2026 Freelancer Tax Changes — What Every 1099 Worker Must Know Before January 1

Starting January 1, 2026, freelancers, creators, gig workers, 1099 contractors, and independent professionals will face the biggest tax shift in years.

This affects:

- Content creators

- Social media managers

- Online coaches

- Copywriters

- Videographers

- Designers & editors

- Real estate agents

- Tech contractors

- Gig workers (Uber, Lyft, Instacart)

- Upwork & Fiverr freelancers

- Influencers

- Microbusiness owners

Even though QBI is now permanent under OBBBA, freelancers lose several 2018–2025 protections and face higher tax burdens unless they plan ahead.

This guide breaks down every 2026 freelancer tax change.

Qualified by IRS Code

All analysis reflects OBBBA’s QBI permanence + TCJA 2026 reversion rules.

Maximum Savings Promise

If we miss a legal freelancer deduction, we redo your plan free.

100% Accuracy Guarantee

Reviewed by a licensed MERNA™ Strategist specializing in 1099 tax law.

Higher 2026 Federal Tax Brackets Hit Freelancers First

Freelancers already pay:

- Income tax

- Full self-employment tax (15.3%)

- No employer-covered benefits

Example:

Freelancer net income: $95,000

Estimated tax increase (federal only): $2,500–$4,500

Higher brackets = higher taxes on every dollar of freelance income.

Standard Deduction Shrinks (This Hurts Freelancers Badly)

Projected 2026 deduction:

For freelancers:

- This reduces protection against self-employment tax

- More income gets taxed

- Less cushion if you don’t itemize

This change alone adds $1,200–$3,000 for many freelancers.

QBI (20% Deduction) Is Permanent — But the Rules Tighten

Thanks to the One Big Beautiful Bill Act (OBBBA) signed in July 2025:

- QBI stays

- QBI is now permanent

- QBI is NOT ending in 2026

BUT many freelancers must adjust to new 2026 rules:

New OBBBA QBI updates include:

- Updated income thresholds

- Wider SSTB phaseout ranges

- Revised formulas for high-earning “service businesses”

- Strict anti-abuse rules (no fake business income splitting)

- Stronger documentation requirements

- New safe harbor rules for “creator income”

- Guidelines for digital-service freelancers

Self-Employment Tax Remains the Freelancer’s Largest Tax Burden

👉 But because more income becomes taxable in 2026 (due to lower standard deduction + higher brackets), your total SE tax increases.

Even freelancers making $50K–$80K will see increases unless they restructure.

This is a HUGE angle for converting freelancers into S-Corp strategies.

IRS Tightens Deduction Rules for Freelancers in 2026

The IRS is increasing enforcement on:

Home office

Must be exclusively and regularly used for business.

Mileage

Logs required — apps recommended.

Travel

Must have a clear business purpose.

Meals

50% only and must meet stricter documentation.

Internet / phone

Must be properly allocated.

Software subscriptions

Still deductible, but must be ordinary & necessary.

Equipment

Bonus depreciation windows shrink drastically.

Freelancers who don’t keep records will lose deductions — period.

Platform Income (PayPal, Stripe, Uber, Airbnb, Etsy) Has New Reporting Rules

- Expanded 1099-K reporting at lower thresholds

- More platforms required to report

- Advanced matching against freelancer Schedule C returns

- AI-driven audits for underreported income

Freelancers who “forget” income will be automatically flagged.

Real Estate Agents, Creators & Digital Contractors Face Additional Changes

Real Estate Agents

- New REPS interaction rules

- Updated QBI safe harbor for real estate businesses

- Tighter mileage & travel documentation

- Commission timing considerations for 2025–2026

Creators & Influencers

- New rules on product gifts

- Required reporting of PR packages

- Content-related deductions must meet new standards

- QBI safe harbor for creator income begins 2026

Tech Contractors

- New SSTB phase-in thresholds

- Adjusted QBI rules for specialized knowledge roles

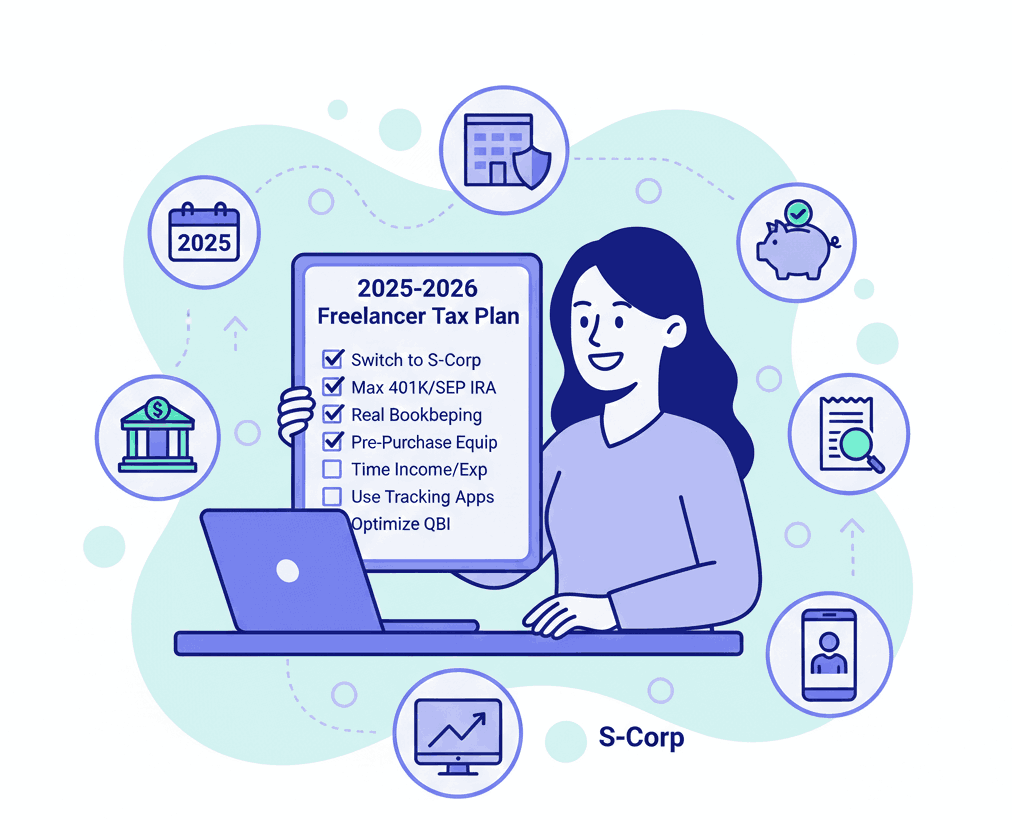

Best 2025–2026 Planning Moves for Freelancers

- Consider switching to S-Corp if profit is $60K–$200K

- Maximize 2025 retirement contributions

- Track ALL business expenses (real bookkeeping)

- Pre-purchase equipment before bonus depreciation drops

- Use accountable plan reimbursements (S-Corp only)

- Time income and expenses around 2025 vs 2026 bracket jumps

- Separate business and personal finances

- Use mileage & expense tracking apps

- Optimize QBI eligibility under OBBBA rules

For many freelancers, these steps will save thousands.

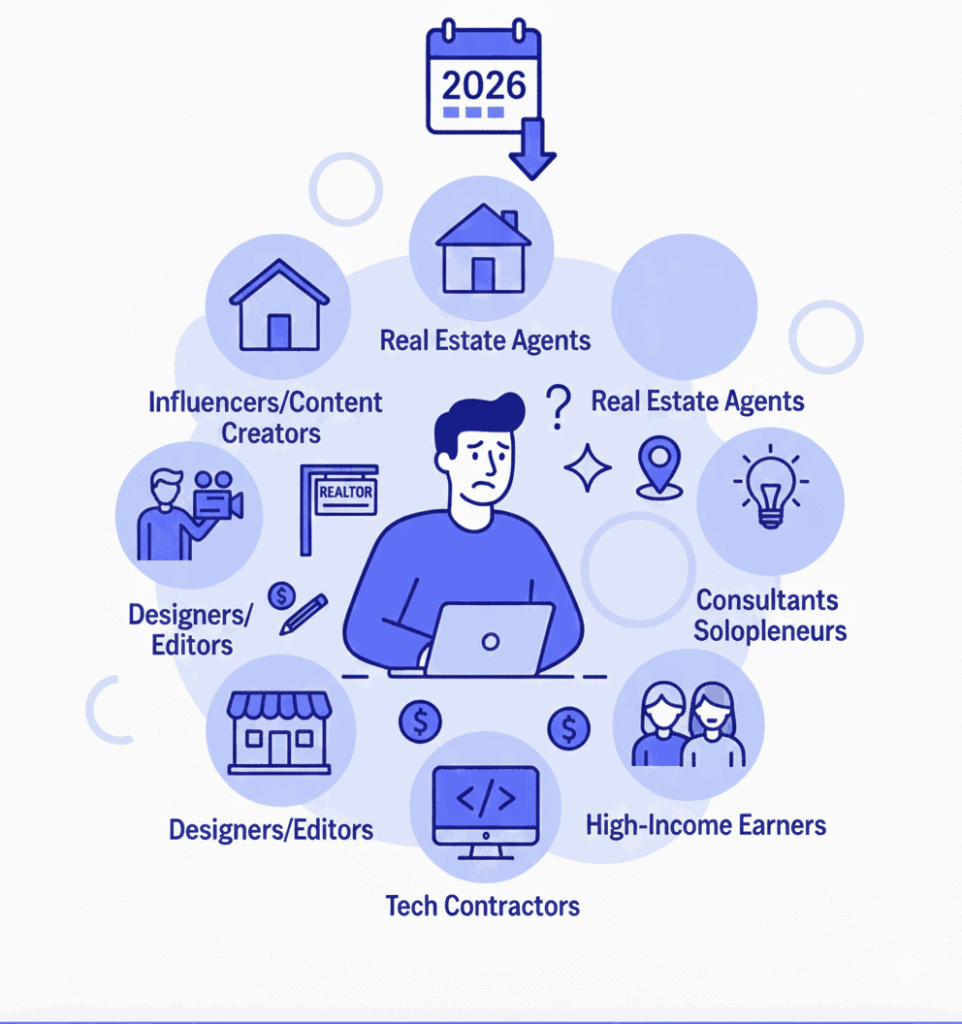

Who Gets Hit the Hardest

- Freelancers earning $75K–$250K

- Influencers and content creators

- Real estate agents

- Consultants & solopreneurs

- Gig workers in high-cost states

- Designers, editors, videographers

- Tech contractors & developers

- Online service pros

- Single-member LLC freelancers

- Married freelancers (due to returning marriage penalty)

2026 Freelancer FAQ

Are freelancers paying more tax in 2026?

Most will — unless they restructure and plan.

Is QBI ending?

No. QBI is permanent under OBBBA (July 2025).

Should freelancers switch to S-Corp in 2025?

If net profit is $60K–$200K, S-Corp often saves thousands.

Do home office deductions still exist?

Yes — but enforcement becomes stricter.

Do gig workers get hit by new IRS reporting rules?

Yes — platforms must report much more income in 2026.

Can freelancers reduce 2026 taxes now?

Absolutely — with income timing, retirement contributions, structures, and QBI optimization.

Get Your 2026 Freelancer Tax Plan

Freelancers are one of the MOST impacted groups in 2026.

Higher brackets + lower deductions + stricter rules = higher taxes.

QBI stays — but qualifying is more complex than ever.

Your 2026 plan MUST be set before December 31, 2025.