Maine 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax changes take effect as previous TCJA provisions expire and updated rules continue forward.

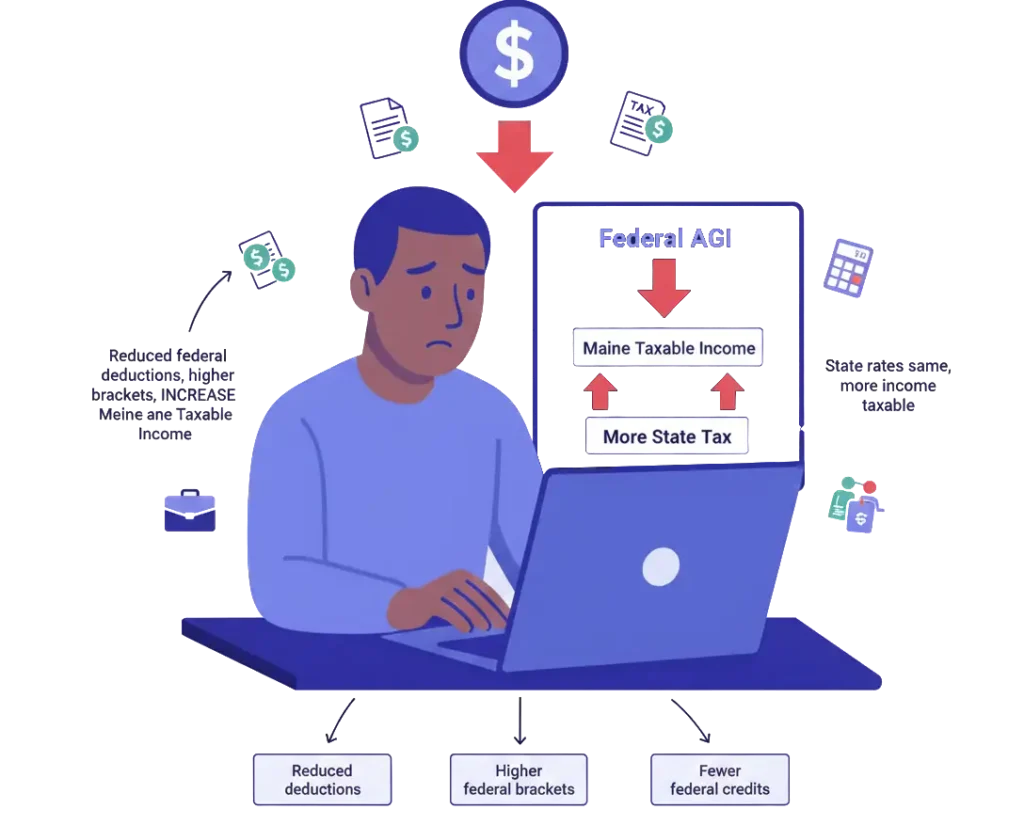

Because Maine has a progressive state income tax and uses federal AGI as a starting point, federal changes will directly affect Maine taxable income as well.

These changes impact:

- W-2 earners in Portland, Bangor, Lewiston, Auburn, Augusta, Biddeford

- Healthcare, education, and state employees

- Small business owners, LLCs, S-Corps, and contractors

- Fishermen, lobstermen, and seasonal workers

- Real estate investors, rental property owners, and STR hosts

- Families with children

- Retirees drawing IRA or pension income

- Dual-income households

Below is what Maine residents must understand about the 2026 tax changes.

Key Federal Changes Affecting Maine Residents

Standard Deduction Shrinks in 2026

Maine has:

- high housing costs in certain regions

- substantial heating and utility expenses

- a large population of retirees and moderate-income households

The reduced deduction increases federal — and therefore Maine — taxable income.

Federal Tax Brackets Increase

- 12% → 15%

- 22% → 28%

- 24% → 31%

- healthcare professionals and educators

- trades and manufacturing workers

- dual-income households in Portland suburbs

- families in midsize cities like Bangor and Lewiston

- remote workers earning out-of-state incomes

QBI (20% Business Deduction) Remains Federal; Maine Does Not Conform

QBI continues as a federal deduction, but Maine does not offer a matching state-level deduction.

- Federal taxable income may decrease

- Maine taxable income does not receive a QBI reduction

- Business owners must plan for this discrepancy

- small service businesses

- trades and contractors

- real estate agents

- fishermen and tourism-based business owners

- LLCs and S-Corps

- self-employed and gig workers

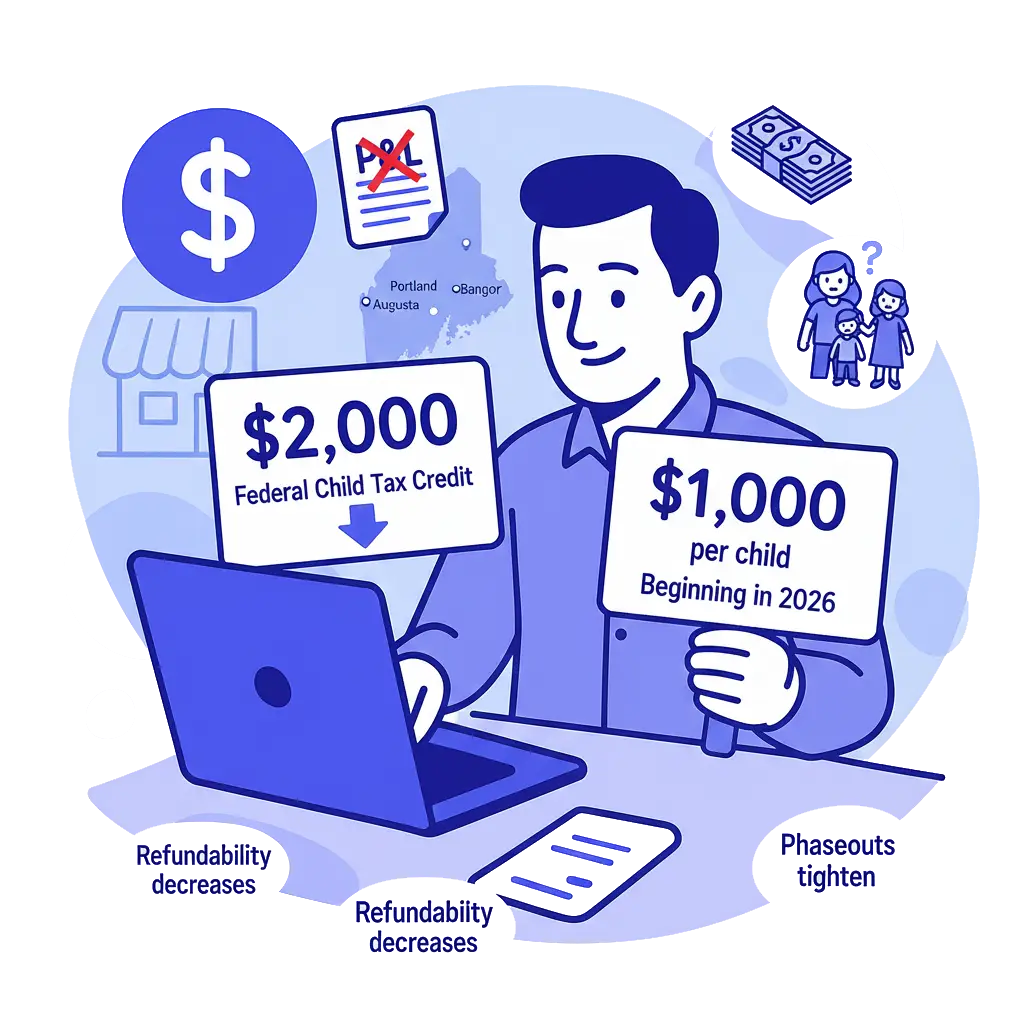

Child Tax Credit Shrinks

- Federal Child Tax Credit reduces from around $2,000

- To roughly $1,000 per child

- Refundability decreases

- Phaseouts tighten

Families across Maine — especially in Portland, Bangor, and Augusta — will see smaller federal refunds.

Marriage Penalty Returns

Maine has many dual-income households.

- joint filers move into higher brackets sooner

- combined income causes credits to phase out faster

- federal taxable income increases

Couples earning between $75K–$200K combined will see noticeable changes.

Maine-Specific Tax Considerations

1. Maine Uses Federal AGI as the Foundation for State Tax

Maine has a progressive state income tax system.

- reduced federal deductions

- higher federal brackets

- fewer federal credits

…will result in higher Maine state taxable income.

2. Real Estate Owners & Rental Investors Will Be Affected

- Portland

- Biddeford

- Scarborough

- Brunswick

- Bangor

- Coastal vacation areas

- capital gains

- depreciation

- STR participation rules

- rental classification

- timing of property sales

Owners selling highly appreciated property may face increased exposure.

3. STR (Short-Term Rental) Owners Face Stricter Rules

- Coastal towns

- Portland

- Bar Harbor

- Camden

- Old Orchard Beach

Because credits shrink and brackets increase, these workers often see reduced refunds and higher balances due.

- depreciation

- rental loss treatment

- IRS documentation

- safe harbor participation rules

4. Seasonal & Fishing Industry Workers Are Significantly Impacted

- fishing and lobstering

- tourism

- seasonal employment

These industries often have variable income and unique deduction needs.

Federal bracket changes and deduction reductions may significantly affect these households.

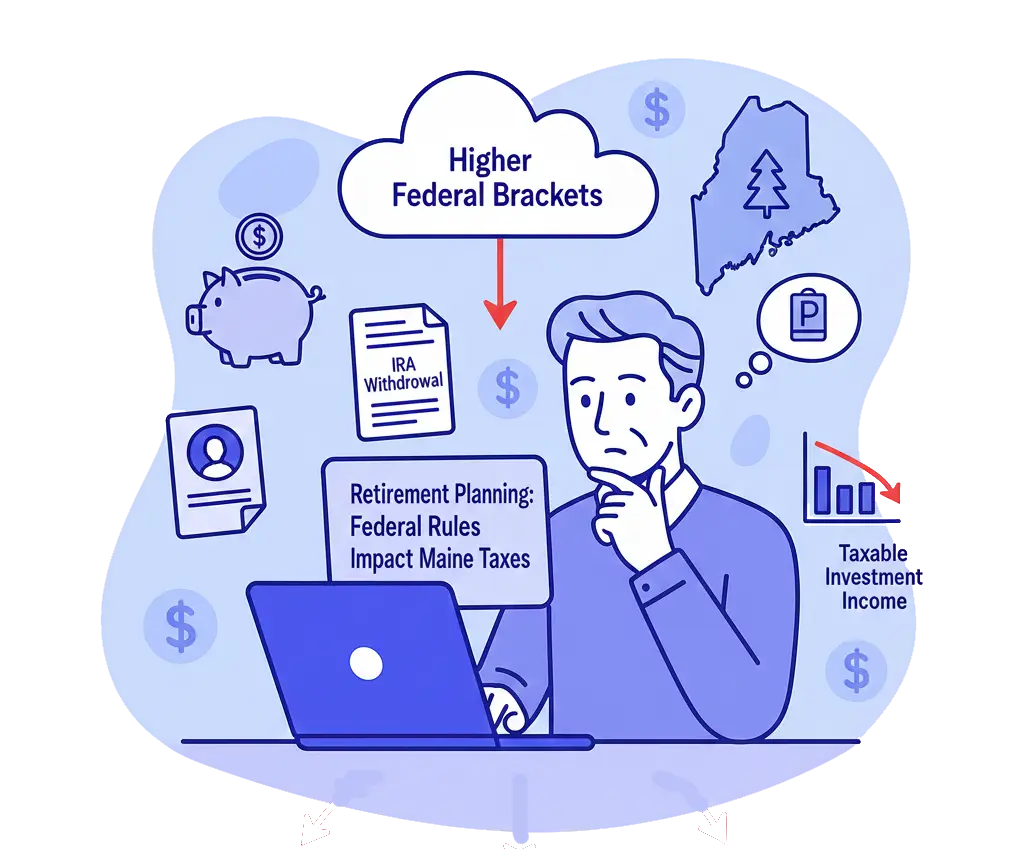

5. Retirement Planning Still Depends on Federal Rules

Maine taxes most retirement income except for certain exclusions.

- IRA withdrawals

- pensions

- 401(k) distributions

- taxable investment income

Maine retirees must plan for both state and federal impacts.

Who Is Hit Hardest in Maine (2026)

- Dual-income households

- Families with children

- Homeowners and renters in high-cost coastal areas

- Business owners and contractors

- Fishermen, lobstermen, and seasonal workers

- Real estate investors and landlords

- STR operators

- Retirees drawing taxable income

- Middle-income earners

What Maine Residents Should Do Before December 31, 2025

- Adjust state and federal withholding

- Maximize retirement contributions

- Consider Roth conversion timing

- Review S-Corp/LLC structuring

- Document STR and rental participation

- Review capital gains exposure

- Evaluate timing of property or equipment purchases

- Build a 2025–2026 federal and Maine tax strategy

Maine 2026 Tax FAQ

Does Maine conform to QBI?

No — QBI is federal-only.

Will Maine taxes increase?

Rates remain the same, but taxable income rises due to federal changes.

Are families affected?

Yes — reduced child credits and higher federal taxable income impact refunds.

Are STR owners impacted?

Yes — depreciation and participation rules tighten.

Are retirees affected?

Yes — both federal and state taxation of retirement withdrawals may increase.

Get a 2026 Maine Tax Strategy

Maine residents will face meaningful tax changes from higher federal brackets, reduced deductions, shifting credit eligibility, and rules impacting business owners, seasonal workers, homeowners, and retirees.

A personalized plan ensures you’re ready before these changes take effect.