Portland Maine Tax Preparation 2026: Complete Guide to New Deductions, Deadlines & Strategies

For the 2026 tax year, Portland Maine residents face significant changes that make professional Portland Maine tax preparation more valuable than ever. The One Big Beautiful Bill Act introduced sweeping tax changes that apply retroactively to 2025 income. New deductions for seniors, service workers, and families—combined with state-specific considerations—mean many Maine taxpayers could leave thousands on the table without expert guidance. This comprehensive guide covers everything you need to know about maximizing deductions, meeting deadlines, and filing strategically for 2026.

Table of Contents

- Key Takeaways

- What Are the 2026 Tax Filing Deadlines for Portland Maine Residents?

- What New Deductions Are Available for the 2026 Tax Year?

- How Can Portland Maine Taxpayers Maximize Maine-Specific Tax Benefits?

- What Are the Penalties for Missing Tax Filing Deadlines?

- How Have the 2026 Standard Deductions Changed?

- What Strategies Help Portland Maine Residents Maximize Their 2026 Tax Refund?

- Uncle Kam in Action: Real Results for Maine Taxpayers

- Next Steps

- Frequently Asked Questions

- Related Resources

Key Takeaways

- April 15, 2026 is the deadline for individual tax returns; file early to avoid penalties and delays.

- New deductions available: Up to $6,000 for seniors (65+), $25,000 for tips, $12,500 for overtime pay.

- Standard deductions increased for 2026: $31,500 for married couples, $15,750 for singles, $23,625 for heads of household.

- IRS default refunds are now electronic; paper checks take significantly longer to arrive.

- Portland Maine tax preparation experts can identify missed deductions worth thousands.

What Are the 2026 Tax Filing Deadlines for Portland Maine Residents?

Quick Answer: The primary deadline for 2026 individual tax returns is April 15, 2026. Partnership and S-Corp returns must be filed by March 16, 2026. W-2 and 1099 forms must be filed by January 31, 2026—a deadline many Portland Maine businesses have already passed.

Understanding tax filing deadlines is critical for Portland Maine residents and business owners. The 2026 tax season opened on January 26, with the IRS now accepting individual returns. However, different document types carry different deadlines.

Key Tax Filing Deadlines for 2026

| Document/Filing Type | 2026 Deadline | Penalty for Missing |

|---|---|---|

| Form W-2 (employer to SSA) | January 31, 2026 | $60-$680 per form |

| Form 1099-NEC (contractor payments) | January 31, 2026 | $60-$680 per form |

| Partnership/S-Corp Returns (Form 1065/1120-S) | March 16, 2026 | 5% monthly penalty |

| Individual Tax Returns (Form 1040) | April 15, 2026 | $60-$680 + interest |

For Portland Maine residents, the April 15 deadline applies to individual income tax returns. However, many residents who file early—especially through electronic filing with direct deposit—receive refunds within 21 days or less. This is significantly faster than paper returns, which the IRS now processes as a secondary option.

Pro Tip: Portland Maine tax preparation professionals recommend filing by mid-March to ensure smooth processing. Early filing also reduces stress and allows time to address any IRS correspondence before the April deadline.

Extensions are available if you cannot meet the April deadline. However, even with a six-month extension, any taxes owed must still be paid by April 15 to avoid interest and penalties.

What New Deductions Are Available for the 2026 Tax Year?

Quick Answer: The 2026 tax year introduces three major new deductions under the One Big Beautiful Bill Act: a $6,000 senior deduction (up to $12,000 for married couples), $25,000 for tips income, and up to $12,500 for overtime pay ($25,000 for joint filers). These deductions were retroactive to 2025 income.

The One Big Beautiful Bill Act, signed into law in July 2025, represents the most significant tax law changes in years. For Portland Maine taxpayers, these new deductions create opportunities to significantly reduce taxable income—but only if you know how to claim them correctly.

Senior Deduction for Taxpayers 65 and Older

Maine has a large retiree population, making this deduction especially valuable for Portland residents. Starting with the 2025 tax year (filed in 2026), taxpayers aged 65 and older can claim a new deduction of up to $6,000 on top of their standard or itemized deduction. Married couples where both spouses are 65+ can deduct up to $12,000.

The full $6,000 senior deduction is available to single filers with modified adjusted gross income below $75,000 and married couples filing jointly with income under $150,000. The deduction phases out gradually at higher income levels and is completely eliminated at $175,000 (single) or $250,000 (married).

Did You Know? This deduction applies even if you don’t have Social Security income. If you’re 65+ with retirement income from pensions, investments, or part-time work, you still qualify.

Deductions for Tip Income and Overtime Pay

Service workers in the Portland Maine hospitality and restaurant industries can now deduct up to $25,000 in qualified tip income annually. Workers earning overtime can deduct up to $12,500 per return, or $25,000 for joint filers. These benefits phase out for higher earners and expire after 2028.

To claim these deductions, you must file using the newly created Schedule 1-A form. Both spouses must have valid Social Security numbers, and married couples must file jointly to qualify.

How Can Portland Maine Taxpayers Maximize Maine-Specific Tax Benefits?

Quick Answer: Maine residents can maximize state and federal benefits by claiming state income tax deductions on their federal returns, understanding Maine-specific credits, and coordinating timing between state and federal filings. Professional Portland Maine tax preparation ensures you capture every allowable benefit.

Maine residents have unique opportunities to optimize taxes through state-specific strategies. The expanded SALT deduction (State and Local Tax deduction) now allows deductions up to $40,000 on federal returns through 2029—up from the previous $10,000 cap. For high-income Portland Maine residents with significant state tax bills, this change alone can save thousands.

Understanding Maine’s Tax Environment

Maine has a progressive income tax system with rates ranging up to 5.75% on higher incomes. For Portland Maine residents, professional tax preparation services understand Maine-specific deductions and how they interact with federal tax planning. Many residents can itemize deductions rather than taking the standard deduction, especially when combining federal and state tax payments with mortgage interest and charitable contributions.

The key is coordinating timing between federal and state filings. If you file federal returns electronically, Maine recommends following with a state return within two weeks to maintain proper documentation and avoid processing delays.

Utilizing Credits and Deductions Specific to Portland Residents

Portland Maine residents working with professional preparers should evaluate state credits including education credits, child dependent care credits, and retirement income credits. Maine also offers various business-related deductions for self-employed professionals and small business owners operating in Cumberland County.

What Are the Penalties for Missing Tax Filing Deadlines?

Quick Answer: Late filing penalties start at $60 for returns filed within 30 days of the deadline and escalate to $680+ per return for intentional disregard. Interest also accrues on unpaid taxes, making late filing expensive for Portland Maine residents.

The IRS imposes strict penalties for missing tax deadlines. Understanding these penalties emphasizes why professional Portland Maine tax preparation with timely filing is critical.

| Filing Status | Penalty Amount | When It Applies |

|---|---|---|

| Within 30 days late | $60 per return | April 15 – May 15, 2026 |

| 30+ days, before August 1 | $130 per return | May 15 – August 1, 2026 |

| After August 1 | $340 per return | August 1+, 2026 |

| Intentional disregard | $680 per return (no cap) | Applies when fraud indicated |

Beyond these penalties, the IRS also charges interest on unpaid taxes. For 2026, federal interest rates are compounded daily. Portland Maine residents who cannot pay taxes owed by April 15 should still file on time to minimize penalties—unpaid taxes owe interest regardless of penalty status.

Pro Tip: If you owe taxes, file on time and pay what you can now. The IRS allows payment plans that can significantly reduce interest and avoid the failure-to-pay penalty.

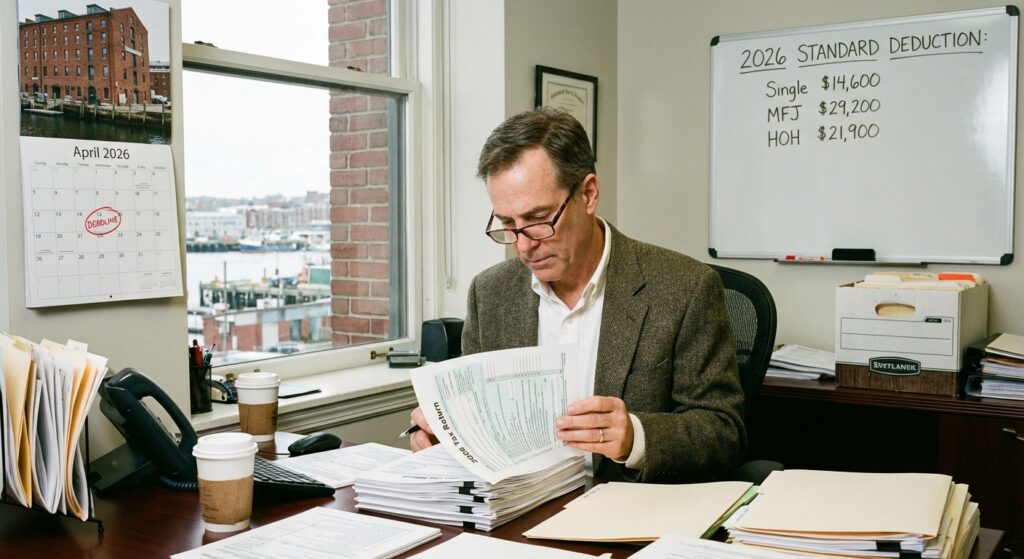

How Have the 2026 Standard Deductions Changed?

Quick Answer: For 2026, the standard deduction is $31,500 for married filing jointly (up from prior years), $15,750 for single filers, and $23,625 for heads of household. These increases reflect inflation adjustments and are the amounts Portland Maine residents should use when calculating tax liability.

The standard deduction is the amount taxpayers can deduct from their gross income if they don’t itemize deductions. For Portland Maine residents, understanding whether to use the standard deduction or itemize is crucial for minimizing tax liability.

For 2026, the IRS has adjusted standard deductions based on inflation. Most Portland Maine residents can claim the standard deduction without additional documentation. However, residents with significant itemized deductions—such as mortgage interest on a Portland home, state and local taxes (now up to $40,000 under expanded SALT rules), or charitable contributions—may benefit from itemizing instead.

What Strategies Help Portland Maine Residents Maximize Their 2026 Tax Refund?

Quick Answer: The average 2026 refund is estimated at $3,800—up 25% from 2025. To maximize yours, file electronically with direct deposit, claim all new deductions, and use professional Portland Maine tax preparation to identify missed opportunities.

The Tax Foundation estimates that the average 2026 tax refund will reach $3,800, representing a significant increase from prior years. This jump reflects new deductions, expanded credits, and changed withholding patterns among American workers.

For Portland Maine residents, maximizing refunds requires three key actions. First, file electronically through IRS e-file rather than paper returns. Electronic returns process in less than 21 days with direct deposit, compared to 20+ days for paper processing. Second, claim direct deposit for your refund rather than a paper check—paper checks now take significantly longer due to IRS operational changes. Third, work with professional tax preparers who understand Portland Maine-specific deductions and new federal benefits you might otherwise miss.

Did You Know? The new senior deduction alone could increase Portland Maine retirees’ refunds by $900-$1,800. Service workers claiming the new tip or overtime deductions could see similar increases. Professional tax preparation helps ensure you capture these benefits.

Uncle Kam in Action: Portland Maine Couple Increases Refund by $3,240 with Strategic Tax Planning

Client Snapshot: A married couple in Portland, Maine, both age 67, with combined retirement income of $140,000 annually from Social Security, pension distributions, and rental property investments.

Financial Profile: The clients had been filing basic returns independently for years, using only the standard deduction. Their 2025 income (filed in 2026 tax season) consisted of $85,000 in pension income, $35,000 in Social Security benefits, and $20,000 in rental property income. They owned a modest home in Portland with paid-off mortgage.

The Challenge: These clients were completely unaware of the new $12,000 senior deduction for married couples 65+ (now filing 2025 returns in the 2026 tax season). They were also missing out on SALT deduction optimization and Maine state-specific credits available to them. Additionally, their rental property deductions were suboptimized, and they hadn’t properly documented maintenance and depreciation expenses.

The Uncle Kam Solution: Our Portland Maine tax preparation team implemented a comprehensive strategy. First, we claimed the full $12,000 senior deduction available to both spouses. Second, we conducted an itemization analysis and found that itemizing—using the expanded $40,000 SALT deduction plus charitable contributions—saved them $2,100 compared to the standard deduction. Third, we optimized their rental property deductions, properly calculating depreciation on the building and capturing all maintenance, repair, and property management expenses documented over the previous year. Fourth, we ensured all Maine state-specific senior credits were properly claimed.

The Results:

- Tax Savings: $3,240 additional refund compared to their independent filing approach

- Investment: $450 for comprehensive Portland Maine tax preparation services

- Return on Investment (ROI): 7.2x return in the first year alone

This is just one example of how our proven tax strategies have helped clients achieve significant savings. For Portland Maine retirees, service workers with tip or overtime income, and small business owners, similar opportunities exist to reduce taxes and increase refunds through strategic planning and professional guidance.

Next Steps

Maximizing your 2026 tax preparation requires prompt action. Here’s what to do now:

- ☐ Gather your documents – Collect all W-2s, 1099s, mortgage interest statements, and charitable contribution records before meeting with your tax preparer.

- ☐ Review new deductions – Determine if you qualify for senior deductions, tips deductions, overtime deductions, or expanded SALT benefits.

- ☐ Schedule a consultation – Contact professional Portland Maine tax preparation services for an initial consultation to discuss your specific situation.

- ☐ File early – Aim to file by March 15, 2026, to ensure processing before the April 15 deadline and maximize refund speed.

- ☐ Choose direct deposit – Ensure your refund goes via direct deposit for fastest processing (21 days or less vs. 20+ days for paper).

Frequently Asked Questions

Q: What happens if I miss the April 15 deadline?

If you miss the April 15 deadline without requesting an extension, you’ll face penalties starting at $60 if filed within 30 days of the deadline. Interest also accrues on any unpaid taxes. File as soon as possible—even late returns reduce penalty risk if filed promptly. The IRS allows extensions, which push the deadline to October 15, 2026, but taxes owed are still due April 15 to avoid interest.

Q: Am I eligible for the senior deduction if I work part-time?

Yes. The senior deduction ($6,000 for single filers 65+, $12,000 for married couples) applies regardless of income source. Whether your income comes from employment, pensions, Social Security, investments, or rental properties, you qualify for the senior deduction as long as you meet the income thresholds and age requirement.

Q: Should I itemize or take the standard deduction?

Compare both options. For 2026, the standard deduction for married couples is $31,500. If your itemized deductions (mortgage interest, state/local taxes up to $40,000, charitable contributions, etc.) exceed this amount, itemize. Many Portland Maine homeowners benefit from itemizing, especially with the expanded SALT deduction now available.

Q: How long will it take to receive my refund?

Electronic filing with direct deposit typically results in refunds within 21 days. The IRS currently processes most electronic returns within 10-14 days. Paper returns take 20+ days on average. Paper check refunds, which are now a secondary option, take significantly longer. For fastest refunds, file electronically and select direct deposit.

Q: Can I deduct state and local taxes for my Portland property?

Yes, through the SALT deduction. For the 2026 tax year, you can deduct state and local taxes (income, sales, and property taxes combined) up to $40,000 if filing jointly ($20,000 if filing separately). This is up from the previous $10,000 limit and is one of the most valuable changes for Portland Maine homeowners and business owners with high state tax bills.

Q: What documents do I need for professional tax preparation?

Gather all W-2s, 1099 forms, mortgage interest statements (1098), charitable contribution records, property tax statements, business income records, and documentation of deductible expenses. For Maine residents, also collect state income tax payment records and any documentation of rental property expenses, education credits, or other specific deductions you may qualify for.

Q: Is it better to file early or wait for all documents?

File as soon as you have most documents, typically by mid-March. If you’re waiting for a few forms, you can file an amended return later. The IRS processes early filings faster, and you’ll receive refunds sooner. Waiting too close to the April deadline increases risk of processing delays and errors.

Q: How can I maximize my refund as a service worker with tips?

The new tip deduction allows you to deduct up to $25,000 in qualified tip income annually. To claim this, you must file using Schedule 1-A. Keep detailed records of all tips received throughout the year. Professional tax preparation ensures you properly calculate and claim this deduction while maintaining compliance with IRS requirements.

Related Resources

- IRS: New Tax Deductions for Seniors, Tips, and Overtime (2026)

- Comprehensive Tax Strategy Services

- IRS E-File: File Your Taxes Electronically

- Complete Tax Preparation Guides

- Real Estate Tax Strategies for Maine Property Owners

This information is current as of 02/03/2026. Tax laws change frequently. Verify updates with the IRS (IRS.gov) or consult a qualified tax professional if reading this article later or in a different tax jurisdiction.

Last updated: February, 2026