Texas 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax changes take effect as key Tax Cuts and Jobs Act (TCJA) provisions expire and updated rules continue under the One Big Beautiful Bill Act (OBBBA).

Texas has no state income tax, but millions of Texans will feel these federal changes because taxable income, credits, and business rules change nationwide.

- W-2 earners in Houston, Dallas, Austin, San Antonio, Fort Worth, El Paso

- Oil, gas, construction, and trades workers

- Contractors, freelancers, and gig workers

- Small business owners, LLCs, and S-Corps

- Real estate investors and landlords

- Short-term rental (STR) hosts

- High-income earners relocating from tax-heavy states

- Families with children

- Retirees drawing taxable retirement income

- Dual-income households

Key 2026 Federal Changes Affecting Texas

Standard Deduction Shrinks

TCJA temporarily doubled the standard deduction.

OBBBA did not extend it.

- Single: ~$8,300

- Married Filing Jointly: ~$16,600

- Head of Household: ~$12,400

This significantly increases federal taxable income for Texas households.

- higher federal withholding

- smaller refunds

- larger balances due

- reduced protection for middle-income families

Federal Income Tax Brackets Increase

- 12% → 15%

- 22% → 28%

- 24% → 31%

- dual-income households

- oilfield workers with high overtime

- trades and construction workers

- technology and medical professionals

- service and hospitality workers

- households earning $60K–$300K

Higher federal brackets reduce take-home pay for many Texans.

QBI Deduction Made Permanent Under OBBBA

OBBBA permanently extended the 20% Qualified Business Income (QBI) deduction. This is particularly important in Texas, which has one of the largest self-employed and small-business populations in the country.

- LLCs

- S-Corps

- sole proprietors

- contractors, freelancers, and consultants

- qualifying rental activities

- new income thresholds

- updated SSTB phaseouts

- stricter documentation requirements

Texans fully benefit from QBI since there is no state income tax.

Child Tax Credit Shrinks

- from about $2,000

- To roughly $1,000 per child

Refundability also decreases.

Families across Texas — especially in suburban regions — will see smaller refunds.

Marriage Penalty Returns

The marriage penalty reappears in 2026 due to the expiration of TCJA protections.

- Dallas

- Houston

- Austin

- San Antonio

- Fort Worth

Married couples will move into higher brackets faster and lose credits sooner.

Texas–Specific Tax Considerations

1. No State Income Tax — But Federal Changes Still Hit Hard

- increased federal taxable income

- higher retirement withdrawal taxation

- greater self-employment tax exposure

- changes in refund and withholding patterns

Federal law impacts Texas residents more heavily because the state provides no income tax offsets.

2. Real Estate Investors & Landlords Must Expect 2026 Changes

- Dallas–Fort Worth

- Houston

- Austin

- San Antonio

- El Paso

- Frisco

- Plano

- The Woodlands

- capital gains

- depreciation

- rental loss limitations

- STR compliance

- timing of sales or refinances

Texas’s rapidly appreciating markets increase exposure to federal capital gains.

3. STR Owners Must Prepare for Updated Rules

- Austin

- San Antonio

- Dallas

- Fort Worth

- Houston

- Galveston

- Fredericksburg

- Hill Country

- reduced bonus depreciation

- stricter material participation rules

- enhanced IRS safe harbor requirements

- stronger documentation standards

STR hosts must maintain precise logs and records.

4. Texas’s Large Self-Employed Workforce Is Significantly Affected

Texas leads the nation in entrepreneurship and independent contracting.

- QBI planning

- payroll structures

- contractor income reporting

- business deduction documentation

Without state income tax, optimizing federal strategies is even more important.

5. Retirement Income Remains Federally Taxed

- IRA withdrawals

- pension payouts

- 401(k) distributions

- investment income

Higher 2026 federal brackets increase total tax cost.

Who Is Most Affected in Texas (2026)

- Dual-income families

- Oil and gas workers

- Trades and construction workers

- Small business owners and freelancers

- Real estate investors and landlords

- STR hosts

- Families with children

- Retirees with taxable income

- Middle- and upper-middle-income earners

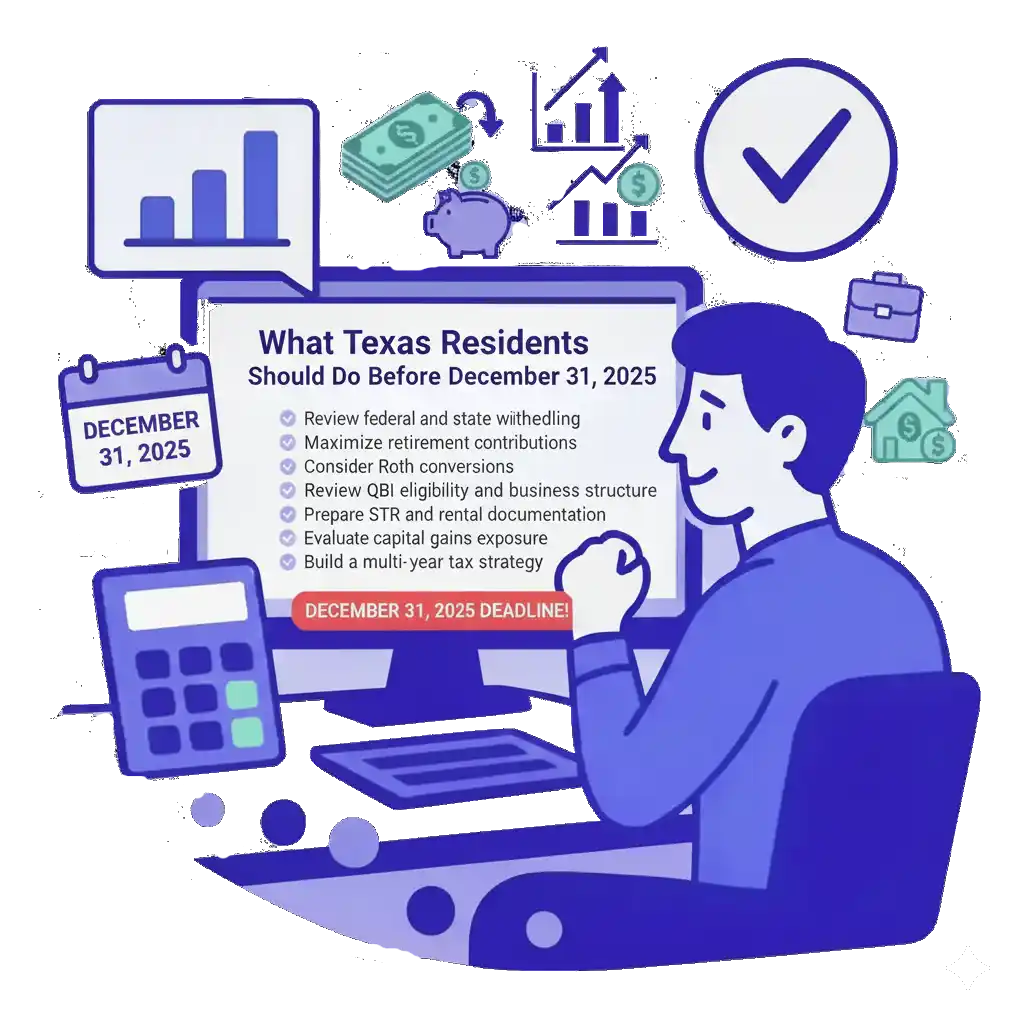

What Texas Residents Should Do Before December 31, 2025

- Review federal withholding

- Maximize retirement contributions

- Consider Roth conversions

- Review QBI eligibility and business structure

- Document STR participation

- Evaluate capital gains exposure

- Plan timing for property or business sales

- Build a multi-year federal tax strategy

Texas 2026 Tax FAQ

Does Texas have state income tax?

No. Only federal taxes apply.

Did OBBBA prevent tax increases?

OBBBA made QBI permanent but did not extend TCJA’s brackets or standard deduction.

Are families affected?

Yes. Reduced Child Tax Credit and higher taxable income reduce refunds.

Are STR owners impacted?

Yes. Depreciation, participation, and rental rules become more restrictive.

Are retirees affected?

Yes. Higher federal brackets increase taxation on retirement withdrawals.

Get your 2026 Texas Tax Strategy

Texas doesn’t tax income — but the federal government does.

Reduced deductions, higher brackets, and updated rules for rental income, small businesses, and families make advance planning essential.