It’s not your fault.

You formed a Limited Liability Company (LLC) to protect your assets and build your dream. But here’s the secret no one tells you: that legal shield is also the most powerful tax-saving tool an entrepreneur can possess. The problem? By default, it’s set to “basic” mode, a setting that forces you to give the IRS a much larger cut of your profits than they are legally entitled to.

Most business owners overpay by thousands—sometimes tens of thousands—in taxes every single year for one simple reason: they are using the wrong tax structure. They’re stuck in the default settings, letting the IRS drain their business account with a 15.3% self-employment tax that is largely avoidable.

This guide is your roadmap to flipping the switch. We are going to pull back the curtain and show you exactly how to unlock the hidden tax advantages of your LLC. You will learn how to choose the right tax classification, why the S-Corporation election is the single most important money-saving decision for a profitable business, and how to legally and ethically slash your tax bill, starting today.

The IRS doesn’t actually have a tax form for an “LLC.” This is a crucial point. They see your LLC and immediately classify it based on one thing: how many owners (or “members”) it has. This default status is simple, but it’s also incredibly inefficient from a tax perspective.

Your power as an owner lies in your ability to *tell the IRS* you want to be treated differently. This is the most important financial decision you’ll make for your business. Here’s the breakdown in plain English:

| Tax Classification | Who It’s For | The Good, The Bad, and The Ugly |

|---|---|---|

| Disregarded Entity | New single-owner LLCs |

Good: Simple. Bad: All profits hit with 15.3% self-employment tax. Ugly: You’ll overpay the moment you become profitable. |

| Partnership | New multi-owner LLCs |

Good: Simple to set up. Bad: Every partner pays 15.3% self-employment tax on their entire share of the profits. |

| S Corporation | Profitable LLCs |

Good: Massive self-employment tax savings. Bad: More compliance. Ugly: Only if you don’t have a pro guiding you. |

| C Corporation | Niche cases (reinvesting all profits) |

Good: Lower corporate tax rate, great benefits. Bad: Double taxation. Ugly: Almost never the right choice for a small business. |

Let’s dig into what this actually means for your wallet.

If you are the sole owner of your LLC, the IRS “disregards” the LLC for tax purposes and treats you as a sole proprietor. All of your business income and expenses are reported on a Schedule C, which is part of your personal Form 1040 tax return.

The Tax Trap: The simplicity is appealing, but it’s a trap. Every single dollar of your net profit is subject to both regular income tax AND the full 15.3% self-employment tax. If your business profits $80,000, you’re paying a staggering $12,240 in self-employment tax before you even calculate your income tax.

If your LLC has two or more members, the IRS defaults to treating you as a partnership. The LLC files an informational tax return (Form 1065), and each partner receives a Schedule K-1 detailing their share of the profits.

The Tax Trap: This is the same trap as the disregarded entity, just split among partners. Each partner pays income tax and the full 15.3% self-employment tax on their entire distributive share of the profits. There is no way to separate your labor from your ownership returns.

This is the strategy. This is how savvy business owners play the game. By filing a simple form (Form 2553), you can elect to have your LLC taxed as an S-Corporation. This one move fundamentally changes your tax picture for the better.

Here’s how it works:

Let’s see it in action.

An LLC can also elect to be taxed as a C-Corporation. This is uncommon for most small businesses because it creates double taxation: the corporation pays tax on its profits, and then you pay tax again when those profits are distributed to you as dividends.

So why would anyone do it? It can make sense for businesses that plan to reinvest all or most of their profits back into the company, as the corporate tax rate might be lower than the owner’s personal rate. It also allows for more extensive employee fringe benefits. For 99% of small business owners, however, the S-Corp is the far superior choice.

Book a Free Tax Savings Analysis and get a definitive answer in minutes.

Stop wondering and start knowing. Use our free, instant calculator to see exactly how much you could save by choosing the right tax structure for your LLC. This isn’t an estimate—it’s your money.

.

Federal taxes are only half the battle. Your state has its own set of rules, and ignoring them is a recipe for penalties and sleepless nights. State-level taxation can be a minefield of franchise taxes, annual fees, and specific income tax laws that can significantly impact your bottom line. Understanding these nuances is critical for a complete tax strategy.

Here’s a more detailed look at what to expect in key states:

| State | Annual Fee / Franchise Tax | State Income Tax Treatment | Key Strategic Considerations |

|---|---|---|---|

| California | $800 annual franchise tax for all LLCs, regardless of income or activity. | Pass-through taxation is the default. California also imposes an LLC fee based on total California income, starting at $900 for income over $250,000 and going up to $11,790 for income over $5 million. | The $800 tax is a fixed cost of doing business in California. High-revenue businesses may benefit from S-Corp status to avoid this punitive state-level fee. |

| Texas | No state income tax, but subject to the Texas Franchise Tax. | Calculated on the LLC’s “margin.” Most small businesses fall below the “no tax due” threshold ($1.23 million for 2023). | Even if no tax is owed, a No Tax Due report must be filed annually. Failure to file can result in penalties and loss of liability protection. |

| New York | A biennial statement fee is required. | Pass-through taxation plus a separate LLC filing fee based on NY-sourced gross income. | Filing fees range from $25 up to $4,500. This is a significant and often unexpected cost. |

| Florida | Annual report filing with a fee. | No state income tax for individuals or pass-through entities. | Florida is highly tax-friendly. The primary requirement is filing the annual report to remain in good standing. |

| Delaware | $300 annual Alternative Entity Tax. | No state income tax for LLCs that do not conduct business in Delaware. | Popular for formation, but requires compliance in both Delaware and the state where you actually operate. |

The Takeaway: Your business’s physical and economic nexus dictates your state tax obligations. A comprehensive tax strategy must be built on a deep understanding of both federal and state law to protect you from expensive surprises and ensure you are not paying a dollar more in tax than is legally required, at any level of government.

We’ve helped thousands of business owners fix their tax situations. Here are the top 10 mistakes we see every single day that cost entrepreneurs a fortune:

Using your business account for personal groceries is the fastest way to invite the IRS to pierce your corporate veil and destroy your liability protection.

The Fix: Open a separate business bank account and credit card. Do it today. All business income and expenses go through these accounts. No exceptions.

The IRS operates on a “pay-as-you-go” system. If you wait until April 15th to pay your taxes for the whole year, you’ll be hit with underpayment penalties.

The Fix: Calculate and pay your estimated taxes every quarter. Set calendar reminders for April 15, June 15, September 15, and January 15. It’s a 15-minute task that saves you hundreds in penalties.

Being a “disregarded entity” is fine when you’re starting out. It’s a financial disaster once you’re profitable.

The Fix: The moment you are on track to clear $50,000 in net profit for the year, you need to have a serious conversation about the S-Corp election. Every day you wait is money lost.

You can’t deduct what you can’t prove. Messy books are an open invitation for the IRS to disallow your legitimate expenses during an audit.

The Fix: Use modern bookkeeping software like QuickBooks or Xero. Connect your business accounts and categorize transactions weekly. It’s non-negotiable.

Trying to save money by calling your employees “independent contractors” is one of the biggest red flags for the IRS. The penalties for getting this wrong are severe.

The Fix: Understand the IRS rules around behavioral and financial control. If you dictate how, when, and where the work is done, they are likely an employee. When in doubt, consult a pro.

If you pay a contractor $600 or more in a year, you must send them a Form 1099-NEC by January 31. Failing to do so results in penalties.

The Fix: Get a Form W-9 from every contractor before you pay them a dime. This gives you their legal name and tax ID number, making 1099s a breeze.

In an S-Corp, you can’t pay yourself a $1 salary on $200,000 of profit. The IRS will reclassify your distributions as salary and send you a bill for back payroll taxes and penalties.

The Fix: Document why your salary is reasonable. Look at industry data, your experience, and what it would cost to hire someone to do your job. A tax pro can provide a defensible number.

If you’re an S-Corp, you shouldn’t be taking a home office deduction on your personal return. You should be using an accountable plan to have the business reimburse you for these expenses, tax-free.

The Fix: Create a formal accountable plan document. Submit monthly expense reports to your own company for costs like home office, cell phone, and internet. The reimbursements are a deduction for the business and tax-free to you.

When you sell a business asset, you may have to pay tax on the depreciation you’ve claimed over the years. This can be a nasty surprise.

The Fix: Keep meticulous records of asset purchases and depreciation. Before selling a major asset, model out the tax impact with a professional.

Your time is best spent growing your business, not trying to become a tax expert from YouTube videos. The tax code is over 6,000 pages long. One mistake can cost you more than a decade of professional fees.

The Fix: Find a proactive tax strategist, not just a reactive tax preparer. A preparer records history. A strategist helps you write it.

Staying compliant and strategic is a year-round sport. Here are the key dates and actions to have on your radar.

How to Automate Your Quarterly Tax Payments in Under 10 Minutes

For years, you’ve been conditioned to believe that taxes are something that just happen to you. You add up your income, you get a bill, you pay it, and you hope for the best next year.

That’s the wrong way to think about it. That’s playing defense.

Taxes are not a passive event; they are the outcome of a year-long series of financial decisions. With a proactive strategy, you can influence that outcome. You can legally and ethically structure your business and your finances to minimize your tax liability and maximize the amount of money you keep in your pocket.

Choosing the right LLC tax structure is the first and most important step in that strategy. It’s the foundation upon which all other tax-saving moves are built.

If you’re an LLC owner making over $50,000 in profit and you’re not an S-Corporation, there’s a 90% chance you’re overpaying on your taxes. It’s time to find out for sure.

Book a free, no-obligation Tax Savings Analysis with one of our certified strategists. In just a few minutes, we’ll analyze your situation and tell you exactly how much you could be saving. No fluff, no sales pressure—just a clear, actionable plan to stop the bleeding and start building wealth.

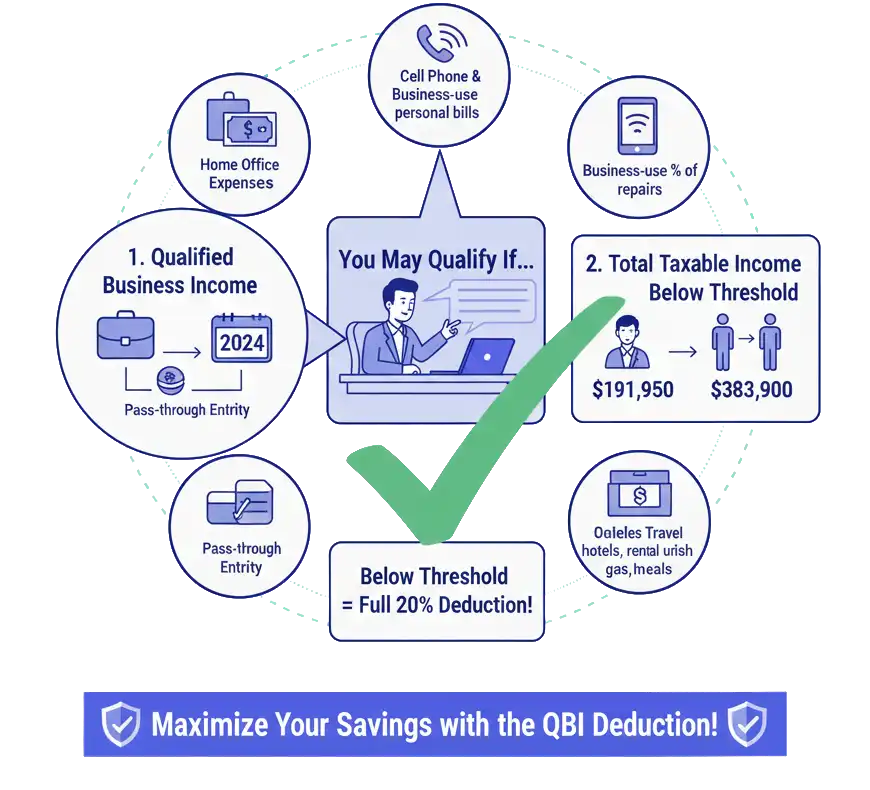

Beyond the S-Corp election, one of the most significant tax breaks for LLC owners is the Qualified Business Income (QBI) Deduction, also known as Section 199A. This is a complex but powerful provision that allows eligible owners of pass-through businesses (including sole proprietorships, partnerships, and S-Corps) to deduct up to 20% of their qualified business income.

Think of it as a 20% discount on a portion of your business profits. However, it’s not that simple. The deduction is subject to several limitations based on your income, the nature of your business, and W-2 wages paid.

In general, you may qualify if:

For 2024, the income thresholds are $191,950 for single filers and $383,900 for those married filing jointly. If your income is below these thresholds, you can generally take the full 20% deduction, regardless of your business type.

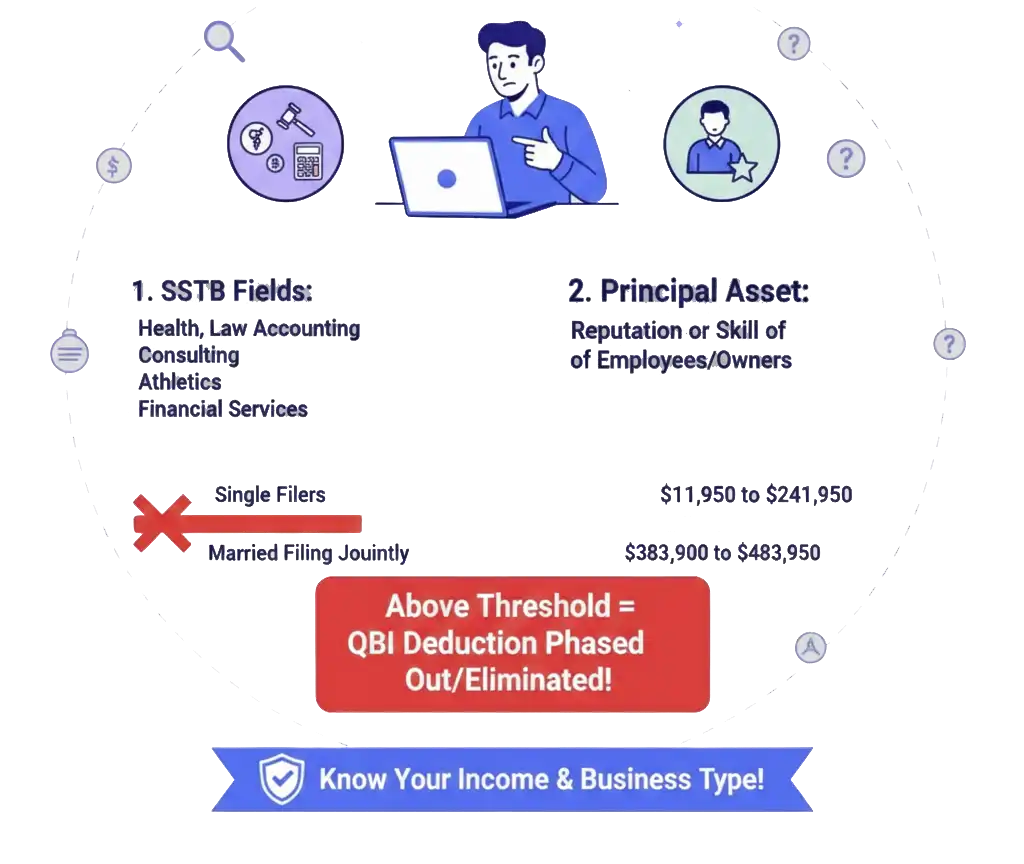

If your income is above the thresholds, the rules get much more complicated, especially if you operate a Specified Service Trade or Business (SSTB). An SSTB is any trade or business involving the performance of services in fields like:

If you are in an SSTB and your income is above the threshold, your QBI deduction is phased out and eventually eliminated completely. For 2024, the deduction is fully phased out for SSTB owners with taxable income over **$241,950** (single) or **$483,900** (married filing jointly).

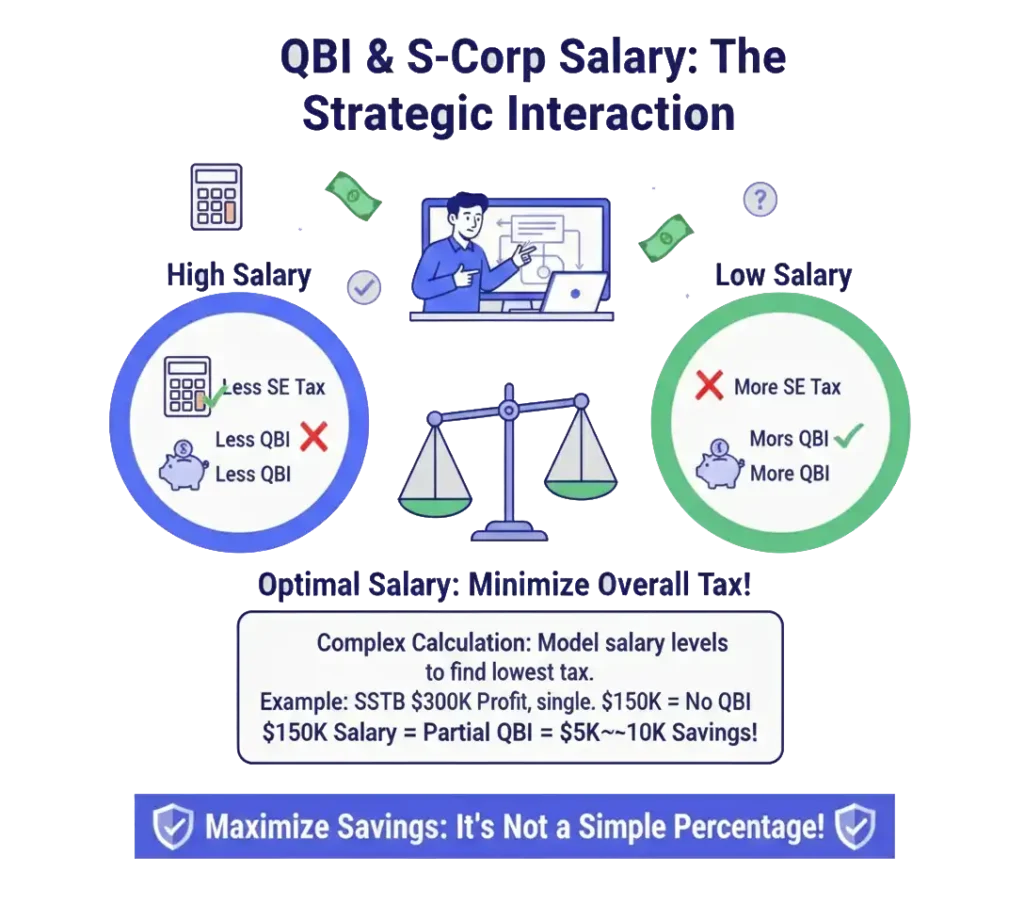

This is where tax strategy becomes critical. Your “reasonable salary” as an S-Corp owner is not considered Qualified Business Income. Only the pass-through profits (your distributions) count towards the QBI calculation.

This creates a strategic tension:

Finding the optimal salary that minimizes your overall tax liability—considering both self-employment tax and the QBI deduction—is a complex calculation that requires professional analysis. It is not a simple percentage rule. It involves modeling different salary levels to find the precise point where the combined tax bill is lowest.

Ready to move beyond the basics? These are the strategies the top 1% use to slash their tax bills. These are not loopholes; they are specific provisions in the tax code designed to incentivize certain behaviors. Here’s how to use them correctly.

This is a powerful way to shift money from your business to your personal accounts without paying a dime of tax.

This strategy allows you to shift income from your high tax bracket to your child’s zero tax bracket, keeping thousands of dollars within the family.

Making the S-Corp election is a process, but it’s a straightforward one. Here’s exactly how to do it.

Making the S-Corp election is the single most impactful step a profitable LLC owner can take to reduce their tax burden. It is the gateway to strategic tax planning.

Staying compliant and strategic is a year-round sport. Here are the key dates and actions to have on your radar.

For years, you’ve been conditioned to believe that taxes are something that just happen to you. You add up your income, you get a bill, you pay it, and you hope for the best next year.

That’s the wrong way to think about it. That’s playing defense.

Taxes are not a passive event; they are the outcome of a year-long series of financial decisions. With a proactive strategy, you can influence that outcome. You can legally and ethically structure your business and your finances to minimize your tax liability and maximize the amount of money you keep in your pocket.

Choosing the right LLC tax structure is the first and most important step in that strategy. It’s the foundation upon which all other tax-saving moves are built.

If you’re an LLC owner making over $50,000 in profit and you’re not an S-Corporation, there’s a 90% chance you’re overpaying on your taxes. It’s time to find out for sure.

Book a free, no-obligation Tax Savings Analysis with one of our certified strategists. In just a few minutes, we’ll analyze your situation and tell you exactly how much you could be saving. No fluff, no sales pressure—just a clear, actionable plan to stop the bleeding and start building wealth.