Colorado 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax law changes take effect as TCJA provisions expire and new rules under OBBBA continue rolling out.

Colorado residents will feel these changes through:

- Higher federal tax brackets

- A lower standard deduction

- Updated business and QBI rules

- Reduced family credits

- Real estate and STR tax changes

- Shifts in capital gains treatment

- Retirement and income planning adjustments

Whether you live in Denver, Colorado Springs, Boulder, Fort Collins, Aurora, Lakewood, or any other part of the state, these changes impact your federal return — and flow into your Colorado state taxes as well.

Federal Changes Affecting Colorado Residents

Below are the most important 2026 tax rule changes Colorado taxpayers need to prepare for.

Standard Deduction Drops in 2026

Impact on Colorado

Many households will see higher taxable income due to the deduction drop. Homeowners, families, and middle-income earners in Colorado’s metro and suburban areas may feel this the most.

The federal standard deduction decreases significantly:

Federal Tax Brackets Increase

Federal tax brackets increase for all filing statuses:

- 12% → 15%

- 22% → 28%

- 24% → 31%

Coloradans earning between roughly $80,000–$350,000 will experience a noticeable rise in federal taxes, especially dual-income households and professionals.

QBI (20% Deduction) Is Now Permanent, But Colorado Does Not Conform

The QBI deduction remains in place at the federal level.

However:

- Colorado does not conform to QBI

- This means your Colorado state taxable income does not receive the 20% pass-through deduction

- Federal taxable income decreases, but Colorado taxable income stays higher

This impacts business owners, independent contractors, real estate professionals, and anyone operating an LLC or S-Corp.

Child Tax Credit Shrinks

The Child Tax Credit is projected to decrease:

- From about $2,000 per child → to about $1,000 per child

Refundability also decreases, impacting families throughout the state.

Marriage Penalty Returns

The marriage penalty reappears in 2026, causing many two-income households to be taxed more when filing jointly.

This is especially impactful for couples with:

- Two professional incomes

- High combined earnings

- Multiple dependents

Colorado-Specific Tax Considerations

Below are state-related considerations that interact directly with the 2026 federal rule changes.

1. Colorado Uses Federal AGI as the Basis for State Taxes

- Lower federal deductions

- Higher federal taxable income

- Reduced federal credits

…result in a higher starting point for Colorado state taxes.

This raises state tax bills for many residents even though the state rate itself does not increase.

2. Colorado Real Estate & Rental Property Impacts

- Higher capital gains taxes from lower federal thresholds

- Reductions in depreciation benefits

- Tighter rules for STR activity

- Increased scrutiny for passive vs active rental classification

- More complex planning needs for properties in high-appreciation areas

This affects primary residences, long-term rentals, short-term rentals, and multi-property holdings.

3. Short-Term Rental (STR) Rules Tighten

Popular STR regions — including mountain towns and metro cities — will be impacted by:

- Lower bonus depreciation

- Stricter participation requirements

- Increased documentation requirements

- Updated rules for qualifying losses

- New safe harbor guidelines

Owners seeking to use STR losses against other income must prepare in advance.

4.Retirement Planning Changes

- IRA withdrawals

- 401(k) distributions

- RMD planning

- Roth conversions

…all become more expensive.

Who Is Affected Most in Colorado (2026)

- Dual-income households

- Homeowners

- Business owners (LLCs, S-Corps, contractors)

- Real estate investors and STR owners

- High-earning professionals

- Families with children

- Retirees with taxable IRA income

- Self-employed and gig workers

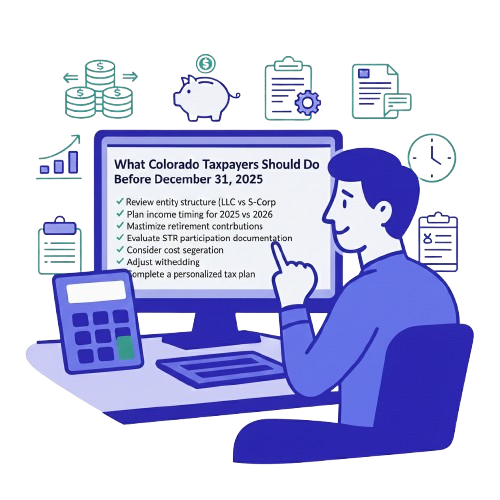

What Colorado Taxpayers Should Do Before December 31, 2025

- Review entity structure (LLC vs S-Corp)

- Plan income timing for 2025 vs 2026

- Maximize retirement contributions while brackets are lower

- Evaluate Roth conversions

- Prepare STR participation documentation

- Consider cost segregation before depreciation rules change

- Adjust withholding to prepare for higher taxes

- Complete a personalized 2025–2026 tax plan

Colorado 2026 Tax FAQ

Does Colorado conform to federal QBI rules?

No — QBI is federal-only.

Will Colorado state taxes go up in 2026?

The rate won’t change, but taxable income may be higher due to federal adjustments.

Are STR owners affected?

Yes — STR rules tighten and depreciation benefits shrink.

Will families see smaller refunds?

In many cases, yes, due to the smaller Child Tax Credit and higher taxable income.

Should retirees plan ahead?

Yes — retirement income becomes more heavily taxed due to higher brackets.

Get a 2026 Colorado Tax Strategy

Colorado residents face significant changes due to adjustments in deductions, credits, business rules, real estate treatment, and retirement taxation.

A strategic plan is essential before 2026 takes effect.

Because tax situations vary by individual and business, many Colorado residents choose to work with a qualified tax professional. You can explore available Colorado tax services and professionals by location and specialty.