Arkansas 2026 Tax Changes — What Residents & Business Owners Must Know

On January 1, 2026, major federal tax law changes take effect as TCJA provisions expire and new rules under OBBBA fully activate.

Even though Arkansas has a state income tax, the biggest shifts for Arkansans are federal:

- W-2 workers in Little Rock, Conway, Jonesboro, Bentonville, Rogers, Springdale

- Walmart headquarters professionals in Bentonville

- Tyson, J.B. Hunt, & manufacturing employees in Northwest Arkansas

- Teachers, nurses, and state workers

- Small business owners, contractors, and LLCs

- Self-employed, gig workers, and agricultural families

- Real estate investors, STR hosts, and landlords

This guide explains exactly how 2026 tax changes affect Arkansas households — in clear, localized language.

Guaranteed Strategy Backed by IRS Code

Every recommendation aligns with federal and Arkansas tax law.

Maximum Savings Promise

If a strategy applies to you and we miss it, we redo your plan free.

100% Accuracy Guarantee

Plans reviewed by a licensed MERNA™ strategist familiar with Arkansas taxpayers.

What’s Changing Federally in 2026 — Arkansas Edition

Arkansas residents face major federal-level changes that increase taxable income and reduce credits if they don’t plan ahead.

Federal Standard Deduction Drops

Arkansas Impact

Arkansas has:

- Large populations of married couples

- Many families with children

- High rates of homeownership in suburbs like Benton, Bryant, Cabot, Fayetteville, Rogers

- Middle-income families

- Homeowners

- Teachers, nurses, police, and state workers

- Rural households with moderate AGI

Federal Tax Brackets Increase

Every Arkansan filing a federal return faces higher tax brackets in 2026:

- 12% → 15%

- 22% → 28%

- 24% → 31%

- Walmart HQ professionals

- Tyson & J.B. Hunt workers

- Fayetteville / Bentonville dual-income families

- Rural residents with multiple incomes

- Medical staff in Little Rock & Jonesboro

- Teachers + service workers combining incomes

If your combined income is $60K–$250K, expect a noticeable increase unless you take action.

QBI (20% Deduction) Is Permanent Under OBBBA — With New Rules

QBI remains one of the biggest deductions for Arkansas business owners.

QBI is now permanent, but the rules change in 2026:

- income thresholds adjust

- SSTB phaseouts widen

- stronger documentation

- wage and capital tests enforced

- real estate QBI safe harbor clarified

- Contractors

- Electricians, plumbers, HVAC

- Trucking/transportation (huge in Arkansas)

- Real estate agents (thriving NWA housing market)

- Self-employed professionals

- Online and remote workers living in Arkansas

- Retail entrepreneurs

Child Tax Credit Shrinks in 2026

- $2,000 → ~$1,000 per child

- Refundability drops

- Phaseouts tighten

Arkansas has a high family density, especially in:

- Conway

- Jonesboro

- Benton/Bryant area

- Northwest Arkansas

Families will see smaller refunds and larger balances owed.

Marriage Penalty Returns

Dual-income Arkansas households are impacted, especially:

- Walmart HQ couples

- Tyson/J.B. Hunt employee households

- Teachers + nurses

- Police + service employees

- Middle-income couples ($75K–$200K combined)

The return of the marriage penalty means income stacks faster, pushing couples into higher brackets.

Arkansas-Specific Considerations

This is where local nuance boosts SEO authority.

1. Arkansas State Income Tax Still Applies

Arkansas has a progressive state income tax, and state AGI starts from federal AGI.

- lower standard deduction

- higher brackets

- smaller credits

…your Arkansas state tax burden also increases.

2. Rapid Growth in Northwest Arkansas

- Bentonville

- Rogers

- Fayetteville

- Springdale

…are experiencing explosive economic growth.

- capital gains on home & investment sales

- higher taxable income

- STR tax tightening

- QBI threshold navigation

3. Arkansas Has Growing STR Markets

- Hot Springs (vacation + lake properties)

- Bentonville (Crystal Bridges + Walmart tourism)

- Eureka Springs

- Northwest Arkansas (events, sports, biking trails)

- lower bonus depreciation

- tighter STR participation rules

- fewer upfront write-offs

- higher capital gains if selling rentals

4. Rural Arkansas & Agricultural Income

- land income

- livestock sales

- crop payments

- part-time W-2 income

- equipment deductions

2026 makes agricultural planning more critical.

Who Is Hit Hardest in Arkansas (2026)

- W-2 earners $60K–$250K

- Walmart/industry professionals in NWA

- Dual-income households

- Families with multiple children

- Small business owners (LLC, S-Corp)

- Contractors & trades

- Truckers and logistics workers

- STR investors in Hot Springs, NWA, Eureka Springs

- Retirees with IRA withdrawals

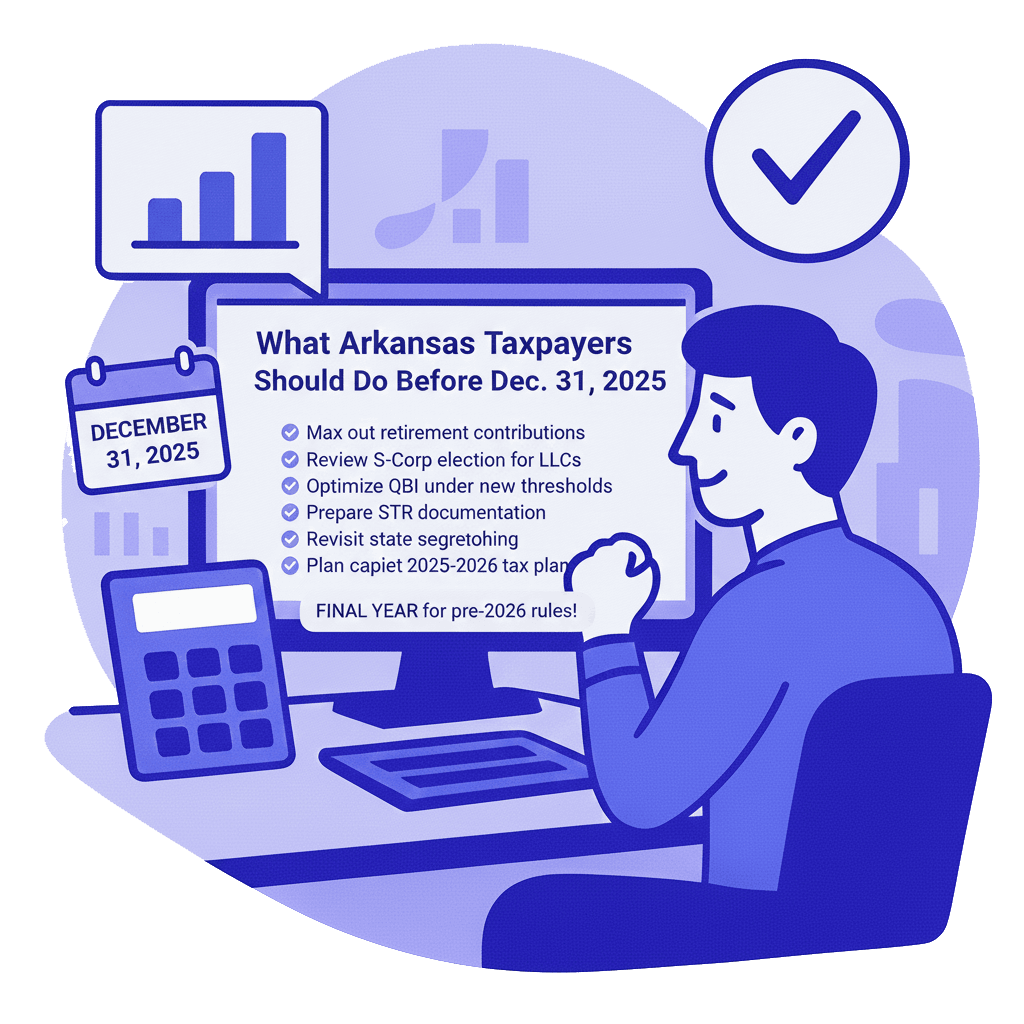

What Arkansas Taxpayers Should Do Before December 31, 2025

- Max out retirement contributions

- Review S-Corp election for LLCs

- Optimize QBI under new thresholds

- Prepare STR documentation before 2026

- Run cost segregation while bonus depreciation is still high

- Revisit state withholding amounts

- Plan capital gains timing

- Complete a 2025–2026 tax plan

THIS is the final year to use pre-2026 rules to your benefit.

Arkansas 2026 Tax FAQ

Are Arkansas taxes going up in 2026?

State rates stay the same, but taxable income increases because federal rules change.

Does QBI still apply in 2026?

Yes — permanently — with updated rules.

Are families hit harder in Arkansas?

Yes. Child credits shrink and deductions drop.

Do STR owners get affected?

Yes, especially in Hot Springs, NWA, and tourist regions.

Will my paycheck be smaller?

Likely yes, unless you adjust withholding and plan ahead.

Get a 2026 Arkansas Tax Strategy

Arkansas families, business owners, contractors, and investors face major 2026 changes.

Your:

- bracket exposure

- QBI qualification

- STR deductions

- state AGI

- retirement strategy

- real estate holdings

…all need updating before Dec 31, 2025.

Because tax situations vary by individual and business, many Arkansas residents choose to work with a qualified tax professional. You can explore available Arkansas tax services and professionals by location and specialty.