2026 Standard Deduction: The Permanent, Larger Deduction is Here to Stay

Great news for American taxpayers: The standard deduction is NOT shrinking in 2026. In fact, it’s getting bigger. Thanks to the One, Big, Beautiful Bill Act (OBBBA), the higher standard deduction amounts from the Tax Cuts and Jobs Act (TCJA) have been made a permanent part of the U.S. tax code.

For years, taxpayers have been warned about a “tax cliff” at the end of 2025, when the standard deduction was scheduled to be cut in half. That threat is now gone. This guide explains what the permanent, larger standard deduction means for you, how much it is for 2026, and how it simplifies tax planning for the future.

Millions of Americans who currently benefit from the larger deduction will suddenly pay thousands more unless they plan ahead before December 31, 2025.

This guide explains what changes, who gets impacted, and what you can do now to avoid overpaying.

The Tax Cliff That Wasn’t: Understanding the Permanent Change

Before OBBBA was signed into law on July 4, 2025, the tax code was on a path to revert to its pre-2018 rules. This would have caused the standard deduction to be cut by nearly 50%, forcing millions of Americans to once again go through the complex process of itemizing deductions and leading to a significant tax increase for most households.

OBBBA averted this scenario entirely. The law locked in the higher standard deduction, ensuring that the vast majority of taxpayers will continue to benefit from a simplified, more generous tax filing process.

Official 2026 Standard Deduction Amounts

The Internal Revenue Service (IRS) has released the official inflation-adjusted standard deduction amounts for the 2026 tax year (the return you file in 2027).

| Filing Status | 2025 Standard Deduction | 2026 Standard Deduction | Increase |

|---|---|---|---|

| Single | $15,750 | $16,100 | +$350 |

| Married Filing Jointly | $31,500 | $32,200 | +$700 |

| Head of Household | $23,625 | $24,150 | +$525 |

| Married Filing Separately | $15,750 | $16,100 | +$350 |

As you can see, not only is the deduction not shrinking, it is actively increasing to keep pace with inflation.

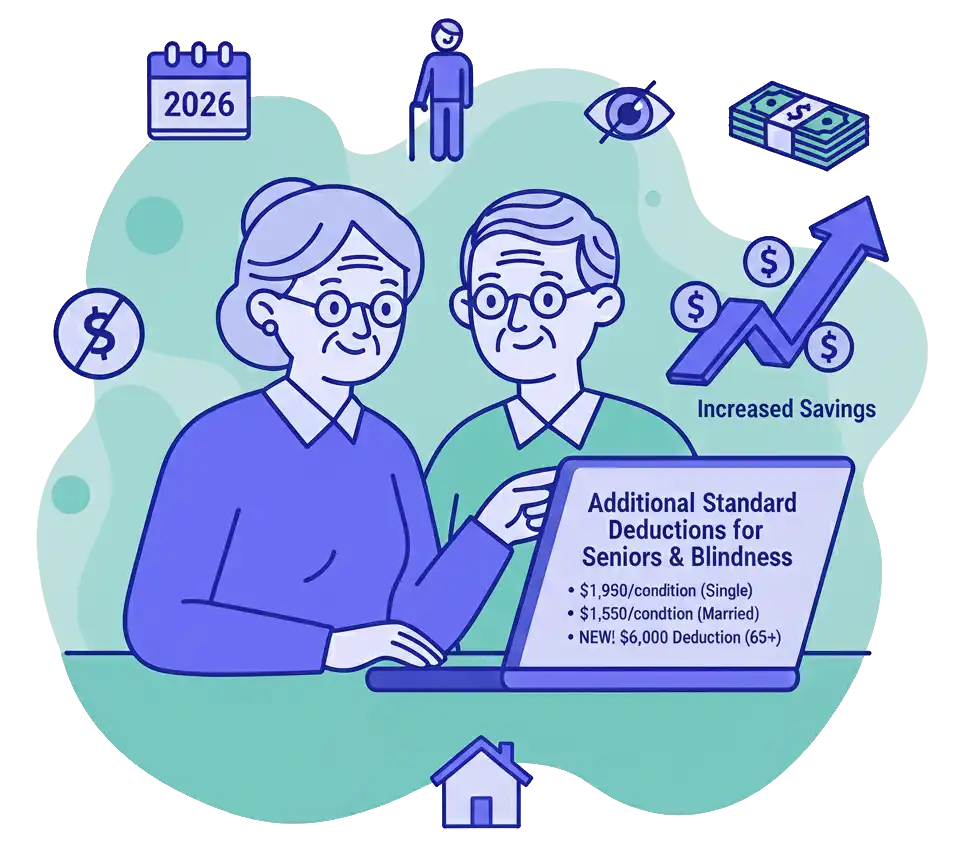

Additional Standard Deductions for Age and Blindness

In addition to the base standard deduction, taxpayers who are age 65 or older or who are blind are entitled to an additional standard deduction amount. For 2026, this additional amount is:

- $1,950 for each qualifying condition (e.g., a single individual who is 65 and blind would get an additional $3,900).

- $1,550 for married taxpayers for each qualifying condition.

OBBBA also introduced a new, separate $6,000 deduction for seniors aged 65 and older, which is in addition to the standard deduction and the additional amounts for age/blindness.

What the Permanent Standard Deduction Means for You

Simplified Tax Filing: The vast majority of taxpayers will not need to itemize. The Tax Foundation estimates that nearly 90% of households will now take the standard deduction, simplifying the filing process and reducing the need to track and document itemized expenses like mortgage interest, state and local taxes, and charitable contributions.

Lower Tax Bills: For most Americans, the permanent, higher standard deduction directly translates to a lower overall tax bill compared to the pre-OBBBA scenario.

Long-Term Certainty: You can now plan your finances for the long term with the certainty that this foundational piece of the tax code is stable. This makes it easier to make decisions about homeownership, charitable giving, and other financial matters.

Frequently Asked Questions

Does the standard deduction really drop in 2026?

No. This is the most important takeaway. The One, Big, Beautiful Bill Act (OBBBA) made the higher standard deduction permanent. It will not drop; it will continue to increase with inflation.

Will I have to itemize my deductions again?

Probably not. You should only itemize if your total itemized deductions (such as mortgage interest, state and local taxes up to the $10,000 SALT cap, and charitable contributions) are greater than your standard deduction amount. For most people, the standard deduction will be the better option.

How does this affect the SALT deduction?

The $10,000 cap on the state and local tax (SALT) deduction remains in place. However, OBBBA did increase the SALT cap to $40,000 for most taxpayers. The higher standard deduction makes the SALT cap irrelevant for the majority of filers who no longer itemize.

Get a 2026 Standard Deduction Strategy

The deduction drop is one of the biggest 2026 tax changes — and it hits almost every household.

Planning NOW (in 2025) is how you protect yourself from higher taxes.