2026 S-Corp Tax Changes: Stability and New Strategic Opportunities

For S-Corporation owners, the tax landscape has fundamentally shifted. The One, Big, Beautiful Bill Act (OBBBA) has made key provisions of the Tax Cuts and Jobs Act (TCJA) permanent, providing stability and creating new opportunities for strategic tax planning.

This guide explains what the permanent changes mean for your S-Corp, how to navigate the new rules, and what you should be doing now to optimize your tax position.

Some S-Corp owners will see $8,000–$25,000+ increases if they don’t adjust their structure before the deadline.

This is the official 2026 S-Corp guide.

QBI Deduction for S-Corps is PERMANENT

The most significant development for S-Corp owners is the permanent extension of the 20% Qualified Business Income (QBI) Deduction. This valuable deduction, which was scheduled to expire, will continue to be a cornerstone of tax planning for S-Corps, allowing owners to deduct up to 20% of their qualified business income.

This provides much-needed certainty and ensures that S-Corps will continue to benefit from this powerful tax-saving provision.

Key Federal Tax Changes for S-Corps under OBBBA

OBBBA has brought clarity to the future of S-Corp taxation. Here’s a summary of the new reality:

| Tax Provision | The Old Fear (Pre-OBBBA) | The New Reality (Post-OBBBA) |

|---|---|---|

| QBI Deduction | Expiring in 2026 | Permanent |

| Individual Tax Brackets | Rising to pre-TCJA levels | Permanent at lower TCJA rates |

| Standard Deduction | Dropping by nearly 50% | Permanent and increasing with inflation |

| SALT Deduction | Capped at $10,000 | Increased to $40,000 for most taxpayers |

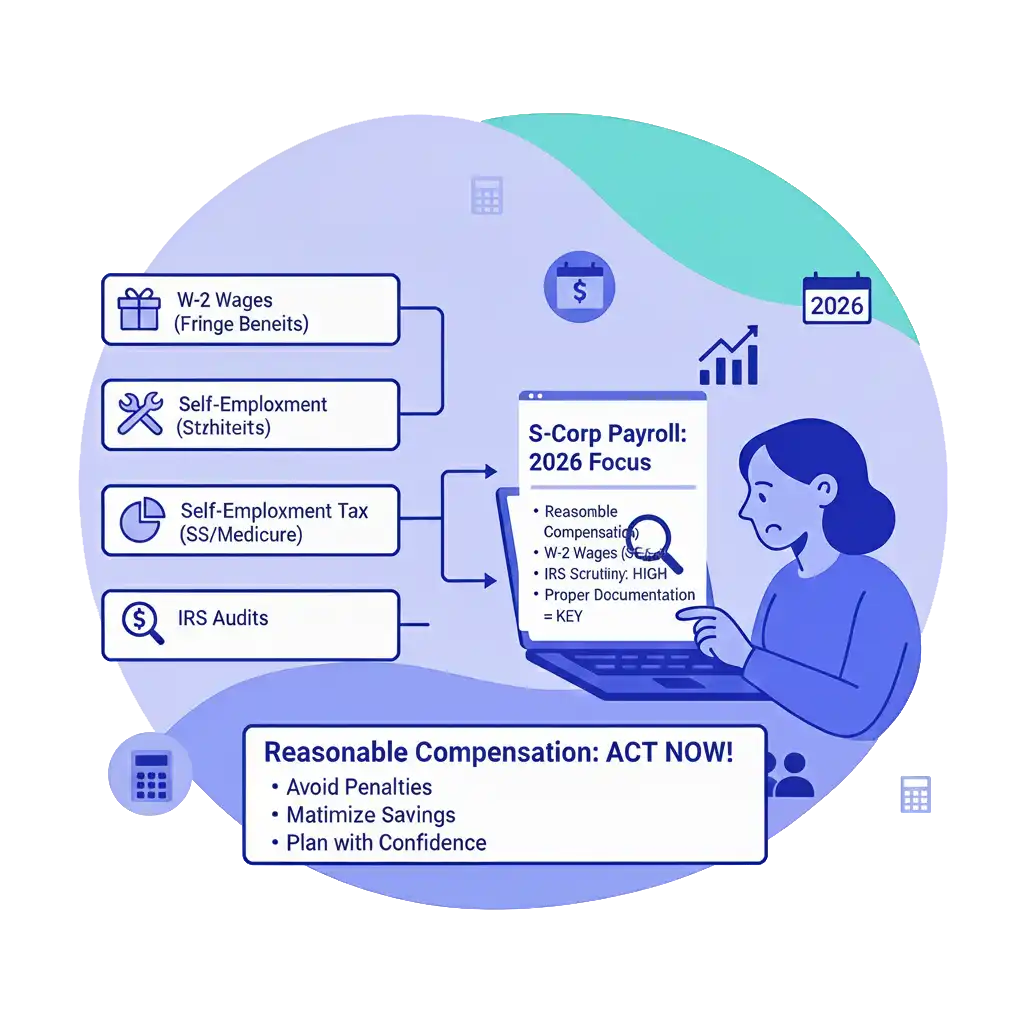

Reasonable Compensation and Payroll Rules

One of the most critical aspects of running an S-Corp is paying yourself a “reasonable compensation” as a W-2 wage. This is the portion of your income that is subject to self-employment taxes (Social Security and Medicare).

With the new tax landscape, it is more important than ever to ensure your reasonable compensation is properly calculated and documented. The IRS continues to scrutinize this area, and with the permanence of the current tax structure, there is no reason to delay a proper analysis.

Is the S-Corp Election Still the Best Choice?

For many profitable small businesses, the S-Corp election remains the default smart structure. The ability to split income between a reasonable salary and distributions (which are not subject to self-employment taxes) is a powerful tool for reducing your overall tax liability.

While the permanent QBI deduction benefits all pass-through entities, the S-Corp structure provides an additional layer of tax savings that is not available to sole proprietorships or partnerships.

New Deductions for S-Corp Owners

OBBBA introduced several new deductions that can further reduce the taxable income of S-Corp owners:

Deduction for Tips

A new deduction for a portion of tip income

Deduction for Overtime

A new deduction for a portion of overtime pay

Deduction for Auto Loan Interest

A new deduction for interest paid on auto loans.

What S-Corp Owners Should Do Now

- Review Your Reasonable Compensation: Ensure your salary is appropriate for your industry and role, and that it is well-documented.

- Optimize Your Payroll and Distributions: Work with a tax professional to find the right balance between salary and distributions to minimize your tax liability.

- Maximize Retirement Contributions: Take full advantage of retirement plans like Solo 401(k)s and SEP IRAs to shelter more of your income from taxes.

Frequently Asked Questions

Is QBI definitely ending?

No. The OBBBA made the QBI deduction permanent.

Do S-Corp owners pay more in 2026?

No. With the permanent extension of the QBI deduction and lower tax brackets, most S-Corp owners will be in a better tax position than if the TCJA had expired.

Is S-Corp still better than an LLC in 2026?

For many profitable businesses, the S-Corp structure offers significant tax advantages over a standard LLC due to the savings on self-employment taxes.

Get Your Custom 2026 S-Corp Tax Plan

2026 will reshape S-Corp taxation across the entire country.

Your payroll structure, distributions, retirement planning, and deduction strategy MUST be aligned before December 31, 2025.