New Jersey 2026 Tax Changes — What Residents & Business Owners Must Know

Starting January 1, 2026, major federal tax changes take effect as key provisions of the Tax Cuts and Jobs Act (TCJA) expire and updated rules continue under the One Big Beautiful Bill Act (OBBBA).

New Jersey residents — who already face one of the highest state tax burdens in the country — will feel these federal changes more than most states because federal AGI flows directly into New Jersey’s tax system.

- W-2 earners across Newark, Jersey City, Hoboken, Paterson, Elizabeth, and the suburbs

- Commuters working in New York or Philadelphia

- Self-employed professionals, freelancers, and contractors

- LLCs and S-Corps operating in New Jersey

- Real estate investors and rental property owners

- Families with children

- Retirees drawing taxable retirement income

- Dual-income households in dense metro areas

Below is the full New Jersey–specific breakdown of what changes in 2026.

Key Federal Changes Affecting New Jersey Residents

Standard Deduction Shrinks

TCJA temporarily increased the standard deduction, but OBBBA did not extend it.

In 2026, the deduction drops significantly:

This is especially impactful in New Jersey, where high living costs make deductions critical.

Federal Tax Brackets Increase

With the end of TCJA’s lower brackets, 2026 federal tax rates rise:

New Jersey residents — especially those earning $80K–$400K — will see a significant increase in federal tax liability.

Residents in high-cost areas such as Bergen, Essex, Hudson, and Middlesex counties are especially affected.

QBI Deduction Made Permanent Under OBBBA

- LLCs

- S-Corps

- Sole proprietors

- Contractors and freelancers

- Qualified rental operations

This is a major win for New Jersey’s dense population of self-employed and high-income service professionals.

However, updated 2026 QBI rules include new income thresholds and stricter documentation requirements.

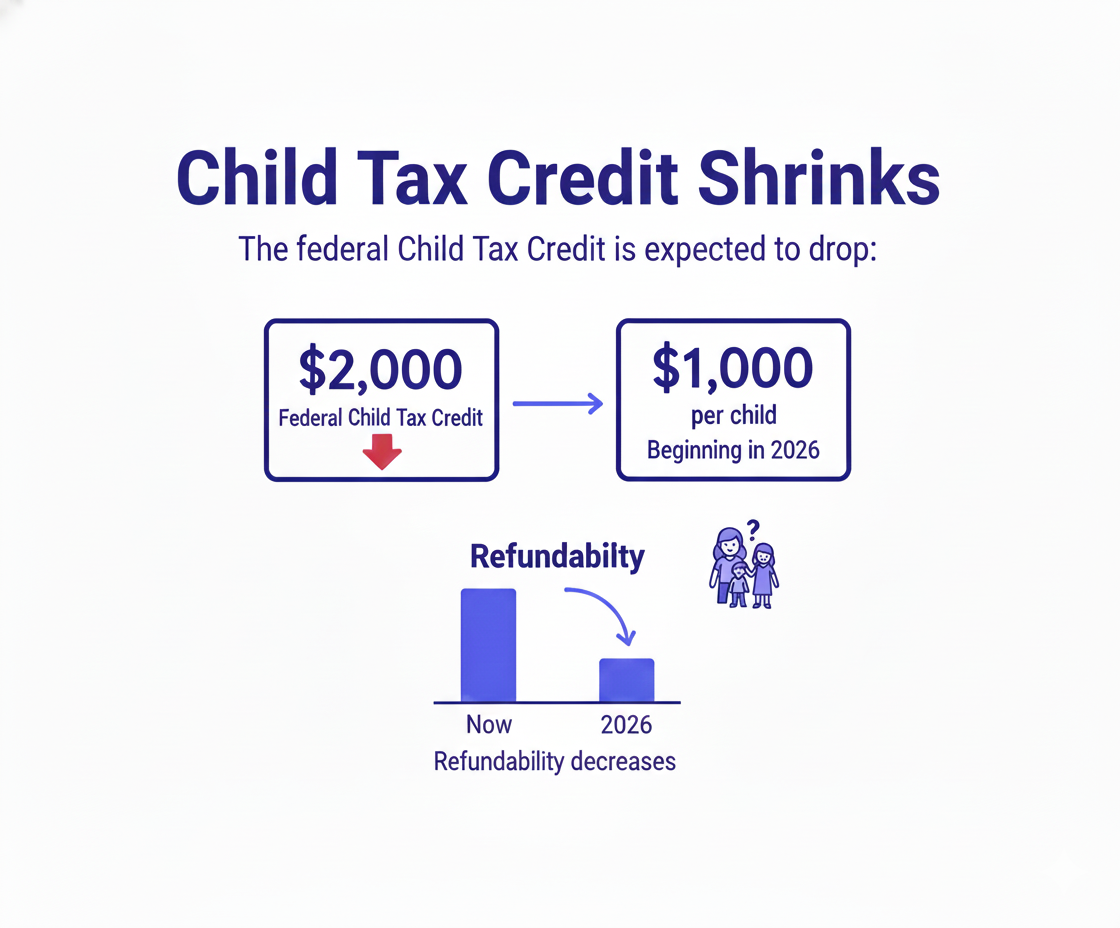

Child Tax Credit Shrinks

- from about $2,000

- to roughly $1,000 per child

Refundability also decreases, which affects many New Jersey families with high childcare costs.

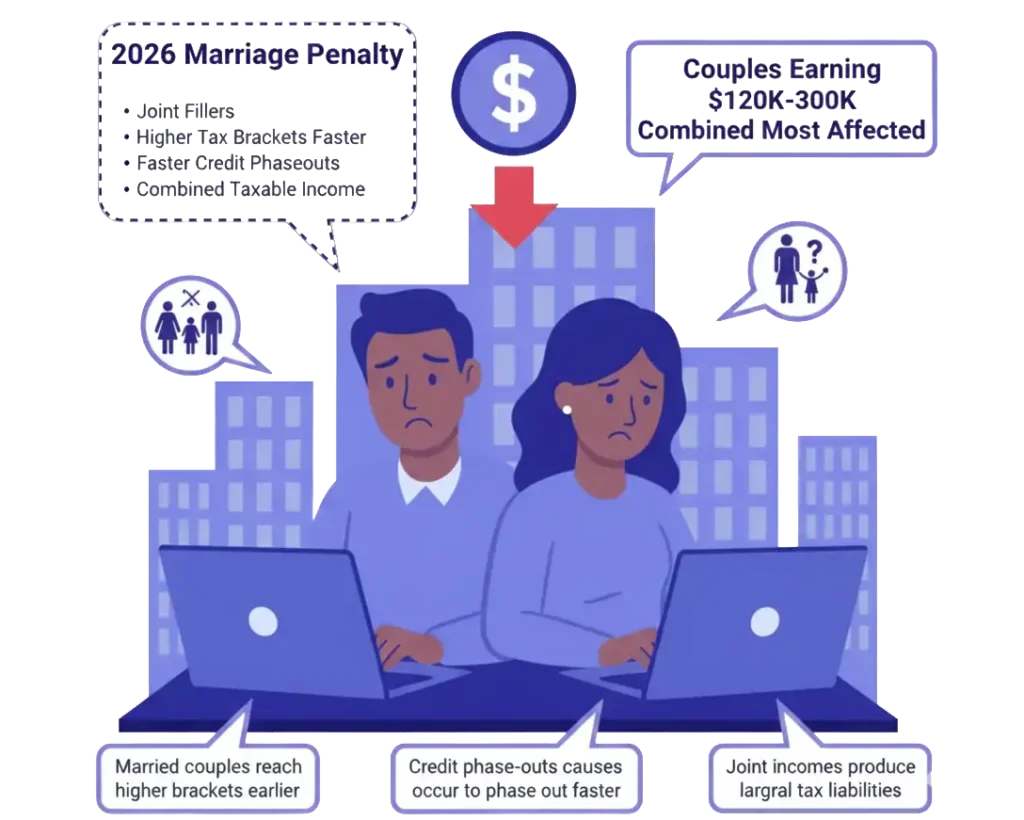

Marriage Penalty Returns

TCJA temporarily eased the marriage penalty; OBBBA left that provision to expire.

In 2026:

- Married couples will reach higher brackets more quickly

- Combined incomes reduce credit eligibility sooner

- Many NJ metro-area dual-income households will feel the impact immediately

This affects a very large percentage of households in suburban counties.

New Jersey–Specific Tax Considerations

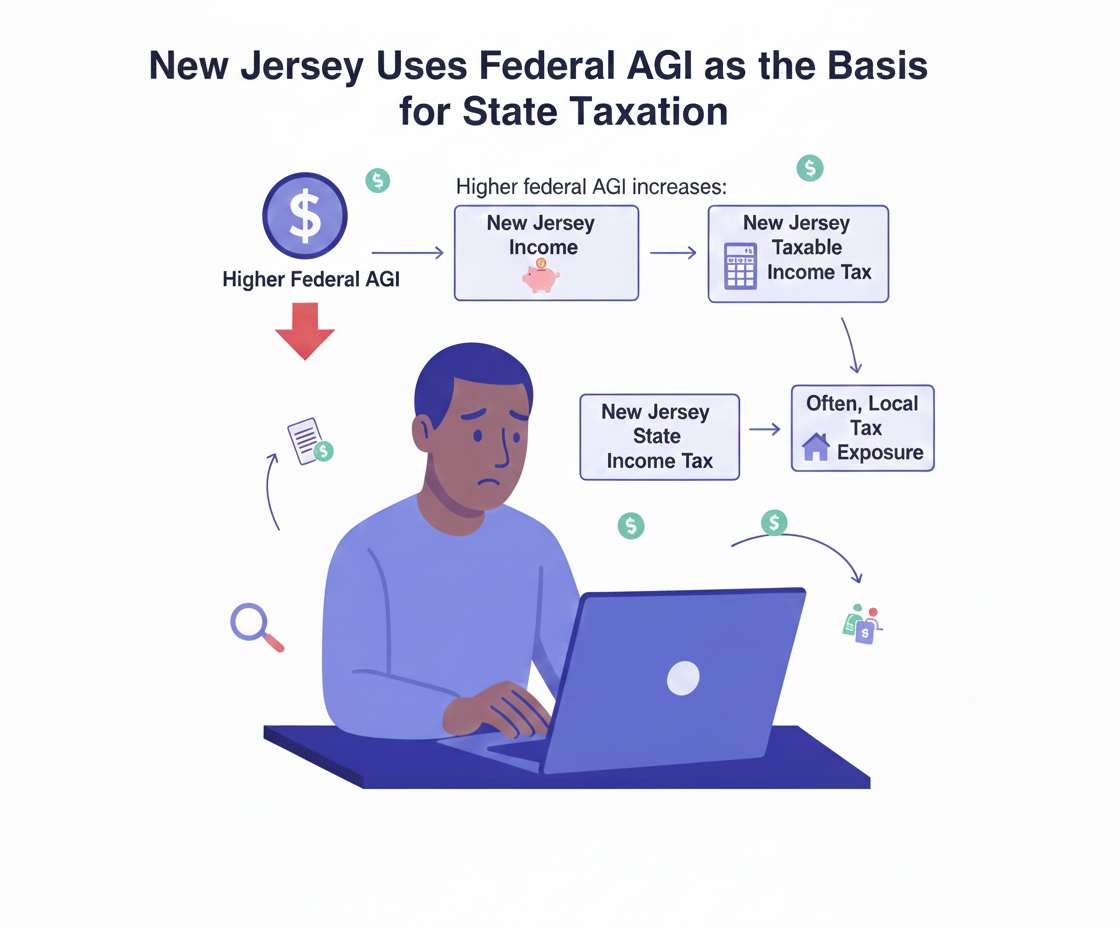

1.New Jersey Uses Federal AGI as the Basis for State Taxation

- New Jersey taxable income

- New Jersey state income tax

- Often, local tax exposure

Because New Jersey has a progressive state tax structure, even small increases in AGI can have a big impact.

2. High Cost of Living Intensifies Federal Changes

- high property taxes

- high childcare costs

- high mortgage payments

- high transportation costs

- high insurance premiums

Reduced deductions and higher federal brackets hit NJ households harder than most states.

3. Real Estate Owners Face Significant 2026 Impacts

- North Jersey (Bergen, Essex, Hudson)

- Central Jersey (Middlesex, Monmouth)

- South Jersey (Camden, Burlington, Gloucester)

- Dover

- Lakes Region

- Mount Washington Valley

makes federal tax changes especially important.

- capital gains

- depreciation

- STR classification

- loss limitations

- sale timing

Homeowners with large appreciation may face increased federal capital gains exposure.

4. STR Owners Must Prepare for Updated Federal Rules

- Jersey Shore towns

- Hoboken & Jersey City

- College towns

- Suburban commuter areas

- Bonus depreciation declines

- STR participation rules tighten

- IRS requires stronger documentation

- Rental losses face new restrictions

5. Retirement Income Planning Is Critical in New Jersey

- IRA withdrawals

- 401(k) distributions

- pension payouts

- investment income

Retirees must prepare for higher combined state + federal tax exposure.

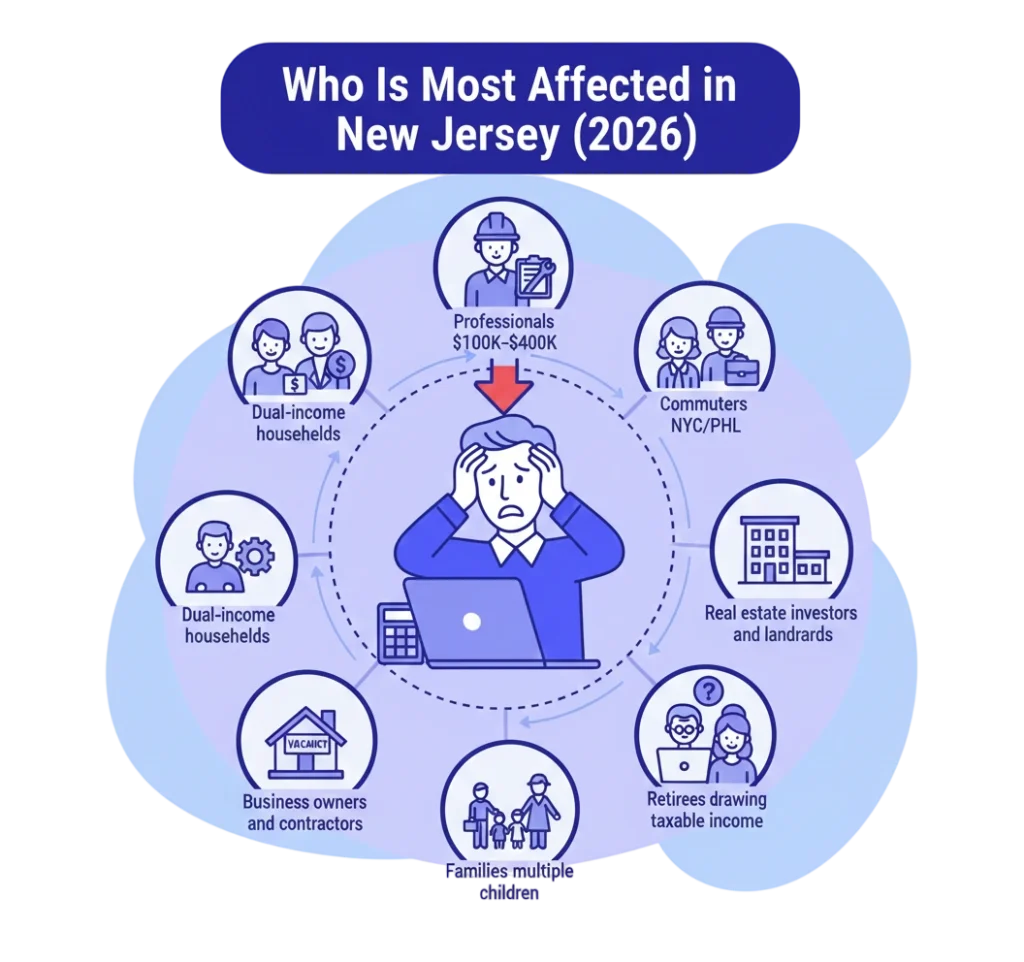

Who Is Most Affected in New Jersey (2026)

- Dual-income households

- Professionals earning $100K–$400K

- Commuters working in NYC or Philadelphia

- Business owners and contractors

- Real estate investors and landlords

- STR operators

- Families with multiple children

- Retirees drawing taxable income

What New Jersey Residents Should Do Before December 31, 2025

- Review federal withholding

- Maximize retirement contributions

- Evaluate Roth conversions

- Review LLC/S-Corp structures for 2026 QBI compliance

- Prepare rental and STR participation records

- Evaluate capital gains exposure

- Time property or investment sales carefully

- Build a comprehensive 2025–2026 tax strategy

New Jersey 2026 Tax FAQ

Does New Jersey conform to QBI?

No. QBI is federal-only. New Jersey does not offer a matching deduction.

Will New Jersey state taxes increase?

State rates don’t change, but taxable income rises due to federal rule changes.

Are families affected?

Yes. Reduced child credits and higher AGI shrink refunds.

Are STR owners impacted?

Yes. STR depreciation and participation rules are stricter in 2026.

Are retirees affected?

Yes. Higher federal brackets increase total tax cost on retirement income.

Get your 2026 New Jersey Tax Strategy

New Jersey residents will see substantial changes under the 2026 federal tax rules. Reduced deductions, higher brackets, and updated business and rental rules require early planning.