Mississippi 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax changes take effect as temporary TCJA provisions expire and updated rules continue.

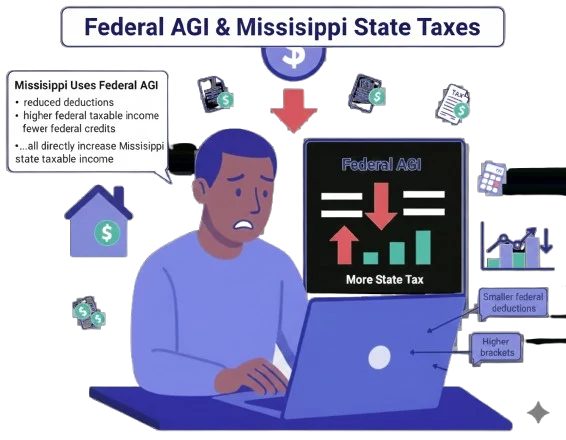

Mississippi has a state income tax system that begins with federal AGI, so federal changes will directly increase state taxable income for many residents.

- W-2 earners in Jackson, Gulfport, Biloxi, Hattiesburg, Southaven, Oxford

- Construction workers, trades, and manufacturing employees

- Small business owners, freelancers, and LLC/S-Corp operators

- Teachers, healthcare workers, and state employees

- Real estate investors, landlords, and STR owners

- Families with children

- Retirees drawing taxable retirement income

- Dual-income households

Below is a full breakdown of how 2026 affects Mississippi taxpayers.

Key Federal Changes Affecting Mississippi Residents

Standard Deduction Shrinks in 2026

Mississippi households — especially families, homeowners, and retirees — will see higher federal taxable income.

Because the federal AGI flows into Mississippi state tax calculations, state taxes may also increase.

Federal Tax Brackets Increase

- 12% → 15%

- 22% → 28%

- 24% → 31%

- dual-income households

- trades and construction workers

- manufacturing and logistics workers

- healthcare professionals

- teachers and public employees

- households earning between $50K–$200K

Higher brackets mean more federal tax and a larger Mississippi state tax base.

QBI (20% Business Deduction) Remains Federal; Mississippi Does Not Conform

QBI continues federally, but Mississippi does not apply a similar state-level deduction.

- Federal taxable income may decrease

- Mississippi taxable income does not

- Business owners must plan around the differences

- contractors and trades

- small LLCs and S-Corps

- self-employed professionals

- agricultural and rural businesses

- real estate agents

- service-based businesses

Child Tax Credit Shrinks

- reduces from around $2,000

- To roughly $1,000 per child

- with reduced refundability

Families across Mississippi — especially in Jackson, Gulfport, Tupelo, Hattiesburg, and Biloxi — will see smaller refunds.

Marriage Penalty Returns

Mississippi is heavily populated with dual-income households.

- married couples filing jointly move up brackets faster

- combined incomes disqualify families from credit eligibility sooner

- federal AGI increases, raising both federal and state tax burdens

Households earning $70K–$180K combined will feel these changes the most.

Mississippi-Specific Tax Considerations

1. Mississippi Uses Federal AGI for State Tax Calculations

- reduced deductions

- higher federal taxable income

- fewer federal credits

…all directly increase Mississippi state taxable income.

Even if Mississippi adjusts rates in the future, federal changes still affect how much Mississippians owe.

2. Real Estate Owners & Rental Investors Face New Rules

Mississippi’s real estate markets — including Gulfport, Biloxi, Jackson suburbs, Oxford, and Starkville — will be affected by:

- capital gains changes

- depreciation rule adjustments

- STR participation requirements

- rental activity classification

- timing of selling rental or investment property

As property values rise in many areas, capital gains impact becomes more significant.

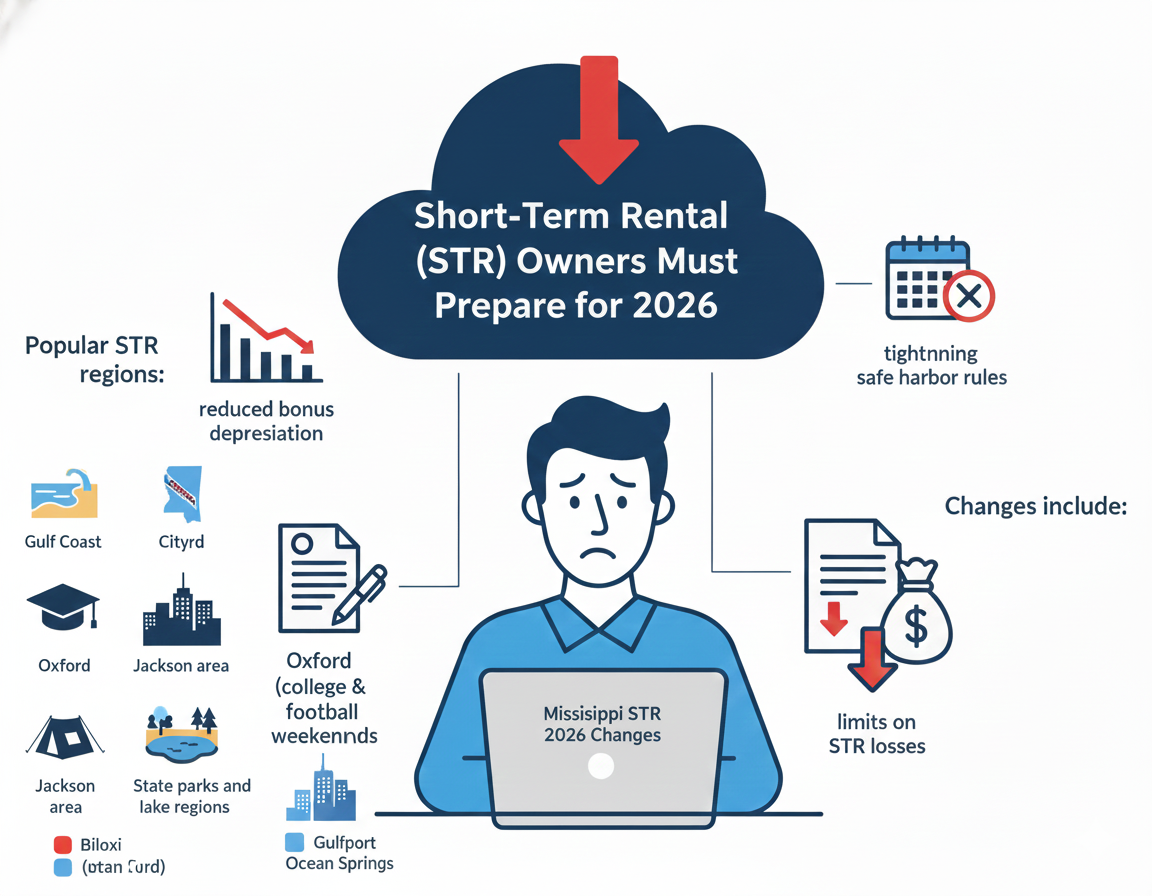

3. Short-Term Rental (STR) Owners Must Prepare for 2026

Popular STR regions:

- Gulf Coast (Biloxi, Gulfport, Ocean Springs)

- Oxford (college & football weekends)

- Jackson area

- State parks and lake regions

- reduced bonus depreciation

- stricter participation documentation

- tightening safe harbor rules

- limits on STR losses

4. Agriculture & Rural Households Will Be Impacted

- farming families

- livestock operations

- crop producers

- forestry-based operations

- equipment depreciation

- capital gains on land sales

- treatment of farm income

- operating loss rules

- income averaging

Agricultural households should plan strategically.

5. Retirement Income Planning Is More Important in 2026

- IRA withdrawals

- 401(k) distributions

- pension income

- investment income

With higher federal brackets, retirees may owe more even with state-level relief.

Who Is Hit Hardest in Mississippi (2026)

- Dual-income households

- Trades, construction, and industrial workers

- Business owners and contractors

- Real estate investors and landlords

- STR operators

- Agricultural and rural households

- Families with children

- Retirees drawing taxable retirement income

- Middle-income earners

What Mississippi Residents Should Do Before December 31, 2025

- Review federal and state withholding

- Maximize retirement contributions

- Evaluate Roth conversions

- Review business entity structure (LLC vs S-Corp)

- Prepare STR and rental documentation

- Evaluate capital gains exposure

- Time property or equipment sales strategically

- Build a complete 2025–2026 tax plan

Mississippi 2026 Tax FAQ

Does Mississippi conform to QBI?

No — QBI is federal-only.

Will Mississippi taxes go up?

Rates are unchanged, but taxable income rises due to federal changes.

Are families affected?

Yes — child credit reductions and higher taxable income impact refunds.

Are STR owners impacted?

Yes — depreciation and participation rules tighten.

Are retirees affected?

Yes — federal bracket changes increase tax cost on withdrawals.

Get a 2026 Mississippi Tax Strategy

Mississippi residents face important tax changes from reduced deductions, higher federal brackets, shifting credit rules, and updates affecting business owners, families, retirees, and property owners.

A personalized tax plan ensures you’re prepared before 2026 rules take effect.

Because tax situations vary by individual and business, many Mississippi residents choose to work with a qualified tax professional. You can explore available Mississippi tax services here: