2026 Capital Gains Changes — What Investors Must Prepare For Before Year-End 2025

On January 1, 2026, the capital gains tax system shifts dramatically as the Tax Cuts and Jobs Act (TCJA) expires and new OBBBA adjustments take effect.

This impacts every type of investor:

- Stock investors

- Crypto holders

- Real estate investors

- Business owners planning exits

- Short-term rental investors

- Long-term rental property owners

- High-income earners

- Retirees selling appreciated assets

Even though OBBBA preserves many business benefits (like QBI), it does NOT protect capital gains from reverting back to pre-2018 rules.

For many investors, capital gains could be thousands to tens of thousands higher in 2026.

This guide explains everything you need to know.

IRS-Aligned Projections

All data based on TCJA reversion + OBBBA adjustments.

Maximum Savings Promise

If we miss a legal capital gains strategy, we redo your plan free.

100% Accuracy Guarantee

Reviewed by licensed MERNA™ Strategists specializing in real estate + investment tax law.

Capital Gains Thresholds Drop Sharply in 2026

Under 2018–2025 rules, capital gains had HIGH thresholds before hitting higher rates.

In 2026, thresholds drop back to pre-TCJA levels, adjusted for inflation.

The biggest change?

You hit the 20% capital gains rate faster in 2026.

This is especially painful for:

- Real estate sales

- Crypto liquidation

- Stock cash-outs

- Business sales (partial or full exits)

Higher Ordinary Income Brackets Affect Short-Term Capital Gains

Short-term capital gains (profits on assets held <1 year) are taxed at ordinary income rates.

In 2026, those rates rise sharply:

👉 Meaning: If you flip stocks, trade crypto frequently, or sell investments within 12 months…

Your tax bill will go up automatically.

Real Estate Investors Are Hit the Hardest in 2026

Capital gains changes impact:

- Rental property owners

- STR (Airbnb/VRBO) operators

- REIT investors

- Fix-And-Flippers

- BRRRR investors

- Long-term landlords

- Real estate professionals

Key changes:

1. Depreciation recapture remains at 25%

This doesn’t change, but because 2026 brackets are higher, planning becomes more important.

2. Cost segregation benefits shrink

Bonus depreciation phases out:

- 2025 → 40%

- 2026 → 20%

- 2027 → 0%

Lower bonus depreciation = higher taxable gain on sale.

3. 20% CG threshold drops faster

High-appreciation markets (CA, TX, FL, AZ, NC) will trigger 20% earlier.

4. 1031 exchange pressure increases

More investors will try to exchange → more competition → more timing risk.

5. REPS rules interact differently with capital gains

OBBBA modifies QBI + REPS coordination rules starting in 2026.

2025 is the last “flexible” year for real estate tax strategies.

Crypto & Stock Investors Face Higher Tax Bills

Crypto + equities investors will pay more due to:

- lower capital gains thresholds

- higher ordinary income rates for short-term gains

- new IRS reporting enforcement

- expanded 1099-DA for digital assets

- AI-driven audit flags for unreported trades

- wash-sale rules expected to expand to crypto

If you have large unrealized gains in crypto or stocks, 2025–2026 planning is critical.

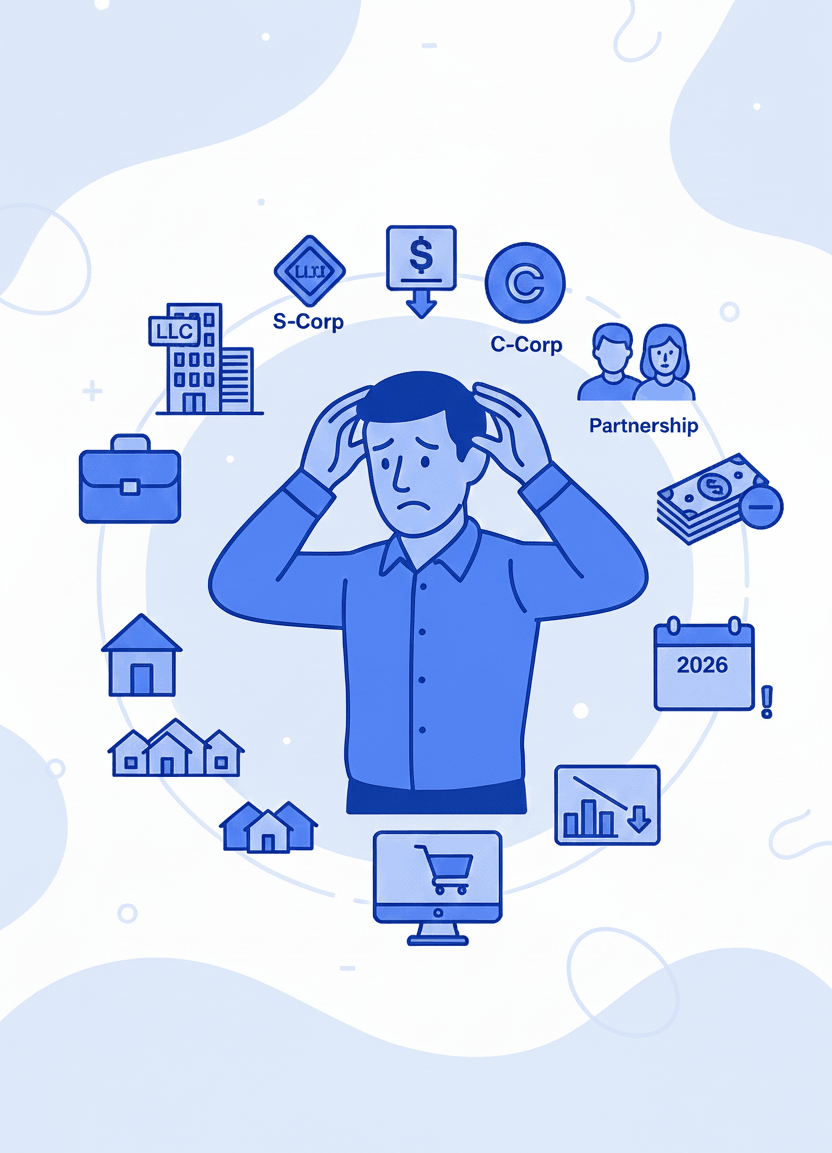

Business Owners Selling a Business in 2026

Business exits are the biggest losers in the 2026 capital gains shift.

- an LLC

- S-Corp

- C-Corp

- Partnership share

- Real estate portfolio

- Online business

…you could lose:

- millions in tax

- due to lower S-Corp goodwill thresholds

- lower QSBS qualification limits

- higher CG thresholds

- new OBBBA rules for basis adjustments

If someone wants to sell a business between 2025–2027, timing is EVERYTHING.

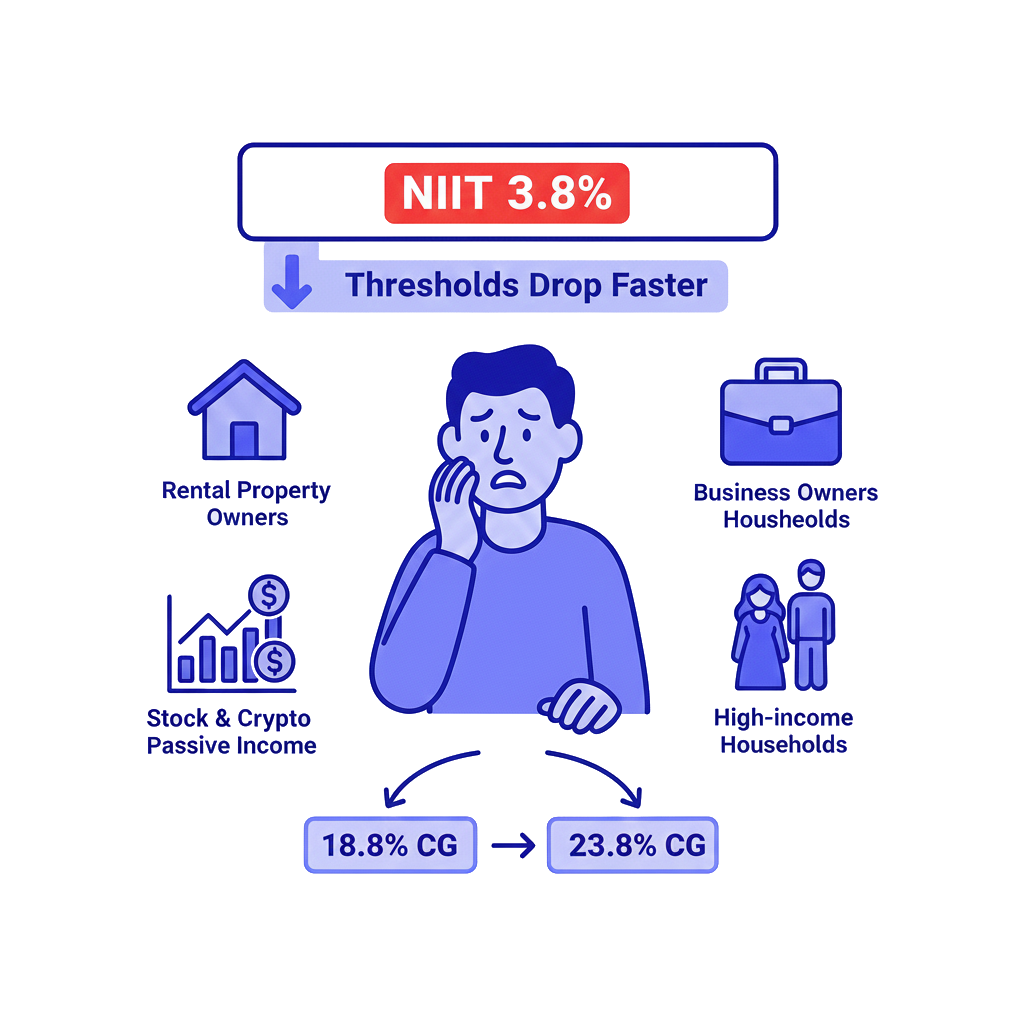

The Net Investment Income Tax (NIIT) Hits More People

- high-income households

- passive real estate investors

- stock/crypto traders

- rental property owners

- business owners with passive income streams

Because thresholds drop faster in 2026, MORE taxpayers get hit by NIIT.

This pushes many investors into:

- 18.8%

- or even 23.8% combined capital gains rates.

Strategies to Reduce 2026 Capital Gains Taxes

- Sell appreciated assets in 2025 to lock in lower rates

- Harvest gains strategically in 2025

- Harvest losses to offset 2026 gains

- Do 1031 exchanges earlier in 2025

- Use installment sales for business exits

- Execute opportunity zone strategies

- Use DSTs / structured sales

- Reclassify rentals for REPS qualification

- Explore tax-deferred business exit strategies

- Accelerate depreciation while bonus depreciation exists

- Complete entity restructuring before sale

This section is a monster conversion point for high-income investors.

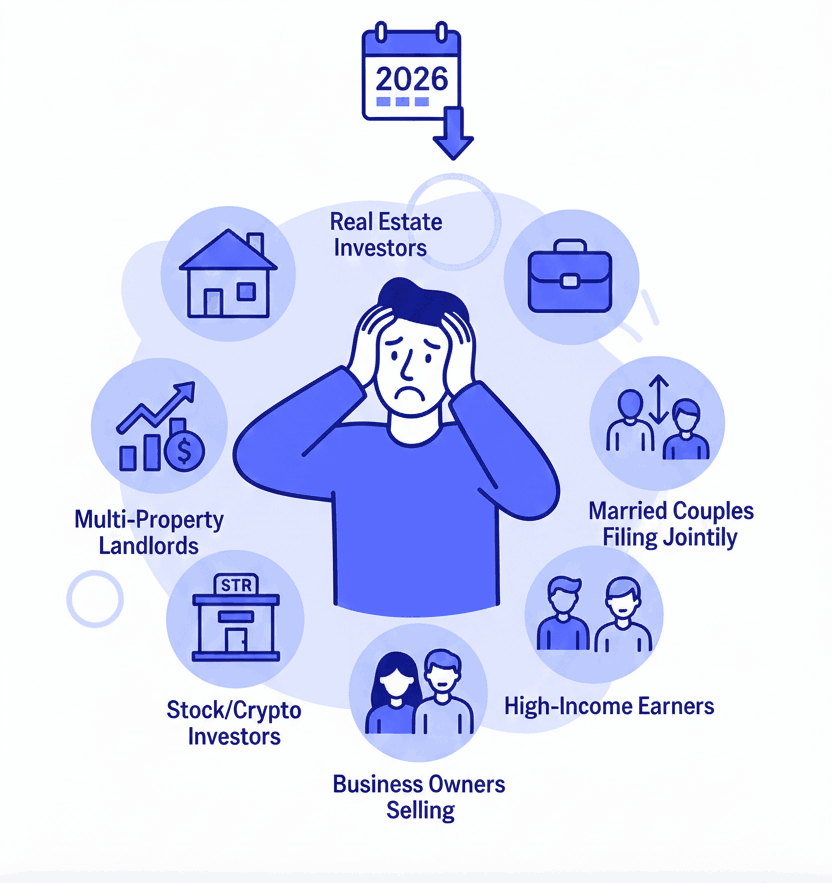

Who Gets Hit the Hardest by 2026 Capital Gains Changes

- Real estate investors

- Stock investors with large gains

- Crypto investors

- High-income earners

- Married couples filing jointly

- Business owners selling a company

- STR operators

- Retirees selling appreciated assets

- Investors in high-appreciation markets

- Multi-property landlords

This page is core to attracting high-ticket tax planning customers.

2026 Capital Gains FAQ

Are capital gains taxes going up in 2026?

Yes — thresholds drop and more gains fall into the 20% bracket.

Does OBBBA protect capital gains?

No — it preserves QBI, but capital gains revert to pre-TCJA rules.

Do real estate investors get hit the hardest?

Yes — depreciation, 1031 pressure, and lower thresholds all compound.

Should I sell property before 2026?

It depends — but selling high-appreciation assets in 2025 often saves thousands.

Does the NIIT change?

The rate doesn’t change, but more people fall into NIIT due to threshold shifts.

Should I harvest gains or losses?

Yes — both can reduce exposure to 2026 tax increases.

Get a 2026 Capital Gains Strategy Before the Deadline

Capital gains changes will hit investors HARD in 2026.

Stocks, crypto, real estate, and business sales all become more expensive.

Your strategy must be aligned before December 31, 2025.