The Ultimate Guide to Small Business Tax Deductions (2026)

That feeling in your gut when you look at your tax bill? It’s not just you. Every business owner has felt the sting of sending a huge chunk of their hard-earned money to the IRS. But what if you could legally and ethically keep more of that money in your pocket? That’s not a fantasy; it’s the power of a proactive tax strategy, and it all starts with mastering your business deductions.

This is not another boring list of write-offs. This is a strategic playbook designed to reframe how you think about your business expenses. We’re going to transform your mindset from a reactive, end-of-year shoebox-filler to a proactive, wealth-building tax strategist. The IRS has a rulebook; it’s time you learned how to use it to your advantage. This isn’t about cheating the system; it’s about refusing to leave a tip.

The Golden Rule of Deductions: Mastering "Ordinary and Necessary"

Let's break this down with more nuance:

Ordinary:

An expense is “ordinary” if it is common and accepted in your specific trade or business. This is a crucial point. What is ordinary for a graphic designer is not ordinary for a general contractor. The IRS looks at your industry to determine what is standard. For example, a subscription to Adobe Creative Cloud is ordinary for the designer. A subscription to a construction bidding software is ordinary for the contractor. Neither is ordinary for the other.

Necessary:

An expense is “necessary” if it is helpful and appropriate for your business. This is a more flexible standard than it sounds. The expense does not have to be indispensable or essential to your business’s survival. It just needs to have a clear and logical connection to your business operations. For example, a high-speed internet connection is necessary for a web developer. A high-end espresso machine might be considered necessary for a coffee shop, but it would be harder to justify for a solo

accountant working from home.

👉 The "Reasonableness" Test:

Deep Dive: The Home Office Deduction

The Two Iron-Clad Rules: Exclusive and Regular Use

To qualify for the home office deduction, you must meet two strict tests:

Exclusive Use:

Regular Use:

The Two Methods: Simplified vs. Actual Expense

You have two options for calculating the deduction:

- The Simplified Method: This is the easy way. You simply deduct $ per square foot of your home office, up to a maximum of square feet. This means the maximum deduction is $, per year. It's simple, and it requires minimal record-keeping. However, it is often a much smaller deduction than the actual expense method.

- The Actual Expense Method: This is more complex, but it can result in a significantly larger deduction. With this method, you calculate the percentage of your home that is used for your business, and then you deduct that percentage of your actual home expenses.

This includes:

- Rent or mortgage interest

- Property taxes

- Homeowners insurance

- Utilities (electricity, gas, water, trash)

- Repairs and maintenance

- Depreciation of your home (if you own it)

Example:

- Mortgage Interest: $12,000

- Property Taxes: $4,000

- Homeowners Insurance: $1,500

- Utilities: $3,600

- Repairs: $1,000

- Total: $22,100

With the actual expense method, your deduction would be $, (% of $,). With the simplified method, your deduction would be $, ( sq ft x $). In this case, the actual expense method yields a deduction that is more than double the simplified method.

Pro Tip: Don’t be afraid of the actual expense method. The record-keeping is not as burdensome as you might think, and the tax savings can be substantial. Use a spreadsheet to track your home expenses throughout the year, and the calculation at the end of the year is straightforward.

Use Our Home Office Calculator To See Your Potential Savings in 60 Seconds

Deep Dive: Rent & Utilities for Commercial Spaces

If you have a commercial office, storefront, or workshop, the rules are much simpler. You

can deduct 100% of the rent you pay. But the deductions don’t stop there.

Beyond the Rent:

Common Area Maintenance (CAM) Charges

In most commercial leases, you will be

required to pay a share of the common area maintenance charges. This covers the cost

of maintaining the parking lot, landscaping, and other common areas. These charges

are fully deductible.

Property Taxes

In a triple-net lease (NNN), you are responsible for paying a portion of

the property taxes on the building. These payments are fully deductible.

Utilities

Your electricity, gas, water, internet, and phone bills for your commercial

space are all 100% deductible.

Leasehold Improvements

If you make improvements to your leased space, such as building out new offices or installing new lighting, these are called leasehold improvements. You cannot deduct the full cost of these improvements in the year you make them. Instead, you must depreciate them over a period of 15 years. However, thanks to bonus depreciation, you may be able to deduct a large portion of the cost in the first year.

👉 Pro Tip: Read your lease carefully. Understand what you are responsible for paying in addition to the base rent. All of these additional costs are deductible.

Deep Dive: The "Augusta Rule" Revisited

This is one of the most powerful and underutilized tax strategies for small business owners. The Augusta Rule (Section 280A(g) of the tax code) allows you to rent your personal residence to your business for up to 14 days a year, and the rental income is completely tax free to you personally. Meanwhile, the business gets to deduct the rental payments as a legitimate business expense.

How to Do It Right:

Have a Legitimate Business Purpose

You must be using your home for a legitimate business purpose. This could be a quarterly board meeting, an annual team retreat, a client event, or a photoshoot for your products.

Charge a Fair Market Rent:

You must charge your business a fair market rent for the use of your home. To determine this, you should research what it would cost to rent a comparable event space or meeting room in your area. Get quotes from hotels, coworking spaces, and event venues. Document this research.

Create a Paper Trail

You must treat this as a formal business transaction. This means you should have a rental agreement between you (the homeowner) and your business. You should also send an invoice from you to the business for the rental, and the business should pay you from the business bank account.

Example:

You run an S-Corp and decide to hold your quarterly board meetings at your home. You research comparable meeting spaces and find that it would cost $1,200 per day to rent a similar space. You hold four quarterly meetings, for a total of 4 days. You rent your home to your S-Corp for $4,800. The S-Corp deducts the $4,800 as a rental expense. You receive the $4,800 as tax-free income. If you are in a combined 35% tax bracket, this strategy just saved you $1,680 in taxes.

👉 Pro Tip: This is a powerful strategy, but you must follow the rules. Document everything. The business purpose, the fair market rent research, the rental agreement, the invoice, and the payment. If you do this, you can confidently take advantage of this lucrative tax break.

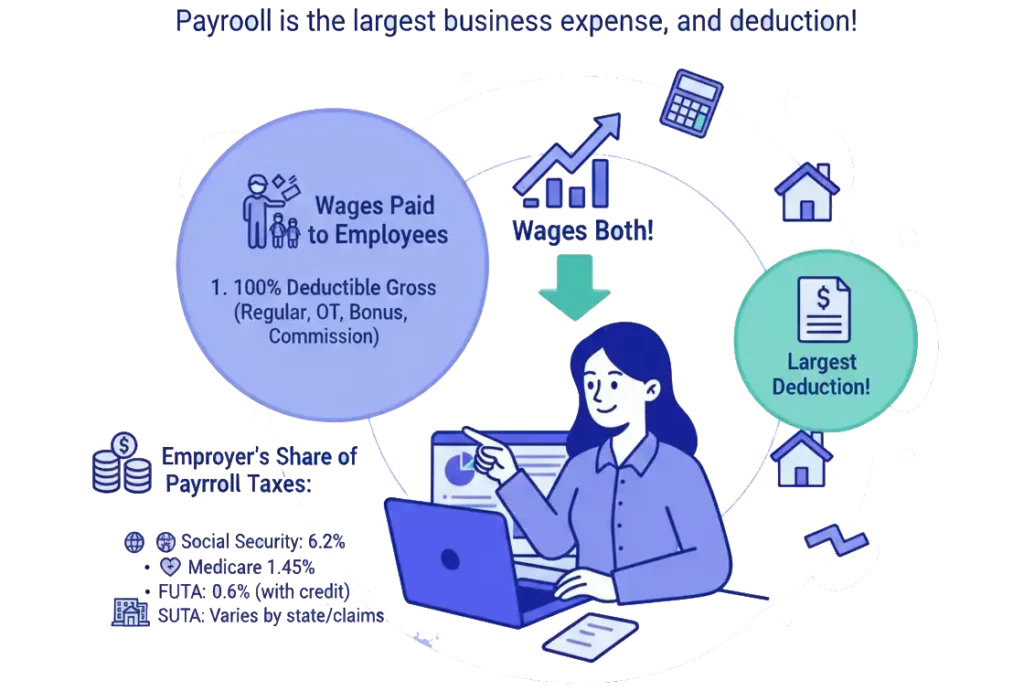

Deep Dive: Salaries, Wages, and the Owner's Paycheck

For most businesses, payroll is the single largest expense. The good news is that it is also one of the largest deductions. However, the rules around deducting payroll are complex, especially when it comes to paying yourself as the owner.

Wages Paid to Employees:

- Social Security: 6.2% of each employee's wages, up to the annual limit

- Medicare: 1.45% of each employee's wages, with no limit

- Federal Unemployment Tax (FUTA): 6% of the first $7,000 of each employee's wages. However, you can get a credit of up to 5.4% if you pay state unemployment taxes, which brings the effective FUTA rate down to 0.6%.

- State Unemployment Tax (SUTA): The rate varies by state and by your business's history of unemployment claims.

The Owner’s Paycheck: A Critical Distinction

How you deduct your own pay depends entirely on your business entity structure:

- Sole Proprietorship or Partnership: You cannot pay yourself a salary. You simply take a "draw" from the business, which is not a deductible expense. Your business profit is your income, and you pay self-employment tax on that profit.

- S-Corporation: You must pay yourself a reasonable salary. This salary is a deductible expense for the S-Corp. This is the primary advantage of the S-Corp structure, as it allows you to split your income between a salary (which is subject to payroll taxes) and distributions (which are not).

- C-Corporation: You can pay yourself a salary, which is a deductible expense for the C Corp. You can also receive dividends, which are not deductible by the corporation and are taxed to you at the qualified dividend rate.

👉 Pro Tip: If you are an S-Corp owner, the concept of “reasonable salary” is critical. The IRS requires that you pay yourself a salary that is commensurate with your experience, your duties, and what other businesses in your industry would pay for similar services. Failing to do so can result in the IRS reclassifying your distributions as salary, which can lead to a massive tax bill

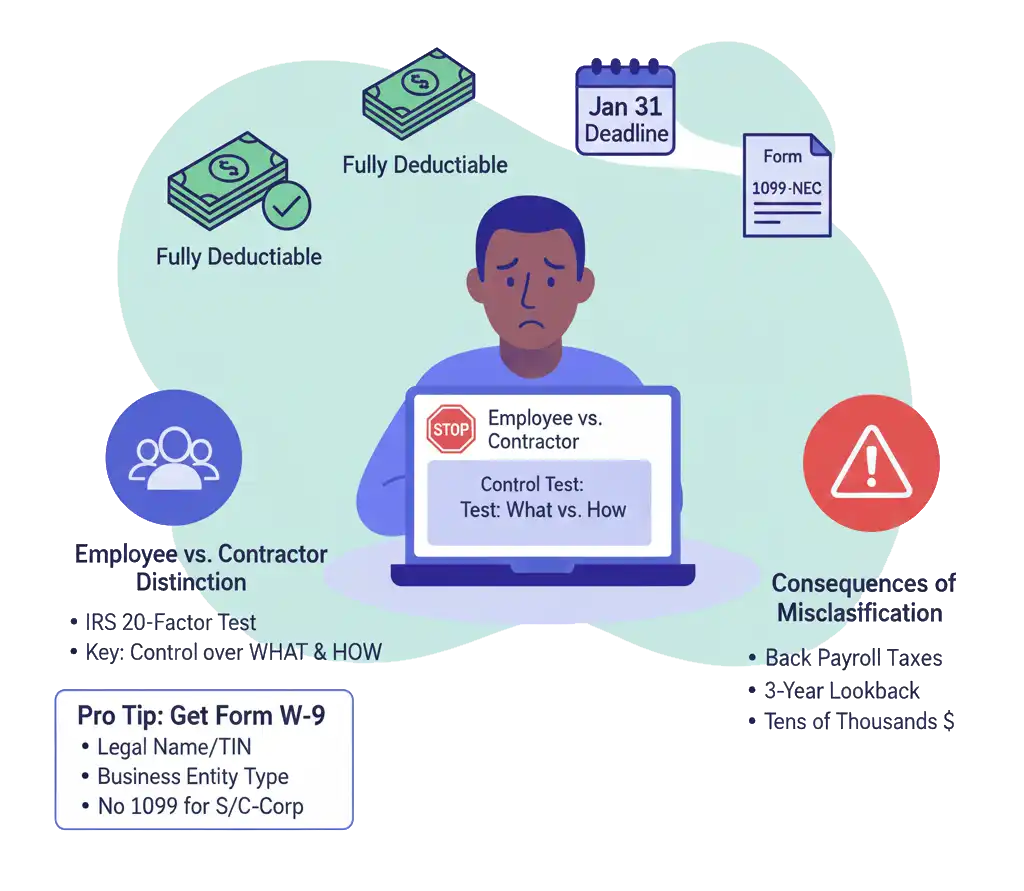

Deep Dive: Contractor Payments and the 1099 Trap

Hiring independent contractors can be a great way to get the talent you need without the cost and complexity of hiring employees. The payments you make to contractors are fully deductible, but the reporting requirements are strict.

The Employee vs. Contractor Distinction:

This is one of the most contentious issues in tax law. The IRS has a 20-factor test to determine whether a worker is an employee or a contractor, but it all boils down to one thing: control. If you have the right to control what the worker does and how they do it, they are likely an employee. If you only have the right to control the result of the work, they are likely a contractor.

Why it Matters So Much:

If you misclassify an employee as a contractor, the consequences can be devastating. You could be liable for back payroll taxes (both the employee’s and the employer’s share), penalties for failure to pay, and interest. The IRS can go back three years, and the total bill can easily run into the tens of thousands of dollars.

The Form 1099-NEC Requirement:

If you pay an independent contractor (who is not a corporation) $600 or more in a calendar year, you are required to file Form 1099-NEC with the IRS and send a copy to the contractor. The deadline for filing is January 31st of the following year. The penalties for failing to file are steep and are calculated on a per-form basis

👉Pro Tip: Before you hire a contractor, have them fill out a Form W-9. This form will give you their legal name, address, and taxpayer identification number, which you will need to file the 1099-NEC. It also has a box for them to indicate their business entity type. If they are a C Corp or an S-Corp, you generally do not have to issue them a 1099.

Deep Dive: Health Insurance and Retirement Plans

Offering benefits is a powerful way to attract and retain top talent, and the tax code provides significant incentives for doing so.

Health Insurance:

The premiums you pay for your employees’ health, dental, and vision insurance are 100% deductible. This is a straightforward and powerful deduction.

For S-Corp owners, the rules are different. If you own more than 2% of the company, you cannot receive tax-free health insurance. Instead, the company must pay the premium, and the premium must be included in your W-2 as wages. You then get to take the self employed health insurance deduction on your personal tax return. This is an “above-the line” deduction, which means it reduces your adjusted gross income (AGI).

Retirement Plans:

Contributions you make to your employees’ retirement plans are deductible. There areseveral types of plans to choose from, each with its own rules and contribution limits:

- SEP IRA: A Simplified Employee Pension (SEP) IRA is easy to set up and allows you to contribute up to 25% of each employee's compensation, up to a maximum of $69,000 for 2024. You must contribute the same percentage for all eligible employees, including yourself

- SIMPLE IRA: A Savings Incentive Match Plan for Employees (SIMPLE) IRA is also easy to set up and allows employees to contribute their own money. You are required to make either a matching contribution (up to 3% of their compensation) or a non-elective contribution (2% of their compensation).

- Solo 401(k): This is a powerful option for self-employed individuals with no employees (other than a spouse). It allows you to contribute as both the "employee" and the "employer." As the employee, you can contribute 100% of your compensation up to $23,000 for 2024 (plus an additional $7,500 if you are over 50). As the employer, you can contribute up to 25% of your compensation. The total contributions cannot exceed $69,000 for 2024

👉Pro Tip: A Solo 401(k) is often a better option than a SEP IRA for a self-employed individual because it allows for higher contributions at lower income levels, and it also allows for Roth contributions, which are not available with a SEP IRA.

Deep Dive: Marketing & Advertising

In the digital age, marketing is more complex and more critical than ever. The good news is that almost every dollar you spend to promote your business is deductible. This is a broad category, so let’s break it down into its modern components

Digital Marketing

- Pay-Per-Click (PPC) Advertising: This includes Google Ads, Bing Ads, and any other platform where you pay for clicks. The full cost of these campaigns is deductible.

- Social Media Advertising: This includes ads on Facebook, Instagram, LinkedIn, Twitter, TikTok, and any other social media platform. The cost of boosting posts and running ad campaigns is deductible.

- Content Marketing & SEO: The costs associated with creating and promoting content are deductible. This includes hiring writers for your blog, paying for graphic design, and the cost of any software you use to create content (e.g., Canva, Adobe Creative Suite). It also includes the cost of hiring an SEO agency or consultant to improve your search engine rankings.

- Email Marketing: The cost of email marketing software like Mailchimp or ConvertKit is deductible.

Traditional Marketing:

- Print Advertising: The cost of ads in newspapers, magazines, and trade journals is deductible.

- Broadcast Advertising: The cost of radio and television commercials is deductible.

- Direct Mail: The cost of designing, printing, and mailing postcards, flyers, and sales letters is deductible.

Other Marketing Expenses:

- Website Costs: The costs of designing, building, and maintaining your website are deductible. This includes domain name registration, web hosting, and the cost of premium themes and plugins.

- Promotional Materials: The cost of business cards, brochures, flyers, and other promotional materials is deductible.

- Sponsorships: Sponsoring a local event, a charity, or a podcast can be a deductible advertising expense, as long as your business gets some form of promotion in return.

👉Pro Tip: Don’t forget to deduct the cost of any software or tools you use for marketing. This can include social media scheduling tools, analytics software, and CRM software. These small monthly subscriptions can add up to a significant deduction over the course of a year.

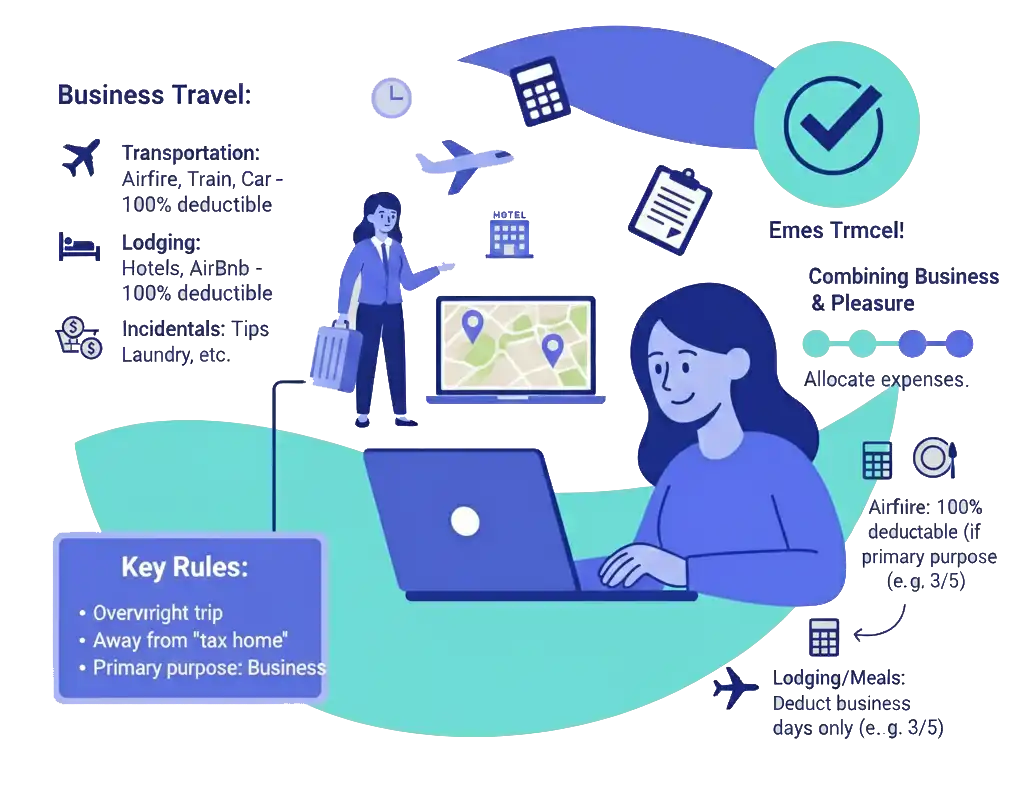

Deep Dive: Business Travel & Meals

This is another area that the IRS scrutinizes, so it’s critical to get it right. The rules are complex, but the deductions can be substantial.

Business Travel:

The cost of travel for business purposes is deductible, but the travel must be overnight and away from your “tax home” (the city or general area where your main place of business is located). The primary purpose of the trip must be for business.

- Transportation: Airfare, train tickets, and rental cars are 100% deductible.

- Lodging: The cost of hotels, motels, and Airbnbs is 100% deductible.

- Incidentals: You can deduct the cost of tips, laundry, and other incidental expenses.

Combining Business and Pleasure

If you extend a business trip for a personal vacation, you can still deduct the business portion of the trip. The key is to allocate your expenses between business and personal days. For example, if you fly to a conference for 3 days and then stay for 2 extra days for, you can deduct the full cost of your airfare (since the primary purpose of the trip was business), but you can only deduct 3/5 of your lodging and meals

Business Meals:

In most cases, you can only deduct 50% of the cost of a business meal. To be deductible, the meal must be with a client, customer, or employee, and you must have a substantial business discussion before, during, or after the meal. You cannot deduct the cost of a meal with a friend, even if you briefly mention your business.

The 100% Deductible Meal Exceptions:

There are a few exceptions to the 50% rule:

- Office Parties: The cost of an office party for your employees is 100% deductible.

- Meals for the Convenience of the Employer: If you provide meals to your employees on your business premises for your convenience (e.g., to have them work through lunch), the cost is 100% deductible.

- Promotional Meals: If you provide meals to the public for promotional purposes (e.g., a grand opening), the cost is 100% deductible.

👉Pro Tip: The documentation requirements for travel and meals are strict. For every travel expense, you must have a record of the amount, the date, the place, and the business purpose. For every meal, you must also have a record of who you were with and what you discussed. Using an app like Expensify can help you keep track of all this information.

Deep Dive: Education & Professional Development

Investing in your own skills and knowledge is one of the best things you can do for your business, and the tax code encourages it. The cost of education that maintains or improvesyour skills in your current business is deductible.

What Qualifies?

- Courses and Seminars: The cost of courses, seminars, and workshops that are directly related to your business is deductible. For example, a photographer could deduct the cost of a workshop on a new lighting technique, and a financial advisor could deduct the cost of a seminar on a new investment product.

- Continuing Education: The cost of continuing education courses that are required to maintain your professional license is deductible.

- Books and Subscriptions: The cost of books, magazines, and newsletters that are relevant to your industry is deductible.

- Coaching and Masterminds: The cost of hiring a business coach or joining a mastermind group can be deductible, as long as the focus of the coaching or group is on improving your skills in your current business.

What Does NOT Qualify?

The key is that the education must relate to your current business. You cannot deduct the cost of education that qualifies you for a new trade or business. For example, a real estate agent cannot deduct the cost of going to law school, even if they plan to practice real estate law. That is considered education for a new profession.

👉Pro Tip: Think broadly about this deduction. It’s not just about formal courses. It can also include things like attending industry conferences, hiring a consultant to teach you a new skill, or even traveling to meet with a mentor. As long as you can show a clear connection to improving your skills in your current business, it is likely deductible.

Deep Dive: Vehicle Expenses

For many small businesses, vehicle expenses are a major cost of doing business. The good news is that the IRS provides two different methods for deducting these costs. Choosing the right method can have a significant impact on your tax bill.

The Two Methods: Standard Mileage vs. Actual Expense

The Standard Mileage Rate

This is the simpler of the two methods. You simply multiply the number of business miles you drive by the standard mileage rate, which is set by the IRS each year. For 2024, the rate is 67 cents per mile. To this method, you must keep a contemporaneous mileage log that shows the date of each trip, your starting point, your destination, the purpose of the trip, and the number of miles you drove.

The Actual Expense Method

This method is more complex, but it can result in a larger deduction if you have high car expenses. With this method, you deduct the business use percentage of your actual car expenses.

This includes:

- Gas and oil

- Repairs and maintenance

- Insurance

- Registration and fees

- Depreciation (or lease payments)

To use this method, you must track all of your car expenses and the total number of miles you drive during the year (both business and personal). Your business use percentage is the number of business miles divided by the total miles.

Which Method is Better?

It depends on your situation:

- The Standard Mileage Rate is often better if you have a newer, more fuel-efficient car with low operating costs. It is also much simpler to track.

- The Actual Expense Method is often better if you have an older, less fuel-efficient car with high operating costs. It is also better if you have a high business use percentage.

Important Limitation: If you use the standard mileage rate in the first year you use a car for business, you can switch to the actual expense method in a later year. However, if you use the actual expense method in the first year, you cannot switch to the standard mileage rate in a later year for that same car.

👉Pro Tip: Use a mileage tracking app like MileIQ, Everlance, or TripLog. These apps use the GPS on your phone to automatically track your drives, and you can easily classify them as business or personal. This makes it incredibly easy to create the detailed mileage log that the IRS requires.

Deep Dive: Professional Services & Insurance

Running a business is complex, and you can’t be an expert in everything. The fees you pay to professionals for their advice and services are deductible, as are the premiums you pay to protect your business from risk.

Professional Services:

- Legal Fees: Fees paid to a lawyer for business matters, such as drafting contracts, reviewing leases, or handling litigation, are deductible. However, legal fees related to the acquisition of a business asset must be capitalized and amortized.

- Accounting and Bookkeeping Fees: Fees paid to an accountant or bookkeeper to maintain your books, prepare your financial statements, and file your tax returns are deductible.

- Consulting Fees: Fees paid to consultants who provide advice on things like marketing, strategy, or operations are deductible.

The Capitalization Rule:

If a professional service relates to the acquisition of a business or a long-term asset, the fee

is generally not deductible in full in the year it is paid. Instead, it must be capitalized (added

to the cost of the asset) and depreciated or amortized. For example, the legal fees you pay

to acquire a new office building would be added to the cost of the building and depreciated

over 39 years.

Business Insurance:

- General Liability Insurance: Protects your business from claims of bodily injury or property damage.

- Professional Liability Insurance (Errors & Omissions): Protects service-based businesses from claims of negligence or malpractice.

- Property Insurance: Covers damage to your business property.

- Business Interruption Insurance: Covers lost income if your business is forced to close due to a covered event.

- Cyber Liability Insurance: Protects your business from data breaches and other cyber threats.

- Workers' Compensation Insurance: Required by law if you have employees.

👉Pro Tip: Don’t be penny-wise and pound-foolish when it comes to professional services. The cost of a good tax strategist or a good lawyer is almost always deductible and will often save you far more than their fee in the long run.

The Final Word: From Deduction-Taker to Tax Strategist

Mastering your business deductions is not just about saving money on your taxes. It’s about a fundamental shift in your mindset as a business owner. It’s about moving from a reactive, end-of-year scramble to a proactive, year-round strategy.

When you understand the rules of the game, you can make smarter decisions every single day. You can structure your business in a way that maximizes your deductions. You can invest in your business and yourself, knowing that the government is effectively subsidizing a portion of the cost. You can confidently take advantage of advanced strategies like the Augusta Rule and hiring your children, knowing that you are doing it correctly and have the documentation to back it up.

This is the difference between a business owner who is constantly stressed about taxes and one who sees the tax code as a tool for building wealth. The choice is yours.

Your Action Plan:

- Get Organized: Implement a system for tracking your income, expenses, and mileage. Use a dedicated business bank account and credit card. Use a bookkeeping software like QuickBooks and a mileage tracking app like MileIQ.

- Schedule a Tax Strategy Session: Meet with a qualified tax professional who specializes in working with small businesses. Don't just talk about last year's taxes; talk about next year's strategy.

- Review Your Business Structure: Is a sole proprietorship still the right choice for you? Or is it time to consider an S-Corp election to save on self-employment taxes?

- Embrace the Proactive Mindset: Start thinking about the tax implications of your business decisions before you make them. A little bit of planning can go a long way.

By taking these steps, you can transform your relationship with taxes from one of fear and frustration to one of confidence and control. You can stop leaving a tip for the IRS and start keeping more of your hard-earned money where it belongs: in your business and in your pocket.