taxation,” and it’s the reason why most small businesses avoid the C-Corp structure.

However, if your business is very profitable and you plan to reinvest most of the profits back into the business, a C-Corp can sometimes result in a lower overall tax burden. This is because the corporate tax rate (21%) is lower than the top individual tax rate (37%). However, this strategy is complex and requires careful planning. You should talk to a tax professional before considering a C-Corp election.

The Audit Risk: What You Need to Know

The S-Corp strategy is a legitimate tax strategy, but it does increase your audit risk slightly. The IRS is aware that some S-Corp owners try to game the system by taking unreasonably low salaries, and they have been cracking down on this in recent years.

However, if you pay yourself a truly reasonable salary and document your decision thoroughly, you should have nothing to worry about. The key is to be proactive and to treat your S-Corp like a real business.

This means:

- Keeping Separate Books and Records: Your S-Corp should have its own bank account, its own bookkeeping system, and its own financial statements. You should not commingle your personal and business finances.

- Holding Annual Meetings: Your S-Corp should hold an annual meeting of shareholders and directors, and you should keep minutes of the meeting. This shows the IRS that you are treating your S-Corp like a real corporation.

- Filing All Required Tax Returns: Your S-Corp must file Form 1120-S every year, even if it has no income. You must also file payroll tax returns (Form 941) every quarter and W-2s for all employees (including yourself) every year.

- Paying Your Payroll Taxes on Time: Payroll taxes must be paid on time, every time. The IRS takes payroll tax compliance very seriously, and the penalties for late payment are severe.

If you follow these rules and document your reasonable salary decision, you should have a very low audit risk. The SCorp strategy is a powerful tool for reducing your self-employment tax, and it’s one that every successful LLC owner should consider.

How to Make the S-Corp Election: A Step-by-Step Guide

If you’ve decided that the S-Corp election is right for your business, here’s how to make it happen. The process is straightforward, but there are some important deadlines you need to be aware of.

Step 1: File Form 2553 with the IRS

The S-Corp election is made by filing Form 2553, “Election by a Small Business Corporation,” with the IRS. This form

tells the IRS that you want your LLC to be taxed as an S-Corp. The form is relatively simple, but it requires some specific information, including:

- Your LLC's name, address, and Employer Identification Number (EIN)

- The date you want the S-Corp election to take effect

- The names, addresses, and Social Security numbers of all shareholders

- The number of shares each shareholder owns

- The signatures of all shareholders, consenting to the election

The deadline for filing Form 2553 is critical. If you want the S-Corp election to take effect for the current tax year, you must file Form 2553 by the 15th day of the third month of your tax year. For most businesses, this means March 15th. If you miss this deadline, the S-Corp election will not take effect until the following tax year.

For example, if you want your S-Corp election to take effect for 2025, you must file Form 2553 by March 15, 2025. If you file it on March 16, 2025, the election will not take effect until 2026.

Step 3: Request Late Election Relief (If Needed)

If you miss the deadline, all is not lost. The IRS has a procedure for requesting late election relief. You can file Form 2553 with a statement explaining why you missed the deadline and requesting that the IRS accept the late election. The IRS will grant late election relief if you have “reasonable cause” for missing the deadline.

Reasonable cause can include things like:

- You relied on the advice of a tax professional who gave you incorrect information

- You were unaware of the deadline due to circumstances beyond your control

- You intended to file on time but made a mistake

The IRS is generally lenient with late election relief requests, especially for new businesses. However, it’s always better to file on time if possible.

Step 4: Set Up Payroll

Once your S-Corp election is approved, you need to set up payroll. This means you need to:

- Determine your reasonable salary

- Choose a payroll processor (such as Gusto, ADP, or Paychex)

- Set up a payroll schedule (weekly, bi-weekly, or monthly)

- Withhold payroll taxes from your salary and send them to the IRS

- File payroll tax returns (Form 941) every quarter

- File W-2s for all employees (including yourself) every year

Setting up payroll can be intimidating, but modern payroll processors make it very easy. Most payroll processors offer full service payroll, which means they will calculate the taxes, file the returns, and send the payments to the IRS on your

behalf. The cost is typically $50 to $150 per month, depending on the number of employees you have.

Step 5: File Form 1120-S Every Year

Once you are an S-Corp, you must file Form 1120-S, “U.S. Income Tax Return for an S Corporation,” every year. This form reports your S-Corp’s income, deductions, and distributions. The deadline for filing Form 1120-S is March 15th (for

calendar-year S-Corps). You can request an automatic 6-month extension by filing Form 7004.

Form 1120-S is more complex than Schedule C, so you will probably need to hire a tax professional to prepare it for you. The cost is typically $500 to $2,000, depending on the complexity of your business.

The Ongoing Compliance Requirements

- Pay Yourself a Salary: You must pay yourself a reasonable salary every year. You cannot skip a year or pay yourself an unreasonably low salary.

- File Payroll Tax Returns: You must file Form 941 every quarter, reporting your payroll taxes. You must also file Form 940 every year, reporting your federal unemployment taxes.

- File W-2s: You must file W-2s for all employees (including yourself) by January 31st of the following year.

- File Form 1120-S: You must file Form 1120-S by March 15th of the following year.

- Hold Annual Meetings: You should hold an annual meeting of shareholders and directors, and you should keep minutes of the meeting.

- Keep Separate Books and Records: You should keep separate books and records for your S-Corp, and you should not commingle your personal and business finances.

These compliance requirements are not difficult, but they do require discipline and attention to detail. If you stay on top of them, you will have no problems. If you let them slide, you could face penalties and interest from the IRS.

Should You Do This Yourself or Hire a Professional?

The S-Corp election is a powerful tax strategy, but it’s not something you should do without professional guidance. The rules are complex, and the consequences of getting it wrong can be severe. I strongly recommend that you work with a qualified tax professional who has experience with S-Corps.

A good tax professional can help you:

- Determine if the S-Corp election is right for your business

- Calculate your reasonable salary

- Set up your payroll

- File Form 2553 and all other required tax returns

- Ensure you are in compliance with all IRS rules and regulations

The cost of hiring a tax professional is typically $1,000 to $3,000 per year, depending on the complexity of your business. This may seem like a lot, but it’s a small price to pay for the peace of mind and the tax savings you will get from the S-Corp election

Your Next Steps

If you are an LLC owner who is paying too much in self-employment tax, the S-Corp election is the solution. Here’s what you should do next:

Step 1: Run the Numbers

Use the S-Corp Savings Calculator at the top of this article to see how much you could save with an S-Corp election. If the savings are significant (typically $5,000 or more per year), the S-Corp election is probably worth it.

Step 2: Talk to a Tax Professional

Schedule a consultation with a qualified tax professional who has experience with S-Corps. They can help you determine if the S-Corp election is right for your business and guide you through the process.

Step 3: File Form 2553

If you decide to move forward, file Form 2553 with the IRS. Remember, the deadline is March 15th if you want the election to take effect for the current tax year.

Step 4: Set Up Payroll

Once your S-Corp election is approved, set up payroll and start paying yourself a reasonable salary.

Step 5: Stay Compliant

Make sure you file all required tax returns on time and keep up with all ongoing compliance requirements.

The Bottom Line

The key is to pay yourself a reasonable salary, document your decision thoroughly, and stay compliant with all IRS rules and regulations. If you do this, you can save thousands of dollars every year and build a more profitable and sustainable

business.

Don’t let the self-employment tax eat away at your profits. Take control of your taxes, make the S-Corp election, and start keeping more of what you earn