New Mexico 2026 Tax Changes — How Federal OBBBA & State Tax Cuts Create a Double Win

On January 1, 2026, the tax landscape for New Mexico residents underwent a historic and positive transformation. At the federal level, the One Big Beautiful Bill Act (OBBBA ) made the popular 2017 TCJA tax cuts permanent and introduced new benefits, avoiding the feared “tax cliff.”

This federal relief is amplified by New Mexico’s own major tax reform: a significant reduction in state income tax rates, with the top rate dropping to 4.9%. This combination of permanent federal cuts and lower state taxes creates a powerful “double win” for residents, investors, and business owners in the Land of Enchantment.

The Double Win: Federal Relief and State Tax Reduction

Permanent Federal Relief from OBBBA

- Lower Federal Tax Brackets are PERMANENT: The lower individual income tax rates from the TCJA are here to stay. This is a crucial win for New Mexico's working families, government employees, and skilled professionals.

- The Federal Standard Deduction is PERMANENT: The higher federal standard deduction is also permanent, simplifying filing and lowering federal taxable income for the majority of households. This is critical because lower federal Adjusted Gross Income (AGI) directly reduces your state taxable income.

- The QBI Deduction is PERMANENT and ENHANCED: The 20% Qualified Business Income (QBI) Deduction is a permanent part of the federal tax code, a massive benefit for the state's many small businesses, contractors, and tourism operators.

New Mexico's Own Tax Cuts

New Federal Tax Breaks for New Mexico Residents

OBBBA also introduced several new federal deductions that will directly benefit many in New Mexico:

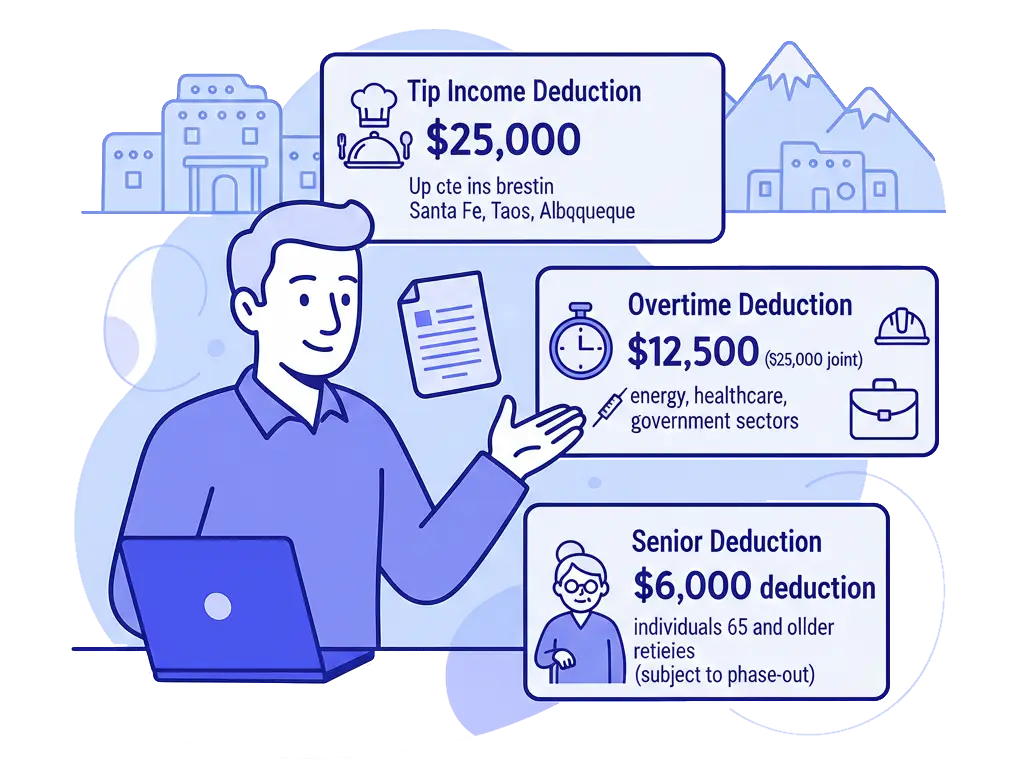

- Tip Income Deduction: Deduct up to $25,000 of reported tip income. This is a huge benefit for workers in New Mexico's world-class tourism and hospitality sectors in Santa Fe, Taos, and Albuquerque.

- Overtime Deduction: Deduct up to $12,500 ($25,000 for joint filers) of qualified overtime pay, a great benefit for workers in the energy, healthcare, and government sectors.

- Senior Deduction: An additional $6,000 deduction for individuals 65 and older, providing federal tax relief for New Mexico’s retirees (subject to phase-out).

New Mexico-Specific Tax Considerations for 2026

A Major Win for Tourism, Energy, and Government Workers

The new federal Tip Income Deduction is a game-changer for New Mexico’s tourism economy. From restaurant servers in Santa Fe to hotel staff in Albuquerque, this provides direct, substantial federal tax relief.

The Overtime Deduction is a significant benefit for the many New Mexicans working in the state’s robust energy sector and for skilled trades and healthcare professionals who work long hours.

Real Estate and STRs in the Land of Enchantment

For property owners in Santa Fe, Taos, and other desirable locations, OBBBA brings welcome news. The 100% bonus depreciation for qualified property is now permanent. This allows real estate investors and STR hosts to immediately write off the cost of certain assets on their federal return, making strategies like cost segregation incredibly powerful to offset rental income.

Retirement in New Mexico

New Mexico offers a partial exemption for retirement income, and Social Security benefits for lower and middle-income seniors are also exempt. The permanent lower federal tax rates under OBBBA, combined with the new federal Senior Deduction, further reduce the overall tax burden for many retirees.

What New Mexico Taxpayers Should Do Now

- Update Your Tax Plan: Your old strategy is obsolete. It’s time to build a new plan based on the dual benefits of permanent federal cuts and New Mexico's lower state tax rates.

- Maximize New Federal Deductions: If you earn tips or overtime, ensure you are accurately tracking your income to take full advantage of these powerful new federal deductions.

- Leverage Your Business Structure: Work with a professional to ensure your LLC or S- Corp is structured to maximize the permanent 20% federal QBI deduction.

- Review Your Retirement Strategy: Factor in the new federal Senior Deduction and permanent lower rates when planning your retirement distributions.

New Mexico 2026 Tax FAQ

Does New Mexico conform to the QBI deduction?

No. QBI is federal-only.

Will New Mexico taxes increase?

Rates stay the same, but taxable income increases due to federal changes.

Are families affected?

Yes. Reduced credits and deduction changes impact refunds.

Are STR owners affected?

Yes. Higher federal brackets increase tax cost on retirement withdrawals.

Are retirees affected?

Yes — federal bracket changes increase the tax cost of retirement withdrawals.

Get Your Personalized 2026 New Mexico Tax Plan

The tax landscape has permanently shifted in your favor. Don’t operate on outdated assumptions. A personalized strategy session will ensure you are structured to maximize every new and permanent benefit under both federal and state law.