2026 Tax Brackets: How OBBBA Locked in Lower Rates for Years to Come

On July 4, 2025, the One, Big, Beautiful Bill Act (OBBBA) was signed into law, preventing a massive, scheduled tax hike and making the lower tax rates from the Tax Cuts and Jobs Act (TCJA) permanent [1].

Forget what you’ve heard about tax brackets reverting to higher, pre-2018 levels. Thanks to OBBBA, the seven-bracket structure with lower rates is here to stay. This is one of the most significant legislative wins for W-2 earners, families, business owners, and investors in decades.

If you make between $50,000 and $500,000, your taxes are almost guaranteed to be lower than you expected—provided you plan for the new landscape.

This guide breaks down the official 2026 tax brackets under the new law, who benefits most, and how to legally maximize your savings.

Guaranteed Strategy Backed by Permanent Law

Every projection here ties directly to the One, Big, Beautiful Bill Act (Public Law 119-21) and the official 2026 inflation adjustments released by the IRS [1].

Maximum Savings Promise

If you qualify for a bracket-lowering strategy under the new permanent law and we miss it, we’ll redo your plan for free.

100% Accuracy Guarantee

All recommendations are reviewed by a licensed MERNA™ Strategist who is an expert in the new 2026 tax code.

Official 2026 Tax Brackets (Under OBBBA)

The IRS has released the official inflation-adjusted tax brackets for 2026. As you can see, the lower rates from the TCJA remain in place.

2026 Tax Brackets — Single Filers

2026 Tax Brackets — Married Filing Jointly

What These Permanent Brackets Actually Mean

1. Your Tax Rate Is NOT Going Up.

2.Middle-Income Households Are Protected.

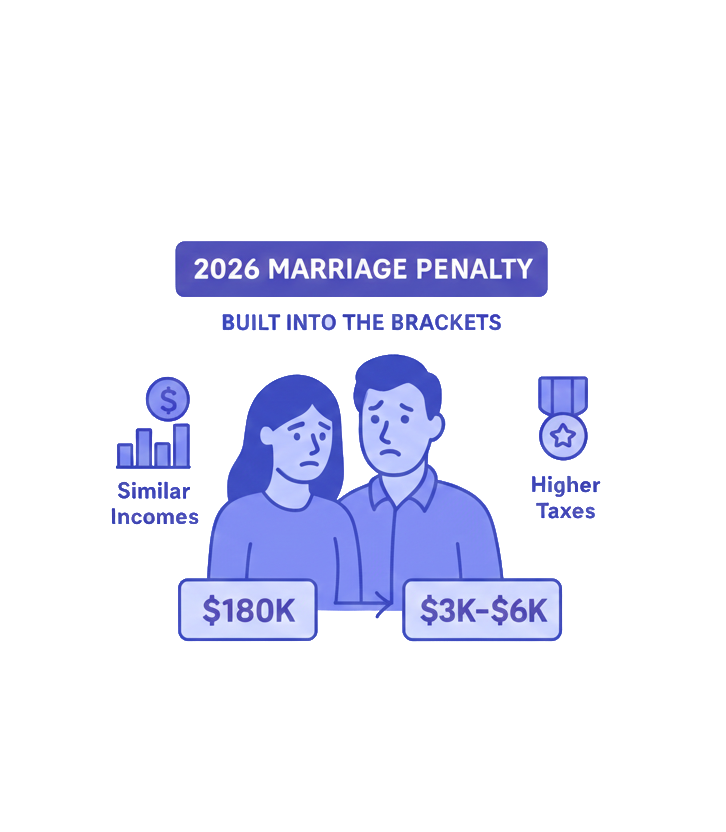

3. The "Marriage Penalty" Relief is Permanent.

4. Tax Planning is About Offense, Not Defense.

Instead of scrambling to avoid a tax increase, the planning focus for 2025 and 2026 is now on offense. How can you use the stability of these brackets, combined with a host of new deductions, to proactively lower your tax bill?

How the 2026 Brackets Impact You

W-2 Earners

Most employees will see:

- Stable Paychecks: Your withholding won’t suddenly jump due to higher tax rates.

- More Take-Home Pay: The combination of low rates and a higher standard deduction ($32,200 for joint filers in 2026) means more money in your pocket.

- New Deduction Opportunities You may now be eligible for new deductions for tip income, overtime pay, and auto loan interest [1].

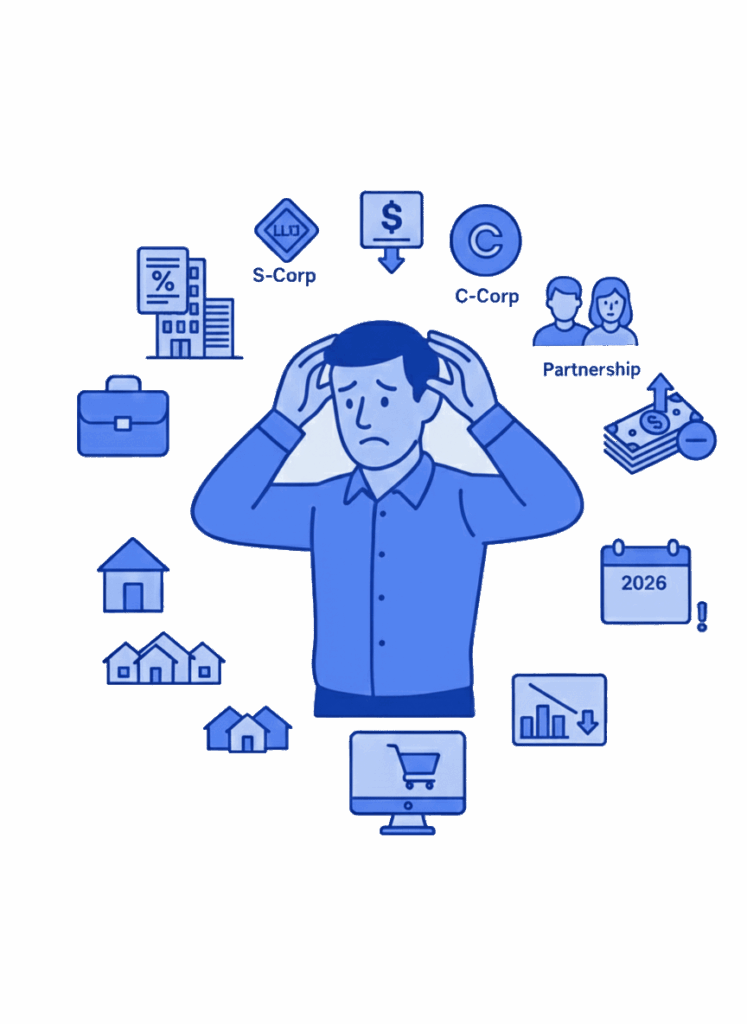

How the 2026 Brackets Impact Small Business Owners

Business owners are the biggest winners. The “double whammy” of expiring QBI and higher brackets never materialized. Instead, you get a double benefit:

- Permanent Low Brackets for your pass-through income.

- A Permanent and Enhanced QBI Deduction to shield 20% of your business income from taxes.

How the 2026 Brackets Impact Real Estate Investors

Investors avoid a triple threat and instead gain a triple advantage:

- Low Ordinary-Income Brackets for rental income.

- Favorable Capital Gains Rates remain in place.

- 100% Bonus Depreciation is PERMANENT, making cost segregation studies more valuable than ever for generating massive upfront deductions.

Who Benefits Most from the Permanent 2026 Tax Brackets?

- Married Dual-Income Households who avoid the return of the marriage penalty.

- W-2 Earners making $75K–$300K who will remain in lower-than-expected brackets.

- Small Business Owners (LLCs, S-Corps) who get to stack the permanent QBI deduction on top of permanent low rates.

- Families with Children who benefit from the increased $2,200 Child Tax Credit on top of favorable brackets.

- Real Estate Investors who can now pair 100% bonus depreciation with stable, low tax rates.

How to Maximize Your Savings Under the New 2026 Brackets

- Utilize New Deductions: Start tracking your tip income, overtime pay, and auto loan interest to take full advantage of these new tax breaks.

- Maximize Retirement Contributions: Use 401(k)s and IRAs to lower your taxable income within these stable brackets.

- Optimize Your Business Structure: With QBI being permanent, is your LLC, S-Corp, or sole proprietorship structured for maximum tax efficiency?

- Time Your Investments: Use the permanent 100% bonus depreciation and Section 179 expensing to strategically lower your tax liability.

Frequently Asked Questions

Are the 2026 tax brackets final?

Yes, the brackets and rates shown above are based on the permanent law established by OBBBA and the official 2026 inflation adjustments released by the IRS on October 9, 2025 [1].

Will everyone pay less tax?

While the rates have been kept low, your individual situation will vary. However, OBBBA prevented a scheduled tax increase for 62% of taxpayers and introduced many new ways to save [2].

Can tax planning still lower my bracket?

Absolutely. Strategic use of deductions for retirement contributions, business expenses, and the new OBBBA provisions can effectively lower your taxable income, dropping you into a lower bracket.