2026 Small Business Tax Changes — What Every Owner Must Know Before January 1

On January 1, 2026, the Tax Cuts and Jobs Act (TCJA) expires — triggering major tax changes for every small business in America.

- LLCs

- S-Corps

- Sole proprietors

- Partnerships

- 1099 contractors

- Freelancers & gig workers

- Real estate investors

- E-commerce sellers

- Service-based businesses

- Agencies & consultants

- Brick-and-mortar businesses

- Online businesses

Whether you’re earning $50K or $500K in profit — YOU WILL FEEL the 2026 shift.

Some small business owners may pay $7,000–$30,000+ more if they don’t prepare before December 31, 2025.

This page breaks it all down.

Guaranteed Strategy Backed by IRS Code

Every analysis is tied directly to federal law and TCJA sunset rules.

Maximum Savings Promise

We find every legal deduction and structure — or we redo your plan free.

100% Accuracy Guarantee

Plans are reviewed by a licensed MERNA™ Strategist.

The End of QBI (20% Pass-Through Deduction)

This is the #1 biggest tax change for small businesses in 2026.

QBI currently allows qualifying businesses to deduct 20% of net income — saving thousands per year.

Example:

- Net income: $150,000

- QBI deduction: $30,000

- Taxed on: $120,000

With QBI gone in 2026, you lose that entire deduction.

Estimated tax increase for small businesses:

- $60K–$100K profit → +$3,000–$6,000

- $100K–$200K profit → +$6,000–$12,000

- $200K–$350K profit → +$12,000–$22,000

Industries hit the hardest:

- Contractors & trades

- Agencies, consultants, coaches

- Real estate businesses

- Professional services (legal, medical, finance)

- Online & e-commerce

- Creatives & digital service businesses

- Freelancers, 1099 workers, gig workers

If you are a small business owner — this is YOUR biggest risk.

Small Business Owners Are Pushed Into Higher 2026 Tax Brackets

Small business owners pay taxes through their personal returns (Schedule C, K-1, or S-Corp).

In 2026, tax brackets increase:

- 12% → 15%

- 22% → 28%

- 24% → 31%

If your business earns $75K–$350K+, you’ll feel it hard.

Example:

Business profit taxed in 2025: $150,000

Estimated additional tax in 2026: $4,000–$8,000

Combined with QBI removal, the impact is massive.

Standard Deduction Drops (This Hurts Small Business Owners)

Projected 2026 standard deduction:

- Single → ~$8,300

- Married filing jointly → ~$16,600

- Head of household → ~$12,400

Small business owners rely heavily on:

- the higher standard deduction, or

- itemizing to maximize write-offs

When the standard deduction drops, your taxable income automatically rises.

For many owners, this adds $2,000–$4,000+ to their tax bill before any other changes.

Depreciation Benefits Shrink Dramatically for Small Businesses

Bonus Depreciation Timeline:

- 2023 → 80%

- 2024 → 60%

- 2025 → 40%

- 2026 → 20%

- 2027 → 0%

For small businesses that buy:

- trucks

- SUVs

- equipment

- computers

- machinery

- tools

- real estate improvements

…this is the last major window to expense big purchases.

Section 179 also tightens, especially for:

- heavy vehicles

- large equipment

- real estate improvements

Small Business Deductions Get Stricter

Several small business deductions become narrower or require more documentation in 2026:

- Vehicle deductions

- Home office deductions

- Meals deductions

- Travel deductions

- Startup costs

- Depreciation categories

- Bonus depreciation

- Accountable plan reimbursements

Small business owners will need stronger bookkeeping and better documentation to defend deductions from IRS scrutiny.

Payroll Taxes & Withholding Shifts

- New withholding tables

- Higher taxable wages

- Increased payroll exposure

- Greater IRS enforcement

- Required payroll recalculations for owners

- “Reasonable compensation” rules become stricter

- Payroll errors become more costly

- IRS enforcement increases significantly

This is one of the biggest hidden tax risks for small business owners.

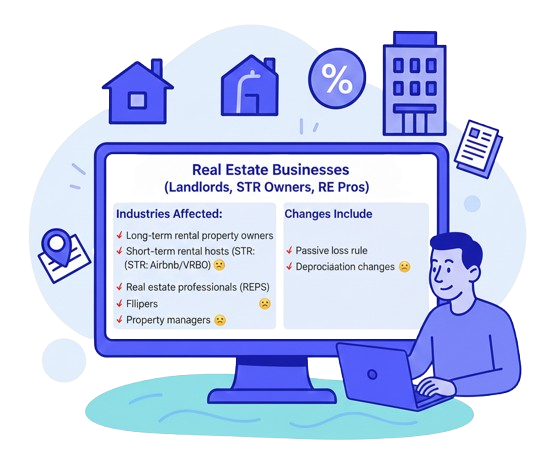

Real Estate Businesses (Landlords, STR Owners, RE Pros)

The following industries — MANY of which are structured as “small businesses” — face the largest hits:

- Long-term rental property owners

- Short-term rental hosts (STR: Airbnb/VRBO)

- Real estate professionals (REPS)

- Flippers

- Property managers

- Passive loss rule tightening

- Real estate professional status enforcement

- STR loophole adjustments

- Depreciation changes

- Capital gains bracket increases

- 1031 exchange rule pressure

If your small business is real estate, 2025 planning is critical.

2026 Small Business Planning Strategies

This section converts extremely well.

- Convert LLC → S-Corp before 2026 (if eligible)

- Maximize retirement contributions in 2025

- Use cost segregation (if real estate is involved)

- Accelerate deductions into 2025

- Shift income into 2025 where possible

- Deduct equipment purchases in 2025

- Add spouse or children to payroll (legal income shifting)

- Reevaluate entity structure

- Use accountable plans aggressively in 2025

- Prepare for payroll withholding changes

- Review health insurance & fringe benefit structures

- Consider multi-entity planning

Your small business tax bill in 2026 depends entirely on planning in 2025.

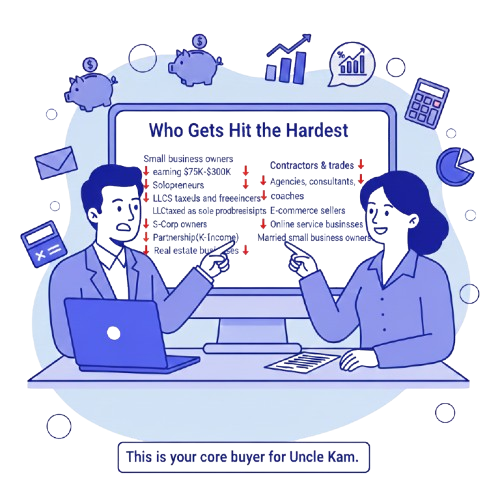

Who Gets Hit the Hardest

- Small business owners earning $75K–$300K

- Solopreneurs and freelancers

- LLCs taxed as sole proprietorships

- S-Corp owners

- Partnerships (K-1 income)

- Real estate businesses

- Contractors & trades

- Agencies, consultants, coaches

- E-commerce sellers

- Online service businesses

- Married small business owners

This is your core buyer for Uncle Kam.

2026 Small Business Tax FAQs

Will every small business pay more in 2026?

Not all — but MOST will unless they restructure or plan aggressively.

Does the 20% QBI deduction really end?

Highly likely. Congress has not extended it.

Should I switch to S-Corp before 2026?

If you earn $60K–$250K in net profit, it’s worth evaluating.

Should I buy equipment or vehicles in 2025?

Very likely — bonus depreciation is disappearing.

Will my payroll need to change?

Yes — withholding and reasonable compensation rules update.

Can tax planning offset the entire increase?

Yes — with proper entity planning, retirement stacking, and deduction timing.

Get Your Custom 2026 Small Business Tax Plan

2026 is the biggest tax shift for small businesses in a decade.

Your structure, deductions, payroll, and strategy MUST be set before December 31, 2025.