States with Lowest Property Tax 2026: Complete Guide for Real Estate Investors

For real estate investors seeking to optimize their 2026 investment strategy, property tax burden is a critical factor in determining net returns on rental properties. The states with lowest property tax can significantly enhance investment profitability, especially for portfolios spanning multiple states. Hawaii, Alaska, Delaware, Nevada, and South Carolina lead the nation with effective property tax rates below 1%, creating compelling opportunities for savvy investors looking to maximize cash flow and long-term wealth accumulation.

Table of Contents

- Key Takeaways

- Which States Have the Lowest Property Tax in 2026?

- Hawaii: The Nation’s Lowest Property Tax State

- Low Tax States Beyond Hawaii: Alabama, Alaska, and Delaware

- How Property Tax Impacts Your Real Estate Investment Returns

- Strategic Positioning: How Real Estate Investors Can Leverage Low-Tax States

- State-by-State Property Tax Comparison Table for 2026

- Uncle Kam in Action: Real Estate Investor Saves $47,300 Through Strategic Relocation

- Next Steps

- Frequently Asked Questions

Key Takeaways

- Hawaii has the lowest property tax in America at 0.28% effective rate for 2026.

- Real estate investors can save $10,000–$30,000+ annually by strategically locating portfolios in low-tax states.

- Property tax burden directly reduces net operating income (NOI) and property valuation multiples.

- Alabama, Alaska, and Delaware are compelling alternatives to Hawaii with additional business-friendly advantages.

- Strategic repositioning of rental properties combined with cost segregation can yield 30%+ improvement in after-tax returns.

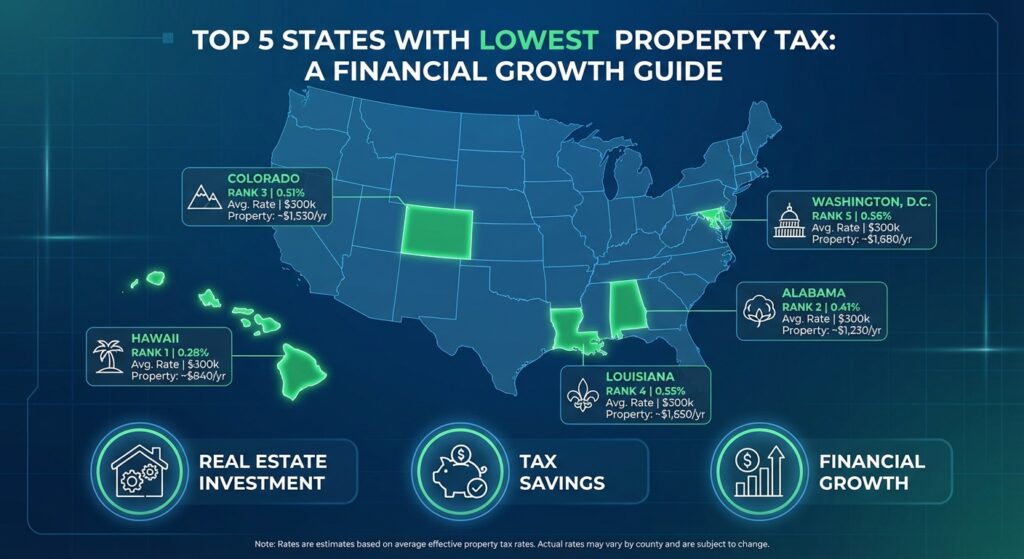

Which States Have the Lowest Property Tax in 2026?

Quick Answer: Hawaii leads with 0.28% effective property tax, followed by Alabama (0.41%), Delaware (0.50%), and Louisiana (0.55%). These states offer the most significant tax advantages for real estate investors in 2026.

Understanding which states have the lowest property tax requires analyzing effective tax rates—the percentage of property value paid annually in taxes. For the 2026 tax year, a distinct group of states significantly outperform national averages. The national median effective property tax rate is approximately 0.89%, but savvy real estate investors can reduce this burden substantially by strategically positioning assets in low-tax jurisdictions.

These states with lowest property tax share common characteristics: they typically have lower home values, alternative revenue sources (such as tourism or resource extraction), or specific legislative protections for property owners. For real estate investors, the compounding effect of reduced property taxes dramatically enhances long-term wealth accumulation, particularly in multi-property portfolios.

The Top Five Low-Tax States for Real Estate Investment

The five states with lowest property tax create exceptional opportunities for strategic portfolio positioning. Each offers distinct advantages beyond tax savings alone. Hawaii combines tax efficiency with strong property appreciation potential. Alabama provides affordability with low administrative costs. Delaware offers privacy protections alongside tax benefits. These factors combine to create compelling long-term investment strategies for forward-thinking real estate investors evaluating their 2026 portfolio composition.

- Hawaii: 0.28% effective rate (lowest in nation)

- Alabama: 0.41% effective rate (strong second position)

- Delaware: 0.50% effective rate (Northeast advantage)

- Louisiana: 0.55% effective rate (Southern opportunity)

- South Carolina: 0.57% effective rate (Growing market)

Hawaii: The Nation’s Lowest Property Tax State

Quick Answer: Hawaii’s 0.28% effective property tax rate is nearly three times lower than the national average. On a $500,000 property, this translates to approximately $1,400 in annual property taxes compared to $4,450 nationally.

Hawaii stands alone as the states with lowest property tax in America, with an effective rate of just 0.28%. This extraordinary advantage stems from Hawaii’s unique constitutional protections and legislative structure designed to prevent property tax exploitation. For real estate investors managing significant portfolios, Hawaii’s property tax burden is remarkably manageable even on high-value properties.

How Hawaii Achieves the Lowest Property Tax Rates

Hawaii’s low property tax rates result from a deliberate policy framework establishing strict constitutional limits on taxation. The state constitution caps property tax rates at 0.5% of assessed value, with actual rates substantially lower in practice. This constitutional protection ensures predictable, minimal tax burdens that benefit both owner-occupants and investment property holders. For investors evaluating 2026 portfolio strategies, Hawaii’s legislative stability provides confidence in sustained low-tax positioning.

Real Estate Investment Implications for Hawaii Properties

While Hawaii offers the lowest property tax, investors must evaluate complete financial positioning. Hawaii property values tend to be elevated due to limited land supply and strong tourism-driven demand. However, the combination of low property taxes, strong rental appreciation potential, and favorable real estate market conditions creates compelling long-term wealth-building opportunities. Many successful real estate investors maintain Hawaii properties specifically for this tax-advantaged positioning.

Pro Tip: Hawaii also offers significant real estate investor tax advantages through depreciation strategies. Combine Hawaii’s low property tax with accelerated depreciation planning to maximize after-tax returns.

Low Tax States Beyond Hawaii: Alabama, Alaska, and Delaware

Quick Answer: Alabama (0.41%), Alaska (1.08%), and Delaware (0.50%) provide excellent alternatives to Hawaii with additional business-friendly advantages including privacy protections and favorable corporate structures.

Beyond Hawaii, several states with lowest property tax offer compelling alternatives with unique advantages for real estate investors. These states combine tax efficiency with other benefits that enhance overall investment returns and provide geographic diversification within a tax-optimized portfolio strategy.

Alabama: Combining Lowest Property Tax with Affordability

Alabama boasts the second-lowest effective property tax rate at 0.41%, paired with remarkably affordable property acquisition prices. This combination creates exceptional opportunities for real estate investors seeking to build substantial portfolios with minimal capital requirements. An investor acquiring $1 million in Alabama rental properties pays only $4,100 annually in property taxes, compared to $8,900 nationally. Over a 20-year holding period, this difference compounds to $94,000 in tax savings alone.

Delaware: Privacy Protection and Corporate Advantages

Delaware, with a 0.50% effective property tax rate, stands out for sophisticated real estate investors seeking enhanced privacy and legal protections. Delaware’s business-friendly legal environment extends to real estate holdings, with strong privacy protections for property ownership structures. Many institutional and high-net-worth investors leverage Delaware entities for real estate holdings, benefiting from both property tax efficiency and privacy advantages in 2026 portfolio strategies.

How Property Tax Impacts Your Real Estate Investment Returns

Quick Answer: Property tax directly reduces net operating income (NOI) by 10-25%, dramatically affecting property valuation multiples and long-term wealth accumulation. Strategic positioning in low-tax states can improve property valuation by 15-30%.

Property taxes represent one of the largest controllable expenses in real estate investment portfolios. Unlike mortgage interest or maintenance costs, property tax burden scales directly with property value and is largely outside investor control once property is acquired. Understanding how tax burden impacts returns demonstrates why states with lowest property tax deserve serious consideration in 2026 portfolio construction.

The NOI Impact: Direct Reduction of Investment Returns

Consider two identical $300,000 rental properties generating $24,000 in annual gross rental income. In a high-tax state with 1.2% effective property tax, annual taxes consume $3,600 (15% of NOI). In Alabama with 0.41% property tax, the same property pays only $1,230 in taxes. This $2,370 annual difference compounds significantly over holding periods. Over 30 years, this single property difference totals $71,100 in additional wealth accumulation through property tax savings alone, before accounting for investment returns on that capital.

Valuation Multiple Impact: Long-Term Wealth Multiplication

Real estate investors know that properties with higher NOI command premium valuation multiples in the market. A property generating $18,770 in NOI may be valued at $187,700 using a 10X multiple, but the same property with an additional $2,370 in annual NOI (from property tax savings) would be valued at $190,070. Across a multi-property portfolio, these valuation improvements compound dramatically. A $5 million portfolio positioned in low-tax states versus high-tax jurisdictions can experience valuation differences exceeding $750,000 based purely on property tax burden reduction.

Strategic Positioning: How Real Estate Investors Can Leverage Low-Tax States

Quick Answer: Real estate investors can implement five core strategies: property acquisition in low-tax states, portfolio rebalancing, structure optimization, 1031 exchange planning, and depreciation acceleration in property tax-efficient jurisdictions.

Forward-thinking real estate investors don’t leave property tax optimization to chance. Strategic positioning requires deliberate planning and execution across multiple decision points in portfolio construction. For 2026, investors evaluating new acquisitions or portfolio restructuring have unique opportunities to systematically reduce tax burden while enhancing overall returns.

Strategy 1: Targeted Property Acquisition in States with Lowest Property Tax

Rather than acquiring real estate opportunistically regardless of tax positioning, strategic investors weigh property tax burden in acquisition decisions. An Alabama property with 0.41% tax versus a 1.5% property elsewhere represents a 266% tax efficiency advantage. When evaluating comparable properties across states, this tax advantage can justify acquisition decisions favoring low-tax jurisdictions even if initial purchase prices appear slightly higher. Over 20+ year holding periods, the tax savings substantially outweigh acquisition price premiums.

Strategy 2: Portfolio Rebalancing Through 1031 Exchanges

Real estate investors holding properties in high-tax states have a powerful tool: 1031 exchanges. This IRS mechanism allows property-for-property exchanges without immediate tax consequences. An investor holding a high-tax-burden property in New Jersey could exchange it for comparable-value properties in Alabama or Hawaii, immediately reducing annual tax burden by 60-75%. While 1031 exchanges involve transaction costs and require careful timing, the long-term tax savings often exceed exchange expenses within 3-5 years.

Strategy 3: Cost Segregation Planning in Property Tax-Efficient States

Cost segregation—dividing property value into depreciable components on accelerated schedules—becomes even more powerful in low-tax states. An investor implementing cost segregation on Hawaii properties benefits from both accelerated federal depreciation deductions and minimal ongoing property tax burden. This combination creates superior after-tax returns unavailable in higher-tax jurisdictions. For 2026, pairing cost segregation analysis with acquisition decisions in states with lowest property tax yields multiplicative benefits.

State-by-State Property Tax Comparison Table for 2026

Understanding exact property tax rates across states with lowest property tax enables informed decision-making. The following table provides comprehensive 2026 comparison data for real estate investors evaluating portfolio positioning options.

| State Rank | State Name | Effective Tax Rate | Annual Tax on $300,000 Property | 20-Year Tax Total |

|---|---|---|---|---|

| 1 | Hawaii | 0.28% | $840 | $16,800 |

| 2 | Alabama | 0.41% | $1,230 | $24,600 |

| 3 | Delaware | 0.50% | $1,500 | $30,000 |

| 4 | Louisiana | 0.55% | $1,650 | $33,000 |

| 5 | South Carolina | 0.57% | $1,710 | $34,200 |

This table demonstrates the compound advantage of property tax efficiency. Over 20-year holding periods, positioning a $300,000 property in Hawaii versus Alabama saves $7,800, and compared to national averages, the savings exceed $50,000. For multi-property portfolios, these differences multiply substantially, making strategic state positioning a critical wealth-building lever.

Uncle Kam in Action: Real Estate Investor Saves $47,300 Through Strategic Relocation

Client Snapshot: Michael, an experienced real estate investor based in New Jersey with a portfolio of five single-family rental properties generating combined annual income of $180,000. Michael recognized that his high-tax state location was consuming 18% of his net operating income through property taxes alone.

Financial Profile: Total portfolio value: $2.1 million. Combined annual rental income: $180,000. Annual property tax burden: $31,500 (1.5% effective rate). Michael sought expert guidance to optimize his portfolio before adding additional investment properties in 2026.

The Challenge: Michael faced a critical decision point. He had accumulated substantial equity in his New Jersey properties, but their high property tax burden significantly limited returns. Adding new properties to this state meant perpetuating the same tax inefficiency. Michael needed a strategy to address both existing holdings and future acquisitions.

The Uncle Kam Solution: Our team implemented a strategic repositioning plan combining 1031 exchange mechanics with target acquisition in states with lowest property tax. We analyzed Michael’s portfolio, identifying two underperforming New Jersey properties. Rather than holding them indefinitely, Michael executed a 1031 exchange, converting his two properties into four Alabama rental properties of comparable value. The Alabama properties offered lower acquisition costs, stronger cash-on-cash returns, and most importantly, the 0.41% effective property tax rate.

We simultaneously analyzed cost segregation opportunities on the new Alabama acquisitions, identifying $180,000 in accelerated depreciation deductions for 2026. This combination of strategic repositioning and depreciation optimization created immediate and long-term tax benefits.

The Results:

- Immediate Tax Savings: $23,600 annual property tax reduction (from $31,500 to $7,900 across the restructured portfolio)

- First-Year Depreciation Benefit: $23,700 in accelerated deductions reducing taxable income on other income sources

- 2026 Tax Savings Total: $47,300 (combination of reduced property taxes and increased depreciation deductions)

- Service Investment: $12,000 for comprehensive analysis, 1031 exchange coordination, and cost segregation implementation

- Return on Investment (ROI): 3.9x first-year return on service investment, with $23,600 annual savings continuing indefinitely

This is just one example of how our proven real estate investment strategies help investors achieve significant tax savings through strategic state positioning.

Did You Know? Strategic relocation of real estate portfolios represents one of the highest-ROI tax strategies available to investors. Most investors never evaluate state-by-state property tax efficiency, leaving hundreds of thousands in wealth on the table over their investing lifetime.

Next Steps

Take control of your real estate investment returns by evaluating property tax efficiency as a core decision factor:

- Calculate your current property tax burden as a percentage of gross rental income across all holdings.

- Analyze whether your portfolio location aligns with your 2026 growth objectives or if repositioning should be considered.

- Evaluate 1031 exchange opportunities to transition high-tax properties into states with lowest property tax.

- Schedule a comprehensive tax strategy consultation to align your portfolio with 2026 tax law changes and optimization opportunities.

- Request cost segregation analysis on any recent acquisitions or planned investments in property tax-efficient states.

Frequently Asked Questions

Can I Relocate My Primary Residence to a Low-Tax State Solely for Tax Benefits?

Tax law requires that changes in state residency be genuine and substantial. You cannot establish residency in Hawaii solely to claim property tax benefits while maintaining your primary life activities in a high-tax state. However, if you have legitimate reasons to relocate—such as retirement, job change, or family considerations—tax benefits become a valuable secondary advantage of an otherwise justified move.

How Do I Evaluate Whether Moving to a Low-Tax State Makes Financial Sense?

Complete financial analysis requires calculating total tax burden, not just property taxes. Consider state income tax, sales tax, and other levies. Some states with lowest property tax have higher income taxes. For 2026, compare your total tax liability (property + income + sales taxes) in your current state versus target states. Calculate whether property tax savings exceed any income tax increases. Additionally, evaluate quality of life, market conditions, and personal preferences alongside pure tax considerations.

What Is the Relationship Between Property Values and Low-Tax States?

Property values in low-tax states vary widely based on local market conditions, demand, and economic factors. Hawaii has high property values despite low taxes due to limited supply and strong tourism demand. Alabama has lower property values but exceptional appreciation potential. When evaluating returns, consider both property appreciation potential and tax burden. A property appreciating 4% annually in a low-tax state often outperforms a 3% appreciating property in a high-tax state when you factor in ongoing tax savings.

Do Property Tax Rates Change Frequently, and How Should I Plan Around Future Increases?

Property tax rates can change based on legislative action, though states with constitutional protections (like Hawaii) have more stability. Plan conservatively by assuming modest property tax increases over time—typically 2-3% annually. Build this assumption into your investment return projections. States with lowest property tax still maintain rate advantages even after incremental increases. Monitor legislative developments, particularly if a state you’re investing in begins discussing tax increases, but don’t let theoretical future changes prevent optimizing your current situation.

How Do 1031 Exchanges Work When Moving Properties Between High-Tax and Low-Tax States?

1031 exchanges allow tax-deferred exchange of investment real estate without immediate capital gains tax, regardless of state relocation. You have 45 days to identify replacement property and 180 days to complete the exchange. The replacement property must be of equal or greater value and held for investment. This mechanism enables perfect repositioning: sell high-tax property, acquire comparable-value low-tax property, defer all capital gains taxes, and immediately reduce ongoing property tax burden. Many sophisticated investors use 1031 exchanges specifically to optimize state positioning for 2026 and beyond.

Should I Invest Only in States with Lowest Property Tax, or Maintain Geographic Diversification?

Sound investment strategy balances tax efficiency with geographic diversification and market opportunity. While states with lowest property tax offer significant advantages, don’t sacrifice portfolio diversification solely for tax optimization. Maintain exposure to multiple markets for risk mitigation and opportunity capture. When choosing between comparable investment opportunities, property tax burden becomes the deciding factor favoring low-tax jurisdictions. Most sophisticated investors maintain 60-70% of portfolios in tax-efficient states while preserving 30-40% in higher-return or opportunistic markets.

What Are the Hidden Costs or Complications of Owning Property in Low-Tax States?

Some low-tax states require property to be held through specific legal structures, or limit non-resident ownership. Hawaii, for example, has restrictions on agricultural land and some residential properties. Delaware requires registered agent services for business entities. These considerations add minor costs but don’t eliminate tax advantages. Research state-specific ownership requirements before acquiring property. Our team can guide you through any structural requirements to ensure compliant, tax-efficient ownership of low-tax state properties.

How Can I Combine Property Tax Optimization with Other Real Estate Tax Strategies Like Cost Segregation?

Cost segregation and property tax optimization work synergistically to maximize after-tax returns. Cost segregation accelerates depreciation deductions, particularly on building components with 5-, 7-, or 15-year recovery periods. Combined with low property tax burden, this creates multiplicative benefits. An investor implementing cost segregation on a Hawaii property benefits from both rapid depreciation deductions and minimal ongoing property tax. These strategies coordinate naturally—invest in low-tax states, implement cost segregation, and layer additional deductions through strategic entity structuring for maximum tax efficiency.

This information is current as of January 26, 2026. Tax laws change frequently. Verify updates with the IRS or state tax authorities if reading this later.

Last updated: January, 2026