Oklahoma 2026 Tax Changes — What Residents & Business Owners Must Know

Beginning January 1, 2026, major federal tax changes take effect as many provisions from the Tax Cuts and Jobs Act expire and updated rules continue under the One Big Beautiful Bill Act (OBBBA).

Oklahoma residents — who pay a progressive state income tax tied to federal AGI — will feel these changes directly.

- W-2 earners across Oklahoma City, Tulsa, Norman, Edmond, Broken Arrow

- Oil and gas industry workers, trades, and manufacturing employees

- Contractors, freelancers, and small business owners

- Real estate investors and landlords

- Short-term rental hosts

- Families with children

- Retirees drawing taxable income

- Dual-income households

Below is a complete Oklahoma-focused summary of the 2026 tax law changes.

Key Federal Changes Affecting Oklahoma in 2026

Standard Deduction Shrinks

The enhanced standard deduction from TCJA expires in 2026. OBBBA does not extend it.

- Single: ~$8,300

- Married Filing Jointly: ~$16,600

- Head of Household: ~$12,400

This significantly increases federal taxable income — and because Oklahoma uses federal AGI as the starting point, state taxable income rises too.

Federal Tax Brackets Increase

- 12% → 15%

- 22% → 28%

- 24% → 31%

- dual-income families

- oilfield workers with high overtime

- teachers, nurses, and state workers

- contractors and trades

- households earning $50K–$200K

Higher federal tax liability increases the amount of income taxed at the Oklahoma state level.

QBI Deduction Made Permanent Under OBBBA

OBBBA permanently preserved the 20% Qualified Business Income (QBI) deduction for:

- LLCs

- S-Corps

- sole proprietors

- contractors

- freelancers

- qualified rental operations

However, new QBI thresholds, wage rules, and documentation requirements begin in 2026.

Oklahoma does not apply a matching state-level QBI deduction.

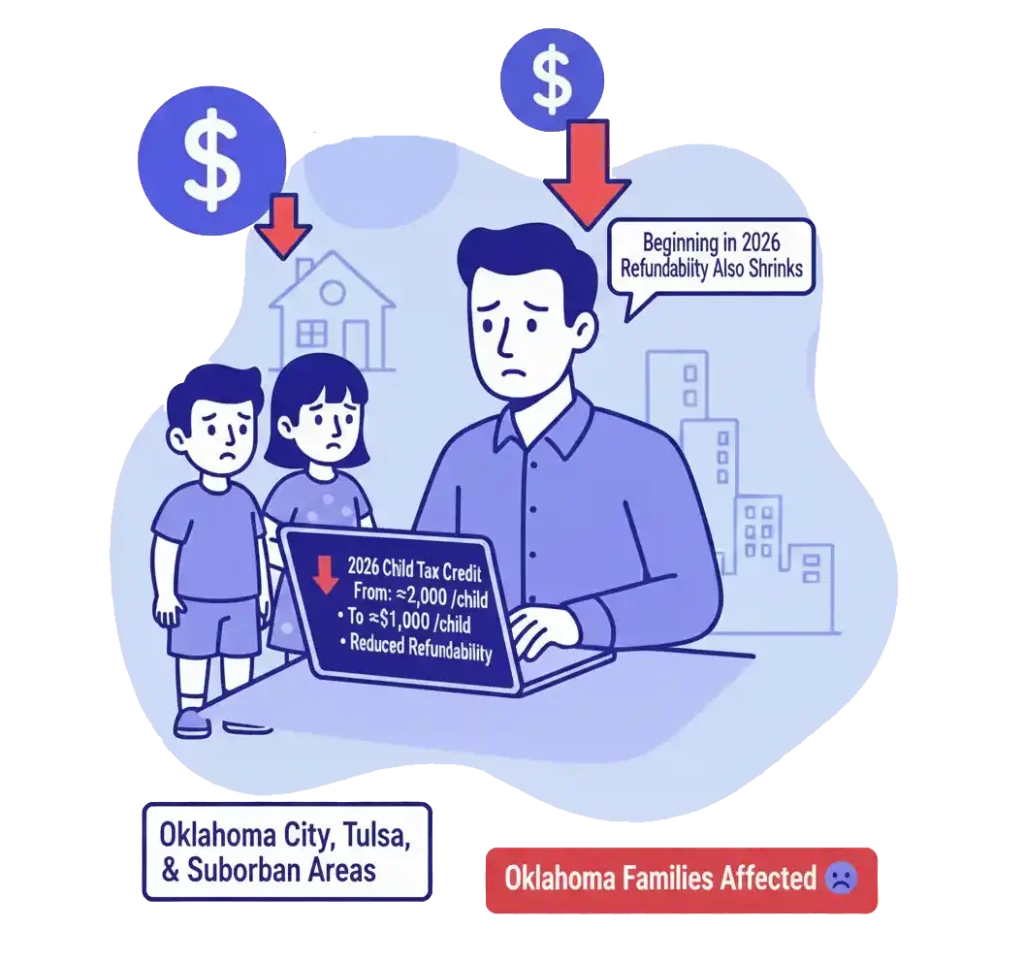

Child Tax Credit Shrinks

- Federal Child Tax Credit decreases from about $2,000

- To roughly $1,000 per child

- Refundability is reduced

Families in Oklahoma City, Tulsa, and suburban areas will notice reduced refunds.

Marriage Penalty Returns

TCJA temporarily eased the marriage penalty, but OBBBA allows it to expire.

- married couples reach higher brackets sooner

- credit eligibility is reduced

- joint incomes push federal AGI up

- Oklahoma state taxes increase as a result

Dual-income households will feel this most.

Oklahoma–Specific Tax Considerations

1.Oklahoma Uses Federal AGI to Calculate State Taxes

Because Oklahoma’s state tax is based on federal AGI:

- higher federal taxable income

- fewer federal deductions

- reduced federal credits

…all directly increase Oklahoma state taxable income.

This impacts many Oklahoma families, especially in metro areas.

2.Oil & Gas Workers Are Strongly Impacted

Oklahoma’s workforce includes a large number of employees in:

- oil and gas extraction

- pipeline and refinery operations

- energy support services

- manufacturing and logistics

These workers often experience:

- high overtime

- varied income

- travel pay issues

Federal bracket increases magnify tax liability on this type of income.

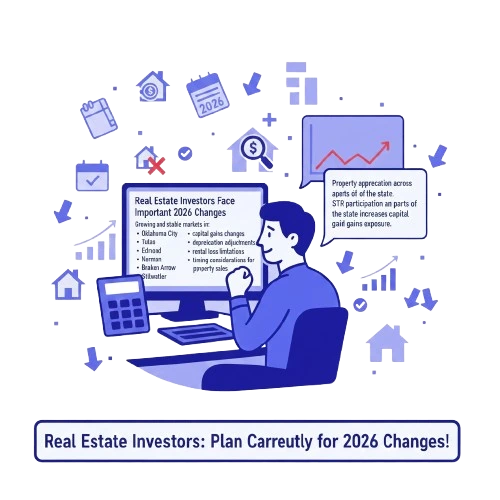

3. Real Estate Investors Face Important 2026 Changes

Growing and stable markets in:

- Oklahoma City

- Tulsa

- Edmond

- Norman

- Broken Arrow

- Stillwater

will be affected by:

- capital gains changes

- depreciation adjustments

- rental loss limitations

- STR participation and compliance rules

- timing considerations for property sales

Property appreciation across parts of the state increases capital gains exposure.

4. STR Owners Must Prepare for Updated Rules

Short-term rental activity is common in:

- Oklahoma City

- Tulsa

- University towns

- Lake and recreation areas

- reduced bonus depreciation

- stricter IRS participation tests

- updated safe harbor rules

- tighter loss limitations

5. Retirement Income Planning Is More Important Than Ever

Oklahoma taxes many forms of retirement income except select exemptions.

Federal bracket increases raise the cost of:

- IRA withdrawals

- 401(k) distributions

- pension income

- taxable investment withdrawals

Retirees may face increased combined tax burdens.

Who Is Most Affected in Oklahoma (2026)

- Dual-income families

- Oil and gas industry workers

- Contractors and small business owners

- Real estate investors and landlords

- STR operators

- Families with children

- Retirees with taxable income

- Middle-income earners

- Manufacturing and logistics workers

Who Is Most Affected in Oklahoma (2026)

- Review federal and state withholding

- Maximize retirement contributions

- Consider Roth conversions

- Review LLC/S-Corp structure for QBI alignment

- Prepare STR participation documentation

- Evaluate capital gains exposure

- Time property or equipment purchases strategically

- Build a comprehensive federal + Oklahoma tax plan

Oklahoma 2026 Tax FAQ

Does Oklahoma conform to QBI?

No. QBI is federal-only.

Will Oklahoma taxes increase?

State rates remain the same, but taxable income increases due to federal changes.

Are families affected?

Yes. Reduced child credits and higher taxable income reduce refunds.

Are STR owners impacted?

Yes. STR depreciation and participation rules change.

Are retirees affected?

Yes. Higher federal brackets increase tax on withdrawals.

Get a 2026 Oklahoma Tax Strategy

Oklahoma residents face substantial changes beginning in 2026. Reduced deductions, higher brackets, updated rental and business rules, and changes to credit eligibility require advance planning.

Because tax situations vary by individual and business, many Oklahoma residents choose to work with a qualified tax professional. You can explore available Oklahoma tax services here: