New Hampshire 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax changes take effect. These include the expiration of key provisions from the Tax Cuts and Jobs Act (TCJA) and the updated rules made permanent or modified under the One Big Beautiful Bill Act (OBBBA).

Although New Hampshire does not tax earned income, federal tax changes will significantly affect residents. These shifts influence wages, business income, retirement withdrawals, rental property income, and family credits.

- W-2 earners across Manchester, Nashua, Concord, Portsmouth, Dover, and Rochester

- Contractors, freelancers, and small business owners

- Real estate investors and short-term rental hosts

- High-income earners relocating from higher-tax states

- Families with children

- Retirees drawing IRA or 401(k) income

- Dual-income households

Below is a complete breakdown of how 2026 impacts New Hampshire taxpayers.

Key 2026 Federal Changes Affecting New Hampshire

Standard Deduction Shrinks

TCJA temporarily increased the standard deduction. OBBBA did not extend this provision.

In 2026, the deduction is projected to drop to:

👉 This increases federal taxable income for most New Hampshire residents.

Federal Income Tax Brackets Increase

With TCJA’s bracket cuts expiring, federal brackets rise:

👉 Because New Hampshire does not tax wages, these higher federal brackets are the primary driver of increased tax liability for residents.

Workers with variable income — including trades, contractors, hospitality, and service workers — will notice higher withholding and potentially smaller refunds.

QBI Deduction Made Permanent Under OBBBA

- LLC owners

- S-Corp owners

- Sole proprietors

- Contractors and freelancers

- Real estate investors (when qualified)

This is a major benefit for New Hampshire’s entrepreneurial and self-employed workforce.

Starting in 2026, updated QBI thresholds and documentation requirements will apply.

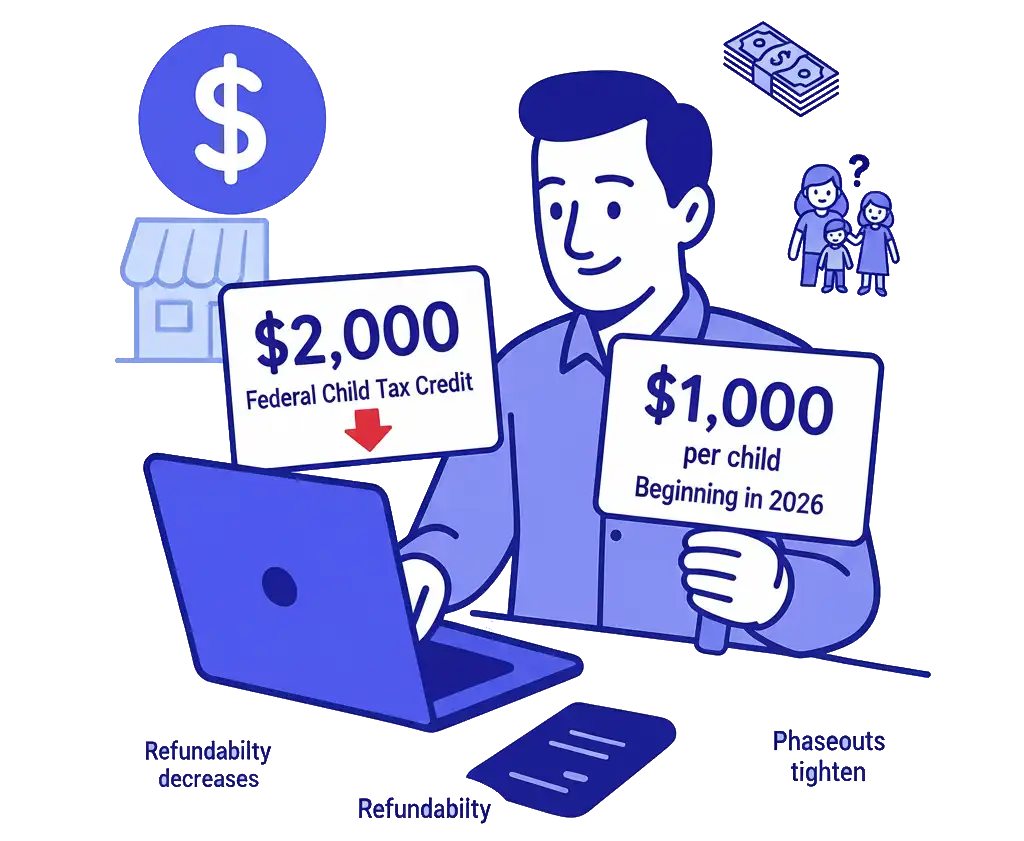

Child Tax Credit Shrinks

- The Child Tax Credit decreases from about $2,000

- To roughly $1,000 per child

- Refundability decreases

Families throughout southern New Hampshire and growing suburban regions will see reduced federal refunds.

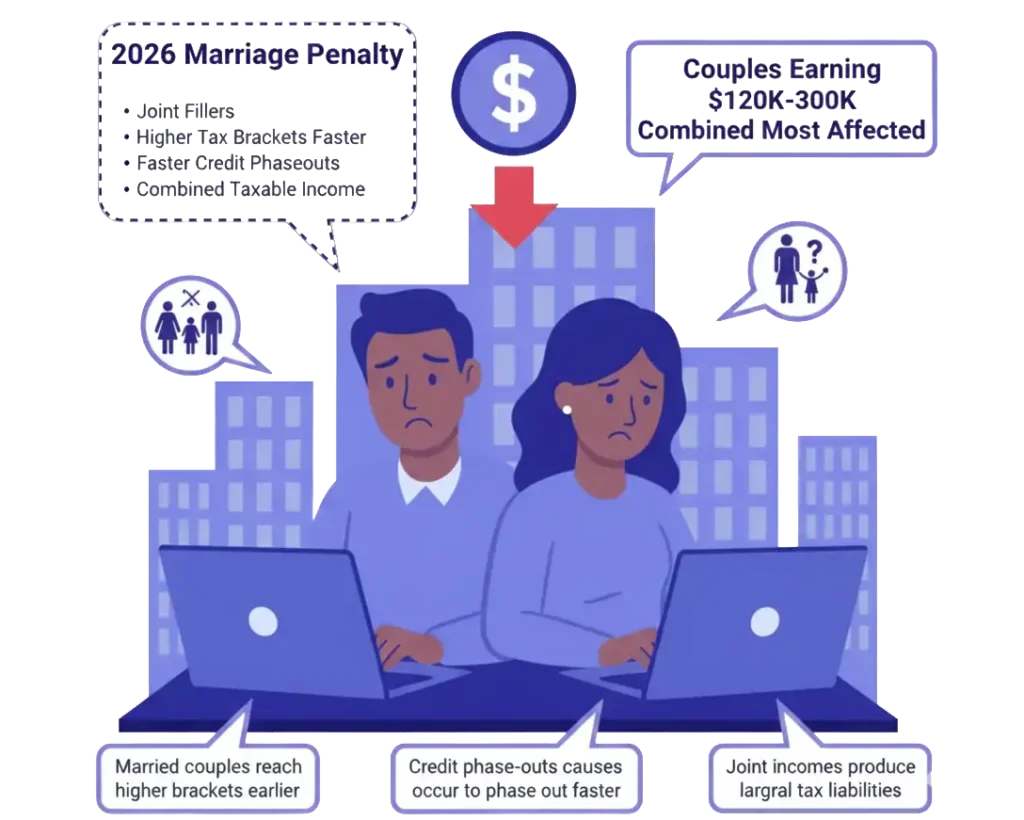

Marriage Penalty Returns

TCJA temporarily reduced the marriage penalty.

OBBBA left this provision to expire.

- Married couples reach higher brackets earlier

- Credit phase-outs occur faster

- Joint incomes produce larger federal tax liabilities

This impacts the many dual-income households across New Hampshire.

New Hampshire–Specific Considerations Under 2026 Rules

1. No Earned Income Tax — But Federal Changes Still Hit Hard

- wages

- salaries

- Social Security

- retirement withdrawals

However, higher federal taxable income affects:

- refund amounts

- withholding accuracy

- investment taxation

- self-employment tax obligations

- quarterly estimates for freelancers and contractors

2. Interest and Dividend Taxes Still Apply

- interest

- dividend income

- taxable investment income

- higher federal capital gains

- taxation of portfolio income under NH rules (where applicable)

Residents with brokerage accounts should monitor investment income closely.

3. Real Estate Investors Face Major Federal Shifts

- Manchester

- Portsmouth

- Nashua

- Dover

- Lakes Region

- Mount Washington Valley

makes federal tax changes especially important.

- capital gains

- depreciation

- rental loss rules

- STR participation standards

- timing of property sales and refinances

Homeowners selling appreciated properties may face larger federal capital gains exposure.

4. STR Owners Must Prepare for Updated Federal Rules

- Lakes Region

- White Mountains

- Littleton

- Portsmouth

- Conway

- Lincoln

2026 updates include:

- reduced bonus depreciation

- stricter material participation rules

- updated IRS safe harbor definitions

- limitations on using STR losses

5. Retirees Must Plan for Higher Federal Taxes

- IRA withdrawals

- pension income

- 401(k) distributions

- taxable investment income

Retirees with significant savings may face increased federal tax liability.

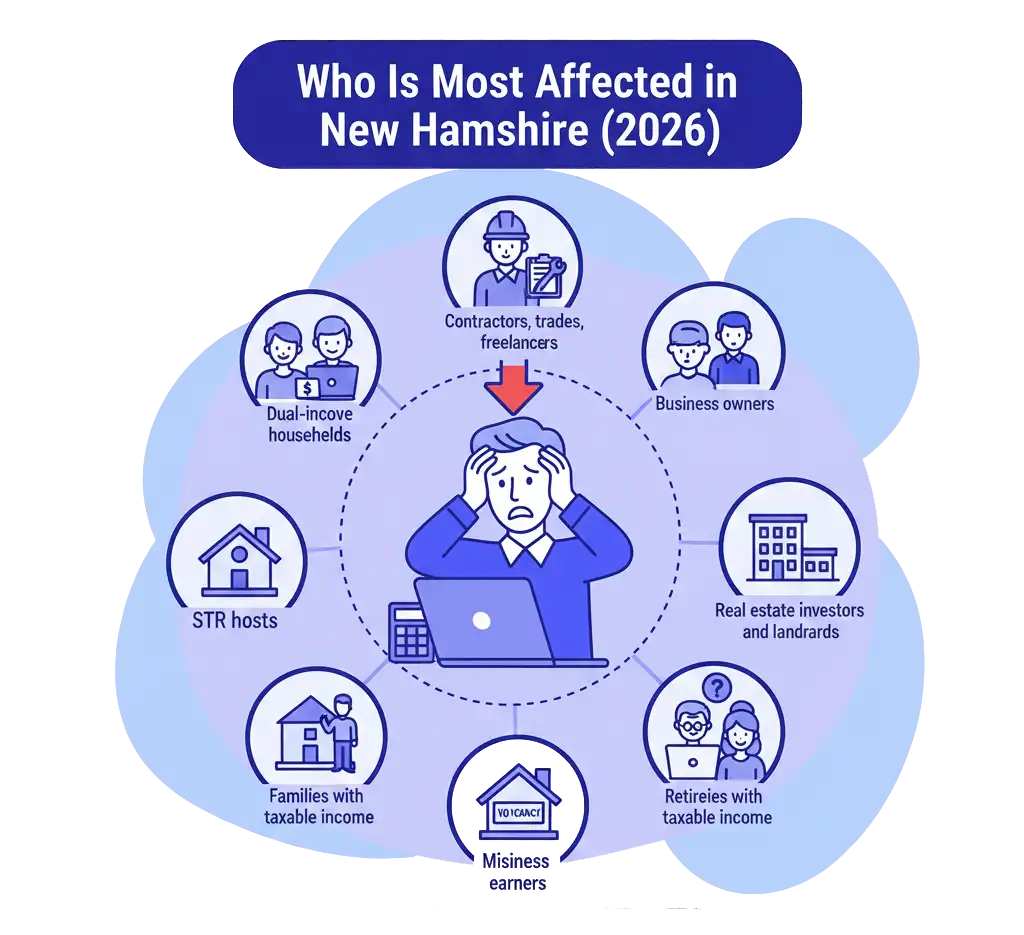

Who Is Most Affected in New Hampshire (2026)

- Dual-income households

- Contractors, trades, and freelancers

- Business owners (LLC, S-Corp, sole prop)

- Real estate investors and landlords

- STR hosts

- Families with children

- Retirees with taxable income

- Middle-income earners

What New Hampshire Residents Should Do Before December 31, 2025

- Review federal withholding

- Maximize retirement contributions

- Consider Roth conversions

- Review business structure for QBI qualification

- Document STR and rental participation

- Evaluate capital gains timing

- Plan income distribution for 2025 vs. 2026

- Build a multi-year federal tax strategy

New Hampshire 2026 Tax FAQ

Does New Hampshire tax wages?

No. New Hampshire does not tax earned income.

Did OBBBA prevent federal tax increases?

OBBBA preserved QBI but allowed many TCJA provisions — such as brackets and the standard deduction — to expire.

Are families affected?

Yes — reduced child credits and higher taxable income impact refunds.

Are STR owners impacted?

Yes — participation and depreciation rules tighten significantly.

Are retirees affected?

Yes — higher federal brackets increase taxation of retirement withdrawals.

Get your 2026 New Hampshire Tax Strategy

Even without state income tax, New Hampshire residents face significant federal tax changes starting in 2026. A personalized plan can reduce the impact and protect your income, retirement savings, and investments.