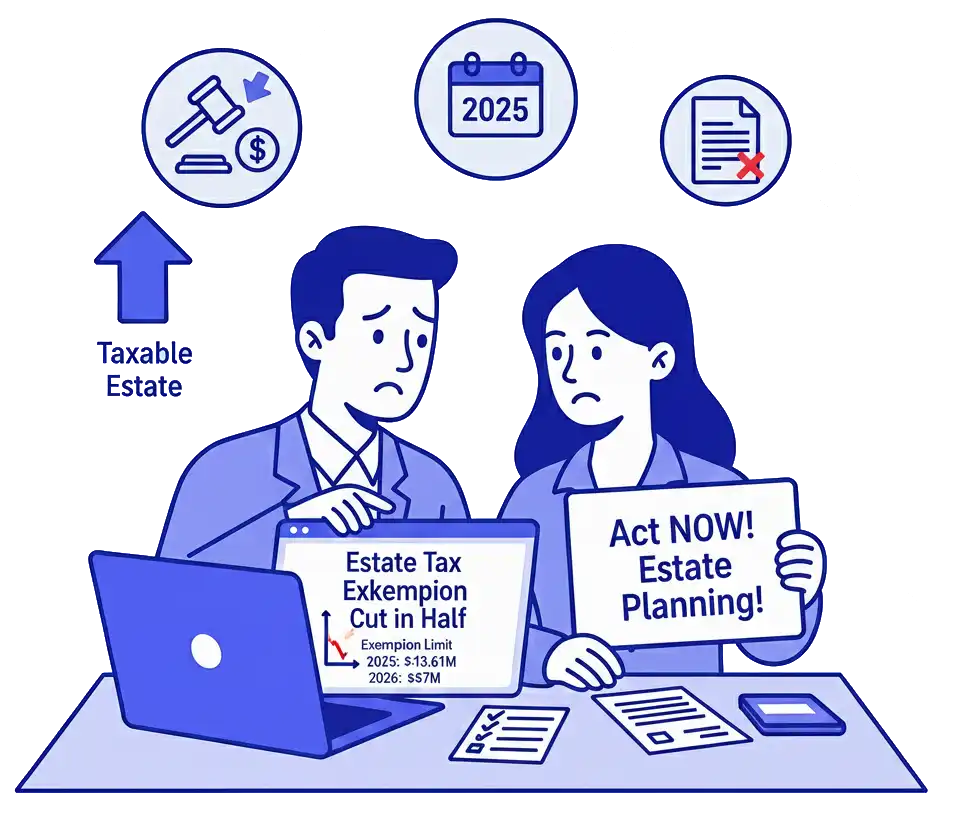

2026 Estate Tax Changes: The Exemption Cliff is Real

Unlike many other provisions of the Tax Cuts and Jobs Act (TCJA), the historically high federal estate tax exemption was NOT made permanent by the One, Big, Beautiful Bill Act (OBBBA). This means that on January 1, 2026, the exemption is scheduled to be cut in half, exposing millions of families and business owners to a potential 40% federal estate tax.

This is not a drill. The “estate tax cliff” is one of the most significant and certain tax changes on the horizon. This guide explains what is happening, who is affected, and what you must do before the deadline to protect your assets.

This guide breaks down the new limits, new strategies, and how to act before the deadline.

The Estate Tax Exemption is Being Cut in Half

The TCJA temporarily doubled the federal estate and gift tax exemption. However, this provision was not extended by OBBBA and is set to expire at the end of 2025.

| Year | Federal Estate Tax Exemption (Per Person) |

|---|---|

| 2025 | ~$13.61 million (inflation adjusted) |

| 2026 | ~$7 million (projected, inflation adjusted) |

This represents a nearly 50% reduction in the amount of wealth that can be passed on tax-free.

What is Included in Your Taxable Estate?

Many people underestimate the total value of their estate. Your taxable estate is not just your cash in the bank. It includes the fair market value of everything you own, such as:

- Real Estate: Primary residence, rental properties, and land.

- Business Interests: Value of your ownership in an LLC, S-Corp, or other business.

- Investments: Stocks, bonds, and cryptocurrency.

- Retirement Accounts: 401(k)s, IRAs, and other retirement funds.

- Life Insurance Proceeds: The death benefit of policies you own can be included.

- Other Assets: Cars, collectibles, and personal property.

For business owners and real estate investors, the value of their assets can easily push them over the new, lower exemption amount.

The 40% Estate Tax Rate Remains

While the exemption amount is changing, the top federal estate tax rate remains a staggering 40%. Any portion of your estate’s value above the exemption threshold will be subject to this tax. This can result in a massive and unexpected tax bill for your heirs, often forcing them to sell assets like a family business or real estate just to pay the tax.

State Estate and Inheritance Taxes

To make matters worse, many states have their own estate or inheritance taxes with much lower exemption amounts than the federal level. If you live in one of these states, your estate could be taxed at both the state and federal level.

States with an Estate Tax:

- Connecticut

- Hawaii

- Illinois

- Maine

- Maryland

- Massachusetts

- Minnesota

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

- Washington D.C.

High-net-worth families in these states must plan aggressively.

States with an Inheritance Tax:

- Iowa

- Kentucky

- Maryland

- Nebraska

- New Jersey

- Pennsylvania

Business Owners Face Major 2026 Estate Issues

If you own a business, your heirs may:

- owe estate tax

- owe income tax

- lack liquidity

- be forced to sell or borrow against the business

This impacts:

- LLCs

- S-Corps

- C-Corp owners

- Family businesses

- High-grossing partnerships

Tools business owners should consider:

- Buy–sell agreements

- Business valuations (pre-2026)

- Entity restructuring

- Trust ownership

- Life insurance for liquidity

Estate tax can destroy generational wealth without planning.

The Urgency of Gifting and Estate Planning

The period before January 1, 2026, represents a critical “use it or lose it” window for estate planning. The high exemption amount allows you to gift significant assets out of your estate now, tax-free, before the limit drops.

Key Estate Planning Strategies to Consider Before 2026:

- Lifetime Gifting: Utilize the current high lifetime gift tax exemption (~$13.61 million in 2025) to transfer assets to heirs or trusts. The IRS has confirmed there will be no "clawback," meaning gifts made under the high exemption will not become taxable retroactively when the exemption drops.

- Set up GRATs, IDGTs, FLPs before the rush

- Transfer business interests now

- Move real estate into the correct entities

- Use life insurance to fund liquidity gaps

- Plan Roth conversions (higher 2026 bracket)

- Use charitable trust strategies

- Pre-transfer appreciating assets to heirs

- Use SLATs to preserve access for married couples

- Capture valuation discounts while available

High-net-worth taxpayers who wait until 2026 will pay dramatically more.

The Urgency of Gifting and Estate Planning

The period before January 1, 2026, represents a critical “use it or lose it” window for estate planning. The high exemption amount allows you to gift significant assets out of your estate now, tax-free, before the limit drops.

Key Estate Planning Strategies to Consider Before 2026:

1. Lifetime Gifting

Utilize the current high lifetime gift tax exemption (~$13.61 million in 2025) to transfer assets to heirs or trusts. The IRS has confirmed there will be no “clawback,” meaning gifts made under the high exemption will not become taxable retroactively when the exemption drops.

2. Irrevocable Trusts

Move assets into various types of irrevocable trusts (like SLATs, GRATs, or IDGTs) to remove them from your taxable estate permanently.

3. Family Limited Partnerships (FLPs)

Transfer assets like a family business or real estate into an FLP to create valuation discounts for gifting purposes.

4. Irrevocable Life Insurance Trusts (ILITs)

Move life insurance policies into an ILIT so the death benefit is not included in your taxable estate.

Frequently Asked Questions

Does the estate tax exemption really drop in half?

Yes. This is one of the few major TCJA provisions that OBBBA did not address. The exemption is scheduled to be cut by about 50% on January 1, 2026.

Will more families owe estate taxes?

Absolutely. Millions of families who are not currently subject to the estate tax will find their estates are over the new, lower threshold in 2026.

Should I transfer assets before 2026?

For anyone whose estate is near or above the projected 2026 exemption of ~$7 million, planning and transferring assets before the end of 2025 is critical to minimize future estate tax liability.

Protect Your Estate Before the 2026 Exemption Shrinks

The estate tax exemption will be cut in half — and once the window closes, it’s permanent.

Your estate plan, trust setup, gifting strategy, business structure, and real estate holdings MUST be aligned before December 31, 2025.