2026 Tax Filing Guide — What Every American Needs To Know Before April 2027

Welcome to the new era of tax filing. Thanks to the One, Big, Beautiful Bill Act (OBBBA), the tax landscape for 2026 is more stable and predictable than it has been in years. The feared expiration of the Tax Cuts and Jobs Act (TCJA) is off the table, and most of its key provisions are now a permanent part of the U.S. tax code.

- W-2 employees

- Self-employed individuals and freelancers

- LLC & S-Corp owners

- Investors in stocks, crypto, and real estate

- Families and retirees

This guide provides everything you need to know to file your 2026 taxes confidently. We’ll cover what’s permanent, what’s still changing, and how to navigate the filing season with clarity.

The 2026 Tax Landscape: Certainty is the New Normal

OBBBA has locked in the most important parts of the TCJA. The constant worry about a massive tax hike has been replaced with a stable foundation for financial planning.

| Tax Provision | The Old Fear (Pre-OBBBA) | The New Reality (Post-OBBBA) |

|---|---|---|

| Federal Tax Brackets | Reverting to higher, pre-2018 levels | Permanent at the lower TCJA rates |

| Standard Deduction | Being cut in half | Permanent and higher (adjusts for inflation) |

| Child Tax Credit | Shrinking from $2,000 to $1,000 | Permanent at $2,000 per child |

| QBI Deduction | Expiring completely | Permanent 20% deduction for pass-through businesses |

This stability means you can now engage in long-term tax planning without the threat of a looming “tax cliff.”

What IS Still Changing in 2026?

- 1. The Federal Estate Tax Exemption: This is the big one. The exemption is still scheduled to be cut in half on January 1, 2026, dropping from over $13 million per person to a projected ~$7 million. This is a critical deadline for high-net-worth individuals and business owners.

- 2. Bonus Depreciation: The phase-out of bonus depreciation continues. For assets placed in service in 2026, the bonus depreciation rate is only 20%, down from 40% in 2025 and 100% in prior years. This impacts real estate investors and businesses that make large equipment purchases.

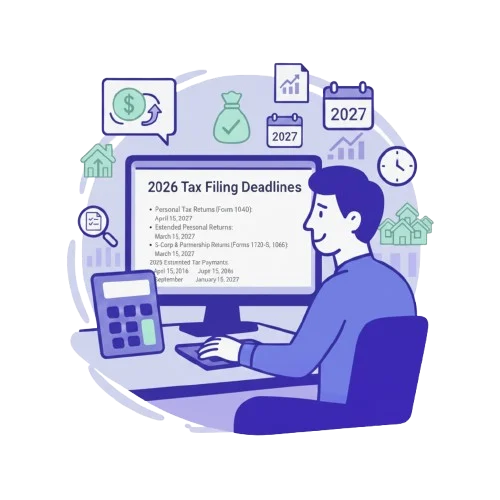

2026 Tax Filing Deadlines

With a stable tax code, the filing deadlines return to their normal, predictable schedule.

- Personal Tax Returns (Form 1040): April 15, 2027

- Extended Personal Returns: April 15, 2027

- S-Corp & Partnership Returns (Forms 1120-S, 1065): March 15, 2027

- C-Corporation Returns (Form 1120): April 15, 2027

- 2026 Estimated Tax Payments: Due on April 15, 2026; June 15, 2026; September 15, 2026; and January 15, 2027.

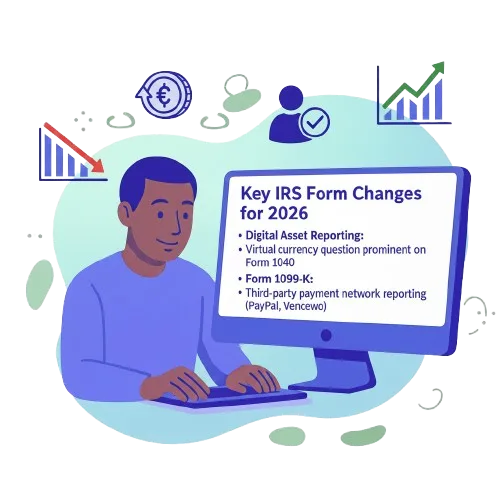

Key IRS Form Changes for 2026

Because the tax code is now stable, you can expect IRS forms to be more consistent year-over-year. The massive annual changes and form redesigns to account for expiring laws are a thing of the past. The primary updates will involve inflation adjustments and continued focus on specific reporting areas, such as:

- Digital Asset Reporting: The question about virtual currency transactions will remain prominent on Form 1040.

- Form 1099-K: Reporting thresholds for third-party payment networks (like PayPal and Venmo) remain a key focus for the IRS.

Smart Filing Strategies for the New Era of Tax Stability

The conversation has shifted from short-term, deadline-driven tactics to long-term, strategic planning.

- 1. Focus on Long-Term Goals: With stable tax brackets, you can more effectively plan for retirement, investments, and other long-term financial goals.

- 2. Optimize Your Business Structure: Now is the time to ensure your business entity (LLC, S-Corp, etc.) is the most tax-efficient for the long haul, especially with the permanent QBI deduction.

- 3. Strategic Retirement Contributions: Maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs to reduce your taxable income in a predictable environment.

- 4. Meticulous Record-Keeping: While the rules are stable, IRS enforcement is not. Maintain excellent records for all deductions, especially for home office, vehicle, and business travel expenses.

2026 Tax Filing FAQ

Will my taxes go up in 2026?

Is QBI still available?

Yes, the 20% Qualified Business Income (QBI) deduction is now a permanent part of the tax code.

Do I need a strategy BEFORE 2026?

Yes, but the strategy has changed. The only urgent deadline is for estate tax planning. For all other areas, the focus should be on creating a sustainable, long-term tax strategy that optimizes your finances in this new, stable environment.

Get Your Personalized 2026 Tax Filing Plan

2026 brings the largest tax shift in years.

Your bracket, deductions, credits, entity structure, and investment strategy MUST be aligned before December 31, 2025.