Kansas 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax changes take effect as prior provisions expire and new rules continue under updated legislation.

Kansas residents will feel these changes at the federal level — and because Kansas uses federal AGI as the starting point for state tax calculations, many households will also see increases in Kansas state income tax.

- W-2 earners in Wichita, Overland Park, Kansas City, Topeka, Olathe, Lawrence

- Small business owners, LLCs, S-Corps, and contractors

- Farmers, ranchers, and agricultural households

- Dual-income households

- Teachers, healthcare workers, and state employees

- Real estate investors and rental property owners

- Families with children

- Retirees drawing taxable income

This page explains exactly how the 2026 tax rules will affect Kansas taxpayers.

Key Federal Changes Affecting Kansans in 2026

Standard Deduction Shrinks in 2026

Kansas taxpayers — especially families, homeowners, and retirees — will see higher federal taxable income.

Since Kansas begins state tax calculations with federal AGI, this increases Kansas state income taxes as well.

Federal Tax Brackets Increase

- 12% → 15%

- 22% → 28%

- 24% → 31%

- dual-income families

- professionals in Wichita and Kansas City metro

- manufacturing, agriculture, and logistics workers

- teachers, nurses, and state employees

- middle-income earners between $60K–$250K

Higher brackets mean higher federal — and state — taxable income.

QBI (20% Business Deduction) Remains Federal; Kansas Does Not Conform

Meaning:

- Federal taxable income may drop

- Kansas taxable income does not

- Business owners must plan around the mismatch

This is particularly relevant for:

- LLC and S-Corp owners

- contractors and construction trades

- professional service providers

- real estate agents

- freelancers and gig workers

- small manufacturing and agricultural businesses

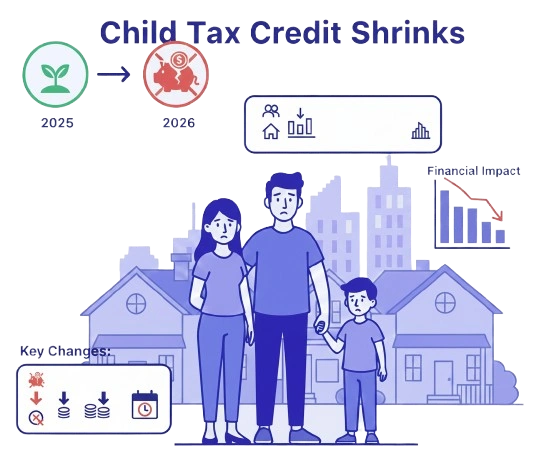

Child Tax Credit Shrinks

The federal Child Tax Credit is projected to reduce:

- from about $2,000 per child

- to roughly $1,000

Kansas families — especially those in suburban and family-oriented regions — will see smaller refunds beginning in 2026.

Marriage Penalty Returns

- joint filers are pushed into higher brackets quickly

- federal credits phase out faster

- combined incomes create higher federal taxable income

Couples earning between $75K–$200K combined will feel the shift most significantly.

Georgia-Specific Tax Considerations

Georgia residents must consider how federal changes affect state-tax calculations.

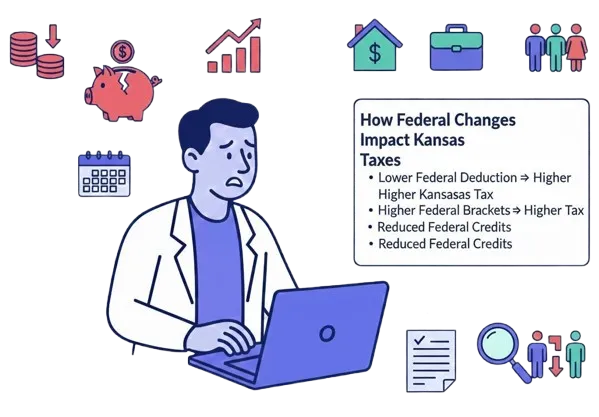

1. Kansas Uses Federal AGI as the Base for State Taxation

- a lower federal standard deduction

- higher federal brackets

- reduced federal credits

…all increase Kansas state taxable income.

Even though Kansas may adjust its rate structure over time, federal changes still affect state-level tax bills.

2. Real Estate Owners and Rental Property Investors Will Feel 2026 Changes

- Wichita

- Kansas City metro

- Overland Park

- Overland Park

- Overland Park

- Manhattan

…will see effects from:

- capital gains increases

- reduced federal depreciation

- tighter classification of rental activity

- STR participation rules

- timing concerns around property sales

3. Agriculture & Rural Households Face Special Considerations

Kansas has a large agricultural economy.

2026 affects:

- farm equipment depreciation

- grain and livestock sales

- land rental arrangements

- operating costs

- schedule F deductions

- income averaging

- capital gains on farmland sales

Many agricultural households will need proactive planning before 2026.

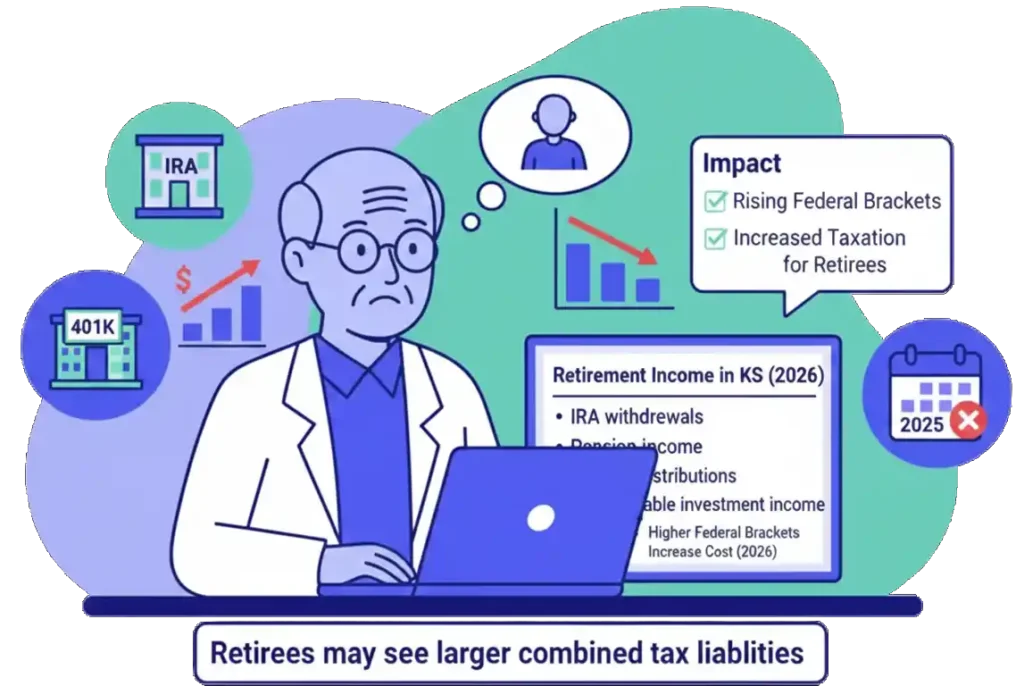

4. Retirement Income Planning Still Heavily Influenced by Federal Rules

Kansas taxes most retirement income except certain Social Security exemptions. Higher federal brackets in 2026 affect:

- IRA withdrawals

- pension income

- 401(k) distributions

- taxable investment income

Retirees may see larger combined tax liabilities.

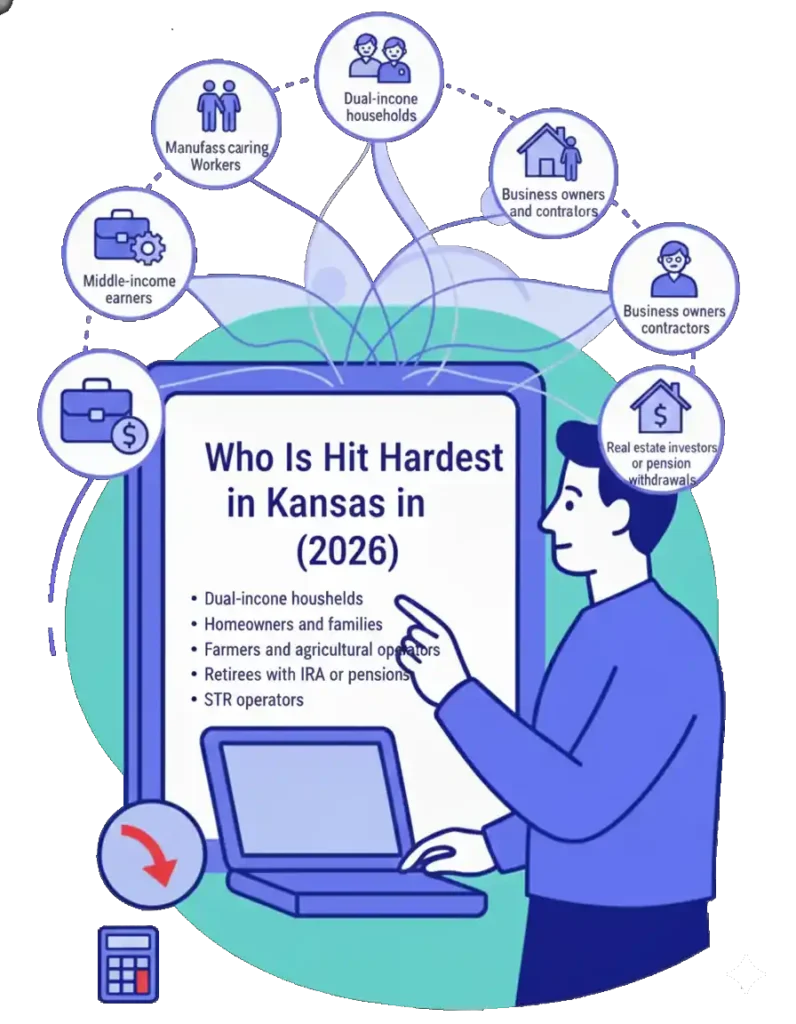

Who Is Hit Hardest in Kansas (2026)

- Dual-income households

- Homeowners and families

- Business owners and contractors

- Farmers and agricultural operators

- Real estate investors and landlords

- STR operators

- Retirees with IRA or pension withdrawals

- Middle-income earners

What Kansas Residents Should Do Before December 31, 2025

- Review federal and Kansas withholding

- Maximize retirement contributions

- Evaluate Roth conversion timing

- Consider S-Corp election or restructuring

- Prepare proper STR participation documentation

- Analyze capital gains exposure

- Plan timing around property or equipment purchases

- Build a personal 2025–2026 tax strategy

Kansas 2026 Tax FAQ

Does Kansas conform to QBI?

No — QBI is federal-only.

Will Kansas taxes increase?

Rates may stay the same, but taxable income increases due to federal changes.

Are families affected?

Yes — reduced credits and higher taxable income impact many households.

Are STR owners impacted?

Yes — depreciation and participation rules tighten.

Are retirees affected?

Yes — federal bracket changes increase taxes on retirement withdrawals.

Get a 2026 Kansas Tax Strategy

Kansas residents face important changes from reduced deductions, higher brackets, shifts in credit eligibility, and adjustments impacting business owners, farmers, homeowners, and retirees.

A personalized plan ensures you’re fully prepared for 2026.

Because tax situations vary by individual and business, many Kansas residents choose to work with a qualified tax professional. You can explore available Kansas tax services here: