Kentucky 2026 Tax Changes — What the One Big Beautiful Bill Act (OBBBA ) Means for Residents

On January 1, 2026, the federal tax landscape underwent a historic and positive transformation. The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, made permanent many of the major tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) and introduced new benefits for taxpayers. The long-feared 2026 “tax cliff” has been avoided.

For Kentuckians, this is exceptionally good news. As a state with a flat income tax that uses federal Adjusted Gross Income (AGI) as its starting point, these permanent federal changes significantly enhance your financial outlook. This guide provides a clear, localized breakdown of how the permanent tax laws under OBBBA will impact your income, business, and financial strategy in 2026 and beyond.

Federal Changes Bring Relief to Kentucky Taxpayers

While Kentucky has its own state tax system, your federal tax bill is a major part of your overall financial picture. OBBBA has made that picture much brighter.

Lower Federal Tax Brackets are PERMANENT

The biggest news is that the lower individual income tax rates from the TCJA are now permanent. The anticipated jump in federal tax rates has been avoided.

Kentucky Impact:

This is a crucial win for Kentucky’s working families. For professionals in Louisville and Lexington, workers in the state’s robust manufacturing and healthcare sectors, and dual-income households, having lower, predictable federal tax rates provides much-needed financial stability.

The Federal Standard Deduction is PERMANENT

The higher federal standard deduction, which simplifies tax filing for millions, is also here to stay.

Kentucky Impact:

A permanent, higher federal standard deduction is a direct benefit for the majority of Kentuckians. It provides a substantial, straightforward deduction on

your federal return, lowering your taxable income without the need for complex itemization.

The QBI Deduction is PERMANENT and ENHANCED (Federal Level)

This is the most critical update for Kentucky’s business and agricultural community. The 20% Qualified Business Income (QBI) Deduction is not expiring. OBBBA has made it a permanent part of the federal tax code and even improved it.

Important Note for Kentucky:

- Kentucky is a non-conforming state, meaning it does not offer a state-level QBI deduction. However, this powerful 20% deduction remains fully available on your federal tax return.

This is a major federal benefit for Kentucky’s:

- LLCs, S-Corps, and Sole Proprietors trades

- Farmers and agricultural businesses

- Real estate investors and landlords

- Independent contractors and skilled trades

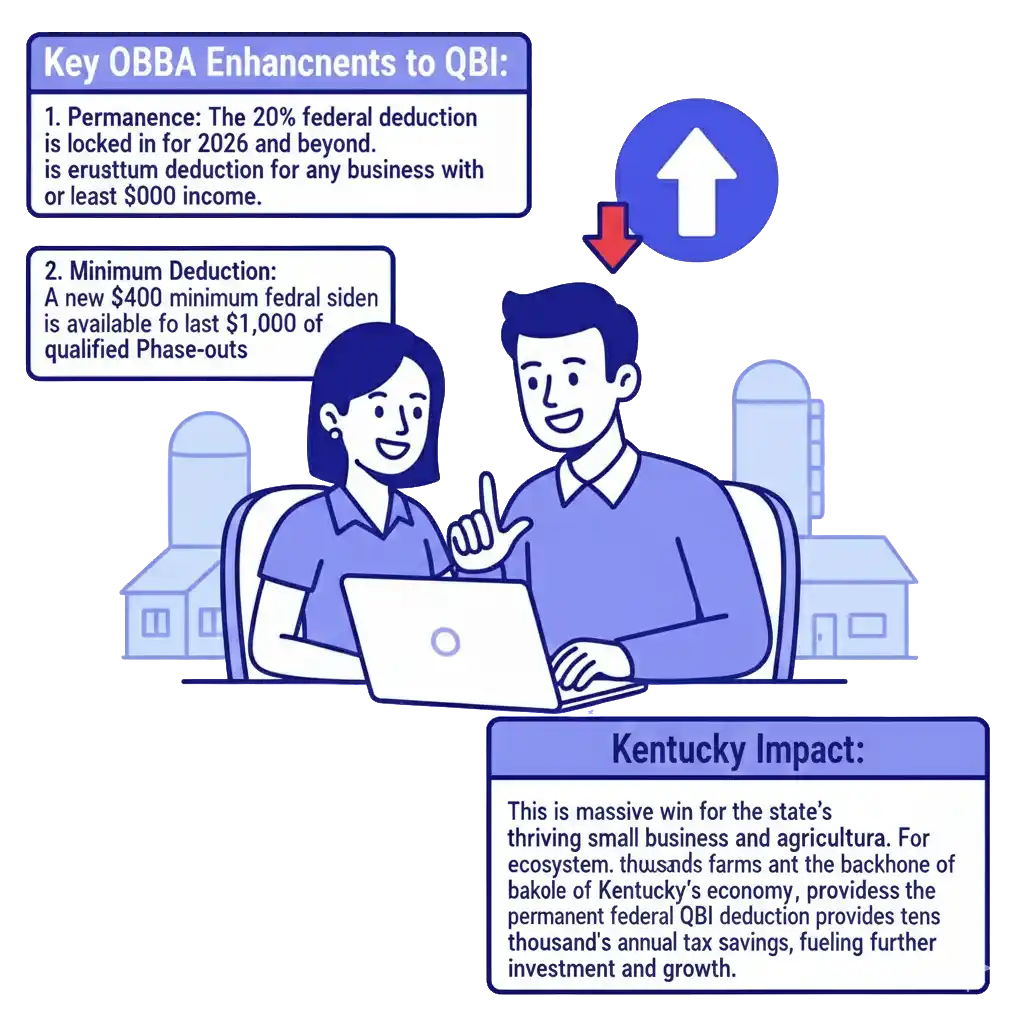

Key OBBBA Enhancements to QBI:

- Permanence: The 20% federal deduction is locked in for 2026 and

- Minimum Deduction: A new $400 minimum federal deduction is available for any business with at least $1,000 of qualified

Kentucky Impact: This is a massive win for the state’s thriving small business and agricultural ecosystem. For the thousands of farms and main street businesses that are the backbone of Kentucky’s economy, the permanent federal QBI deduction provides tens of thousands of dollars in annual tax savings, fueling further investment and growth.

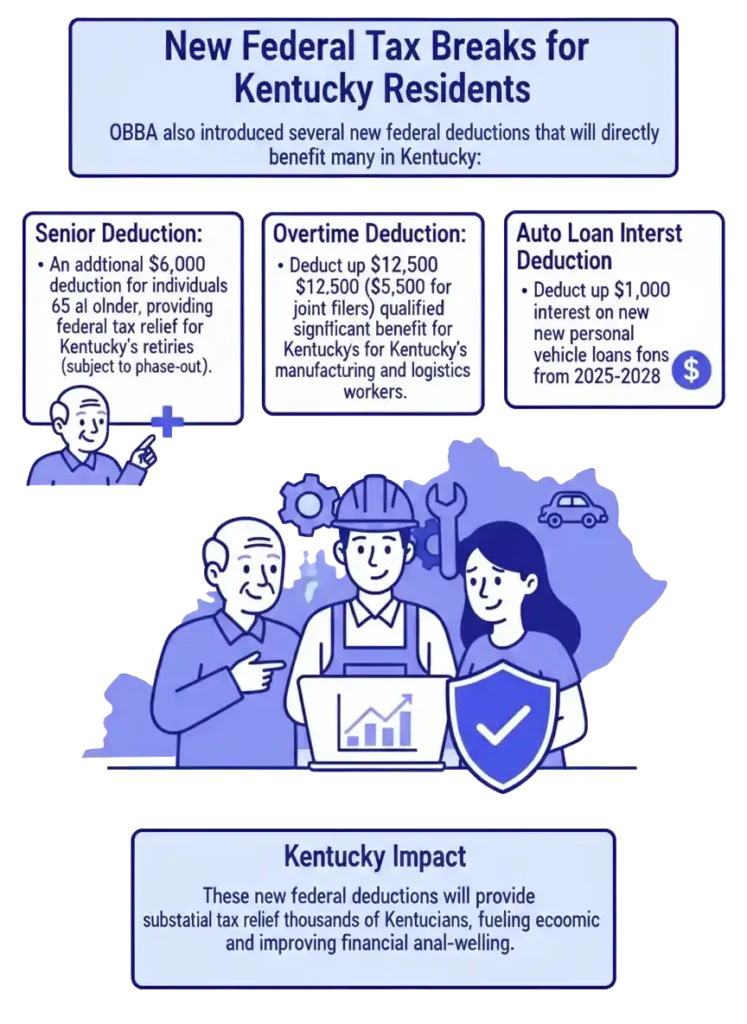

New Federal Tax Breaks for Kentucky Residents

OBBBA also introduced several new federal deductions that will directly benefit many in Kentucky:

- Senior Deduction: An additional $6,000 deduction for individuals 65 and older, providing federal tax relief for Kentucky’s retirees (subject to phase-out).

- Overtime Deduction: Deduct up to $12,500 ($25,000 for joint filers) of qualified overtime pay, a significant benefit for Kentucky’s manufacturing and logistics

- Auto Loan Interest Deduction: Deduct up to $10,000 in interest on new personal vehicle loans from 2025-2028.

Kentucky-Specific Tax Considerations for 2026

Kentucky’s Flat Tax and Federal Conformity

Kentucky has a competitive flat state income tax. Because Kentucky uses federal Adjusted Gross Income (AGI) as the starting point for state taxes, the permanent federal deductions under OBBBA help keep your AGI lower, which in turn can reduce your state tax liability.

While the state tax rate remains the same, a lower starting income figure is a clear benefit.

Agriculture and Rural Households

For Kentucky’s significant agricultural sector, OBBBA provides stability. The permanence of the federal QBI deduction and 100% bonus depreciation for qualified property allows for better long-term planning around equipment purchases and operational investments.

This federal certainty complements Kentucky’s state-level tax environment, creating a supportive framework for farm families and related businesses.

Retirement Income in Kentucky

Kentucky offers a partial exemption for retirement income, but many forms of it are still

taxable at the state level. The good news is that the permanent lower federal tax rates

under OBBBA reduce the overall tax burden on these withdrawals, leaving more money in your pocket.

What Kentucky Taxpayers Should Do Now

- UpdateYour Tax Plan: Your old strategy, based on the fear of expiring tax cuts, is It’s time to build a new plan based on permanence and new federal opportunities.

- Integrate Federal and State Planning: Work with a professional who understands how to maximize permanent federal benefits while navigating Kentucky’s flat tax system.

- Maximize the Federal QBI Deduction: If you own a farm or business, ensure your structure and bookkeeping are optimized to claim the full 20% federal QBI

- LeverageReal Estate Benefits: Plan your real estate investments to take full advantage of permanent 100% bonus depreciation on your federal return.

Kentucky 2026 Tax FAQ

Does Kentucky conform to QBI?

No — QBI is federal-only.

Will Kentucky taxes increase?

Rates stay the same, but taxable income will rise due to federal changes.

Are families affected?

Yes — reduced credits and higher federal taxable income impact refunds.

Are STR owners impacted?

Yes — depreciation and rental classification rules tighten.

Are retirees affected?

Yes — federal bracket increases impact taxable retirement withdrawals.

Get Your Personalized 2026 Kentucky Tax Plan

The tax landscape has permanently shifted in your favor. Don’t operate on outdated assumptions. A personalized strategy session will ensure you are structured to maximize every new and permanent benefit under OBBBA, fully integrated with Kentucky’s unique economic and tax environment.

Because tax situations vary by individual and business, many Kentucky residents choose to work with a qualified tax professional. You can explore available Kentucky tax services here: