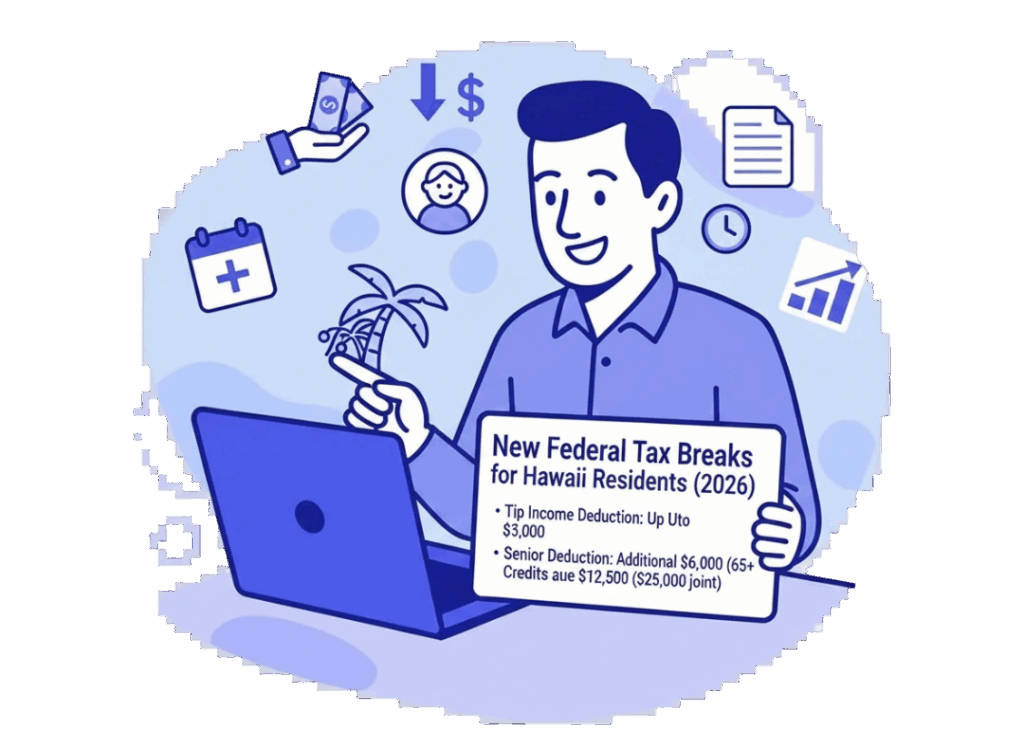

On January 1, 2026, the federal tax landscape shifted in a positive and historic way. The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, made permanent the major tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) and introduced new, taxpayer-friendly benefits. The long-dreaded 2026 “tax cliff” has been averted.

For Hawaii residents, who navigate both a high cost of living and a state income tax, these permanent federal changes provide significant and welcome relief. This guide breaks down exactly how the new OBBBA tax law impacts every Hawaii taxpayer—from W-2 earners in Honolulu and tourism professionals in Maui to business owners in Kona and retirees across the islands.

The biggest news is that the lower individual income tax rates from the TCJA are now permanent. The anticipated jump in federal tax rates has been avoided.

This is a crucial win for Hawaii’s working families. In a state with such

a high cost of living, having lower, predictable federal tax rates provides much-needed breathing room. Dual-income households in Honolulu, military families, and professionals in the healthcare and tourism sectors will all benefit from keeping more of their hard-earned money.

Hawaii Impact:

The 20% Qualified Business Income (QBI) Deduction is not expiring. OBBBA made it a

permanent part of the federal tax code and even improved it.

Important Note for Hawaii: Hawaii is a non-conforming state, meaning it does not offer a

state-level QBI deduction. However, this powerful 20% deduction remains fully available on your federal tax return.

Key OBBBA Enhancements to QBI:

For the thousands of small businesses that drive Hawaii’s economy, the permanent federal QBI deduction provides certainty and significant federal tax savings. Strategic planning to maximize this federal benefit is more important than ever.

Hawaii has a progressive state income tax with rates up to 11%. Unlike many states, Hawaii also taxes most forms of retirement income, including pensions and IRA/401(k)

distributions.

No — QBI is federal-only.

Most Hawaii residents will see higher federal taxable income due to deduction and bracket changes.

Yes — reduced credits will affect many Hawaii families.

Yes — reduced depreciation and stricter rules apply.

Yes — federal changes also influence Hawaii state taxation of retirement income.

Living in paradise comes with a unique financial landscape. The new, permanent federal tax

laws under OBBBA provide a powerful tailwind for Hawaii residents. To make the most of it,

you need a strategy that aligns these federal benefits with your specific situation in Hawaii.

A personalized strategy session will ensure you are structured to capture every new and

permanent advantage.

Because tax situations vary by individual and business, many Hawaii residents choose to work with a qualified tax professional. You can explore available Hawaii tax services here: