2026 Child Tax Credit: Good News for Families

The One, Big, Beautiful Bill Act (OBBBA) has brought welcome stability to the Child Tax Credit (CTC), making the $2,000 credit per child a permanent feature of the tax code. The feared reduction of the credit is no longer a concern for American families.

This guide explains the permanent rules for the Child Tax Credit, who is eligible, and what it means for your family’s finances.

The Child Tax Credit is PERMANENTLY $2,000 Per Child

The most important news for families is that the $2,000 Child Tax Credit is now permanent. This means that for each qualifying child under the age of 17, you can reduce your tax liability by up to $2,000.

Key Features of the Permanent Child Tax Credit

| Feature | The New Reality (Post-OBBBA) |

|---|---|

| Credit Amount | $2,000 per qualifying child |

| Refundable Portion | Up to $1,400 per child |

| Income Phaseouts | Stable and adjusted for inflation |

| Credit for Other Dependents | $500 per dependent (permanent) |

Understanding Refundability

A portion of the Child Tax Credit is “refundable,” which means you can receive it as a refund even if you don’t owe any federal income tax. Under the permanent rules, up to $1,400 of the credit is refundable for each qualifying child.

Income Phaseouts

The Child Tax Credit is subject to income limitations. The credit begins to phase out for taxpayers with modified adjusted gross income (MAGI) above:

- $400,000 for married couples filing jointly

- $200,000 for all other filers (single, head of household)

These income thresholds are now a stable part of the tax code, providing predictability for families.

Credit for Other Dependents

For dependents who do not qualify for the Child Tax Credit (such as children age 17 or older, or other relatives), the $500 Credit for Other Dependents is also permanent.

Strategic Planning for Families

With the Child Tax Credit now a stable part of the tax code, families can focus on long-term financial planning. For business owners, the interaction between the Child Tax Credit and the permanent QBI deduction is an important area for strategic planning. By optimizing your business income and deductions, you can maximize your eligibility for both of these valuable tax benefits.

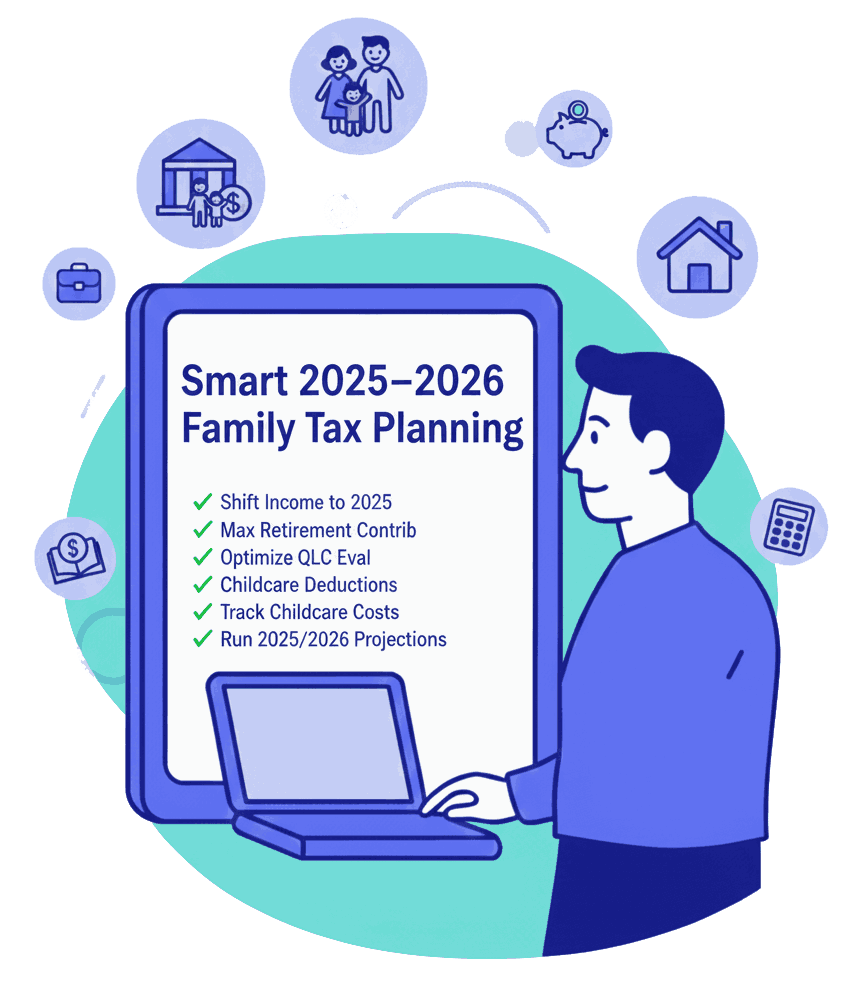

Smart 2025–2026 Family Tax Planning Moves

- Shift income into 2025 if near phaseout thresholds

- Use retirement contributions to reduce AGI

- Maximize QBI under new OBBBA rules

- Evaluate S-Corp vs LLC restructuring

- Claim home office + childcare business deductions (if applicable)

- Correctly aggregate child-related credits

- Track childcare expenses for dependent care credits

- Understand split-custody rules

- Run projections for 2025 vs 2026 refunds

Because the Child Tax Credit shrinks in 2026, families must plan early to avoid surprises.

Frequently Asked Questions

Is the Child Tax Credit really shrinking in 2026?

No. The OBBBA made the $2,000 Child Tax Credit permanent.

Does OBBBA change the Child Tax Credit?

Yes, OBBBA made the $2,000 credit permanent, preventing it from reverting to the pre-TCJA amount of $1,000.

Will my 2026 refund be smaller?

Not necessarily. The refundable portion of the Child Tax Credit is a stable $1,400 per child.

Protect Your Family Before the 2026 Child Tax Credit Shrinks

Families must plan to offset the loss of the Child Tax Credit in 2026.

Your AGI, deductions, entity structure, and income timing matter more than ever.