Delaware 2026 Tax Changes — What Residents & Business Owners Must Know

Beginning January 1, 2026, major federal tax changes take effect as the Tax Cuts and Jobs Act expires and OBBBA provisions continue rolling out.

Delaware residents — who already face no state sales tax but do pay a progressive state income tax — will see meaningful changes in their federal and state tax situations.

Affected groups include:

- W-2 earners across Wilmington, Dover, Newark, Middletown, Milford, Smyrna

- Professionals in finance, healthcare, education, and government

- Small business owners, LLCs, and S-Corp operators

- Self-employed, gig workers, and contractors

- Families with children

- Retirees drawing pension, IRA, or Social Security income

- Real estate investors and landlords

This guide explains exactly how the 2026 tax changes impact Delaware taxpayers.

Federal Tax Changes That Affect Delaware Residents

These are the most important 2026 federal adjustments impacting Delaware households.

Standard Deduction Shrinks in 2026

Many Delaware families will return to itemizing due to:

- higher property taxes in suburban areas

- mortgage interest

- charitable contributions

- medical and education expenses

This change is especially noticeable for homeowners in New Castle County and growing communities such as Middletown and Newark.

Federal Tax Brackets Increase Across the Board

In 2026:

- 12% becomes 15%

- 22% becomes 28%

- 24% becomes 31%

- Upper brackets tighten

Delaware taxpayers in the $60K–$250K income range will feel these adjustments the most.

- state employees and educators

- healthcare workers in Dover and Wilmington

- professionals commuting to Maryland, Pennsylvania, or New Jersey

- dual-income households

QBI (20% Business Deduction) Is Permanent, but Delaware Does Not Conform

Under OBBBA, the federal QBI deduction remains in place.

- Your federal taxable income decreases

- Your Delaware taxable income does not

- consultants

- self-employed professionals

- skilled trades

- real estate agents

- online business owners

- small LLC and S-Corp operators

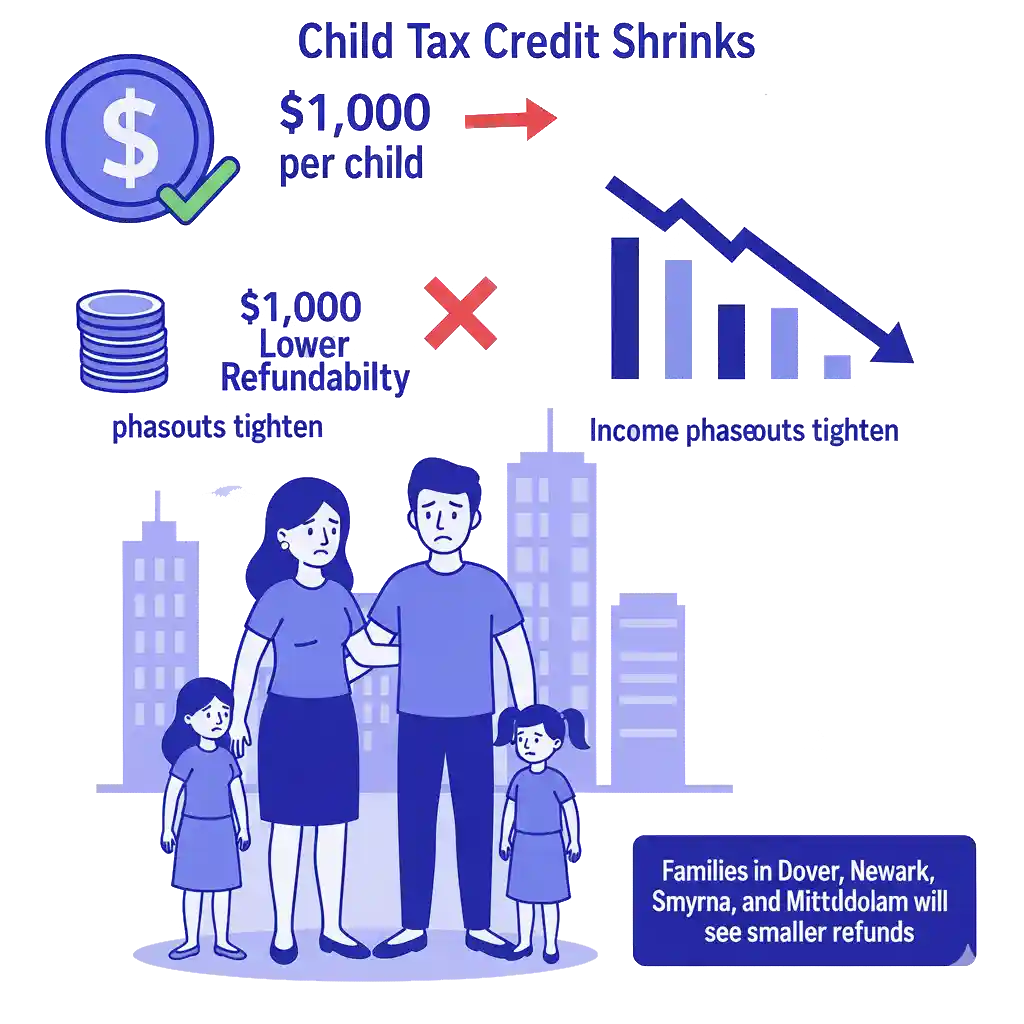

Child Tax Credit Shrinks

- from ~$2,000 → to about $1,000 per child

Refundability also tightens.

Families in Dover, Newark, Smyrna, and Middletown will see smaller refunds.

Marriage Penalty Returns

Married couples filing jointly will once again see:

- faster bracket progression

- reduced credit eligibility

- higher combined taxable income

This impacts Delaware’s large population of dual-income households, especially in New Castle County and metro Wilmington.

Delaware-Specific Tax Considerations

These state-related factors must be considered alongside federal changes.

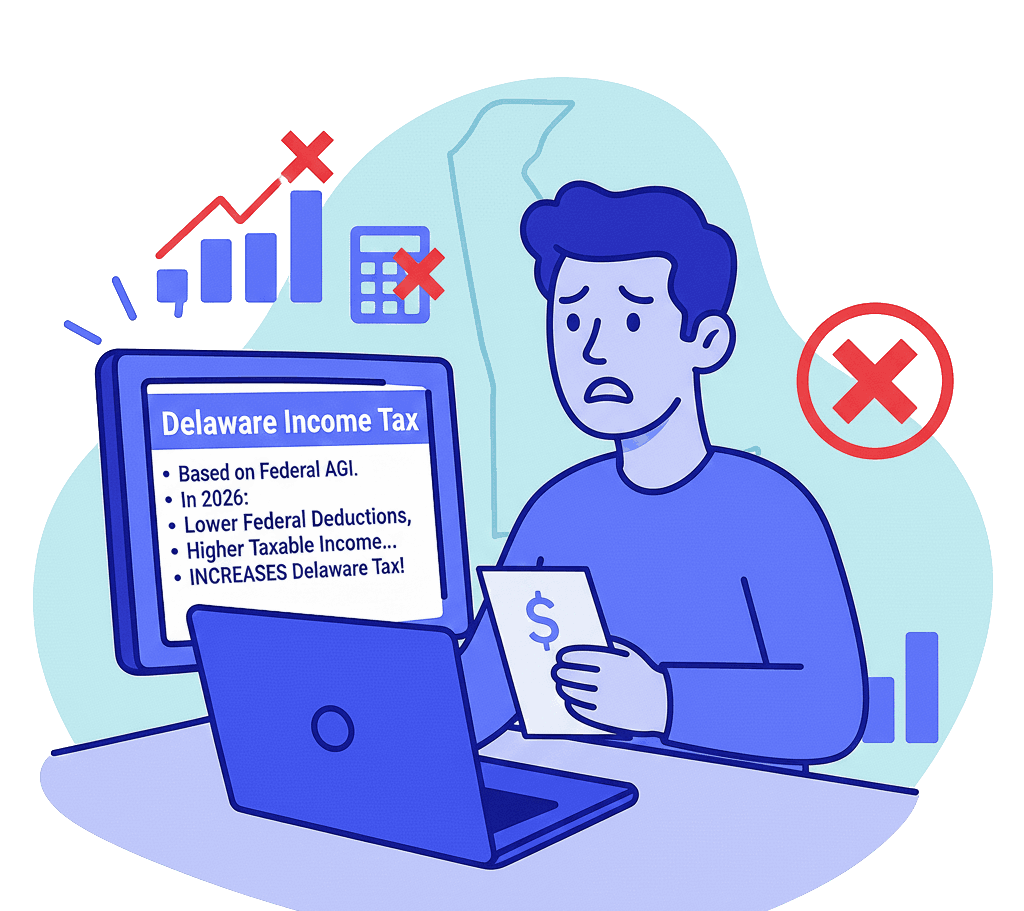

1. Delaware Income Tax Uses Federal AGI as a Starting Point

Delaware tax rates range from 2.2% to 6.6%.

Because Delaware relies on federal AGI:

- Lower federal deductions

- Higher federal taxable income

- Reduced credits

…all increase the amount of income Delaware taxes.

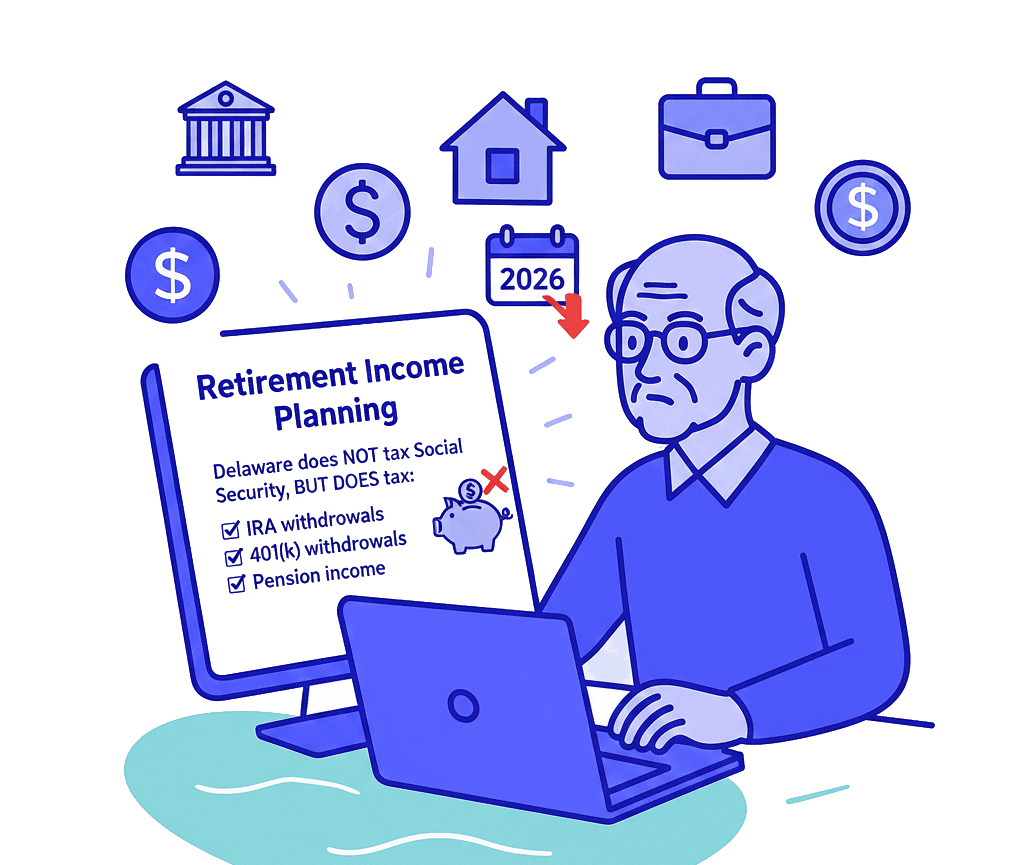

2. Retirement Income Planning Is Important in a High-Cost, Low-Sales-Tax State

Delaware does not tax Social Security benefits, but does tax:

- IRA withdrawals

- 401(k) withdrawals

- pension income (above certain thresholds)

Higher 2026 brackets make strategic planning necessary for retirees.

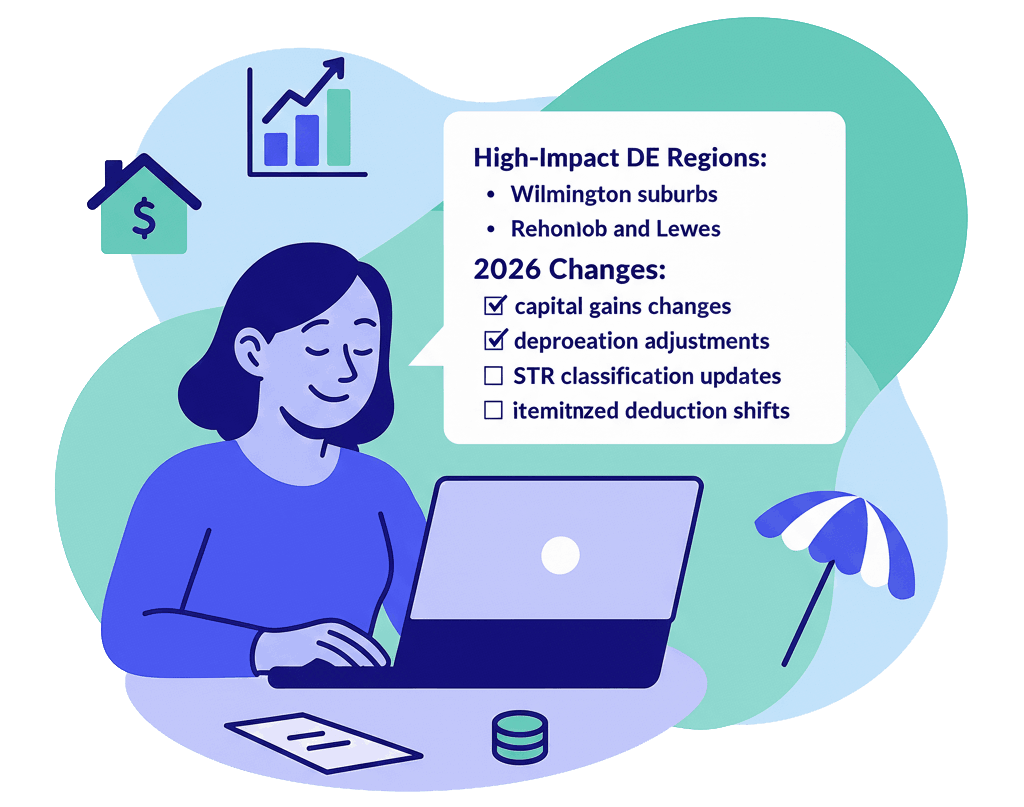

3. Real Estate and Property Ownership Changes

Delaware’s real estate market, especially in:

- Wilmington suburbs

- beach regions like Rehoboth and Lewes

- growing cities like Middletown

…will feel 2026 through:

- capital gains changes

- depreciation adjustments

- STR classification updates

- itemized deduction shifts

Rental investors should review their 2025–2026 strategy.

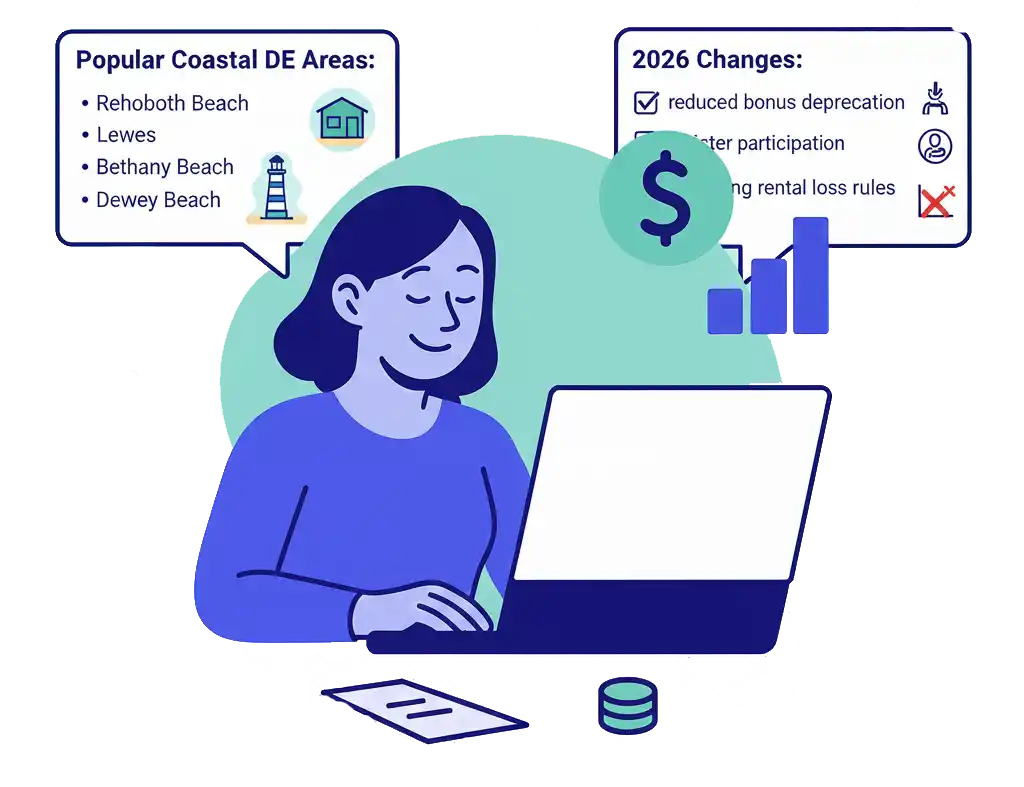

4. Growing STR and Coastal Rental Markets Face New Rules

Popular coastal areas such as:

- Rehoboth Beach

- Lewes

- Bethany Beach

- Dewey Beach

…should prepare for:

- reduced bonus depreciation

- stricter participation requirements

- changing rental loss rules

- updated property classification tests

Who Is Hit Hardest in Delaware (2026)

- Dual-income families

- Homeowners with mortgages

- Small business owners and contractors

- Real estate investors and STR owners

- Families with children

- Retirees with IRA income

- Professionals in healthcare, government, and education

- Self-employed and gig workers

What Delaware Residents Should Do Before December 31, 2025

- Review business structure and QBI impact

- Maximize retirement contributions

- Evaluate timing of Roth conversions

- Prepare STR documentation and planning

- Reassess capital gains exposure

- Consider timing for property sales

- Adjust tax withholding

- Build a full 2025–2026 tax plan

Delaware 2026 Tax FAQ

Does Delaware conform to QBI?

No — QBI is federal-only.

Will Delaware taxes increase?

The rate won’t change, but taxable income likely will.

Are families affected?

Yes — credits shrink, and deductions get smaller.

How will STR owners be impacted?

Stricter documentation and lower depreciation benefits apply.

Are retirees affected?

Yes — IRA and pension withdrawals become more expensive due to higher brackets.

Get a 2026 Delaware Tax Strategy

Delaware residents face higher taxable income, reduced deductions, and meaningful changes to credits, retirement income planning, and real estate taxation.

A proactive strategy is essential before these changes take full effect.

Because tax situations vary by individual and business, many Delaware residents choose to work with a qualified tax professional. You can explore available Delaware tax services and professionals by location and specialty.