2026 Tax Law Changes Are Here: How the One, Big, Beautiful Bill Act (OBBBA) Just Changed Everything

This affects every U.S. taxpayer, but in ways you might not expect:

- W-2 wage earners

- Parents

- Seniors

- Homeowners

- Small businesses (LLCs, S-Corps, and partnerships)

- Realtors and real estate investors

- Realtors and real estate investors

- High-income households

If you don’t plan for these changes BEFORE December 31, 2025, you could miss out on thousands of dollars in new deductions and credits.

This page breaks down EVERY 2026 tax law change under OBBBA in simple, clear language — no legal jargon.

Guaranteed Strategy Backed by the New Law

Every projection here ties directly to the One, Big, Beautiful Bill Act (Public Law 119-21) and official Treasury guidance [1].

Maximum Savings Promise

If you qualify for a new tax-saving strategy under OBBBA and we miss it, we’ll redo your plan for free.

100% Accuracy Guarantee

All strategies are reviewed by a licensed MERNA™ Strategist who is an expert in the new 2026 tax laws.

The Standard Deduction Is Here to Stay (And It’s Bigger)

Forget what you heard about the standard deduction disappearing. OBBBA made the higher standard deduction permanent and even increased it slightly.

Who Benefits the Most from This?

- The vast majority of American taxpayers who will continue to enjoy simplified tax filing.

- Married couples, homeowners, and families with children who rely on the higher deduction.

- Taxpayers in high-cost-of-living states (CA, NY, NJ, MA, WA) who will still benefit from a large standard deduction, even with the increased SALT cap.

Because the standard deduction remains high, fewer Americans will be forced to itemize, simplifying tax time for millions.

2026 Tax Brackets Remain Low

Every tax bracket that was lowered by the TCJA will remain at those lower rates thanks to OBBBA [3]. The new law prevents the scheduled tax hikes, keeping more money in your pocket.

These benefits:

- Households earning $75K–$400K who will avoid a significant tax increase.

- Dual-income families, medical professionals, and tech workers who will continue to benefit from the lower rates.

- Small business owners reporting pass-through income.

QBI (20% Pass-Through Deduction) Is Now PERMANENT and IMPROVED

This is one of the MOST important changes for anyone with:

- LLC income

- Sole proprietor income

- S-Corp income

- Partnership K-1s

The rumor was that the 20% QBI deduction was ending. The reality? OBBBA made it permanent and even enhanced it [4].

Here’s what’s new for QBI in 2026:

- It’s PERMANENT: The 20% deduction is here to stay.

- Wider Phase-In Ranges: The income levels at which the deduction begins to phase out have been expanded, allowing more high-income earners to qualify [4].

- New $400 Minimum Deduction: If you have at least $1,000 in qualified business income, you’re guaranteed a minimum $400 deduction [4].

This is one of the top planning opportunities of the 2025 tax year.

Child Tax Credit INCREASED to $2,200

The current webpage claims the Child Tax Credit is shrinking. This is completely wrong.

Under OBBBA, the Child Tax Credit has been INCREASED to $2,200 per child for 2025 and is now indexed to inflation for future years [5]. The refundable portion has also been significantly increased, putting more money back in the hands of families.

This is a huge win for:

- Parents

- Single mothers

- Married couples with dependents

- Families with 2–4 children

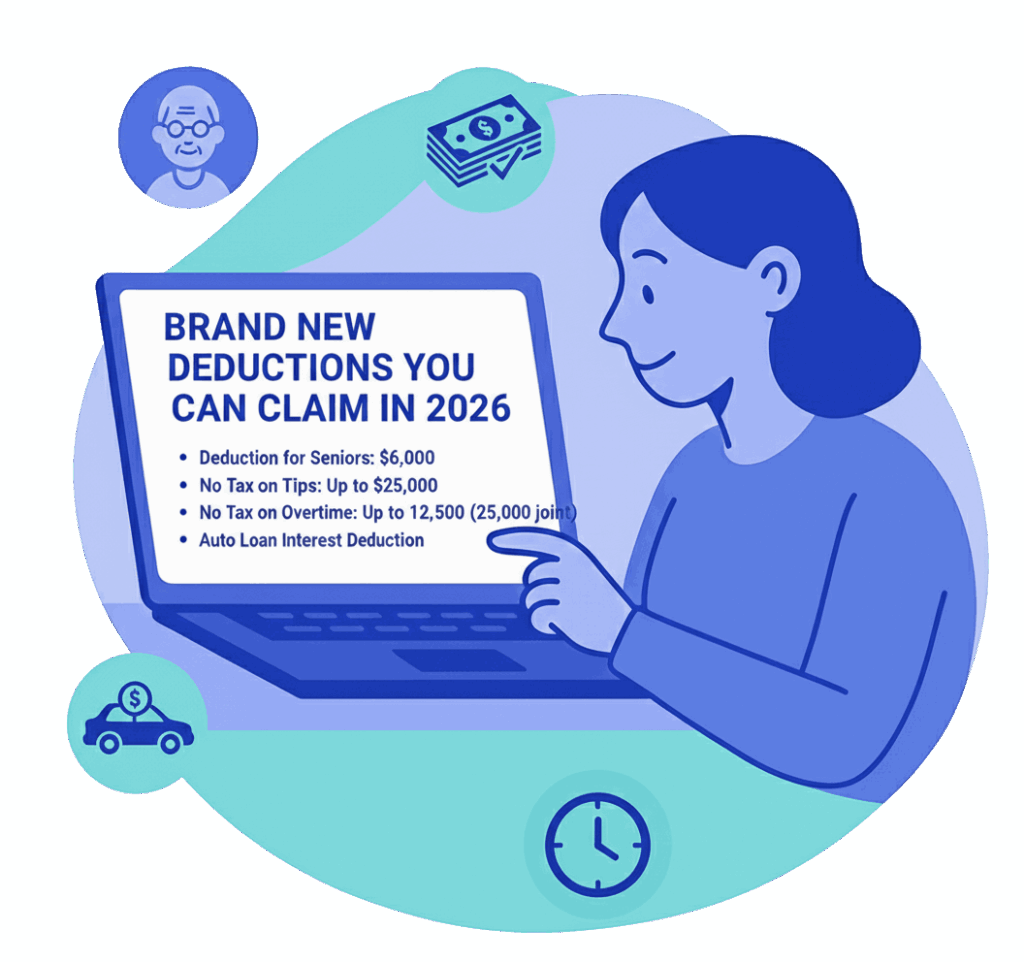

Brand New Deductions You Can Claim in 2026

OBBBA introduced several new, powerful deductions that could significantly lower your tax bill:

- Deduction for Seniors: A new $6,000 deduction for taxpayers age 65 and older [3].

- No Tax on Tips: Up to $25,000 in tip income is now deductible [3].

- No Tax on Overtime: Deduct up to $12,500 ($25,000 for joint filers) of qualified overtime pay [3].

- Auto Loan Interest Deduction: A new deduction for interest paid on car loans [3].

What You MUST Do Before December 31, 2025

- Re-evaluate your tax strategy: The entire landscape has changed. Your old plan is now obsolete.

- Meet with a tax strategist: Understand how these new deductions and permanent provisions affect you.

- Analyze your business structure: With the permanent QBI deduction, is your current entity structure still the most tax-efficient?

- Plan for new deductions: Start tracking your tip income, overtime, and auto loan interest to maximize your savings in 2026.

The year 2025 is the first window to get ahead of these massive, beneficial changes.

2026 Tax Law Changes FAQ (The OBBBA Edition)

Are my taxes going up in 2026?

For most people, no. OBBBA made the TCJA tax cuts permanent, preventing a scheduled tax increase for 62% of taxpayers [2]. Many will see their taxes go down thanks to new deductions.

Is the Standard Deduction really safe?

Yes. It’s now a permanent part of the tax code and was even slightly increased [2].

What happened to the SALT deduction cap?

With the QBI deduction now permanent and enhanced, this is a critical question. A tax strategist can help you determine the best structure for your business under the new law.

Should LLCs switch to S-Corp before 2026?

If your net income is $60K–$200K, the answer is often yes.

Is there anything I can do to maximize these new benefits?

Absolutely. Proactive planning is key. A personalized 2025-2026 tax plan will ensure you take full advantage of every new deduction and credit available to you.

Get Your 2026 Tax Strategy

The biggest tax shift in years is here. Your strategy must be updated BEFORE December 31, 2025.