2026 Self-Employed Tax Changes — What Every Freelancer, 1099 Earner, and Solo Business Owner Must Know

- Freelancers

- 1099 earners

- Gig workers

- Consultants

- Coaches

- Creatives

- Real estate agents

- Online business owners

- Sole proprietors (Schedule C)

- Single-member LLC owners

Even though QBI is now permanent, self-employed individuals face major changes to brackets, deductions, compliance requirements, and planning rules in 2026.

This guide breaks down everything you MUST know.

Guaranteed Strategy Backed by IRS Code

All projections align with OBBBA + TCJA expiration rules.

Maximum Savings Promise

If we miss a deduction or planning strategy, we redo your plan free.

100% Accuracy Guarantee

All plans reviewed by a licensed MERNA™ Strategist.

Higher 2026 Federal Tax Brackets Hit Self-Employed the Hardest

Self-employed individuals pay:

- Income tax, AND

- Full self-employment tax (15.3%)

If you earn:

- $60K–$250K in self-employment income

- You will feel this increase immediately

For Example:

Self-employed income: $120,000

Estimated increase in federal tax alone: $3,000–$6,000

The Standard Deduction Shrinks in 2026

Projected 2026 amounts:

- Single → ~$8,300

- Married filing jointly → ~$16,600

- Head of household → ~$12,400

Self-employed taxpayers are heavily affected because:

- Many relied on the larger deduction

- Shrinking deduction = higher taxable income

- Combined with rising brackets, this compounds tax increases

For many 1099 earners, this alone adds $1,500–$3,500+ in additional tax.

QBI (20% Deduction) Is Now Permanent — But New Rules Apply

Thanks to the One Big Beautiful Bill Act, the QBI deduction:

- Remains permanent

- Does NOT end in 2026

- Stays at 20%

BUT OBBBA adds major new requirements in 2026:

- Updated income thresholds

- New SSTB phase-in formulas

- Expanded anti-abuse rules

- Stricter documentation

- Adjusted wage-and-capital tests (for applicable businesses)

- QBI is still one of your biggest deductions

- But qualifying requires better bookkeeping and compliance

Most freelancers, 1099 earners, and contractors still qualify — but not automatically.

Self-Employment Tax (15.3%) Becomes More Painful in 2026

But your income subject to tax increases, because:

- The standard deduction drops

- Brackets rise

- More income flows through to your adjusted gross income

For many, self-employment tax will be the single largest tax expense in 2026.

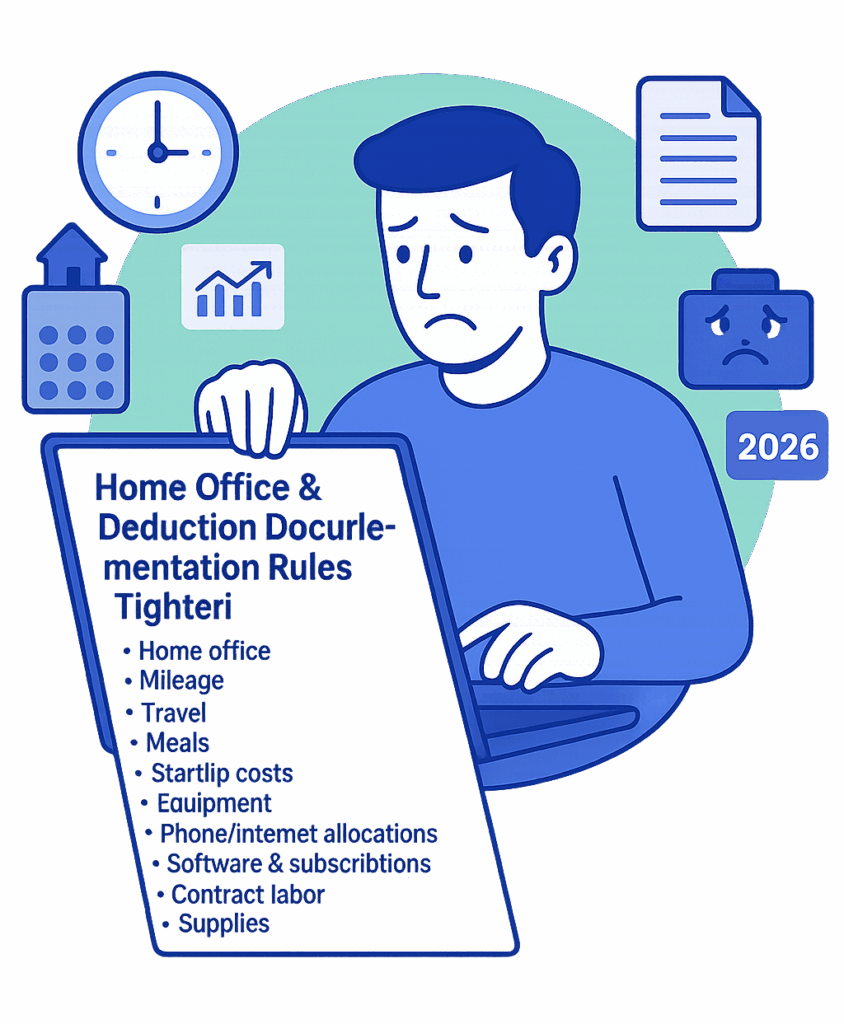

Home Office & Deduction Documentation Rules Tighten

The IRS expands documentation requirements in 2026 for:

- Home office

- Mileage

- Travel

- Meals

- Startup costs

- Equipment

- Phone/internet allocations

- Software & subscriptions

- Contract labor

- Supplies

The deduction rules themselves do not disappear —

but proof requirements increase significantly.

This is a major audit-prevention area for self-employed taxpayers.

Retirement Plans Become Far More Valuable in 2026

With higher brackets in 2026, retirement plans reduce tax liability more dramatically.

Most powerful plans:

- Solo 401(k) (best for self-employed)

- SEP IRA

- Defined-Benefit Plans (high earners)

- Roth conversions (2025) — last year at lower rates

If you earn $100K–$300K, retirement planning becomes one of the best ways to offset bracket increases.

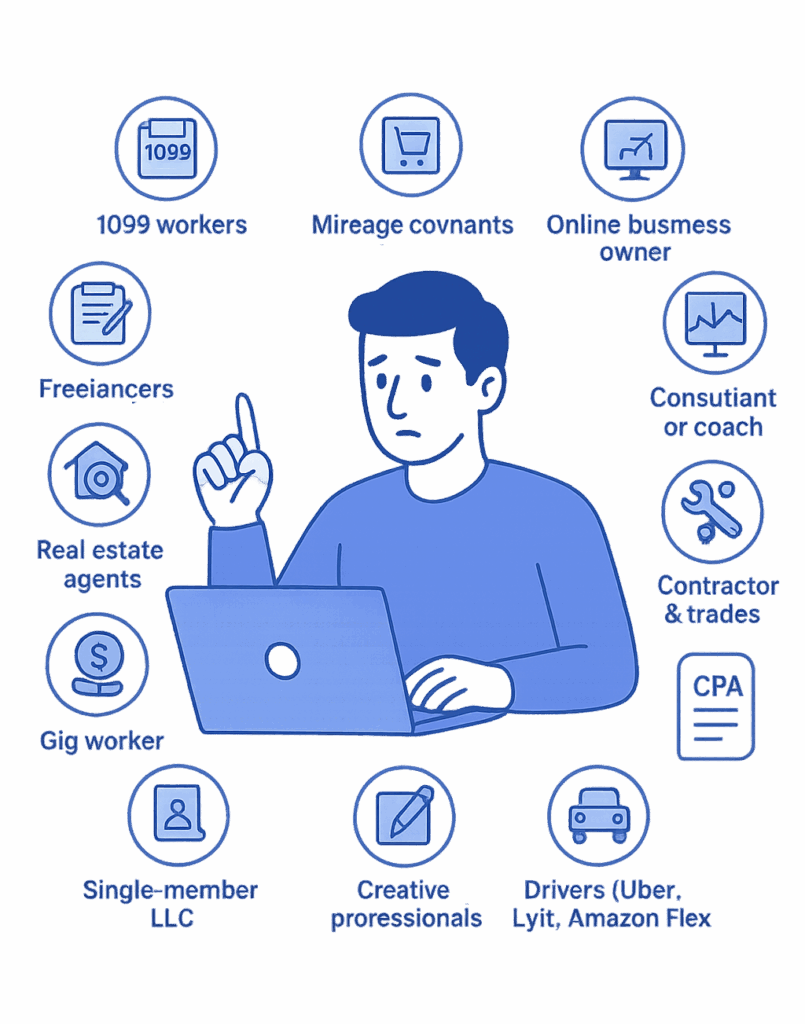

The Self-Employed Are Hit Hardest by 2026 Changes

- 1099 workers

- Freelancers

- Real estate agents

- Online business owners

- Consultants & coaches

- Contractors & trades

- Gig workers

- Single-member LLCs

- Creatives (designers, editors, marketers)

- Drivers (Uber, Lyft, Amazon Flex)

This is one of the most heavily impacted groups in the entire U.S. tax code.

Best 2025–2026 Planning Moves for the Self-Employed

- Maximize retirement contributions in 2025

- Reevaluate business structure (LLC → S-Corp if eligible)

- Shift income into 2025

- Accelerate deductions before TCJA provisions end

- Upgrade bookkeeping & documentation systems

- Use accountable plan reimbursements (if you form an S-Corp)

- Evaluate QBI thresholds under new OBBBA rules

- Pre-purchase equipment and assets (bonus depreciation window)

- Separate personal & business finances flawlessly

Self-employed taxpayers have the MOST to gain by planning in 2025.

2026 Self-Employed FAQ

Will my taxes go up in 2026?

Most self-employed individuals will pay more unless they plan proactively.

Is the QBI deduction still available?

Should I switch to S-Corp before 2026?

Does self-employment tax change in 2026?

Do home office deductions still exist?

Can I reduce my 2026 tax bill now?

Get Your 2026 Self-Employed Tax Plan

Self-employed taxpayers face some of the biggest 2026 tax shifts of any group in the U.S.

QBI stays — but everything around it changes.

Your income, deductions, retirement strategy, and entity structure MUST be optimized before December 31, 2025.