California 2026 Tax Changes — What Residents, Business Owners & Investors Must Know

On January 1, 2026, massive federal tax changes take effect as TCJA provisions expire and OBBBA rules kick in.

California does NOT conform to many federal adjustments, which makes the 2026 transition especially confusing — and painful — for CA taxpayers.

Californians Most Affected:

- W-2 earners in Los Angeles, San Diego, San Francisco, San Jose, Sacramento, Orange County

- High-income households with $150K–$600K AGI

- Real estate investors & STR owners (CA is one of the hardest hit)

- Tech workers, medical professionals, lawyers, creatives

- Business owners, LLCs, S-Corps, and self-employed

- Families with children

- High-property-tax households

- Remote workers living in CA

- Anyone with appreciated stocks, crypto, or rentals

- Retirees taking RMDs and IRA withdrawals

This is the California 2026 Tax Guide — the most accurate, dense, search-optimized breakdown of what’s coming.

Guaranteed Strategy Backed by IRS Code & CA Regulations

We analyze federal + California’s unique (and often stricter) tax laws.

California-Specific Expertise

We understand CA’s high income and property tax burdens, real estate markets, and business rules.

100% Accuracy Guarantee

All plans reviewed by a licensed MERNA™ Strategist.

What’s Changing Federally in 2026 — California Edition

California does not conform to many federal changes, but they still dramatically impact CA residents.

Here’s what is changing for everyone in the state.

How this hits California:

- CA already has lower state-level standard deductions

- CA homeowners have high property taxes & mortgage interest

- More CA residents will itemize

- Itemizing returns to being the normal path in CA

- Los Angeles County

- Orange County

- Bay Area (SF, Oakland, San Jose)

- San Diego

- Sacramento suburbs

High-cost Californians lose massive deduction protection in 2026.

Federal Tax Brackets Increase Sharply

👉 Who gets crushed in California:

Because CA incomes are high, these brackets hit harder here than in any other state:

- tech workers in Silicon Valley

- engineers in Orange County

- entertainment professionals in LA

- medical and legal professionals

- dual-income households earning $150K–$400K

- high-cost-city renters with no federal cushion

California already has the highest state taxes — adding higher federal brackets is a financial double-punch.

QBI (20% Deduction) Is Permanent — But California Does Not Conform

OBBBA made QBI permanent, but:

- You get the 20% business deduction on your federal return

- You do not get it on your CA return

- CA taxable income is often MUCH higher than federal

- CA tax strategies MUST coordinate around this mismatch

- entity restructuring

- payroll optimization

- retirement stacking

- income shifting

- depreciation and real estate strategies

Because CA doesn’t give QBI relief, your CA tax bill remains stubbornly high.

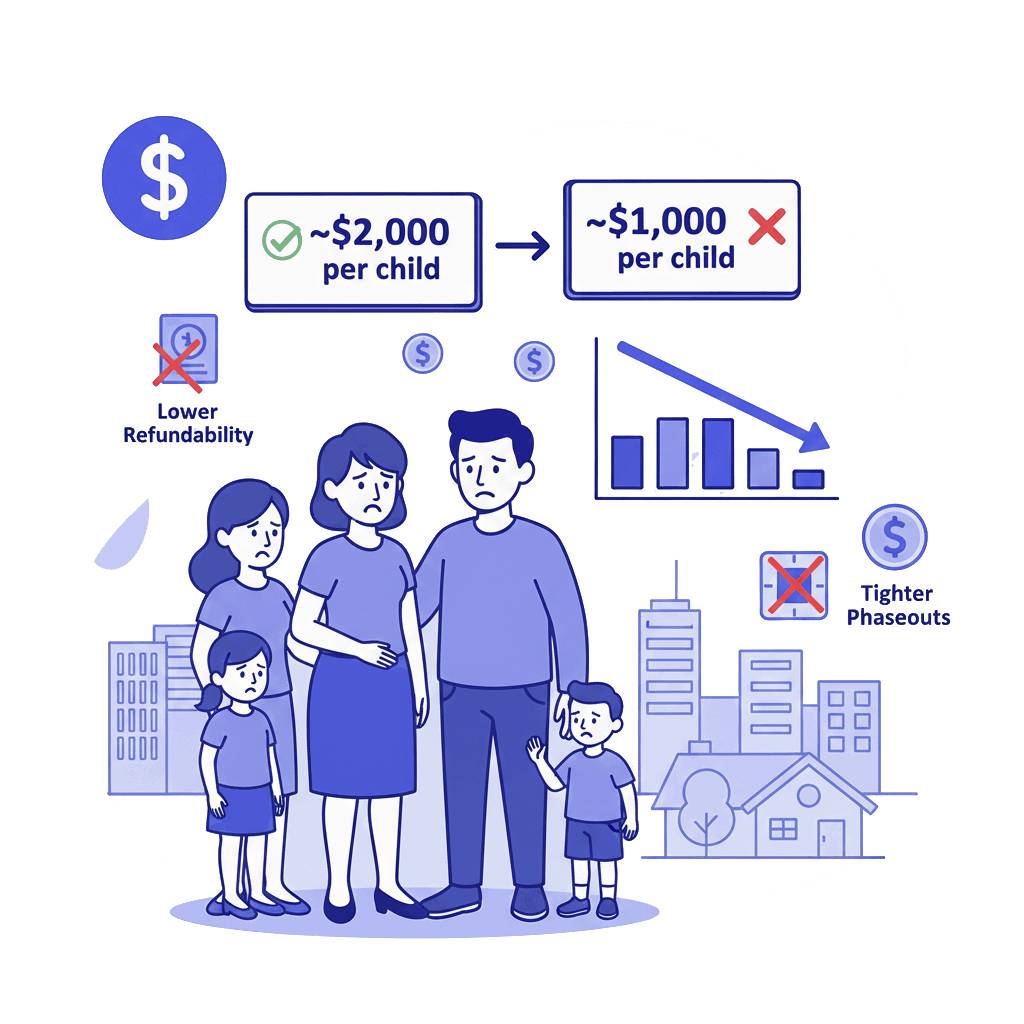

Child Tax Credit Shrinks

- ~$2,000 → ~$1,000 per child

- Lower refundability

- Tighter phaseouts

- families in LA, San Diego, Sacramento, Bay Area

- single parents

- dual-income suburban households

- families with 2–4 children in high-cost cities

CA’s high childcare and cost-of-living intensify the hit.

Marriage Penalty Returns (Horrible for CA Couples)

California has one of the highest percentages of dual-income households.

In 2026:

- joint filer brackets tighten

- credits phase out quicker

- CA’s non-conformity rules + federal marriage penalty combine

- couples get pushed up federal AND state brackets faster

If two partners each make $80K–$200K (EXTREMELY common in CA), they will feel this hard.

California-Specific Considerations

1. California State Income Tax Does NOT Change — But Taxable Income DOES

- 1% to 12.3% income tax

- 1% mental health tax over $1M AGI (top rate 13.3%)

- federal adjustments increase AGI

- which increases California taxable income

- which increases CA tax owed

- the 9.3% bracket

- the 10.3% bracket

- the 12.3% bracket

This is a critical CTA for Californians.

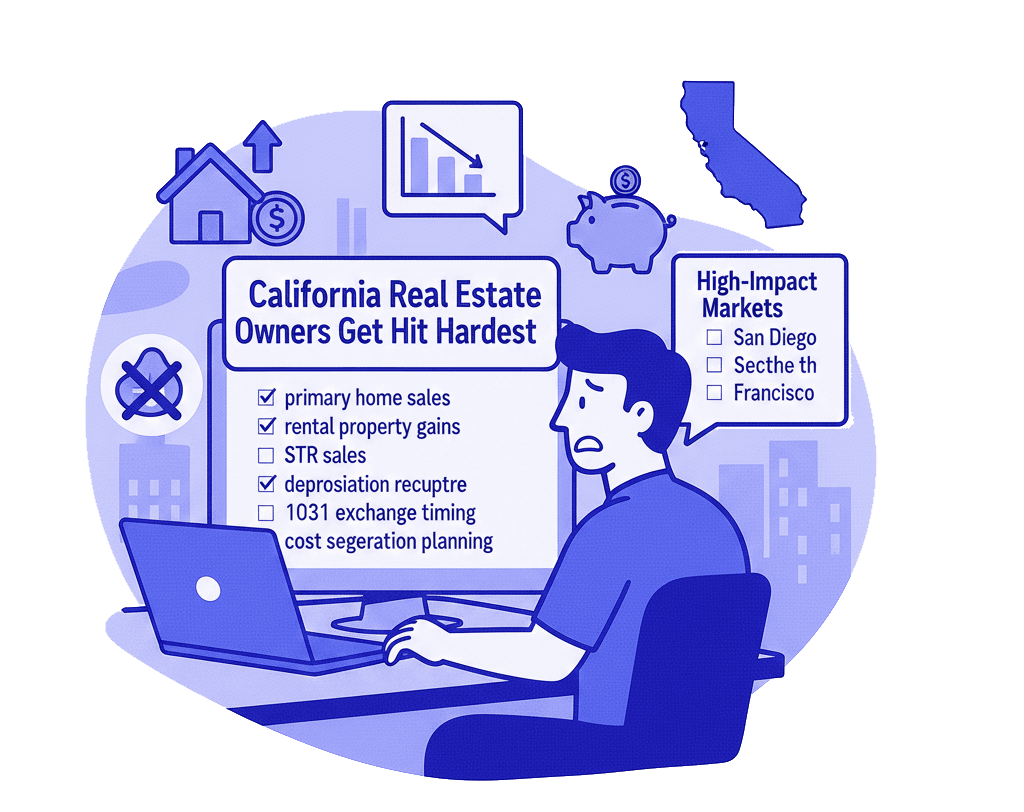

2. California Real Estate Owners Get Hit the Hardest

CA has some of the highest appreciation in the U.S., and 2026 capital gains changes are brutal.

- primary home sales

- rental property gains

- STR sales

- depreciation recapture

- 1031 exchange timing

- REPS qualification

- cost segregation planning

- Los Angeles

- Orange County

- San Francisco + Bay Area

- San Diego

- Sacramento + suburbs

- Inland Empire

- South Bay

- Central Coast (Santa Barbara, SLO)

Californians with appreciated property MUST plan before 2026.

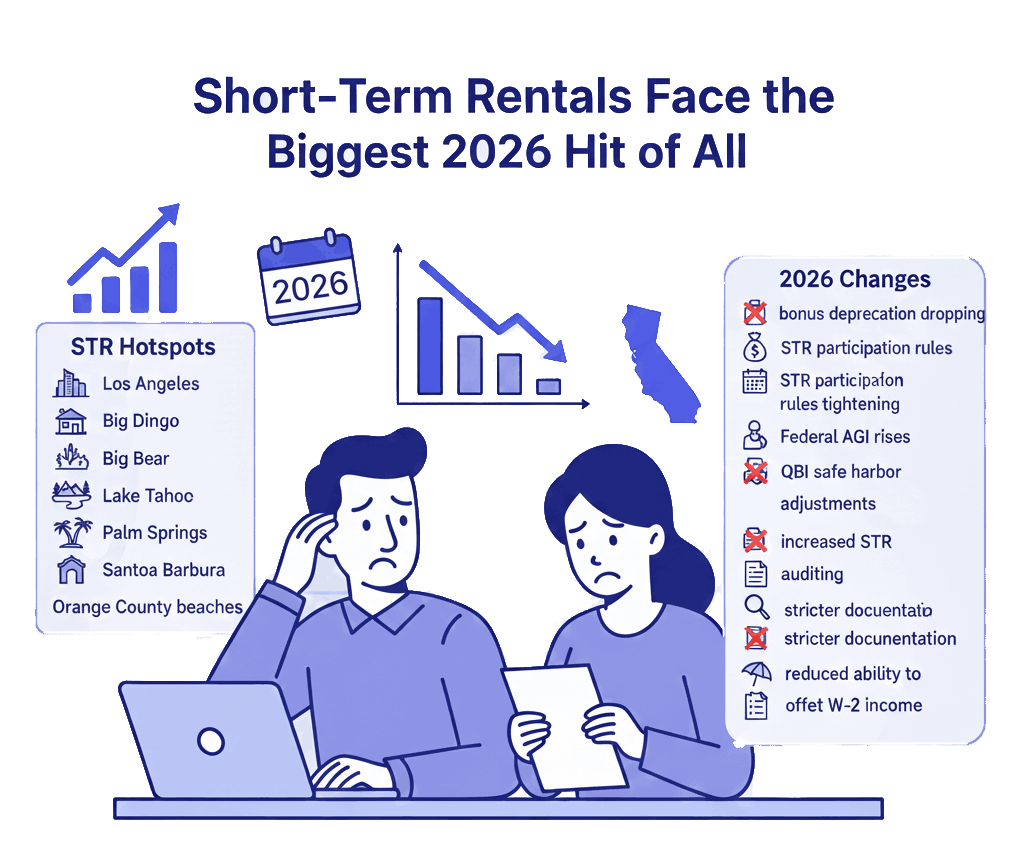

3. Short-Term Rentals Face the Biggest 2026 Hit of All

- Los Angeles

- San Diego

- Joshua Tree

- Big Bear

- Lake Tahoe

- Palm Springs

- Sonoma County

- Napa

- Santa Barbara

- Orange County beaches

- bonus depreciation dropping

- STR participation rules tightening

- QBI safe harbor adjustments

- increased STR auditing

- stricter documentation

- reduced ability to offset W-2 income

CA STR owners are at massive tax risk going into 2026.

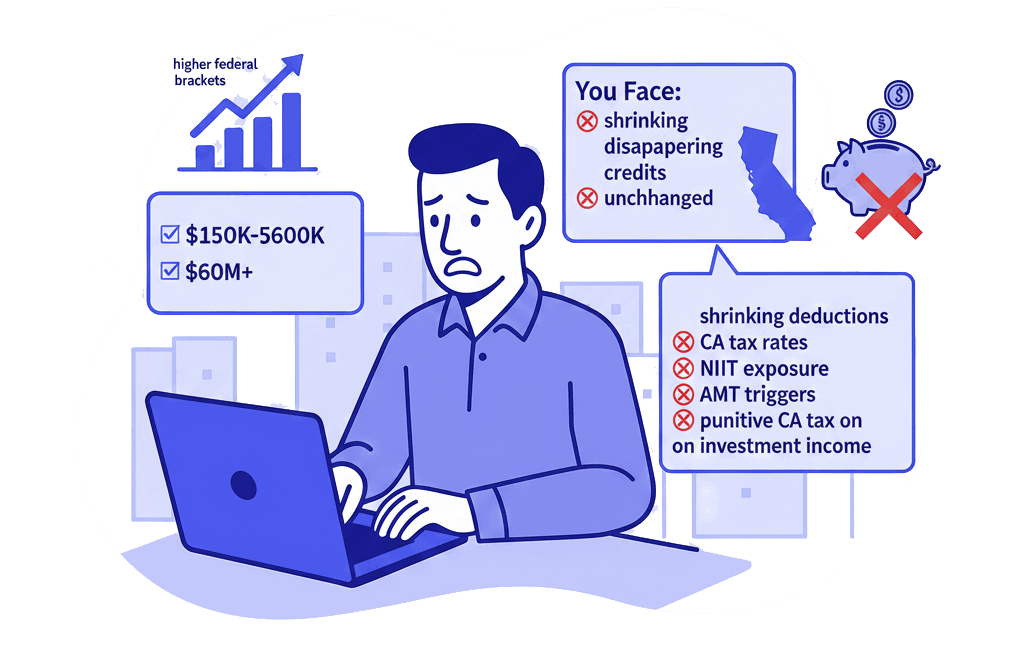

4. California High-Income Earners Get Hit the Hardest Nationwide

- $150K–$600K

- $600K+

- $1M+

- higher federal brackets

- shrinking deductions

- disappearing credits

- unchanged CA tax rates

- NIIT exposure

- AMT triggers

- higher capital gains

- punitive CA tax on investment income

This is the most punished demographic in the country in 2026.

5. Retirement Planning Is Critical in California

- Roth conversions

- RMD planning

- IRA withdrawals

- 401(k) contribution timing

- CA taxable distributions

2025 is the final cheap year to convert Roth.

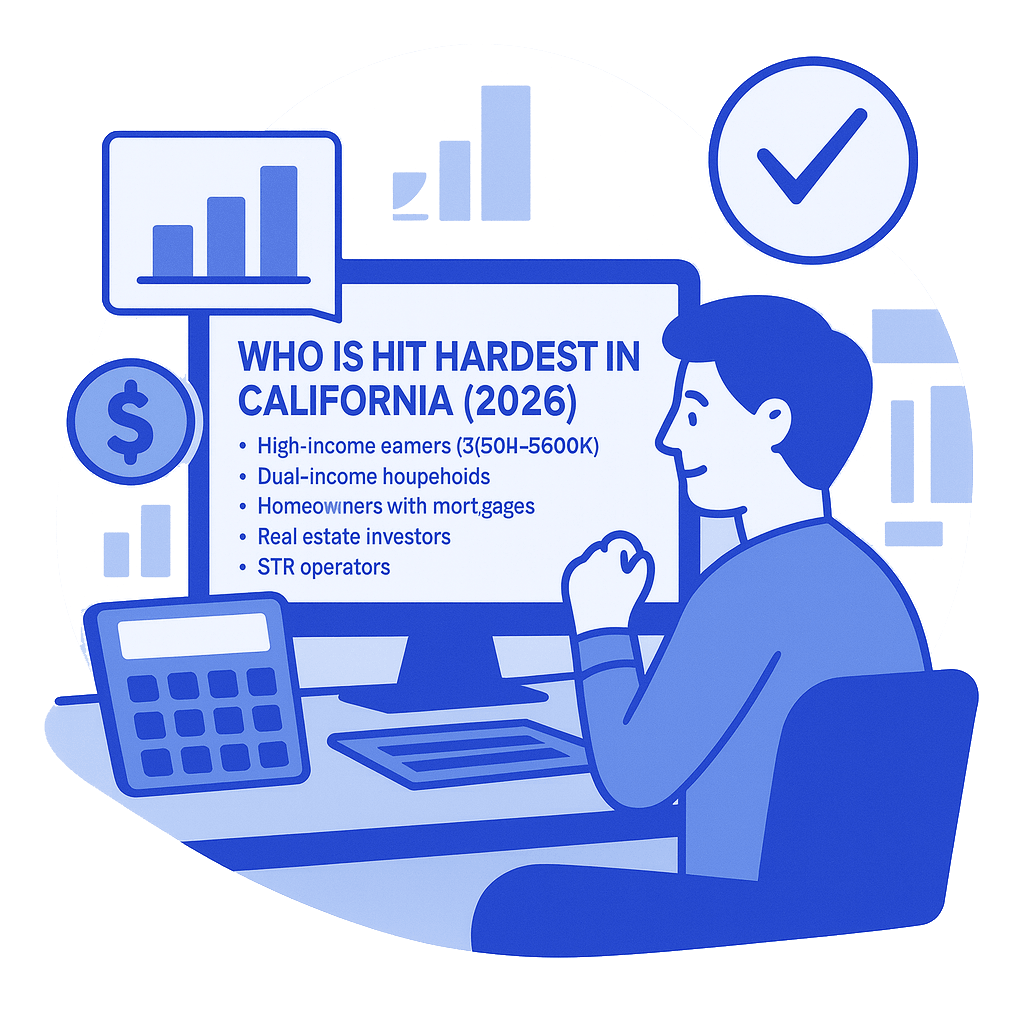

Who Is Hit Hardest in California (2026)

- High-income earners ($150K–$600K)

- Dual-income households

- Homeowners with mortgages

- Real estate investors

- STR operators

- Tech workers (SF, Silicon Valley, LA)

- Healthcare professionals

- Business owners (LLC, S-Corp, agency owners)

- Retirees with large IRAs

- Families with multiple children

- Anyone selling property in 2025–2027

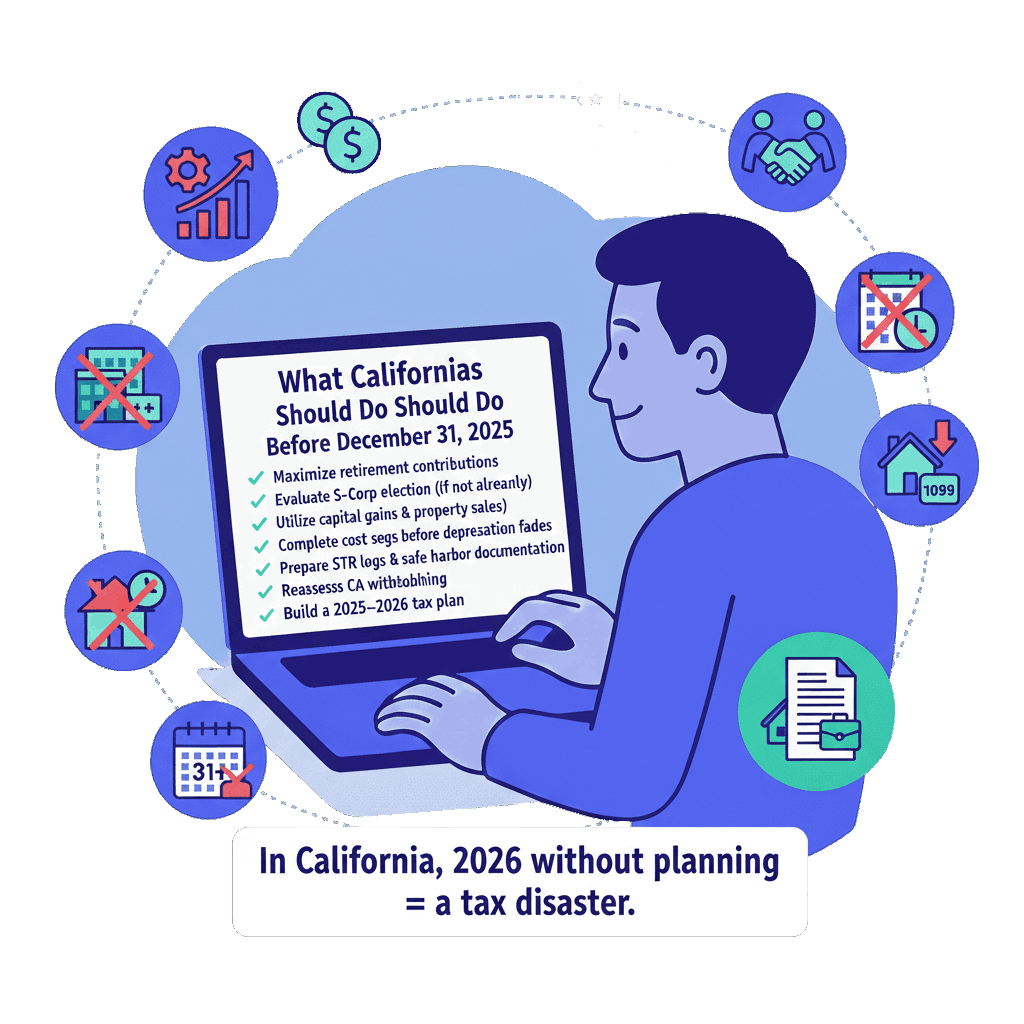

What Californians Should Do Before December 31, 2025

- Maximize retirement contributions

- Evaluate S-Corp election (if not already)

- Utilize QBI strategically (fed-only)

- Plan capital gains & property sales

- Complete cost segs before depreciation fades

- Strategize Roth conversions

- Prepare STR logs & safe harbor documentation

- Reassess CA withholding

- Build a 2025–2026 tax plan

In California, 2026 without planning = a tax disaster.

California 2026 Tax FAQ

Are California state taxes going up in 2026?

No, but your taxable income will go up due to federal changes — meaning higher CA taxes.

Does California conform to QBI?

No. QBI is federal-only.

Will my refund shrink in 2026?

For most Californians — yes.

Are real estate investors hit hard?

Extremely — capital gains changes + depreciation rules + CA tax combine painfully.

Should I sell property before 2026?

It depends — but many Californians benefit from selling in 2025.

Is 2026 a bad year for Roth conversions?

Yes — 2025 is the last “cheap” year for conversions.

Get a 2026 California Tax Strategy

California faces some of the harshest 2026 tax outcomes in the country.

Your:

- income

- credits

- real estate

- business structure

- capital gains

- retirement planning

…must be aligned NOW, not after 2026 hits.