Connecticut 2026 Tax Changes — What Residents & Business Owners Must Know

Beginning January 1, 2026, major federal tax changes take effect as the Tax Cuts and Jobs Act (TCJA) expires and updated rules from OBBBA continue.

Connecticut residents — already dealing with one of the highest state tax burdens in the country — will feel these federal changes more than most.

Those affected include:

- W-2 earners across Hartford, Stamford, New Haven, Bridgeport, Norwalk, Danbury

- High-income households with combined earnings above $150K

- Financial, legal, medical, and insurance professionals

- Business owners, LLCs, S-Corps, and freelancers

- Real estate investors and landlords

- Families with children

- Retirees taking IRA or pension distributions

This guide explains exactly how the 2026 tax changes impact Connecticut households.

Federal Tax Changes Utah Residents Must Prepare For

These are the major federal changes affecting Connecticut taxpayers.

Standard Deduction Shrinks in 2026

Connecticut has some of the highest:

- housing costs

- property taxes

- mortgage interest

- childcare expenses

As more taxpayers return to itemizing, taxable income will rise, especially for families in suburbs such as Westport, Greenwich, Fairfield, Avon, Glastonbury, and Guilford.

Federal Tax Brackets Increase

Federal brackets rise for every income level:

- 12% → 15%

- 22% → 28%

- 24% → 31%

- 32% → 33%

- 37% → 39.6%

Connecticut households most affected:

- dual-income families

- insurance, finance & medical professionals

- New York–commuters living in CT

- homeowners in high-cost counties

Households earning $100K–$400K will see notable increases.

QBI (20% Business Deduction) Is Permanent but Connecticut Does Not Conform

QBI remains a federal deduction, but Connecticut does NOT conform, meaning:

- Federal taxable income decreases

- Connecticut state taxable income does not receive the 20% reduction

- CT business owners must plan for the state-level mismatch

- law firms

- medical practices

- contractors

- consultants

- real estate agents

- online and remote business owners

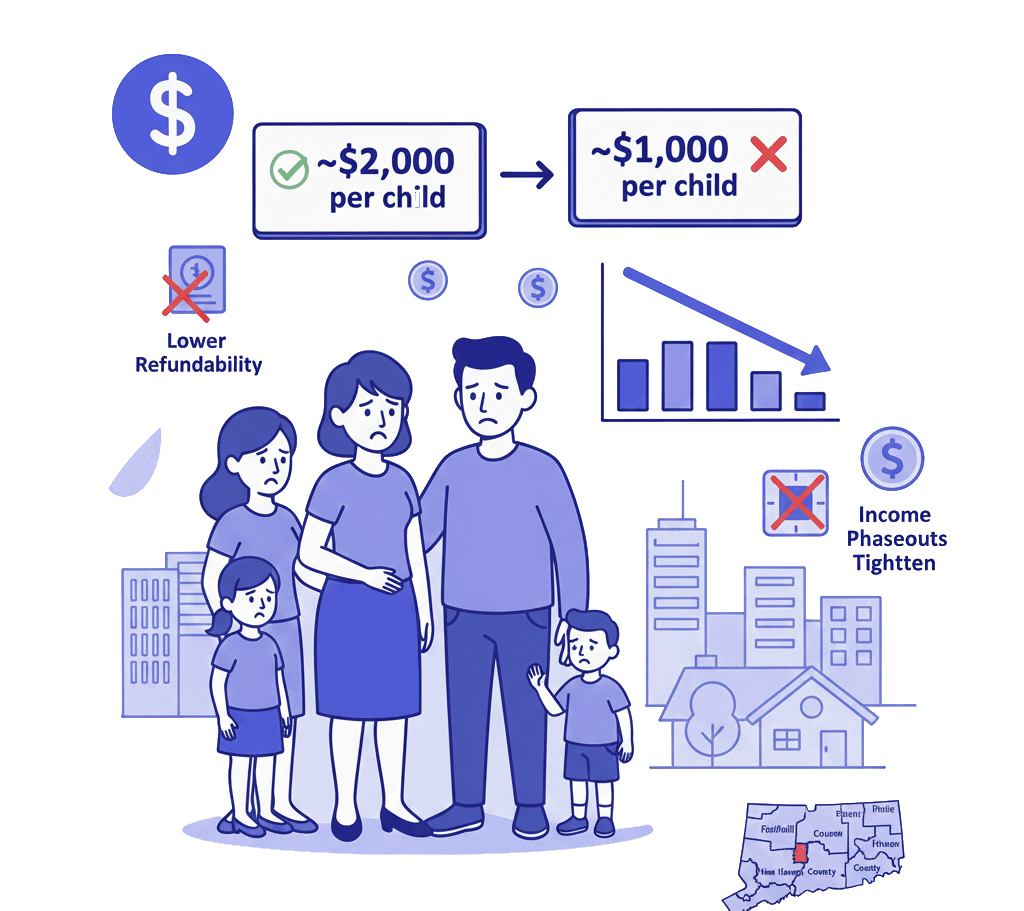

Child Tax Credit Shrinks

- ~$2,000 → ~$1,000 per child

- Lower refundability

- Income phaseouts tighten

Families in Hartford County, Fairfield County, and New Haven County will see reduced refund benefits.

Marriage Penalty Returns

Connecticut has a large concentration of:

- two-income professional couples

- high-earning households

- families with multiple children

In 2026, married couples filing jointly will reach higher brackets faster, and credit phaseouts occur sooner.

Connecticut-Specific Considerations

These factors influence how federal changes hit Connecticut residents.

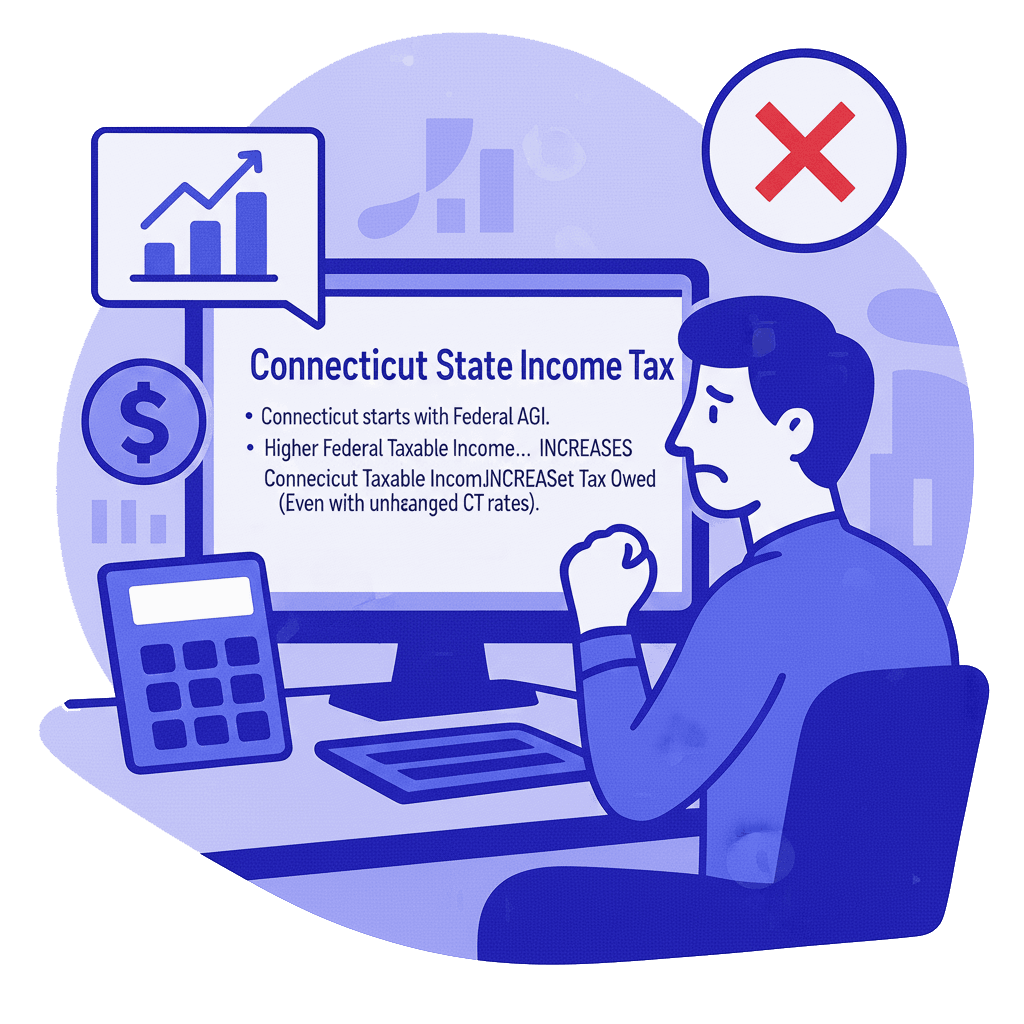

1. Connecticut Income Tax Applies to Higher Federal AGI

Connecticut starts its calculation with federal AGI. With higher taxable income at the federal level, state tax bills increase even though Connecticut’s rates do not change.

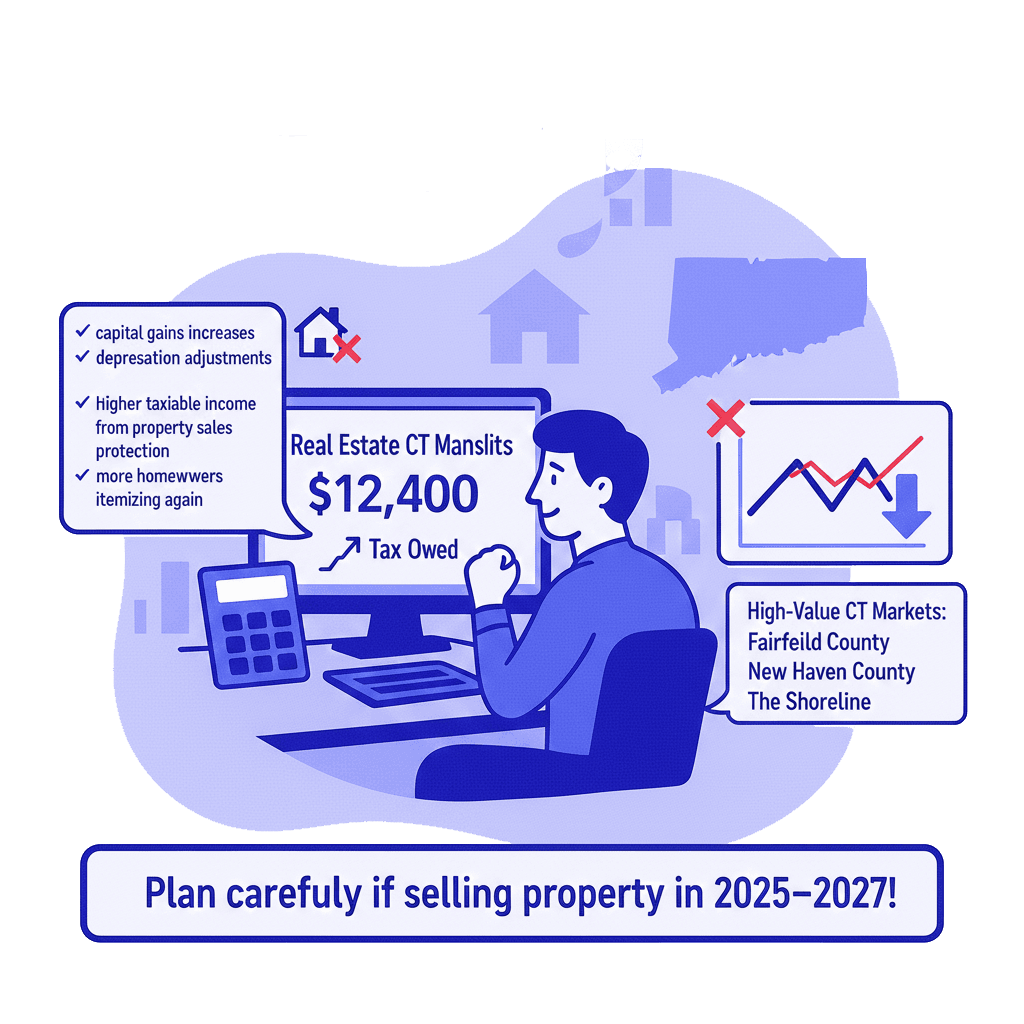

2. Real Estate and Property Ownership Impacts

Connecticut property values vary widely, but many markets — especially in Fairfield County and the shoreline — are exposed to:

- capital gains increases

- depreciation adjustments

- higher taxable income from property sales

- lower federal deduction protection

- more homeowners itemizing again

Anyone selling a rental, STR, or family property in 2025–2027 should plan carefully.

3. Increased Scrutiny for Short-Term Rentals

Popular STR regions such as:

- Mystic

- New Haven

- Hartford area suburbs

- Coastal shoreline towns

…will face tougher documentation rules in 2026, including:

- shorter bonus depreciation

- stricter participation requirements

- more detailed recordkeeping

- updated rental safe harbor rules

4. Retirement Income Is Hit Harder in 2026

Many Connecticut retirees depend on:

- pensions

- IRA withdrawals

- 401(k) distributions

Higher federal brackets increase taxes on these distributions, and many Connecticut retirees also face state taxation depending on income level.

2025 is the optimal year for Roth conversion planning.

Who Is Hit Hardest in Connecticut (2026)

- Dual-income professional families

- Homeowners with mortgages and high property taxes

- Business owners and self-employed professionals

- Real estate investors and landlords

- High-income earners in Fairfield & Hartford counties

- Retirees with taxable IRA or pension income

- Families with multiple dependents

What Connecticut Residents Should Do Before December 31, 2025

- Review entity structure and QBI planning

- Maximize retirement contributions

- Adjust withholding for 2026 bracket changes

- Utilize cost segregation before depreciation phases down

- Prepare STR participation and documentation thoroughly

- Forecast capital gains exposure

- Consider timing of property sales

- Evaluate Roth conversions before 2026

- Build a full 2025–2026 tax plan with a professional

Connecticut 2026 Tax FAQ

Does Connecticut conform to QBI?

No, Connecticut does not apply the federal QBI deduction.

Will Connecticut state taxes increase?

Rates stay the same, but taxable income rises due to federal changes.

Will families receive smaller refunds in 2026?

Yes, due to reduced credits and a lower standard deduction.

Are retirees affected?

Yes, increased federal brackets impact IRA and 401(k) distributions.

Do STR owners face new rules?

Yes, including reduced depreciation and stricter participation tests.

Get a 2026 Connecticut Tax Strategy

Connecticut residents face a combination of federal changes, high living costs, and unique state rules that make proactive planning essential.

Your income, deductions, business structure, real estate decisions, and retirement strategy should be aligned before these changes take full effect.

Because tax situations vary by individual and business, many Connecticut residents choose to work with a qualified tax professional. You can explore available Connecticut tax services and professionals by location and specialty.