New York 2026 Tax Changes — How Permanent Federal Cuts Affect the Empire State

On January 1, 2026, the federal tax landscape underwent a historic and positive transformation. The One Big Beautiful Bill Act (OBBBA ), signed into law on July 4, 2025, made permanent many of the major tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) and introduced new, powerful benefits for taxpayers. The long-feared 2026 “tax cliff” has been avoided.

For residents of New York, a state with one of the highest tax burdens in the nation, this permanent federal relief is a significant development. While it does not change New York’s high state and local income taxes (including the NYC income tax), it provides crucial breathing room on your federal return. This guide provides a clear, localized breakdown of how the permanent tax laws under OBBBA will impact your income, business, and financial strategy in 2026 and beyond.

Permanent Federal Tax Relief for New York Residents

Lower Federal Tax Brackets are PERMANENT

The biggest news is that the lower individual income tax rates from the TCJA are now permanent. The anticipated jump in federal tax rates has been avoided.

New York Impact: This is a crucial win for high-income professionals in finance, law, and tech, as well as dual-income families across the NYC metro area. Lower, predictable federal tax rates help offset New York’s high cost of living and the heavy state and local tax burden.

The Federal Standard Deduction is PERMANENT

The higher federal standard deduction, which simplifies tax filing for millions, is also here to stay.

New York Impact: A permanent, higher federal standard deduction is a direct benefit for the majority of New Yorkers. It provides a substantial, straightforward deduction on your federal return, lowering your taxable income without the need for complex itemization. This is especially important as lower federal AGI can help reduce the impact of phase-outs for state-level credits.

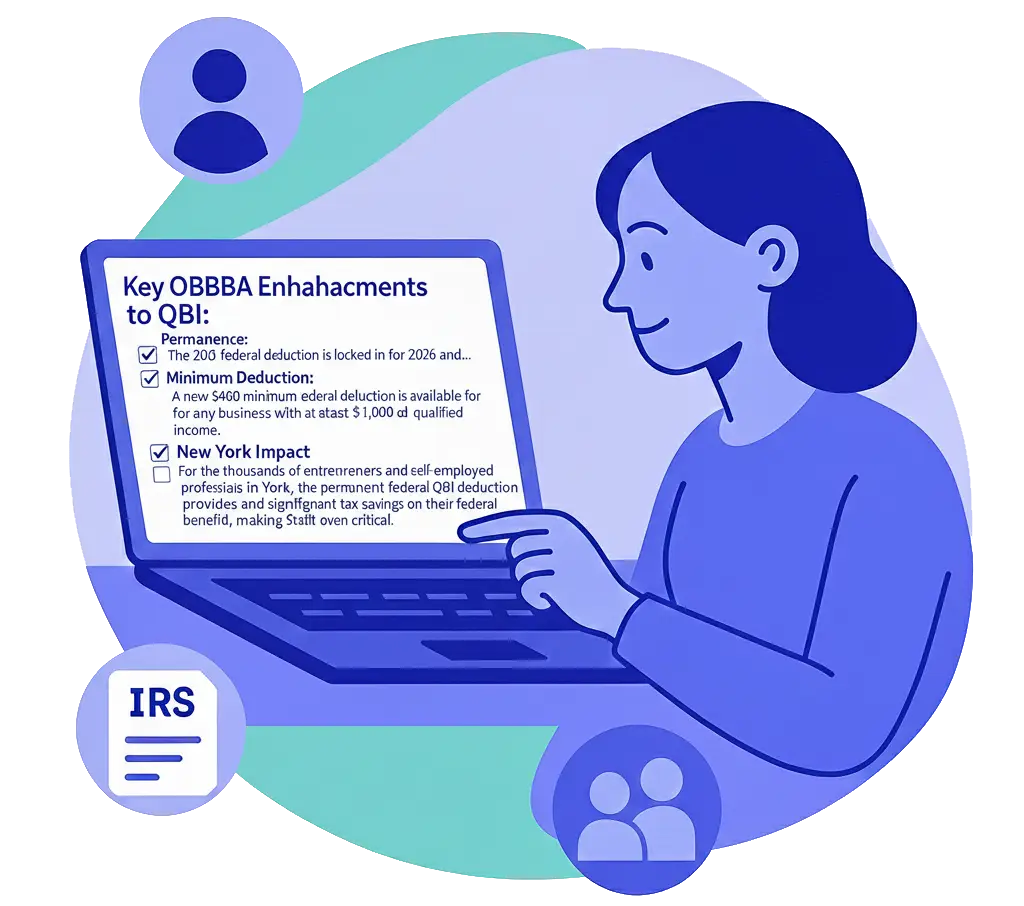

The QBI Deduction is PERMANENT and ENHANCED

This is a critical update for New York’s massive population of small businesses, consultants, and independent contractors. The 20% Qualified Business Income (QBI) Deduction is not expiring. OBBBA has made it a permanent part of the federal tax code and even improved it.

This is a major federal benefit for New York’s:

- Consultants, freelancers, and independent contractors

- LLCs, S-Corps, and Sole Proprietors in every industry

- Real estate investors and landlords

- Skilled trades and construction contractors

Key OBBBA Enhancements to QBI:

- Permanence: The 20% federal deduction is locked in for 2026 and

- Minimum Deduction: A new $400 minimum federal deduction is available for any business with at least $1,000 of qualified

New York Impact: For the millions of entrepreneurs and self-employed professionals in New York, the permanent federal QBI deduction provides certainty and significant tax savings on their federal return. New York State does not offer a state-level QBI deduction, making this federal benefit even more critical.

New Federal Tax Breaks for New York Residents

OBBBA also introduced several new federal deductions that will directly benefit many in New York:

- Tip Income Deduction: Deduct up to $25,000 of reported tip income. This is a huge benefit for workers in New York City’s world-renowned hospitality and service industries.

- Senior Deduction: An additional $6,000 deduction for individuals 65 and older, providing federal tax relief for New York’s large senior population (subject to phase- out).

- Overtime Deduction: Deduct up to $12,500 ($25,000 for joint filers) of qualified overtime pay, a great benefit for skilled trades, healthcare, and logistics workers across the state.

New York-Specific Tax Considerations for 2026

Relief for High Earners and NYC Residents

For residents of New York City facing the “triple tax” (federal, state, and city), the permanent lower federal tax rates provide significant relief. While state and city taxes remain a major factor, a lower federal bill improves the overall financial picture and reduces the total tax burden.

Real Estate and STRs in a High-Cost State

Retirement in the Empire State

New York offers an exclusion for Social Security and some public pension income, but private pensions and other retirement distributions are often taxable. The permanent lower federal tax rates under OBBBA help reduce the overall tax burden on IRA and 401(k) withdrawals, which is crucial for retirees in a high-cost state.

What New York Taxpayers Should Do Now

- Update Your Tax Plan: Your old strategy is obsolete. It’s time to build a new plan based on permanent federal cuts, even with high state and local taxes.

- Maximize New Federal Deductions: If you earn tips or overtime, ensure you are accurately tracking your income to take full advantage of these powerful new federal deductions.

- Leverage Your Business Structure: Work with a professional to ensure your LLC or S- Corp is structured to maximize the permanent 20% federal QBI deduction.

- Plan for Real Estate: Plan your real estate investments to take full advantage of permanent 100% bonus depreciation on your federal return to offset rental income.

New York 2026 Tax FAQ

Does New York conform to QBI?

Will New York State taxes rise?

Are NYC residents affected?

Are families impacted?

Are retirees affected?

Are STR owners affected?

Get Your Personalized 2026 New York Tax Plan

The federal tax landscape has permanently shifted in your favor. Don’t let New York’s high state and city taxes overshadow the significant federal savings now available. A personalized strategy session will ensure you are structured to maximize every new and permanent benefit under OBBBA.